Check Your Financial Adviser Now (and Every Year) or Regret It Later

Fewer than 10% of investors use such free background checks as Investor.gov, BrokerCheck or IAPD to check their financial advisers’ backgrounds. These online tools are easy to use and full of important information, so get clicking.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As I worked with several rookies who took part in this year’s NFL, NBA, MLB and NHL drafts, I noticed the lack of financial literacy in the professional athlete community – especially rookies. It’s insane the trust level they give to agents as well as those in their inner circle.

But it’s not an isolated problem. Financial knowledge across the United States is weak overall, and a December 2019 FINRA Foundation “Investors in the United States” report revealed only a third of respondents are able to answer more than half of the 10 investing quiz questions correctly. In addition, 14% of respondents did not think they paid any investment fees. But the most shocking answer by far was that free investor-related tools – such as BrokerCheck and Investor.gov – are used by fewer than 10% of investors!

It seems that the vast majority of investors are unwilling to do due diligence on their financial advisers, failing to examine the individuals who play such an important role in their financial success or destruction.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Due diligence should be done before ever hiring a financial adviser and every year afterward. (Want more information? Sign up for Carlos Dias’ free webinar, Deciphering the Types of Financial Advisors, on Sept. 24 or Oct. 28.) Here’s how investors can get started:

Look at your adviser’s Form ADV for fees and complaints

Form ADV is a document that investment advisers must fill out for regulators. It comes in two parts – Part 2A and 2B – and can be found on the Securities and Exchange Commission (SEC) website Investment Adviser Public Disclosure ( IAPD).

Part 2A is the firm brochure. It discloses the company’s business model, fees and compensation, conflicts of interest, investment philosophy, disciplinary information, incentives received for certain investment products, and other industry affiliations – including whether the firm acts a broker and/or insurance agency. That’s important to know, because if so, they could be held to a lower standard in their dealings with clients.

Part 2B is the financial adviser brochure. It discloses the adviser’s educational background and business experience, disciplinary information, additional compensation, any financial disclosures, including judgments or bankruptcies, and other business activities – including whether the financial adviser is also registered as a broker and/or insurance agent.

This type of information is important, because it will determine how the financial adviser will be paid and potential conflicts of interest if a dispute were to ever come up. I’ve heard awful stories from clients that a financial adviser explained the business model to them one way and they later found out it operated in a totally different way.

Form ADV should be provided by the financial adviser before your initial meeting so you can review it to formulate questions. Keep in mind that documents that can be used as evidence in a lawsuit must be initiated: Courts won’t rely on verbal testimony alone.

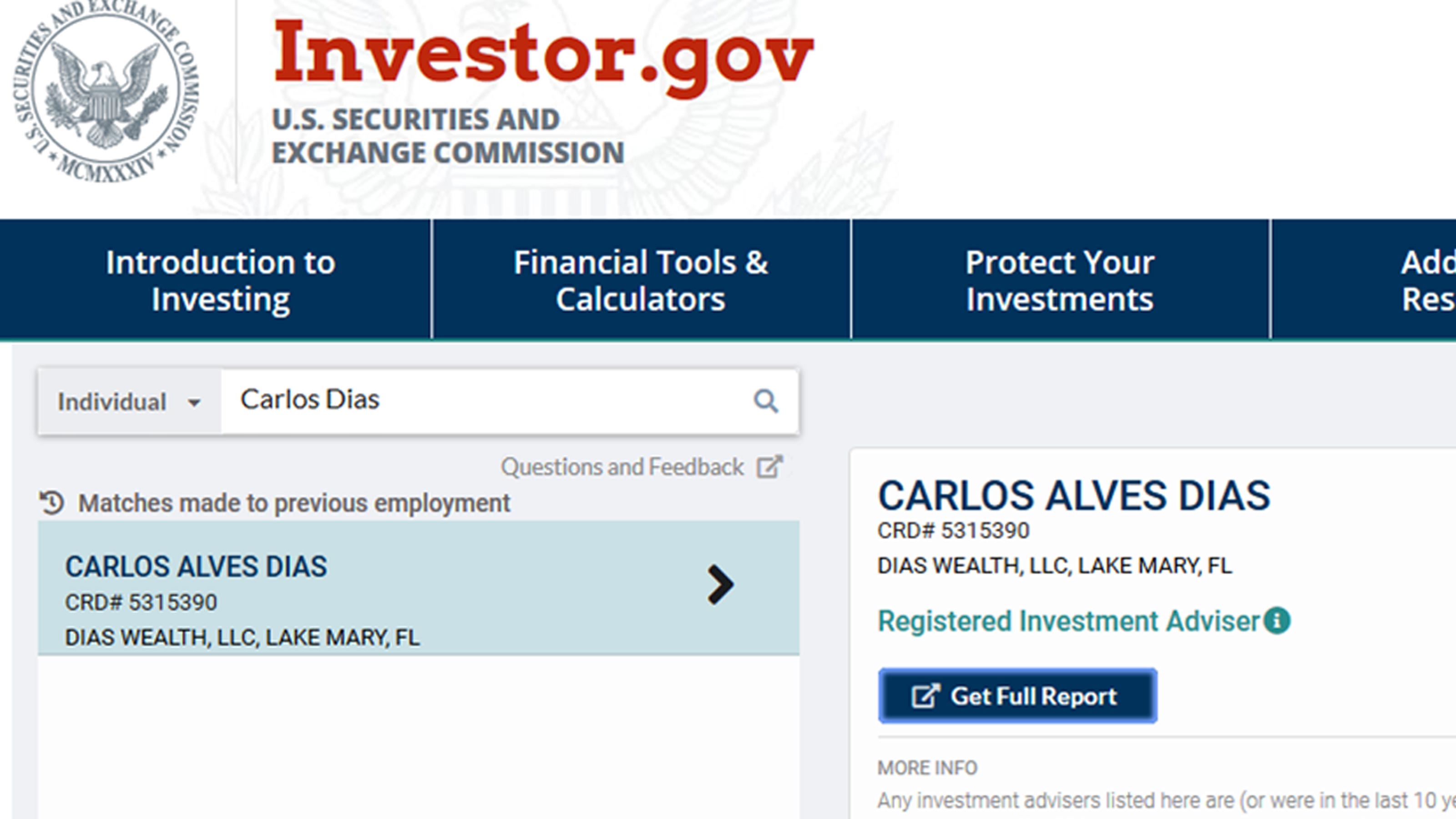

Search Investor.gov, BrokerCheck or IAPD for free

Certain websites offer information on a financial adviser’s background – including licenses, complaints or awards that have been filed against them, or other legal issues. This all can be obtained in the comfort of your home in under a minute at no cost.

Comparing all three options, Investor.gov offers a seamless way to find information. All you have to do is input the financial adviser’s or firm’s name, and it will redirect accordingly. You can also go directly to FINRA or SEC through BrokerCheck or IAPD.

Verify your financial adviser’s background at least every year as a lot can change. A 2019 Public Investors Arbitration Bar Association (PIABA) Foundation report showed substantial customer complaints along with abusive and fraudulent conduct getting deleted – or “expunged” – forever due to loopholes and manipulation in FINRA.

When reading through your adviser’s report online, keep an eye out for how they are registered:

- Broker-dealers or registered representatives of a brokerage firm are licensed and regulated by the FINRA through a suitability standard. That means while investments can often be deemed suitable, they are not always in your best interest.

- Investment advisers, on the other hand, are regulated by the SEC through a fiduciary standard. With this, the financial adviser has a legal obligation to put your best interests first and foremost.

- Dual advisers, or hybrid advisers, are licensed and regulated by both FINRA and the SEC and as such are covered by both the suitability and fiduciary standards. It’s impossible to know in what capacity they’re acting at all times due to the apparent conflicts of interest and licensing.

Realize that credentials can be overused and misrepresented

As of June 2020, there were 214 professional designations listed on the FINRA website and a dedicated section titled “Professional Designations” to assist with your due diligence. Even financial industry experts have a difficult time distinguishing all of them and which ones are really credible.

Professional designations – including Certified Public Accountant (CPA), Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) – are the most prestigious, but all designations are not created equal. The SEC has even issued a warning on their website, “Investor Alert: Beware of False or Exaggerated Credentials.” Not all the designations involve the same level of expertise.

Typically, the CFA is for portfolio managers who are involved with the day-to-day operations of overseeing investments, while the CFP is geared toward planning. But just because a financial adviser has a CFP designation, it doesn’t automatically make them better, although they’ve gone through the process of passing an exam. In fact, an Aite Group study titled “Building a Wealth Management Practice: Measuring CFP Professionals' Contribution” even showed that complaints aren’t minimized due to the financial adviser having the designation. On the contrary, it has verified what I’ve been saying for years – the CFP designation is blatantly overused by brokers in order to sell you investments that may not be in your best interest.

Never blindly trust a financial adviser without first doing your own research and looking at the proper disclosure documents. If you feel awkward asking, and they’re not revealing everything to make an informed decision, never hire them as your financial adviser!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Carlos Dias Jr. is a financial adviser, public speaker and president of Dias Wealth, LLC, headquartered in the Orlando, Fla., area, but working with clients nationwide. His expertise spans a diverse clientele, including business owners, retirees, lottery winners and professional athletes with wealth management, tax planning, estate planning, long-term care, annuities and life insurance. Carlos has contributed to Kiplinger, Forbes and MarketWatch, and his work has been featured in CNN, CNBC, The Wall Street Journal, U.S. News & World Report, USA Today and other publications. He’s spoken at various CPA societies across the United States, and Carlos’ presentations often focus on innovative tax strategies, retirement planning and asset protection, providing valuable knowledge to accountants, attorneys and financial professionals.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.