Best Online Brokers and Trading Platforms for 2025

Find the best online brokers using our survey that compares investment offerings, tools, apps, advice and more.

- Best online broker overall

- Online brokers with the best investment choices

- Online brokers with the best tools and education

- Online brokers with the best mobile app

- Online brokers with the best advisory services

- Online brokers with the best research

- Online brokers with the best customer service and security

- Online brokers with the best commissions and fees

- Best online brokers for your specific needs

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is your broker helping you be a better investor? That was the key question we sought to answer as we rolled out our annual online broker survey.

After all, fees don't matter much anymore. They're low everywhere. So, what's left? Service.

Does your broker provide the tools you need to help you keep track of your financial life and goals? In big and little ways, is it guiding you toward smarter investment decisions? Did you learn anything new about investing from your broker over the past year? Can you get investment advice if you want it?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Can you graduate from an automated adviser to a dedicated financial adviser as you get older to get help with estate planning or Social Security? All told, we engineer our broker rankings to reward the firms that offer the most to the broadest group of investors.

How we chose the best online brokers and trading platforms

To start, we limit the field to brokers that offer stock, mutual fund, exchange-traded fund and individual bond trading. That's one reason you don't see the likes of Robinhood or SoFi here – you can't buy individual bonds on their platforms.

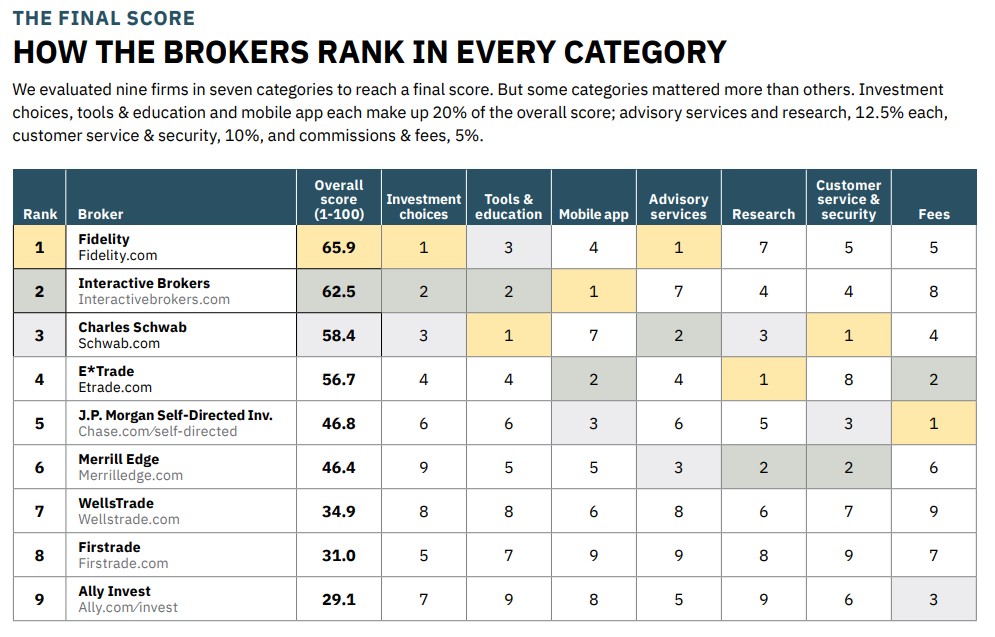

We surveyed nine firms in all: Ally Invest, Charles Schwab, E*Trade from Morgan Stanley, Fidelity, Firstrade, Interactive Brokers, J.P. Morgan Self-Directed Investing, Merrill Edge, and WellsTrade. T. Rowe Price, Vanguard and Citi Self Invest declined to participate.

The biggest, best-known firms score better overall, you'll notice. But each firm shines in one category or another, and no firm aced every one.

Best online broker overall

Drum roll, please. Fidelity landed on top this year by offering a solid mix of investment products, as well as tools and calculators for retirement planning and college savings, among other things.

The firm's fees are far from the lowest, especially if you want to buy shares in a mutual fund for which you must pay a transaction fee. But it was a competitive finisher in primary categories – investment choices, tools and education, and mobile app. And it won major points for its full range of advisory services, which pushed it to the top spot.

Interactive Brokers finished second for the second year in a row. The firm ranked first or second in the most important categories – investment choices, mobile app, and tools and education – and that helped lock in its position in the rankings.

We evaluated its "Lite" pricing plan and its website-based platform, Client Portal. But many of the firm's customers are active traders – defined by the firm as investors who make more than 120 trades per year – and they usually opt for the firm's "Pro" pricing plan and download its desktop trading platform, not considered here.

What's more, Interactive is known for its access to international markets – more than 160 developed and emerging markets – and 71% of its account holders live outside of the U.S. They're mostly interested in trading in the U.S. as well as their local markets, the firm says.

Bear in mind that our survey results combine objective and subjective criteria. We rely on the information that each firm provides, vetting the data as best we can. The scoring boils down to the weighting we assign to each data point and to each category.

Although we base our weightings on what we hear from investors and the industry about what brokerage customers currently value, not everyone will agree with what we chose to play up – or down.

Below, we walk you through the highlights and lowlights of how the brokers performed in each of our categories, listed in order of significance to the final score.

Online brokers with the best investment choices

More is more in this category: The broader the range of investment offerings, from corporate bonds to mutual funds, ETFs and even cryptocurrencies, the better the broker ranked in this category, which makes up 20% of the final score.

Fidelity and Interactive Brokers came out on top. In addition to a robust roster of the usual securities available, both firms also offer better yields than peers on cash that's sitting idle in brokerage accounts (the so-called sweep account).

You can also buy a fraction of nearly every publicly traded U.S. stock or ETF. So instead of shelling out more than $1,000 for a single share of Netflix (NFLX) stock, for instance, you can buy a $1 slice (roughly 0.001% of one share). And you can set up a recurring purchase of shares in ETFs and stocks.

Plus, though it didn't count for much in this category score, Fidelity and Interactive Brokers were the only firms in the survey to offer cryptocurrency trading of select digital coins – the actual currency, not crypto futures or ETFs that track cryptocurrency prices. (Schwab says it expects to offer direct access to crypto in 2026.)

For the record, fractional-share trading is available at other firms, too, but to varying degrees. At Firstrade, customers can buy slices of nearly every publicly traded stock and more than 1,200 ETFs.

Schwab customers can only buy slices of S&P 500 stocks; at J.P. Morgan Self-Directed, fractional purchases are limited to S&P 500 and Nasdaq-100 stocks and all ETFs; and E*Trade investors can buy fractions of 221 ETFs for a $25 minimum investment.

Of course, not every investor wants or even needs access to every investable security. Mutual fund investors will find abundant choices at Charles Schwab, Fidelity and Interactive Brokers, for instance. And buyers of individual corporate bonds will find the greatest number of choices at E*Trade. Municipal bond investors should go to Interactive Brokers or E*Trade.

Want to invest in foreign stocks? You're out of luck at most of the firms we surveyed; only Schwab, Fidelity and Interactive offer access to foreign markets.

Ally Invest, E*Trade and Merrill Edge suffered because they don't offer fractional-share trading of stocks. WellsTrade does, it's worth noting. But Wells and Merrill also slipped, in part, because each of their platforms offers a below-average number of mutual funds and corporate and municipal bonds, relative to other survey respondents.

Online brokers with the best tools and education

How helpful is your broker at keeping you on track with your investment plan and the rest of your financial life?

In this category, which accounts for 20% of the final score, we asked each firm whether they offered certain tools or calculators that assist in a variety of financial goals: How much should I save for college tuition? How am I doing so far on retirement savings? Can I get help building a bond ladder, figuring out how much to withdraw each year from my IRA, and reviewing the asset allocation of my entire investment portfolio?

Calculators, portfolio analyzers, screens for stocks, ETFs and mutual funds, and the like can help investors put their money to work. We scrutinized the array of educational videos, webinars, podcasts and live events, too.

Schwab and Interactive Brokers triumphed in this category. Of the nearly 40 tools and functions we queried each firm about, Schwab offers 33, including savings, tax and retirement calculators and other useful tools, such as a bond-laddering tool and a trade ticket that can be filled out and saved for later. (E*Trade offers a saved trade ticket function, too.) Interactive Brokers finished with 30.

Many are embedded in the firm's retirement-planning tool (such as budgeting and debt management) and portfolio analyst tool (such as getting an aggregate view of asset allocation and risk in your portfolio).

Both firms also got a lift from good scores on the education front. We asked the firms about educational articles and videos available on their websites, as well as how many podcasts and videos were posted in 2024. Schwab and Interactive both scored well, which helped them win the top spots in this category.

But it's worth noting that Fidelity and E*Trade were nearly as strong on education, too. E*Trade, in particular, offers a daily podcast of five minutes or less from Morgan Stanley that covers commentary on the market and other investing topics. Recent podcast headlines: "Trump's AI Action Plan"; "Will the Entertainment Business Stay Human?"; and "Asia's $46 Trillion Question."

The laggards in the tools category were Ally Invest, Firstrade and WellsTrade. They trailed the pack in the overall number of tools offered – Ally with just 11; Firstrade with 16; and Wells with 17.

Ally Invest, for instance, doesn't offer a mutual fund screener, a spending-tracker tool or a "How am I doing?" retirement-savings calculator. WellsTrade offers more than Ally in the way of tools, but you can't export statements to Excel, for instance, and it doesn't include some tools, such as one that would help investors as they start to withdraw cash for retirement.

But Wells and Ally also missed on the education side. Unlike the other firms surveyed, for instance, WellsTrade doesn't provide any educational articles on investing and trading strategies, podcasts, or educational videos.

Ally Invest fared a bit better than Wells because it does provide educational articles, but it lacks the podcasts, videos and other events that the bigger players offer their customers.

Online brokers with the best mobile app

Most brokerage customers log in to their accounts in the mobile app more often than they do on a computer, according to some of the firms we surveyed this year.

They may be just checking their portfolio balance in the middle of the day. Even so, as apps improve, we expect that investors will want to perform more and more investing tasks on their phones over time. So in this category, which makes up 20% of the final score, we explored the breadth of functionality of each firm's mobile app.

The ability to trade stocks, ETFs and mutual funds is a given; every firm's mobile app allows you to do that. And access to stock research reports in the app is pretty much de rigueur.

But can you buy stakes in bonds and crypto in the app? Does it offer stock and ETF screening, for instance, as well as a shortlist of prescreened investments to consider? Can you select specific shares you own in a stock by tax lot before you sell? Can you access a similar variety of savings, retirement, budgeting and portfolio analysis tools that are available on the broker's website? Can you deposit checks electronically into your brokerage account?

Interactive Brokers answered yes to more of our nearly 60 queries than any other firm. It won this category by a clear margin, thanks to a robust array of retirement calculators, tools for tracking spending and college savings, and a bond screener on its app.

E*Trade's offering was similarly robust; it was the only other firm to offer a bond screener on its mobile app, for one thing. It came in second, followed by J.P. Morgan Self-Directed in third place and Fidelity in fourth.

Some of the firms' apps are strong in other ways. All but three of the firms allow you to measure your portfolio's performance against a benchmark, for instance (Ally Invest, Firstrade and WellsTrade are the holdouts).

We'd be content with just three benchmarks – one for U.S. stocks, another for U.S. bonds, say, and a foreign stock market bogey. But at Interactive, you can choose among 340 in the mobile app; Merrill Edge, 35; and J.P. Morgan Self-Directed, 12. Compare that with the five indexes available in Schwab's app and three in Fidelity's and E*Trade's mobile apps.

Meanwhile, for investors in search of investing ideas, only J.P. Morgan and E*Trade offer curated lists for stocks, ETFs and mutual funds on the app.

Fidelity, for instance, has select lists available in its app for mutual funds and ETFs, but not stocks. J.P. Morgan shines again for screeners. It's the only firm, along with Interactive Brokers, to offer screeners for stocks, ETFs, mutual funds and bonds in its mobile app.

Online brokers with the best advisory services

Many investors these days want help with their investments. Brokerage firms tend to offer tiers of service. These range from an all-digital, or automated, service (call it a robo service) to a blend of digital and a little human advice – what we call a hybrid offering – to a more full-service type of account that in some cases offers customized portfolios and a dedicated investment adviser.

We scrutinized the full gamut of offerings at each firm by dividing the overall advisory category into three parts – digital, hybrid and full service. The overall category accounts for 12.5% of the final score; digital service makes up just over half of the category score, and hybrid and full services account for the rest of the category score.

The range of advice varies at each firm. Firstrade doesn't offer any investment advice at all. And most firms offer only two of the three tiers of advice. J.P. Morgan Self-Directed, for instance, doesn't have a robo, but it offers a hybrid service as well as full-service-type plans through J.P. Morgan Wealth Management.

Merrill Edge has a robo (Merrill Guided Investing) and a hybrid (Merrill Guided Investing with Advisor). But it doesn't offer full-service advice – though that is available at a different Merrill business.

Similarly, Wells Fargo's WellsTrade has Intuitive Investor, its all-digital advisory, but no full-service advice. That's available through a different Wells business, so it wasn't included in the survey.

The only two firms to offer all three tiers of advisory services – again, digital, hybrid and full service – ran away with the medal in this category: Fidelity and Schwab. Indeed, Fidelity seems to have an advisory service to suit every kind of investor and account size. The breadth of offerings helped Fidelity come out ahead in this category. But in truth, both Fidelity and Schwab stood out in each tier, winning the top spots across the board.

Bear in mind that our scoring system weighed the nuts and bolts of the services at each firm – investment minimums, variety of portfolios, fees, expense ratios of fund holdings and access to estate-planning experts, among other things – not the portfolio returns.

Let's start with digital and hybrid services. Fidelity offers two kinds of automated advice: Fidelity Go and Fidelity Managed FidFolios. But Fidelity Go steals the show. For as little as $10, customers can get access to 16 different kinds of portfolios filled with funds that charge 0% expense ratios. What's more, accounts with less than $25,000 pay no advisory fee.

Managed FidFolios is a more sophisticated introductory offering – a team of experts manage an all-stock portfolio for you – and requires $5,000 to start. Choose among three actively managed strategies (which charge 0.70% each in annual advisory fees) and five direct indexing portfolios (0.40%), a strategy that involves owning the individual securities that make up a benchmark, instead of owning a mutual fund or ETF, which allows for active tax-loss harvesting (selling losers to offset gains elsewhere).

Fidelity's hybrid service is part of its Fidelity Go offering and kicks in when balances top $25,000. The fee jumps to 0.35% of assets per year, but that gets you unlimited one-on-one "financial coaching to help achieve retirement or other investing goals," according to the firm. Many of those coaches are certified financial planners.

By contrast, in its favor, Schwab's robo, Intelligent Portfolios, charges no annual advisory fee, and investors can choose among 81 diversified portfolios filled with cheap ETFs. Schwab's next step up in service, like Fidelity's, requires a $25,000 minimum. Intelligent Portfolios Premium, as it's called, requires a one-time $300 planning fee on top of a $30 monthly advisory charge. You get the same 81 diversified ETF portfolios as in the robo-advisory service, but the big plus is you have access to a team of financial planners.

At most firms, you must fork over more money to get a dedicated human adviser. That minimum varies from $100,000 at Ally Invest and J.P. Morgan Self-Directed to $500,000 at E*Trade, Fidelity and Schwab. (Firstrade, Interactive, Merrill and Wells don't offer these services.)

At the full-service level, Schwab offered most of the features we were looking for: A dedicated adviser, one-on-one access to specialists for bond and options trading as well as an estate-planning expert, and low advisory fees. For an account with a $750,000 balance, Schwab charges just 0.80% a year.

E*Trade and J.P. Morgan each had competitive offerings at the full-service level. J.P. Morgan has a lower minimum going for it – typically $100,000 for a dedicated adviser – plus access to experts on estate planning and bond and options trading, and a customized portfolio. And investors can choose among advisers at Chase bank branches and at different divisions of J.P. Morgan Wealth Management. Some charge annual advisory fees as low as 0.50% for a $750,000 balance; others cost more (as much as 1.45% a year).

E*Trade's full-service offering from Morgan Stanley Wealth Management stacked up nicely, too, with multiple experts at the ready to help you. Its 2% annual advisory fee for an account with a $750,000 balance was high, however. E*Trade says Morgan Stanley financial adviser rates vary, so it chose the highest rate by default. Of course, in exchange, you get access to Morgan Stanley's full breadth of products and services.

Online brokers with the best research

What some investors consider useful research may be gobbledygook to others. Some may put greater emphasis on technical analysis, for example – the practice of identifying trends or patterns in price charts to spot investing risks and opportunities.

Others may favor fundamental analysis, examining a company's financial statements and industry trends, say, to evaluate it as a potential investment. And then there are those who might find that news alerts and stories can be useful for pinpointing investing prospects, too.

To that end, in this category (12.5% of the final score), we asked the brokers to list the research sources they offer their customers for specific single stocks – Apple (AAPL), Goldman Sachs (GS), Honeywell International (HON), Alibaba Group Holdings (BABA) and WD-40 (WDFC) – as well as the SPDR S&P 500 ETF (SPY) and the Fidelity Contrafund (FCNTX).

We also asked about how many stock and bond market outlook reports were available to do-it-yourself brokerage customers, as well as any ongoing market commentary or analysis. We gave extra credit to firms that provide access to in-depth fundamental research (because that's the kind of research we favor).

That last question helped boost the scores of some firms, including E*Trade, Merrill Edge, Schwab and J.P. Morgan Self-Directed.

Merrill Edge offers access to proprietary analysis of single stocks from BofA Global Research, but only to customers who meet a $100,000 balance threshold. BofA market outlook and commentary reports, however, are available to all customers. We knocked the firm (only by a bit) for this balance requirement, but it was enough to push the firm from a first-place tie with E*Trade to a second-place finish.

Schwab finished a nose behind for third. Schwab offers brokerage customers solid bond and stock market outlooks and commentary from its asset management division, but we discounted Schwab's proprietary stock reports a little because the stock ratings are based on quantitative, not qualitative, measures.

Interactive Brokers blows away the competition with the stratospheric number of research resources it offers its retail customers: 57 reports on Apple and 38 for Goldman Sachs, for example, and a whopping 1,452 for reports on the outlook for the bond market.

By contrast, among all of the firms we surveyed, the median number of reports was three each for the single companies and two for bond market outlooks. But Interactive missed getting extra credit for in-depth fundamental stock analysis, and that's why it finished behind E*Trade, Merrill and Schwab.

Online brokers with the best customer service and security

In our digitized world, customer service takes many shapes. There's chat and email. You can pick up the phone. In some cases, you can even talk face-to-face with a human being at a local branch. No matter the method, one thing's for sure: When you have an investing-related question that you can't answer on your own, you want a prompt answer. Period.

That's why this category, which amounts to 10% of the final score, included questions such as the average telephone hold time for a customer service representative and average email and chat response time.

We also asked about the percentage of time that a customer was able to get an answer to their question at the first point of contact with a live representative, among other questions.

Charles Schwab won for customer service thanks to its 400 branches, a phone line with 24/7 live service, a 33-second average hold time on the phone (below the average 65-second hold time for the firms we surveyed), and a less-than-12-hour response time for email queries (below the average 33-hour response period). Thousands of clients walk into Schwab's retail branches a day, the firm says, and over the first half of 2025, it fielded more than 14 million calls.

Merrill Edge came in second. On top of a 24/7 live representative customer-service line, the firm says that it has a 90% success rate in answering customers' questions at the first point of live contact. It was the best response rate of the group, just ahead of Ally Invest (89%).

To be fair, we should note that some firms didn't disclose this figure, including Fidelity, Firstrade and J.P. Morgan Self-Directed.

J.P. Morgan Self-Directed was hot on Merrill's heels, boosted in large part by a robust training program for its representatives. Depending on the representative's role, the firm says, some training programs last for two-plus years. A below-average phone-line hold time of less than 30 seconds and a roughly 12-hour average response time to email queries helped, too.

Firstrade, Ally Invest and WellsTrade faltered in this category for different reasons. Each of the firms reported shorter training periods for representatives than the other brokers, for a start. Ally and Wells also reported above-average wait times for representatives on the phone.

Security accounts for one-tenth of this category's score, but it's a growing concern as scammers and hackers get better at what they do. We gave extra credit to firms that make two-factor authentication mandatory, namely Ally Invest, E*Trade, In-teractive Brokers and J.P. Morgan Self-Directed. The extra step can be annoying, but it is becoming increasingly necessary.

To be clear, the other firms in the survey offer two-factor authentication as well; you just have to opt in and set it up.

Online brokers with the best commissions and fees

A little over a decade ago, this category accounted for 25% of the final score. This year, commissions and fees make up just 5%. Everyday investing transactions – buying and selling stocks, shares in ETFs or mutual funds, and bonds – are free, or nearly so. And the tasks that do incur a levy – wiring money, say, or having a representative place a bond or options trade for you over the phone – are likely to be infrequent.

And yet, there are some hidden trading costs. Embedded in the price of an individual bond you buy, for instance, may be a transaction cost, such as a markup (the difference between the price a broker-dealer paid to buy a bond and sell it to an investor) or a selling concession (a fee paid to the seller or distributor of the bond you're buying).

Similarly, the brokerage firm may receive a small payment to route trades to certain securities dealers, which can cost you in the form of slightly less favorable prices. These levies are small, but they can add up, and what you don't outlay in fees you can put to work toward your investing goals. So we asked the firms about these hidden transaction costs, among other charges, as well as what they charge for margin interest rates and options contracts.

As expected, the contest was tight. J.P. Morgan Self-Directed skated past the others, largely because it charges middle-of-the-road fees – rarely the highest or lowest on any query. FirstTrade, on the other hand, though it ranks seventh in the pack on fees, boasts the lowest charge for broker-assisted stock and ETF trades ($19.95) and options contracts ($0).

WellsTrade brought up the rear in this category. Its margin rates are above average and bond purchases include a markup, among other things.

Best online brokers for your specific needs

Best for index fund lovers. Fidelity and E*Trade both have suites of zero-fee index funds, but only individual investors with brokerage accounts at those firms can buy them.

Fidelity has four zero-fee index funds – a total market index fund, an international stock fund, a small-company stock fund and a large-company stock fund.

E*Trade has five no-fee index funds available exclusively to self-directed E*Trade investors. If you start working with a Morgan Stanley adviser, you can take them with you (E*Trade has been a Morgan Stanley-owned company since 2020). The five funds include strategies that track the performance of international markets, U.S. bonds, municipal bonds, large-company shares and the total stock market.

Best for individual bond buyers. Of all the firms in our survey, Interactive Brokers offers the greatest number of municipal bonds. But buyers of corporate debt should consider E*Trade. What's more, both firms charge no markup on corporate or muni bond transactions. At E*Trade, Treasuries trade for no fee.

Best robo advisory. Fidelity prevails with its digital offering, Fidelity Go, which charges no annual advisory fee for balances under $25,000 and includes 16 different portfolios (from conservative to aggressive allocations). The kicker: The portfolios hold only no-fee mutual funds, so you're not shelling out anything in annual expense ratios.

Fidelity gets another nod, too, because its most aggressive Fidelity Go portfolios hold 100% of assets in stocks (other firms have a 94% to 96% allocation to stocks).

But Schwab Intelligent Portfolios merits an honorable mention. There's no annual fee, though it takes $5,000 to open an account. And the 81 available portfolios hold low-fee exchange-traded funds that charge annual expense ratios between 0.04% and 0.16%.

Best all-in-one bank and broker. Several firms offer benefits to customers who bank and broker with them. But Merrill Edge and its parent, Bank of America, through its Preferred Rewards program, offer the best benefits.

We like, for instance, that the bonuses start when you have a three-month combined average daily balance of just $20,000 – at the bank and in any Merrill investment account. The pluses include a bump in cash rewards on Bank of America credit cards, priority on customer service phone lines, and interest rate discounts on auto loans and home equity lines of credit.

As your balance grows, the perks improve and expand. When your average daily balance hits $100,000 or more, on top of bigger interest rate breaks on loans and bonuses on credit card rewards, you can get a discount on robo-advisory fees at Merrill Edge, a boost in the interest rate on a Bank of America Advantage Savings account and a waiver on ATM fees at non-BofA banks in the U.S. and anywhere else in the world.

Best for options traders. Active options investors should favor Firstrade, which doesn't charge a contract fee like the others. Most of the other firms we surveyed charge a 0.65-cent fee per contract. Ally Invest is one exception; it charges a 0.50-cent contract fee.

Best for cash hoarders. Fidelity gets kudos for paying the highest yield on idle cash sitting in brokerage accounts. In late May, the firm's so-called sweep accounts – the account that your broker automatically "sweeps" any cash into – paid a 3.94% yield. Some of the other firms, by contrast, offered a 0.01% yield. Interactive Brokers stood out, too, with a 2.83% yield on its sweep account.

Best for investors just getting started. None of the firms we surveyed require a minimum to open an account, but we favor Fidelity for investors with small balances for a couple of reasons.

For starters, for as little as $1, you can buy slices of more than 7,000 stocks and exchange-traded funds. No other firm except Interactive Brokers can match that. The other plus: The firm's digital advisory service, Fidelity Go, has the lowest minimum – just $10 – to get started. In addition, there's no annual advisory fee if your balance is below $25,000, and the funds in the portfolios don't charge annual expenses.

Best for mutual fund investors. Interactive Brokers and Schwab offer the biggest roster of mutual funds for no load and no transaction fee. But we want to give Ally Invest, E*Trade, Firstrade and J.P. Morgan Self-Directed a shout-out, too.

All the funds on each of these platforms – albeit a shorter list of funds than Schwab or Interactive offer – trade for no fee.

Best for margin traders. If you're big into trading on margin – a strategy that allows an investor to borrow money from a brokerage firm to purchase securities – Interactive Brokers' Lite tier charges just 6.83% for a margin balance of less than $100,000, a little over half the going rate at the other firms for the same balance.

Best for investors with foreign addresses. Americans living abroad sometimes have problems opening brokerage accounts at U.S. financial firms. But at Interactive Brokers, citizens and residents of nearly every country can open accounts.

And the firm offers overnight trading of stocks and ETFs from 8 pm to 3:50 am Eastern Standard Time, Sunday through Friday, which makes it more convenient for overseas customers in faraway time zones to buy and sell shares.

Best for ETF investors. Stick with Fidelity, Interactive Brokers and J.P. Morgan Self-Directed, which allow you to buy and sell fractional shares of thousands of ETFs. (Firstrade and E*Trade allow you to buy slices of ETF shares, too, but fewer funds are available.)

Note: This item first appeared in Kiplinger Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

- Mutual Funds Are About to Get the ETF Treatment. Here's What It Means for Investors

- The Best Options Trading Platforms

- 7 Mistakes to Avoid When You First Start Investing

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.