Welcome to Kiplinger’s 2025 tax season blog!

Since the IRS started accepting returns in January, our tax team (Kelley, senior tax editor, and Kiplinger tax writers Gabriella and Kate) has been here with essential updates, practical tips, and analysis to help you navigate every step of tax season — from maximizing deductions and credits to understanding the latest IRS and tax policy changes.

For most filers, Tax Day passed on Tuesday, April 15. So this blog is now officially closed.

If you haven’t filed or paid taxes owed yet, it’s important to do so as soon as possible to avoid penalties and interest. And, although the blog won’t be updated further, you can still explore all of our helpful posts from this tax season.

Thank you for joining us! We hope the insights and guidance we shared made filing easier and kept you informed every step of the way.

Stay tuned to Kiplinger for more expert advice on taxes and personal finance all year round, and subscribe to our weekly email newsletter: Kiplinger’s Tax Tips.

The First Day of Tax Season 2025

As of January 27, the IRS opened its doors for the 2025 tax season. This year brings notable shifts that will impact how millions in the U.S. file their taxes.

For example, the IRS has expanded its Direct File program to allow taxpayers in 25 states to complete returns without traditional preparation costs. That could save millions of households time and money. (The tax agency estimates 30 million taxpayers could participate)

President Trump's return to the White House has prompted significant shifts. On inauguration day, the former IRS Commissioner Danny Werfel stepped down. As the tax agency awaits confirmation of Trump’s Commissioner pick (former Congressman Billy Long), it must deal with a hiring freeze and reduced funding.

What does this mean practically? The core tax season process should remain the same: gathering documents, understanding tax deductions and credits, and eventually meeting the April 15 deadline (if you don’t have a valid tax extension).

However, the federal tax landscape is evolving, and as a new Congress begins to address tax policy, there is uncertainty about what tax bills will look like beyond this year.

For those feeling anxious about the changes, take a deep breath. Focus on the fundamentals of good tax preparation: good record keeping, understanding your income streams, leveraging tax breaks you’re eligible for, and seeking professional advice when and if you need it.

Welcome to Tax Season 2025.

As mentioned, we'll be live blogging all week, offering tips, analysis, IRS updates, and related news and information. In the meantime, here are some resources to get you started.

- Not Ready to File Taxes? Eight Things to Do to Prepare

- When are Taxes Due in 2025? Tax Deadlines By Month

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Tax Changes to Know Before You File

Every year, before you file your 2024 tax return, there are significant federal tax changes you need to know. This tax season is no different.

So, we’ve compiled a list of key IRS changes that could impact your 2024 tax return — from the child tax credit and 1099k thresholds to extended tax deadlines in states affected by devastating natural disasters.

See: Tax Season 2025 Is Here: Seven IRS Changes to Know Before You File

Also, if you aren’t sure where to begin to prepare for tax season or wonder if you even need to file a return this year, we’ve got you covered with the following guides:

Who is Required to File a Tax Return

Does Your Child Need to File a Tax Return?

- Kelley

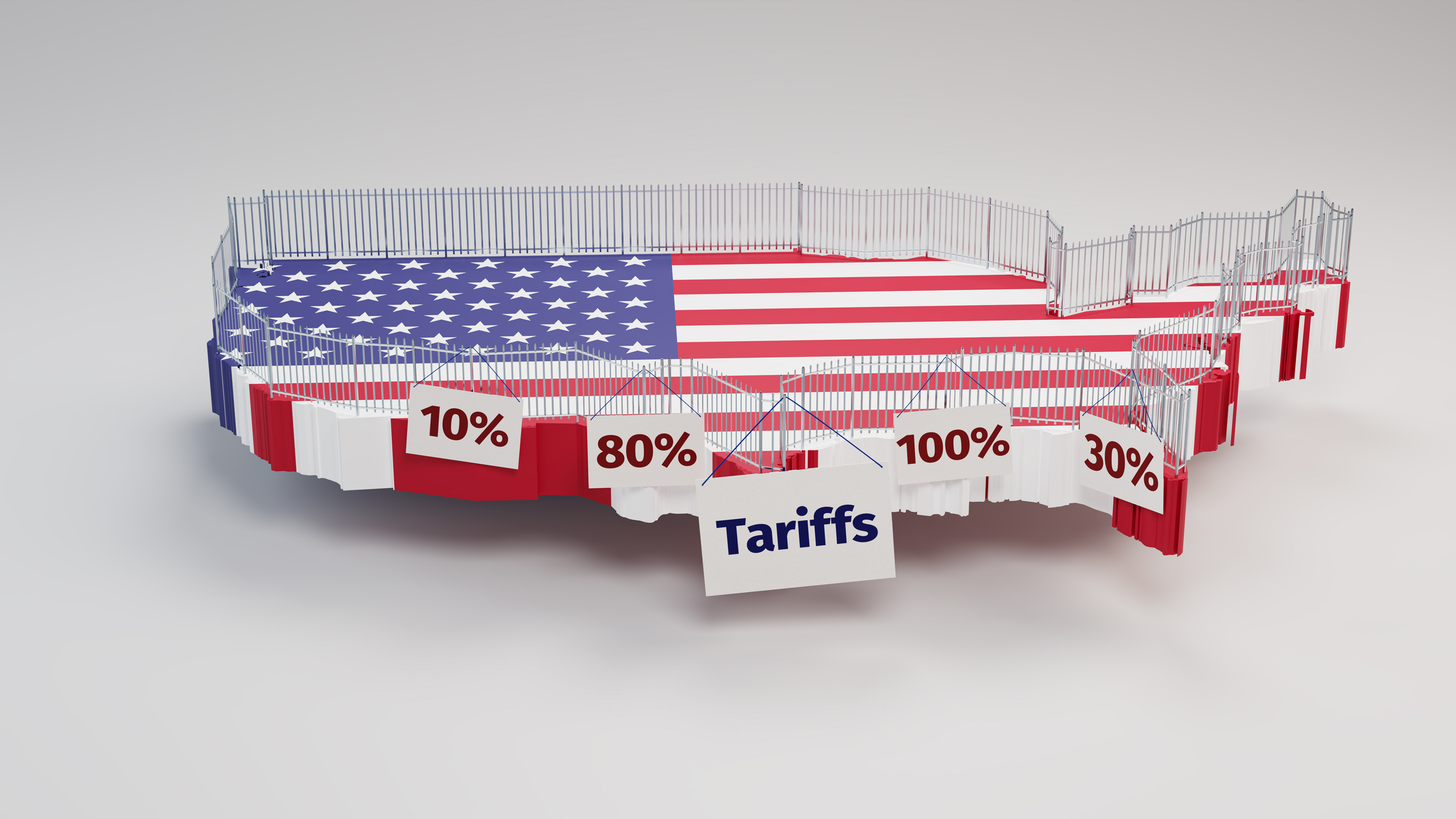

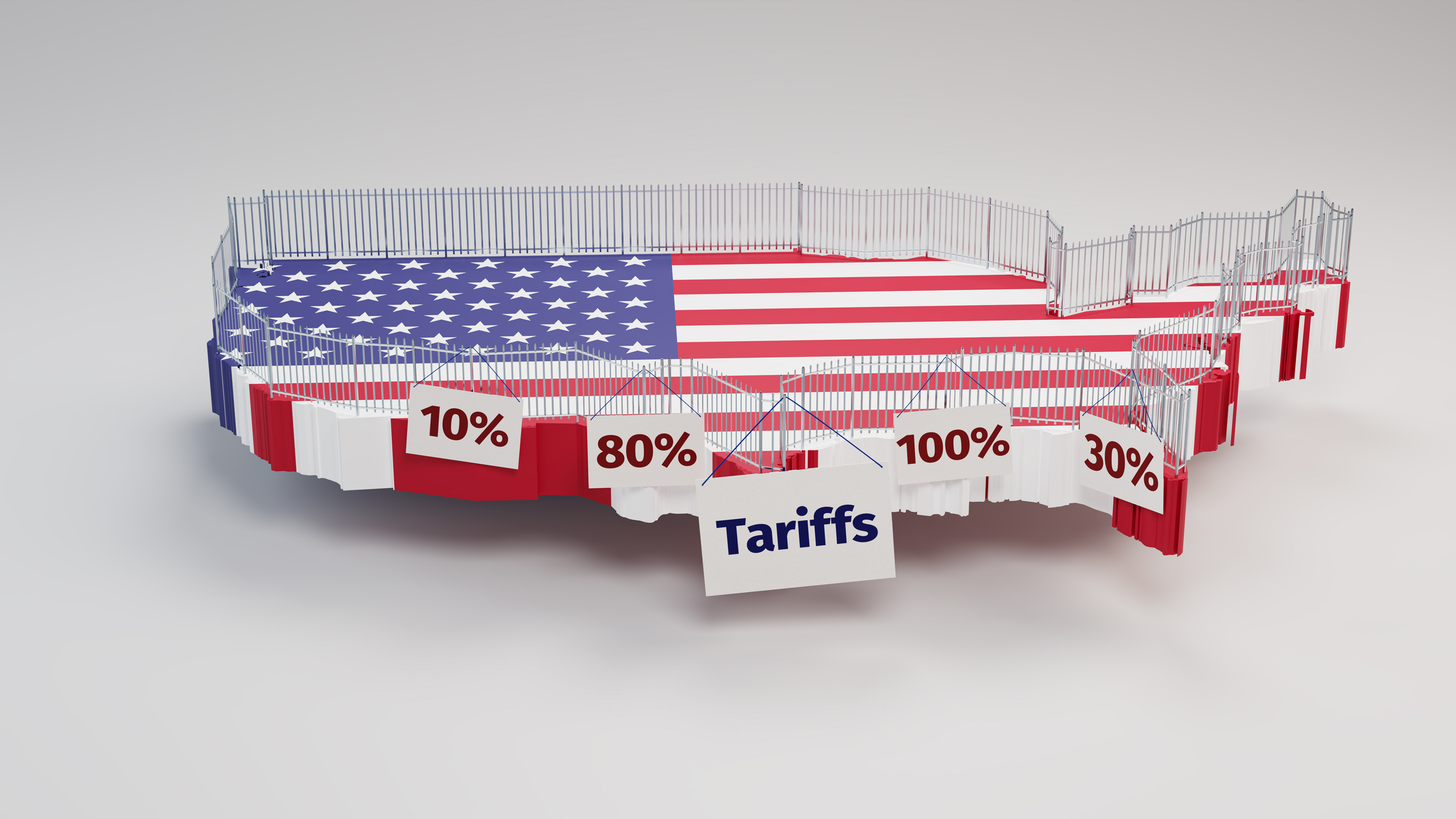

A Bit of News on Tariffs

Among President Donald Trump’s wave of executive orders signed on day one of his second term, one major campaign promise was missing — imposing universal tariffs on all imports.

What’s imminent, however, is how Trump’s sweeping would-be tariffs will impact your wallet as a consumer in the United States. Economists warn that tariffs on China, Mexico, and Canada can impact the cost of everyday essentials like food, gas, and clothing.

Here’s where you could see prices rise sooner than you think.

Food, Gas Prices to Spike if Trump Levies 25% Tariffs on Canada and Mexico

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms involving family tax credits, housing accessibility, banking regulations, student loan debt, and inflation.

Free Tax...Help!

Just a reminder that there are a bunch of ways to file taxes for free this filing season. Here are a few services that the IRS offers:

- Free File is open to low-to-middle-income taxpayers with an AGI of $84,000 (or less).

- Direct File is open to some taxpayers in 25 states with an AGI of up to $250,000.

- The MIL (Military One Source) program (if you’re in the military) or the

- The VITA (Volunteer Income Tax Assistance) program (if you make $67,000 or less, you can meet with an IRS partner or volunteer staff who can provide tax counseling and preparation services)

There are also some free filing options offered by tax prep companies. Just double-check their eligibility rules.

Related: Ways to File Taxes for Free in 2025

...Don’t know what your “AGI” is? No problem.

Adjusted gross income (AGI) is your total income minus specific deductions. It's the starting point for calculating your tax bill before applying standard or itemized deductions designed to give the IRS a clearer picture of your taxable income.

To learn more, check out Kiplinger’s take on AGI, and then head over to our guide to Federal Tax Brackets and Income Tax Rates for more information regarding your 2024 tax rate.

Note: Your marginal tax rate is the percentage you pay on your last dollar earned, not your entire income. Think of it like a staircase: as you climb to higher income levels, only the dollars on each new step are taxed at that step's rate.

Plus, we have everything you need to know about the standard deduction and a load of tax credits and deductions you might be eligible for. (We’ll talk more about some of those tax breaks this week.)

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Fun Fact: Why Most People Don't Itemize Deductions

Did you know the standard deduction has become the choice for nearly 90% of U.S. taxpayers? This surge in popularity isn’t an accident. The Tax Cuts and Jobs Act (TCJA) of 2017 (also known as the “Trump tax cuts”) nearly doubled the standard deduction, and that higher deduction is still in place now.

Data show that before the TCJA, about 30% of taxpayers itemized their deductions. After its implementation, that number plummeted to just under 14%. Congress will have to consider whether to extend the higher base standard deduction amount as it weighs new tax policy.

For the 2024 tax year, the standard deduction amounts are:

- Single filers: $14,600

- Married couples filing jointly: $29,2002

- Head of household filers: $21,900

For more information, see Kiplinger’s guide: What’s the Standard Deduction for 2024 and 2025?

- Kelley

Go Digital This Tax Season

The IRS is expecting more than 140 million individual tax returns to be filed by April 15, and the last thing you want is for your return to be delayed or lost in the mix.

As you prepare to file your taxes, storing your tax forms and supporting documents in a digital folder can help you file a secure and accurate tax return. Depending on your tax situation, you may collect receipts for expenses you’d like to deduct or claim as credit.

To get started, some documents you should consider digitizing include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Paystubs or unemployment compensation

- Receipts for deductible expenses

- Investment records or bank statements

File digitally. As we’ve mentioned, IRS Direct File is available in 25 states, allowing taxpayers to file for free and directly to the IRS. Meanwhile, if you earned less than $84,000 in 2024, consider filing with IRS Free File. You can also select a direct deposit and receive a refund quicker if you are entitled to one

Avoid accidental loss. Digitizing your tax records and supporting documents can help you avoid the risk of losing crucial paperwork in the event of a natural disaster.

Consider the political landscape. The IRS has recently overcome years of challenges due to old tech, limited staff, and paper backlogs. The Trump administration is halting hiring new staff and considering cutting back on IRS funding. These changes may lead to potential tax processing delays, particularly for paper returns or those that need manual review.

- Gabriella

Related:

Some News: Scott Bessent Becomes New Treasury Secretary

The Senate confirmed Scott Bessent as the new U.S. Treasury Secretary on January 27, with a vote of 68-29. Bessent, known for his work in the hedge fund industry, is the 79th Treasury Secretary, succeeding Janet Yellen.

During his confirmation hearing, Bessent outlined several key focus areas, some of which center on tax policy.

- Addressing the upcoming expiration of certain Tax Cuts and Jobs Act (TCJA) provisions

- Managing the national debt and debt ceiling negotiations

- Potential reforms to the IRS

- Navigating international trade relationships, particularly with China

As Bessent takes on his new role in the Trump administration, his decisions and policies will likely significantly impact the U.S. economy.

- Kelley

Trump Wants to Freeze All Federal Aid

The White House Office of Management and Budget (OMB) has issued a memo pausing all federal grants and loans, effective January 28, 2025. While not directly targeting taxes, this unexpected and sweeping move could significantly affect the tax landscape.

Just before the 5 pm deadline when the pause was supposed to go into effect, a federal judge paused its implementation until Feb. 3. The situation is developing.

The memo came in addition to executive orders already issued freezing federal hiring for 90 days (indefinitely for the IRS), requiring a return to the office for many federal workers, and changing processes for reclassifying federal workers.

Key points of the memo:

- Halts distribution of federal financial assistance

- Excludes Social Security, Medicare, and Medicaid benefits

- Federal agencies must report on affected programs by February 10, 2025 (this will likely be impacted by the judge's order.)

Potential tax impacts:

- IRS Operations: A hiring freeze at the IRS could slow tax return processing and impact customer service.

- Tax Credits: Uncertainty around grant-supported tax credit programs, especially in clean energy and electric vehicles.

- Tax Guidance: Possible delays in issuing guidance on recent tax law changes.

- Program Changes: Tax-related federal programs could be affected, potentially altering available incentives and credits.

Notably, the memo doesn't specify an end date for this "temporary" pause, adding another layer of uncertainty. And it's hard to say what will happen from a legal standpoint.

As we navigate this open-ended situation, keep an eye on any IRS updates and consider consulting a tax or finance professional if you have specific concerns about impacts on your situation.

Related:

What Trump's Federal Hiring Freeze Means for Your Tax Return

Is the EV Tax Credit Going Away?

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

A Reminder for Those With Student Loan Debt

If you’re paying off a student loan, you could be eligible for an up to $2,500 tax break for student loan interest, among other education tax credits and deductions.

Some education-related tax breaks hinge on "qualified education expenses," including tuition and fees, room and board, and loans for school supplies, like books. But in some cases, the combined total could save you thousands.

Why this matters. Data show that more than 50% of students graduate with student loans, with the average student loan payment of around $300.

On top of that financial burden, there may also be a new challenge for some students: Parts of the SAVE plan (a federal student loan repayment program) are currently being contested in a federal lawsuit.

For more information on how you can save tax dollars on your student debt and to learn about the taxability of recently forgiven student loans, check out these Kiplinger reports:

Don't Miss This $2,500 Tax Break for Paying Your Student Loan

How to Get a 401(k) Match for Your Student Loan Payment

Will You Owe Taxes on Your Recently Forgiven Student Loan?

A Little-Known Way to Help Pay Your Student Loan

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

In the News...No More Income Tax?

Donald Trump has once again stirred the debate on tax policy, recently advocating for eliminating income tax and returning to a tariff-based revenue system.

"We're going back to the old days. No income tax, just tariffs. It worked before, and it'll work again," Trump said during a January 25 event in Las Vegas, Nevada.

The remarks, which come not long after a Republican lawmaker separately proposed to abolish the IRS and rewrite that tax code, reignited discussions about fundamental changes to the U.S. tax system.

(It's worth noting that critics argue that heavy reliance on tariffs could lead to trade wars, increased consumer prices, and potential economic instability.)

To learn more about this latest tax suggestion, see: Hello Tariffs? What's Wrong With Trump's Plan to Abolish Income Tax.

- Kelley

$1,400 IRS Stimulus Check?

Keep your eyes peeled for some extra cash flow coming your way via mailbox or a direct deposit.

As Kiplinger reported, the IRS is sending a million individuals a pandemic stimulus check worth up to $1,400 per taxpayer. The tax agency said it would send $2.4 billion in payments, which should be delivered by the end of this month (January).

The checks in question are from the 2021 Recovery Rebate Credit, a refundable credit for folks who did not receive one or more Economic Impact Payments (EIP) or stimulus checks.

Why such a delay? The IRS has been reviewing internal data to identify eligible taxpayers who filed a return but didn’t claim the credit. During the pandemic, the tax agency was short-staffed and faced many challenges as it dug itself out of paper backlogs.

Most taxpayers have already received their credit. However, some have not yet filed their 2021 tax returns and may qualify for a refund. If you’re in that situation, you’ll need to file that prior return by April 15.

For all the details, see our story, IRS is Sending Up to $1,400 to One Million People: Are You Eligible?

- Gabriella

Don't Overlook This Tax Break

This year marks the 50th anniversary of the Earned Income Tax Credit (EITC), and there’s no better way to celebrate than by claiming your credit.

The EITC is a refundable tax credit designed for low- and moderate-income workers. If you qualify, you can use the credit to reduce your tax liability and may get a refund.

Approximately 23 million workers and families received $64 billion in EITC last year. Nationwide, the average tax credit amount was $2,743 —some good news: the Earned Income Tax Credit is expected to be slightly higher this year.

- To qualify, you must have an earned income under $66,819 or an investment income under $11,600 last year.

- For the 2024 tax year (taxes generally filed in early 2025), the EITC is worth up to $4,213 if you have only one qualifying child. That figure increases to $6,960 for two kids and up to $7,830 for three or more eligible children.

- You don’t have to have children to qualify. Single taxpayers with an income under $18,591 ($25,551 for married filing jointly) qualify for a maximum EITC of $632.

Lastly, 31 states, plus the District of Columbia and Puerto Rico, currently have their state or local government version of the earned income tax credit in addition to the federal EITC.

Also, watch for EITC Awareness Day this Friday, January 31, 2025. The IRS in collaboration with community organizations, elected officials, schools, employers, and other partners, offers taxpayers free information and help to claim the EITC and other family tax credits.

For more details, see: Earned Income Tax Credit: How Much Is It?

Also: 2025 Family Tax Credits: Four IRS Changes That Can Save You Money

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

The Child Tax Credit: A Boost for Families

Since 1997, the Child Tax Credit (CTC) has supported millions of families. What began as a $400 per child credit now provides up to $2,000 per eligible child, reaching approximately 46 million families - more than the population of Spain.

The CTC's impact is significant:

- It helps lift nearly 2 million children out of poverty each year, comparable to emptying a city the size of Houston.

- By providing financial support, the credit creates opportunities and stability for families across the United States.

For the 2024 tax year, the maximum CTC remains $2,000 per qualifying child under 17, but the refundable portion has increased from $1,600 last year to $1,700 for this tax filing season.

Families with lower tax liabilities can receive up to $1,700 back as a refund, even if they owe no taxes.

Learn more: Child Tax Credit 2024 and 2025: How Much Is It?

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Are You Receiving a New Tax Form This Year?

Here’s some news for gig workers, eBay sellers, and part-time Etsy vendors: You may get a tax form this year that you haven’t received before.

The IRS instituted a new 1099-K reporting change for this 2025 filing season (2024 tax returns). Previously, taxpayers received Form 1099-K when they reached $20,000 and 200 online transactions. Now, the threshold is just $5,000. This means more casual sellers of goods and services may receive this tax form for the first time.

While the new lower threshold doesn’t change the taxability of these items, you should review your Form 1099-K to ensure proper classification of what is taxable income.

For example, your form could accidentally include nontaxable transactions to friends and family. Items like splitting a meal, gifting birthday money, and like-personal transactions shouldn't trigger tax.

For more information, check out Kiplinger’s report 1099-K Reporting Change for the 2025 Tax Season.

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Types of Income That Aren't Taxed by the IRS

It can often feel like the IRS taxes most of your hard-earned money, but thankfully, certain types of income are nontaxable in the eyes of the federal tax agency. And those exceptions can significantly impact your financial strategy and tax planning.

Some examples? Gifts and inheritances up to certain limits, life insurance proceeds, some Social Security benefits, and interest from municipal bonds. Qualified distributions from Roth retirement accounts also provide tax-free benefits in retirement. Additionally, profits from the sale of a home may be exempt from tax under specific conditions.

For 2025, the annual gift exclusion is $19,000 per recipient, up from $18,000 in previous years. Additionally, Roth IRA withdrawals can be tax-free if you're over 59½ and have held the account for at least five years. It's important to note that while these income sources may be tax-free at the federal level, some might still be subject to state taxes depending on where you reside.

See: Common Types of Nontaxable Income to Know

While these and some other opportunities for tax-free income exist, remember that tax laws are complex, and each exemption has its own set of rules and qualifications.

Check out our summary on several types of income the IRS doesn’t tax. And, as always, consult a qualified tax professional who can help you navigate what in your financial life is and isn’t taxable.

- Kelley

Learn More:

Types of Income the IRS Doesn’t Tax: What to Know for 2025

Qualified Charitable Distribution (QCD): Lower Your Taxes with This RMD Strategy in 2025

When you are planning out your required minimum distributions (RMDs), remember to take advantage of a special tax consideration: Qualified Charitable Distributions.

RMDs are the minimum amount someone 73 or older must withdraw yearly from their retirement savings plan. A QCD is a donated portion of your RMD and can be made by anyone 70 ½ or older.

In addition to helping a qualified charity, a QCD may help you save on 2025 income tax through potentially:

- Lowering the amount of tax you owe

- Reducing high taxes on Social Security benefits

- Lowering Medicare premiums

QCDs aren’t itemized deductions, so you can take full advantage of this tax benefit while still claiming the standard deduction.

Ready to learn more? Check out Kiplinger’s reports:

What Is a Qualified Charitable Distribution (QCD)?

RMDs: Key Points and What to Know

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Form 1099 Guide: What You Need to Know About All 22 IRS 1099 Forms

If you have a tax paper from someone other than your employer, you may have received a 1099. But what does the form mean, and why did you receive it?

IRS Form 1099 is informational. This means that taxes may not be due, but you should report the information (however small) anyway. Not only does this make your return more accurate, you can decrease the risk of getting audited by the IRS and potentially avoid any penalties or other tax fees associated with underfiling.

It's important to understand that different 1099 forms serve various purposes. For example, Form 1099-MISC reports miscellaneous income such as rent or royalties, while Form 1099-NEC is specifically for reporting non-employee compensation.

Form 1099-K reports payment card and third-party network transactions. For tax year 2024, the reporting threshold for 1099-K has been lowered significantly, potentially affecting many more taxpayers involved in gig economy work or online selling. Be sure to carefully review any 1099-K forms you receive and compare them against your own records to ensure accuracy

Check out our guide to the many types of Form 1099 so you can get off to a good start this filing season.

IRS 1099 Forms: What to Know About All 22 of Them

- Kate

Capital Gains Tax 2025: Rates, Rules, and How to Minimize Your Tax Bill

Now that tax season has arrived, investors who sold assets in 2024 face the reality of capital gains taxes.

Any profit from selling stocks, real estate, or other investments is subject to capital gains tax. The rate depends largely on your holding period: assets kept for over a year qualify for favorable long-term rates, while those sold within a year are taxed as ordinary income. This distinction can make a substantial difference in your tax liability.

Fortunately, there are strategies to mitigate the impact. For example:

- Investment losses can offset gains, potentially reducing your tax burden.

- Homeowners who sold their primary residence may be eligible to exclude a portion of the profit from capital gains tax—up to $250,000 for individuals or $500,000 for married couples filing jointly.

As you navigate this tax season, don't underestimate the importance of capital gains in your overall financial picture. Planning and clearly understanding these rules can allow you to retain more investment returns for future growth.

More on capital gains tax:

The Wash Sale Rule: Six Things Investors Need to Know

States With Low and No Capital Gains Tax

The Capital Gains Tax Exclusion for Homeowners

Capital Gains Tax Rates for 2024 and 2025

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

State Retirement Taxes 2025: A Complete Guide to Taxes by State

Navigating taxes in retirement isn’t always easy. After all, how your retirement income is taxed depends on multiple factors, such as what type of income you receive, federal taxes, and which state you live in. Not all states tax retirement income, and some tax some types of income but not others. Even within states, taxes can differ for each type of retirement income.

If you are considering moving to a different state, it's a good idea to investigate how each state handles taxes on retirement income before you decide. And even if you’re not moving, this list can help give you a picture of your state's tax landscape for retirees.

Check out this overview of how income from employment, investments, a pension, retirement distributions, and Social Security are taxed in every state and the District of Columbia.

Retirement Taxes: How All 50 States Tax Retirees

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Trump's Social Security Tax Plan: Will Your Benefits Be Tax-Free?

As a presidential candidate, Donald Trump pledged to eliminate taxes on Social Security benefits if he won the election. What happens now that he's in the White House?

Currently, folks with incomes under $25,000 ($32,000 if married filing jointly) don’t pay any taxes on their Social Security benefits. Those earning up to $34,000 ($44,000 joint filers) are subject to up to 50% tax on Social Security benefits. For anyone earning above those limits, up to 85% of their benefits can be taxed.

Theoretically, Trump’s promise to end taxes on SS benefits could provide tax relief to some retirees — but his administration has yet to propose a working mechanism to offset lost revenue.

- Fully exempting taxes on Social Security benefits would drive the program’s retirement and Medicare hospital insurance trust funds into insolvency by 2032 rather than late 2033, according to government reports.

- Medicare’s funding would hit rock bottom six years earlier than expected — as early as 2030.

At worst, that means millions of beneficiaries would see reduced benefits in less than a decade. Those hardest hit would be the lowest-income beneficiaries. However, experts say this is unlikely to reach that point. Congress would have to intervene.

For more information, see What’s Wrong With Trump’s Pledge to End Taxes on Social Security Benefits.

Also see:

Taxes on Social Security: Five Things Retirees Need to Know

Calculating Taxes on Social Security

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Avoid Tax Filing Errors: When Shouldn't You File Your 2024 Taxes?

Now that tax season has officially started, you might feel ready to get it over with and complete your filing. While the go-getter spirit may help make tax season less stressful, be wary of rushing to get things done. The IRS expects you to file a complete and accurate return.

For instance, you don’t want to start filing before you have all your tax documents in order. This includes 1099s, W-2s, or investment statements. You may also have to wait for documentation like Form 1098 if you plan to claim the mortgage interest deduction.

Tip: One common mistake taxpayers make when filing early is overlooking late-arriving tax forms. For example, some investment income forms, like certain 1099s, may not arrive until mid-February or even March. Filing before you have all your documents can lead to underreporting income and potential IRS scrutiny.

...Did you catch our guide to all 22 IRS Form 1099?

Additionally, waiting to file may give you more time to review tax law changes that might affect your return. For instance, the 2025 tax year has seen adjustments to standard deductions and tax brackets due to inflation. Taking the time to understand these changes can help ensure you're taking advantage of all available deductions and credits.

Another key area the IRS looks at is gambling winnings and losses (particularly if you claim high winnings or significant losses). Last year, the IRS started looking more closely at gambling winnings, with increased enforcement efforts on high-income earners. (With new leadership at the IRS, it's hard to say what enforcement priorities will be going forward.)

To learn more, see Taxes on Gambling Winnings and Losses and Is the IRS Coming for Your Gambling Winnings?

And as you prepare to file, there may be prudence in minding IRS audit red flags.

So, no matter how early you file, remember that the federal tax return deadline (Tax Day) is April 15th, 2025. The federal extended deadline is October 15th, 2025 for most taxpayers (but taxes owed are still due by April 15).

For more information on both federal and state tax return deadlines, check out Kiplinger’s reports:

When Are Taxes Due in 2025? Tax Deadlines by Month

States With 2025 IRS Tax Deadline Extensions

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

2024-2025 Tax Brackets: Find Your Federal Income Tax Rate

Currently, in the federal system, there are seven federal tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates generally don't change unless Congress passes major tax legislation. (That happened with the 2017 Tax Cuts and Jobs Act (TCJA, also known as the "Trump tax cuts.") However, the tax brackets tied to the rates change yearly since they are adjusted for inflation.

These rates apply to your taxable income, which is your total income minus deductions and credits. Thankfully, though, your entire income isn't taxed at the rate of your highest bracket. Instead, the U.S. uses a progressive tax system with marginal tax rates.

That means only the portion of your income that falls into each bracket is taxed at that bracket’s rate.

So, what’s your bracket for this filing season?

Check out our guide: 2024 and 2025 Tax Brackets and Income Tax Rates.

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

In the News: Mexico & Canada Tariffs: Will They Raise Your Gas & Food Prices in 2025?

President Donald Trump hasn’t backed down (so far) from plans to impose 25% tariffs on Canada and Mexico imported goods on Feb. 1. He’s also set to impose a 10% tariff on Chinese goods.

Trump’s bold 25% tariffs will hurt your wallet: The tax on Mexico and Canada will raise gas, food, and car prices. Not to mention, your Valentine’s Day may just be more expensive this year. Canada is a major supplier of chocolate, while Mexico is a main exporter of strawberries to the U.S.

China's 10% tariff impact: As Kiplinger has reported, the price of everyday goods like clothing, electronics, and furniture will spike. It’s worth noting that Trump previously threatened 60% to 100% tariffs on Chinese products during his 2024 campaign.

Here’s how tariffs work and can impact your finances.

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Breaking: Trump's EU Tariffs: How They Could Impact Your Finances in 2025

As the United States prepares to levy tariffs on Mexico, Canada, and China, President Donald Trump takes it a step further.

Trump told reporters he would “absolutely” impose tariffs on the European Union in the future, arguing that the EU has treated the U.S. “so terribly.”

The European Union’s commissioner for the economy Valdis Dombrovskis told CBS that Europe would respond in a “proportionate way” in defense of its economic interests earlier this month.

The potential of tariffs on EU goods could have far-reaching effects on American consumers and investors. For instance, prices of imported European luxury goods, wines, and certain food products might increase. This could impact individual consumers and businesses in the hospitality and retail sectors.

As reported by Kiplinger, Trump plans to hit Canada and Mexico with 25% tariffs on Saturday, Feb. 1. China will also be hit by a 10% tariff on all imports to the U.S. The neighboring countries' leaders say they are preparing to retaliate, citing Trump’s tariffs as a “strategic mistake.”

In short, Trump’s tariffs on Canada, Mexico, and China’s imported goods will cause the costs of food, gas, and cars to increase this month. This is a developing story.

For more on how universal tariffs can impact your wallet see Trump’s Tariffs Could Dramatically Spike Clothes, Toys Prices in 2025. Also, see What's Happening With Trump Tariffs?

- Gabriella

When Will You Get Your Refund?

The IRS anticipates that more than 140 million individual federal tax returns for the 2024 tax year will be filed before the April 15 federal deadline. More than half of all returns expected to be filed this year will be with the help of a tax professional.

Taxpayers will file the rest independently using self-service platforms like IRS Direct File, which is now available in 25 participating states, or IRS Free File.

To avoid unwanted delays, the safest way to receive a refund is to file electronically (e-file) your tax return and request a direct deposit. Data from the U.S. Treasury Department show that paper refunds are 16 times more likely to have an issue, such as going lost, destroyed, stolen, or uncashed.

Once you complete those steps, you can track your refund in real time using the IRS ‘Where’s My Refund’ tool. Generally, more than 90% of refunds issued by the IRS are delivered in less than 21 days.

At this time last year, over 13 million tax returns had been processed and the average refund amount was $1,395. That can give some families and taxpayers a well-needed boost to their income.

Why should you file sooner this year? The IRS is currently experiencing a hiring freeze as part of President Donald Trump’s executive orders. The Trump administration has also placed federal employees tied to Diversity, Equity, and Inclusion (DEI) initiatives on leave and offered a buyout.

Not to mention, the agency recently experienced a $20 billion loss in funding allocated to key enforcement programs. U.S. Treasury officials anticipate that recent changes to the IRS workforce will impact its ability to adequately service taxpayers.

For more information, check out our recent reporting:

No New IRS Agents? What Trump’s Federal Hiring Freeze Means for Your Tax Return

Where’s My Refund? How to Track Your Tax Refund Status

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

February Tax Deadlines 2025: Tips, Dates & What to Know

February is here! And since some see this as a less busy month after the frenzy of the holiday season and new year, why not use this month to get your finances in order?

Here are some helpful planning tips to reach your 2025 tax and financial goals:

Observe National “Pay Your Bills” Week (Feb. 2-8). Data show that 77% of US adults lose sleep over money. Don’t let that be you. Make a list of your 2025 home projects, insurance payments, and cash outlays, and plan accordingly. Budgeting early can help cut overspending at other times of the year.

Check Your Mailbox. Many tax forms, including 1099s, Form 1098, and other tax documents, are mailed out at the end of January. We’ve got a rundown of all 22 IRS 1099 Forms if needed.

Know Your February Tax Deadlines:

- February 10 is the deadline to report tips to your employer (if you have any).

- February 18 is the deadline to reclaim a tax exemption on withholding for 2025.

Don’t miss these important due dates. For more information, check out Kiplinger’s report Tax Deadlines By Month.

Also, as we approach the April 15th tax filing deadline, it's crucial to gather your necessary documents now. This includes W-2 forms, 1099 forms for various types of income, receipts for deductible expenses, and records of any estimated tax payments made throughout the year.

Organizing these materials early can help you avoid last-minute stress and potential errors on your return. Additionally, consider scheduling an appointment with a tax professional soon if you plan to use one, as their calendars fill up quickly in the weeks leading up to the deadline.

More to come, but for now, have a Happy February, and try not to eat too much chocolate.

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Trump Trade War Watch

President Donald Trump levied 25% tariffs on all imports from Canada and Mexico on Feb. 1, and the neighboring countries' top leaders are taking action.

Canada’s Prime Minister Justin Trudeau said he would impose 25% tariffs on $155 billion worth of U.S. goods. The tariffs would be enacted tomorrow, Feb. 4, on $30 billion worth of U.S. imports, the rest would be issued in three weeks. Trudeau said the timing would allow Canadian companies and supply chains to seek and find alternatives to U.S. trade.

Mexico President Claudia Sheinbaum Pardo said her government would announce retaliatory trade penalties soon.

Both Canada and Mexico are top trading partners for fresh food, crude oil, and auto parts and vehicles. That means prices at the gas pump and grocery store could spike soon.

Not sugarcoating it: If the trade war persists, many certain food and other products will be more expensive for consumers not to mention items like chocolate and strawberries that will also be more expensive in time for Valentine's Day.

Trump admitted Sunday that Americans could feel “some pain” from the developing trade war triggered by his penalties on Canada, Mexico, and China. Canada and Mexico’s leaders have warned that this will cause supply chain issues, raising prices for U.S. consumers like you.

Trump will reportedly discuss the next steps with Mexico and Canada's leadership today.

For more information and tariffs and how they work see our latest coverage:

Food, Gas Prices to Spike as Trump Levies 25% Tariffs on Canada and Mexico

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Breaking: Trump Pauses 25% Mexico Tariff

As Gabriella mentioned, we are on Trump tariff watch today and there's news:

Mexican President Claudia Sheinbaum has agreed to send 10,000 soldiers to the Mexico border in exchange for a one-month delay in the 25% tariff Trump imposed two days ago.

According to a post on X (formerly Twitter), Sheinbaum said the border reinforcement would be to stop drug trafficking from Mexico to the United States.

Stay tuned for more information.

- Kelley

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

2025 State Tax Changes to Know

Tax season is heating up, and as we’ve mentioned, 2025 is already looking like a wild ride for your wallet.

We've already covered many federal issues and will continue to delve into the new administration, TCJA tax cut expirations, and IRS shakeups. But to kick things off for February, let's take a minute to focus on something equally important: state tax changes.

This year, states are offering a mixed bag of tax reforms that can impact your finances in varied ways. This includes everything from income tax cuts and property tax tweaks to rent relief and those inevitable gas tax increases.

These aren't just numbers on a page—they're changes that'll directly impact how much cash you keep each month.

Ready to learn more about what's changed in your state?

Check out our guide: Key 2025 State Tax Changes: What They Mean for Your Money

- Kelley

More News: Trump Pauses Tariffs on Canada

President Trump is holding off 25% tariffs on imports from Canada for at least 30 days. This comes a day before Canada would have imposed retaliatory 25% tariffs on $155 billion worth of U.S. imports.

Outgoing Prime Minister Justin Trudeau said Canada would reinforce the border with “new choppers, technology and personnel” to stop the flow of illicit drugs, particularly fentanyl, to the U.S.

The pause was announced hours after Trump and Mexico’s President Claudia Sheinbaum agreed to a 30-day pause on 25% tariffs. In a similar negotiation, Sheinbaum is to send 10,000 troops to the border to mitigate the flow of illegal migrants and illicit drugs.

For more information, see Trump Abruptly Delays 25% Tariffs on Canada, Mexico for One Month.

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Trump Considers Ending NYC Congestion Pricing

Yesterday, we posted about state tax changes, and it’s worth noting that the Trump administration is discussing plans to kill New York’s congestion pricing barely a month after it started.

President Trump has reportedly been in talks with NY Gov. Kathy Hochul recently as the Department of Transportation considers withdrawing the controversial $9 toll to drive into downtown Manhattan South of 60th Street. The measure went into effect Jan. 5, despite facing multiple lawsuits.

To unravel congestion pricing, the Trump administration must revoke federal authorization for the tolling plan received from the Biden administration last year. Lawmakers say such a move will be challenged in court.

Early data show that congestion pricing seems to be working, with MTA officials citing speedier bus service and more riders using public transit compared to a year ago.

Stay tuned for more on this developing story.

For more information about congestion pricing, see NYC Congestion Pricing: ‘Ghost Tax’ or Necessary Fee?

- Gabriella

No, Elon Musk Didn’t Delete Direct File: What to Know

Throughout the day, we’ll catch you up on developments that impact the tax and financial landscape and continue a mini-focus on state taxes. First up, let’s talk about IRS Direct File.

On Monday, Musk declared on his social media platform X that he had "deleted" 18F, the digital services agency responsible for developing the IRS Direct File system.

Despite Musk's claim, which caused some confusion, the Direct File program remains operational, accepting tax returns for the 2025 tax season, which began on January 27, 2025.

This free tax filing program, which expanded to 25 states this year, allows eligible taxpayers to file their federal returns directly with the IRS at no cost.

It’s worth noting that during his confirmation hearing on January 16, 2025, Scott Bessent, who has since been confirmed as Treasury Secretary, committed to maintaining the IRS Direct File program for the 2025 tax season, Though he didn’t make any long-term commitment, saying, "If confirmed, I will consult and study the program and understand it better and make sure that it works to serve the IRS' three goals of collections, customer service and privacy"

We'll have more to come on this, but, for now, to learn more about whether filing taxes directly with the IRS could help you, see our report: IRS Direct File: What You Need to Know for 2025.

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

No taxes on overtime pay?

The "no tax on overtime" proposal is part of a series of tax cut promises Donald Trump made during his presidential campaign. As Kiplinger has reported, the now president previously suggested eliminating taxes on tips and ending the tax on Social Security benefits.

While the idea of tax-free overtime may sound appealing, critics worry.

There's the potentially significant loss of federal tax revenue (on the low end, depending on what income is exempted, an estimated $145 billion over ten years, according to the Tax Foundation)

Plus, the possibility of employers relying more on overtime instead of hiring additional workers

Similar concerns have been raised about the no-tax-on-tips proposal (the Tax Foundation estimates a cost, on the low side, of $107 billion over ten years).

As a result, at this time, it's unclear whether the no tax on overtime proposal will make it into the reconciliation bill the Republican-led Congress is trying to craft and pass this year. But for now, it’s important to know how overtime pay is currently taxed.

Check out: Taxes on Overtime Pay: What's Happening in 2025

- Kelley

These States Don’t Tax Retirement Income

Living in a state that doesn’t tax retirement income may sound exciting. Not only could you pay fewer taxes in retirement, but you may save by not paying any state income tax. However, some states still tax certain earnings, so you may want to consult a tax professional depending on your type of taxable income.

But if your retirement income includes Social Security benefits, distributions from a 401(k) or IRA, or a pension, read on: you won’t see a tax bill from any of the states listed in our guide:

Thirteen States With No Retirement Taxes

Note: While these states don’t tax “traditional retirement income,” you may still have to pay tax on other income types you earn in retirement, like wages, interest, and dividends.

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

Breaking: China Retaliates Trump Tariffs, Files Lawsuit

China will impose 15% tariffs on imports of coal and liquified natural gas from the United States in retaliation for the Trump administration’s 10% duty on Chinese goods.

The Chinese government also announced another series of targeted 10% tariffs on U.S. imports of crude oil, agricultural machinery, and certain vehicles. These tariffs are slated to go into effect on Feb. 10.

The Chinese Ministry of Commerce filed a lawsuit against the United States for allegedly violating the World Trade Organization’s rules. The ministry claims Trump’s 10% unilateral tariff increase on Chinese imports to the U.S. undermines the economic and trade cooperation between the two countries.

“China firmly opposes the U.S. approach and urges the U.S. to immediately correct its wrong practices,” the commerce ministry said in a statement.

President Donald Trump had issued 25% blanket tariffs on Mexico and Canada, and a 10% duty on Chinese imports to the U.S. on Feb. 1, 2025. After negotiations with top leaders, the Trump administration agreed to delay 25% tariffs until March 1.

Trump is reportedly set to speak with Chinese President Xi Jinping “soon” over China’s retaliatory tariffs.

For more information: Trump Abruptly Delays 25% Tariffs on Canada, Mexico for One Month.

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Musk Treasury Access Sparks Tax Refund Concerns

As the 2025 tax filing season continues, Elon Musk's influence over government systems and recent claims about "deleting" an agency have created confusion and alarm about potential tax return disruptions.

It’s also worth mentioning that Musk, who has been deemed a “special government employee” tasked by Trump with cutting government spending through a Department of Government Efficiency (DOGE), heads Tesla, which paid zero income tax last year despite making billions.

For his part, Musk posted the following Tuesday on his social media platform X: "We're never going to get another chance like this. It's now or never. Your support is crucial to the success of the revolution of the people."

Wondering what this means for you?

Learn more about Musk and your taxes: Will Elon Musk’s Treasury Access Derail Your Tax Refund?

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Musk Polls X Users Regarding IRS Audit

Elon Musk has once again stirred controversy by appearing to propose an audit of the IRS through his Department of Government Efficiency (DOGE). In a poll on X, Musk asked his followers if DOGE should investigate the IRS, which attracted more than one million responses.

Over 90% of respondents initially backed the potential audit, including some selecting an emphatic "F Yes" option.

Would you like @DOGE to audit the IRS?February 4, 2025

This comes amid ongoing tensions between Musk and government agencies, particularly after he announced the "deletion" of 18F, a government technology agency that worked on IRS Direct File. As Kiplinger reported, this created confusion about the new free tax filing program being deleted. (Direct File is operational for this 2025 tax filing season.)

As a "special government employee" under President Donald Trump, Musk claims to want to save the federal government money through cost-cutting. However, the X tease raises questions about the potential politicization of tax oversight and the implications of a private entity auditing a federal agency.

For more information, see our report on Musk's increasing power and how it might impact the IRS.

Musk Treasury Access Raises Alarm: Is Your Tax Refund at Risk?

- Kelley

USPS Resumes Delivery of Parcels from China Amid Trade War

Today, we’ll deliver updates on the developing trade war with China, tax refunds, and potential tax credits on Trump’s chopping block. Let’s dive in!

The U.S. Postal Service (USPS) announced on Wednesday that it will continue accepting inbound international packages from China and Hong Kong after saying it would temporarily suspend deliveries on Feb. 4, 2025.

"The USPS and Customs and Border Protection are working closely together to implement an efficient collection mechanism for the new China tariffs to ensure the least disruption to package delivery," the Postal Service said in a statement, suggesting the temporary suspension was related to Trump's escalating trade war with China.

The Trump administration levied 10% blanket tariffs on all Chinese imports to the U.S. on Feb. 1, 2025. Meanwhile, proposed duties on Mexico and Canada were paused for 30 days.

China countered on Feb. 4 with targeted tariffs on select U.S. imports and put Google under notice for potential sanctions. The Chinese government said the retaliatory tariffs would go into effect next Monday, February 10. This is a developing story.

Want to know more about what China tariffs could mean for you, follow our recent coverage: Trump Abruptly Delays 25% Tariffs on Canada, Mexico for One Month.

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

EITC and ACTC Refunds Available Starting Feb. 27

Yesterday, we clarified that IRS Direct File remains fully functional, despite Elon Musk's claims about “deleting” 18F — the digital services agency responsible for developing the program.

On that note, if you’ve done your due diligence and filed early, you may wonder where your tax refund is, especially if you’re expecting an Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC).

- The maximum EITC amounts to claim for the 2024 tax year (taxes generally filed in 2025) are $632, $4,213, $6,960, and $7,830, depending on your filing status and household size.

- Meanwhile, the ACTC allows you to receive up to a maximum of $1,700 per qualifying child for the 2024 tax year.

How soon can you receive your refund? Due to federal regulations, the IRS cannot issue EITC and ACTC refunds before mid-February. That being said, you should be able to see an updated status of your refund by Feb. 17 through the IRS-free tool: Where’s My Refund?

The tax agency notes that related EITC/ACTC refunds should be available on your bank or debit cards by February 27, 2025, if you select a direct deposit with your return. Normally, tax refunds are issued within 21 days.

Check out: Where’s My Refund? How to Track Your Tax Refund Status

- Gabriella

Family Tax Cuts on GOP Chopping Block

It was clear to anyone who won the 2024 presidential election: taxes would key item going into 2025.

The Trump administration is facing a looming tax cliff tied to expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA), which contain temporary expansions to key family tax breaks like the Child Tax Credit.

President Donald Trump promised a myriad of tax cuts if he won, mostly for the rich, and some for businesses and working taxpayers. These tax cuts, along with other immigration policies and energy reforms are being bundled into “one big, beautiful bill.” The issue: congressional Republicans are scrambling to find revenue to afford Trump’s ambitious tax proposal.

A 50-page policy menu prepped by the House Budget Committee was recently leaked, listing a deluge of tax breaks in danger of being gutted by the GOP.

On the chopping block are family tax credits like the Child and Dependent Care Credit, reductions of eligibility to the CTC, and eliminating education tax credits.

For more information see: Family Tax Deductions and Credits on GOP Chopping Block This Year

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

CIA Offers Buyouts to Workforce

The Central Intelligence Agency (C.I.A.) offered buyouts to its entire workforce on Tuesday, citing its compliance with the Trump administration’s goal to shrink the government.

This comes as the federal government is undergoing a Trump-imposed hiring freeze, and 2 million federal employees across other agencies face a Feb. 6 deadline to take an exit offer in exchange for “pay and benefits” until Sept. 30. So far, according to the Office of Management and Budget (OMB) 20,000 federal employees have voluntarily resigned.

The move to purge the federal workforce seems to align with Project 2025, a conservative-led blueprint that calls to reshape the government. Some impacted agencies include the IRS, the Federal Reserve, and the Department of Education.

See how the federal hiring freeze can impact you: No New IRS Agents? What Trump’s Federal Hiring Freeze Means for Your Tax Return

- Gabriella

Abolishing the Department of Education?

President Donald Trump is reportedly drafting an executive order to abolish the Department of Education. Now what?

The Education Department is responsible for distributing billions of dollars in federal financial aid for education and supports federal college loan programs like the Pell Grant. It even administers funding for K-12 schools, including the Title 1 grant program, to schools with high percentages of low-income students.

Before you panic, it would require congressional approval to shut down the department, even if Trump plans to issue an executive order. Still, the development is troubling.

It’s also part of the Heritage Foundation's Project 2025 tax overhaul blueprint. This conservative think tank proposes transferring functions like student loans or Title 1 funding to other government agencies, such as the U.S. Treasury Department.

Worth noting: GOP lawmakers are considering eliminating certain education tax credits to fund Trump’s tax plans in 2025. These include the American Opportunity Tax Credit and other important family tax credits on the chopping block.

The Fine Print: What Trump Isn’t Telling You About His 2025 Tax Plans

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

State Tax Holidays, Property Tax Relief, and Tax Credits

Welcome back! Here are a few state tax news highlights from the week in case you missed them:

- Florida Gov. DeSantis released his 2025-2026 budget proposal, including a new “Second Amendment” tax holiday that turned heads. (We’ll have more detail on this later.)

- Missouri Republican lawmakers seek to eliminate the state’s income tax and replace it with an expanded sales and use tax.

- North Dakota passed a bill to enact a $1,000 tax credit per homeschooled child. Qualified expenses may include books, computers, and other educational costs.

- Ohio Gov. DeWine proposed a new child tax credit in his state budget, which would provide a tax credit of up to $1,000 per child under seven years old.

- Texas Republican lawmakers look to slash property taxes for homeowners and businesses alike, as Gov. Abbott declared property tax cuts an “emergency item” last Sunday.

We’ll be covering some state tax updates every Thursday, so be sure to check back for more news on states. See also Kiplinger’s reports on state taxes:

Best States for Middle-Class Families Who Hate Paying Taxes

The Nine States With No Income Tax in 2025

Retirement Taxes: How All 50 States Tax Retirees

Kate is a CPA with experience in tax, audit, and finance topics. As a tax writer at Kiplinger, Kate helps you and your wallet stay in the know.

How Much Do You Have to Make to File Taxes?

The short answer: It depends. The IRS requires filing a federal return once you meet a certain "gross income" (total income) threshold in tax year 2024:

- $14,600 or higher (if single) OR,

- $29,200 (if married filing jointly)

However, you may meet a different minimum if you fall under another filing status, income type, or age. For instance, provided that one spouse is 65 or older, you may need to file federal taxes if your gross income is at least $30,750. Alternatively, the self-employed have to file a federal tax return if their net earnings are $400 or more.

Also, keep in mind that your state tax division may have different income requirements or none at all if you live in one of the nine states without income tax.

For more information on filing tips, check out Kiplinger’s reports:

- Who is Required to File a Tax Return?

- The Extra Standard Deduction for People Age 65 and Older

- Does Your Child Need to File a Tax Return This Year?

- Kate

IRS Employees Can’t Take Trump’s Buyout Until May 15

The Trump administration gave approximately 2.3 million full-time federal workers until Feb. 6 at midnight to accept a so-called buyout offer. The resignation package promised former employees pay and benefits until Sept. 30, 2025, even if they stop working effective immediately.

So far, reports show that as many as 40,000 government employees have taken the deal. There’s no telling how many are tied to the IRS.

That thought may have sprung to the Trump administration’s collective concerns last night, as IRS employees were suddenly told that “critical” tax filing season workers are exempt from the “deferred resignation offer” until May 15. Anyone who already voluntarily accepted the deal must work through the end of the period. Tax season ends on April 15, 2025.

For more details on Trump’s goal to hollow out the IRS, check out:

Trump Wants You Out of the IRS, But You’ll Have to Wait Until May

Gabriella is a seasoned finance journalist with 8 years of experience covering consumer debt, economic policy, and tax. She contributed to national dialogues on fiscal responsibility, market trends, and economic reforms.

Breaking: Judge Pauses Buyout Trump Offered Federal Employees

In a developing situation, a federal judge has paused President Trump’s federal employee buyout program pending a court hearing scheduled for Monday.

The decision to temporarily enjoin the so-called “Fork in the Road Directive” came just hours before the deadline Trump’s emails provided to millions of federal workers. Tens of thousands had reportedly already accepted the offer. Confused?

Here’s our story: Judge Pauses Trump Buyout Offers As Deadline Loomed

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Did You Bet on the Super Bowl? There are some Taxes With That...

Super Bowl LIX is in the books and if you're a Chiefs fan, you're not happy. And if you placed an online sports bet, you might not be happy either, since you can't forget about the IRS. The federal tax agency has specific rules surrounding taxes on gambling winnings and losses, which include sports betting:

- You must report all gambling winnings on your tax return as “other income” on IRS Form 1040.

- If your winnings are more than a certain amount, the payer will withhold 24%.

- You should keep adequate records, like dates and types of specific wagers, for tax documentation.

Gambling losses may be claimed on your federal tax return but only to the extent of your gambling winnings (generally, you must itemize to claim a deduction). State tax laws may also apply to your sports bets.

For more information, check out Kiplinger’s reports on gambling winnings and losses:

Did You Bet on Super Bowl 59? Don’t Forget the Taxes

Is the IRS Coming for Your Gambling Winnings?

Taxes on Gambling Winnings and Losses: 8 Tips to Remember

- Kate

GOP Tax Talks on Reconciliation Bill: ‘Stuck in the Mud’

Good Morning! With the 2017 Tax Cuts and Jobs Act (TCJA, “Trump tax cuts”) provisions set to expire, we start this Friday with news that Republicans are struggling to forge a path forward on tax reform.

Rep. Byron Donalds (R-Fla.) described the situation to reporters as "stuck in the mud," highlighting the challenges in passing a single reconciliation bill in the U.S. House of Representatives.

The comments came after President Trump outlined his 2025 tax priorities, including:

- Extending expiring TCJA provisions

- Expanding the State and Local Tax (SALT) deduction

- Tax breaks for American-made goods

- Cutting taxes on income from tips, overtime, and Social Security

- Eliminating tax breaks for carried interest and stadium owners

According to the Committee for a Responsible Federal Budget, the proposed package could reduce revenue by $5 trillion to $11.2 trillion over ten years, raising concerns about the national debt. Fiscal conservatives are reportedly pushing for significant spending cuts to offset these reductions.

The Road Ahead? As the TCJA expiration approaches, Republicans will have to navigate these challenges to advance their ambitious tax agenda. That won’t be easy since a also divide exists between House and Senate Republicans. The House wants a single comprehensive bill, while the Senate is reportedly leaning toward a separate approach.

Sen. Lindsay Graham of South Carolina told NBC news, "I've always believed that one big, beautiful bill is too complicated,” adding, "What unites Republicans, for sure, is border security and more money for the military. It's important we put points on the board."

The coming months will determine whether they can overcome these obstacles and pass a reconciliation bill that balances Trump’s priorities with fiscal responsibility.

Read More:

- The Fine Print: What Trump Isn't Telling You About HIs 2025 Tax Plans

- Can Trump End Taxes on Social Security?

- What's Happening With Taxes on Overtime Pay?

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Carried Interest Tax Loophole in Trump's Crosshairs?

In an unexpected twist, President Trump has reignited the debate on the so-called “carried interest loophole,” calling for its elimination as part of his 2025 tax reform agenda.

The carried interest tax provision has long allowed fund managers to pay lower tax rates on their earnings. While Trump's stance on this loophole isn't new — he criticized it in his 2016 presidential campaign — its resurgence in his priorities has raised a few eyebrows.

Notably, the move aligns him with some political rivals, at least for now, as ending this controversial tax break has been a bipartisan talking point for years.

For example, former President Biden consistently called for carried interest reform. He proposed taxing carried interest as ordinary income, subjecting it to a higher tax rate than the current long-term capital gains rate. (Biden's budget proposals also include other tax changes impacting high-income earners, such as increasing the Net Investment Income Tax (NIIT) rate, the corporate tax rate, and a minimum tax for billionaires.)

However, the loophole has survived numerous attempts at elimination, protected by intense lobbying efforts and entrenched interests. Given competing fiscal priorities and a historically slim majority in the U.S. House of Representatives, the path to carried interest reform remains murky at best.

- Kelley

Tax Reform 2025: Key Deductions and Credits at Risk

With the Tax Cuts and Jobs Act (TCJA) expiring at the end of 2025, the Republican-led Congress is considering significant tax code changes that will likely impact millions of taxpayers.

Kiplinger has reported on proposed cuts to popular tax breaks listed in a document circulated by the GOP that, if embraced, would be used as offsets for more than $4 trillion in tax cuts President Trump desires.

Some family tax credits and benefits in jeopardy:

- Child and Dependent Care Credit

- Head of Household Status

- Child Tax Credit

- American Opportunity Tax Credit

Other key tax breaks that could change or go away:

- Home Mortgage Interest Deduction

- SALT Deduction

- Clean Energy Credits

- Certain Employer-Provided Benefits

What does this mean for you? If some or all of these tax breaks are altered or eliminated, that could impact millions of families, students, homeowners, and employees. While proposals are preliminary, staying informed and planning is crucial.

Consult a qualified and trusted tax professional or financial planner to discuss potential impacts and the best action for you and your finances.

Learn More:

Florida Second Amendment Summer Tax Holiday: What to Know Now

Governor Ron DeSantis has unveiled a proposal for a "Second Amendment Summer Tax Holiday" as part of his 2025-2026 budget plan for Florida. This initiative, which has garnered significant attention, would eliminate state sales tax on firearms, ammunition, and related accessories from Memorial Day to Independence Day.

The tax holiday is just one component of DeSantis' $115.6 billion budget proposal, which includes various other tax relief measures, from back-to-school supply exemptions to disaster preparedness item holidays and tax breaks on outdoor recreation equipment.

DeSantis estimates that these combined tax relief efforts could save approximately $2.2 billion for Florida families. While the proposed gun tax holiday has sparked debate, it's not unprecedented in the United States.

- States like Louisiana and Mississippi have implemented similar tax exemptions for firearms and hunting equipment.

- However, Florida's proposal contrasts with actions taken in other states like California, which has recently increased its gun and ammunition tax.

DeSantis has expressed confidence in the proposal's popularity, suggesting that it aligns with voter expectations. However, the budget still requires approval from the state legislature, which will begin its regular session on March 4, 2025.

The "Second Amendment Summer" tax holiday is projected to save Floridians about $8 million on eligible items. This measure is part of a broader set of tax relief initiatives in the budget, including a "Freedom Month" sales tax holiday for outdoor recreation purchases in July and a new "Marine Fuel Tax Holiday" to provide savings for boaters.

As the budget proposal moves forward, it will likely generate further discussion among legislators, citizens, and advocacy groups on both sides of the gun rights issue. The outcome of this proposal could have significant implications for Florida's gun policies and tax structure in the coming years.

Check out Kate's story: Florida Gun Tax Holiday Turns Heads.

Musk, Trump IRS Changes for 2025: What's Happening?

The 2025 tax season is already one of the more confusing in recent memory due to the convergence of leadership changes, workforce disruptions, and unprecedented access to sensitive systems in the early weeks of filing.

Leadership Vacuum? The IRS is currently operating without a confirmed commissioner. Danny Werfel, resigned on January 20, 2025, coinciding with President Trump's inauguration. While Trump nominated former Rep. Billy Long for the position, the former congressman/auctioneer still awaits Senate confirmation. In the interim, Deputy Douglas O'Donnell is currently serving as acting commissioner.

See: IRS Leadership Shakeup: What It Means for Your Taxes

Workforce Disruptions? President Trump's administration has implemented a "deferred resignation program" to reduce the federal workforce. This buyout offer, however, has created significant complications for the IRS:

- Critical IRS employees involved in the 2025 tax season are prohibited from accepting buyouts until May 15, 2025.

- The IRS buyout offer could have caused confusion and staffing shortages during peak tax season.

- Union leaders have advised federal workers against accepting these "dubious" offers.

Adding to the complexity, a federal judge has temporarily paused the controversial buyout offer just hours before the original deadline was set to expire, suspending the program's implementation until at least the start of next week.

See: Trump Wants You Out at the IRS But Not Until May and Judge Blocks Trump Buyout Offer: What It Means for You

Unprecedented Access to Treasury Systems? In an unprecedented move, the Trump administration granted Elon Musk and his Department of Government Efficiency (DOGE) team access to the federal payment system. This system controls the trillions in government funds, including tax refunds. While the U.S. Treasury Department claims this access was reportedly "read-only," concerns remain about potential implications for data security and the integrity of the payment process. A judge has since temporarily blocked Musk's Treasury system access.

See: Will Elon Musk’s Treasury Access Derail Your Tax Refund?

Impact on Taxpayers? As the IRS grapples with these challenges, the specific impacts on you as a taxpayer are unclear. Given the workforce uncertainties and potential staffing shortages, processing delays for returns and refunds could occur. Customer service support could be reduced, making it more difficult for taxpayers to get timely assistance with their questions and concerns. Additionally, there's increased uncertainty regarding tax policies and procedures, which could confuse filers.

Some tax professionals advise filing early to avoid potential processing backlogs that may arise later in the season. Electronic filing methods can help streamline the process and reduce the likelihood of delays.

Staying informed about any IRS announcements or policy changes is crucial, as the situation remains fluid.

For those with complex returns, seeking professional tax assistance may be particularly beneficial this year, given the increased complexity and uncertainty surrounding the tax filing process.

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Tax News: Tax Refund Status, the Penny and Steel Tariffs?

As we kick off the week, a lot is happening in the world of tax policy and filing season updates. We’ll have more in-depth coverage to come, but for now, here’s some of what you need to know:

Farewell to the penny? President Trump has directed the U.S. Mint to discontinue the production of pennies. The move is designed to cut costs associated with minting the coin, which exceeds its face value. While this change doesn’t have direct tax implications, there could be some adjustments for many, who might have to round cash transactions to the nearest nickel. However, it's worth noting that some questions remain about whether the president has unilateral authority to stop minting pennies.

Tax filing season: Early stats are in. The 2025 tax filing season is underway, and here are some key updates from the IRS:

- As of January 31, the IRS has issued 3.2 million refunds, with an average amount of $1,928. This figure is expected to fluctuate as more returns are processed. (We’ll have more to say on tax refunds this week.)

- The IRS anticipates processing over 140 million individual returns by the April 15 deadline.

- For those seeking faster refunds, the IRS recommends filing electronically and opting for direct deposit.

Tax policy. Congress is gearing up for significant tax policy discussions: House Republicans are advancing a framework for extending the 2017 Tax Cuts and Jobs Act (TCJA) provisions, many of which expire at the end of 2025. Proposals include making some tax cuts permanent while introducing revenue-raising measures to offset costs.

What we’re watching? Here are a few developments to keep an eye on this week:

Budget Reconciliation Progress. The House Budget Committee will mark up an FY2025 budget resolution soon. This marks a crucial step toward unlocking reconciliation for tax legislation.

Tariff Talk. President Trump has floated plans to announce tariffs that could impact the steel industry.

Stay tuned for more updates.

Kelley simplifies federal and state tax information, news, and developments to help empower readers. She has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Don’t Miss the Earned Income Tax Credit: Valuable Benefits You Need to Know

The Earned Income Tax Credit (EITC) is an often overlooked refundable tax credit available to workers with low and moderate incomes with or without children.

The amount you can be eligible for will depend on your income, filing status, and amount of “qualifying children” in your household.

For the 2024 tax year, the maximum EITC ranges from $632 for those without qualifying children to $7,830 for those with three or more qualifying children.

To qualify, your adjusted gross income (AGI) and earned income must be below certain thresholds, which vary based on your filing status and other factors.

It’s important to note that to be eligible for the federal EITC, you must have a valid Social Security number, be a U.S. citizen or “resident alien” for the entire year, and your investment income, if any, can’t be more than $11,600 for the 2024 tax year. If you’re claiming the EITC without qualifying children, you must be at least 25 years old but not older than 65.