Worried about Money Because of COVID-19? 5 Tips for Millennials

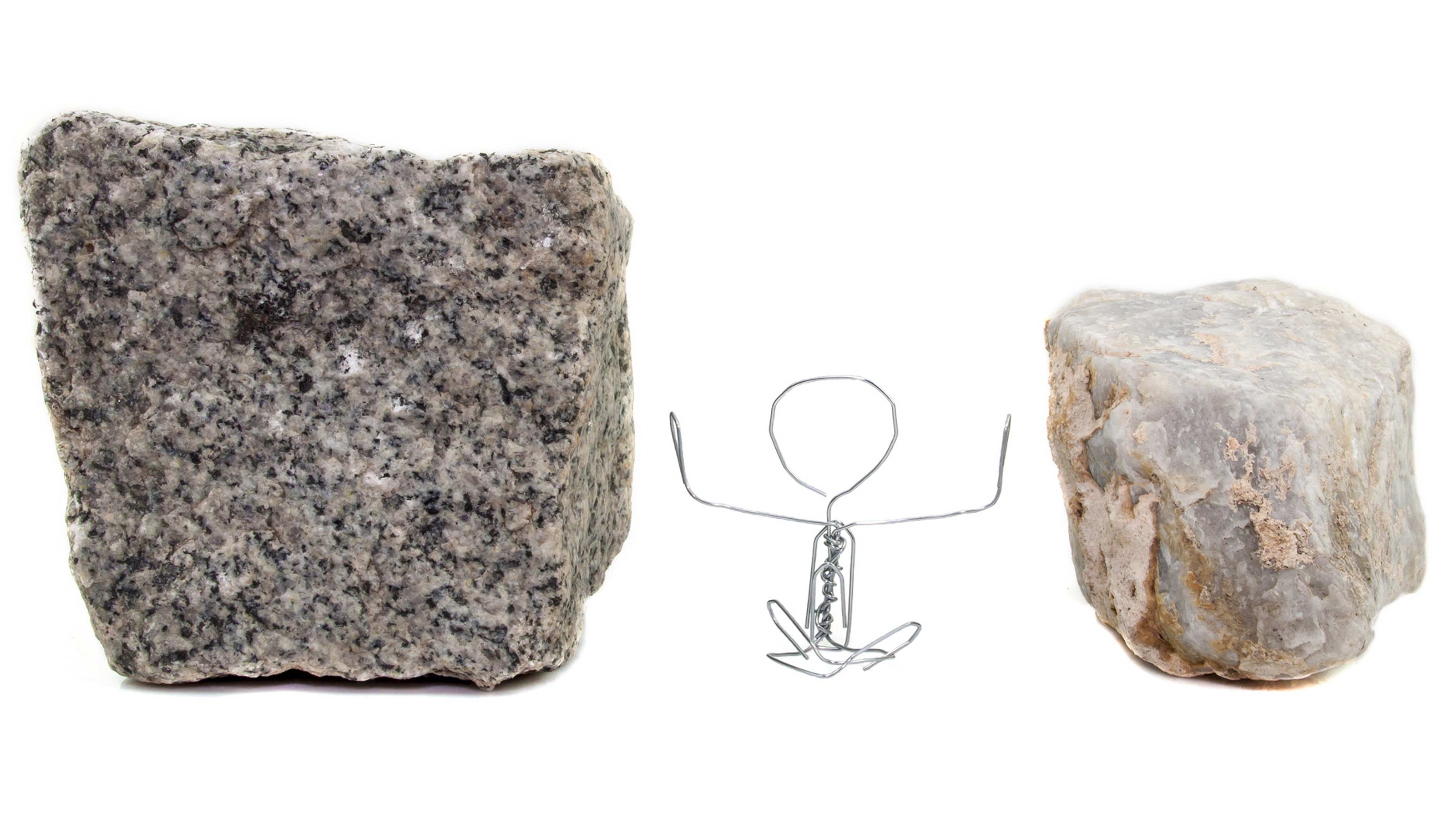

Millennials have been between a rock and a hard place for years. The global pandemic has made matters worse for this generation, but there are some steps they can take to improve their finances going forward.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The financial fallout from COVID-19 has had an outsized impact on Millennials. In fact, a survey by the Pew Research Center found that 32% of younger Americans said the COVID-19 pandemic was a bigger threat to their finances than to their health.

According to our own upcoming Advisor Authority study of more than 2,500 advisers, financial professionals and individual investors, during the pandemic Millennials have been the generation that is far more likely to take a pay cut, be laid off from a job and take on added responsibilities as a caregiver for a family member or friend.

Millennials have already faced their share of financial challenges. Coming of age during the Crash of 2008 and the Great Recession, saddled with more student loan debt than any other generation, many Millennials have been forced to put important life decisions on hold — from buying a first home to starting a family. Now, facing another “once-in-a-lifetime” financial challenge brought on by the pandemic, 84% of Millennials say they could do all the right things to manage their finances, and still be blindsided by outside events.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If you’re a Millennial, the struggle is real — and so are your fears. But there is a light at the end of this tunnel, and time is on your side. Here are five tips to help Millennials manage their finances during the pandemic.

Tip #1. It’s All in the Search: Find a Financial Professional

For many Millennials, the pandemic has been a financial wake-up call. According to a COVID-19 Flash Poll conducted by the Nationwide Retirement Institute, younger Americans are more likely to delay paying their bills and increase their credit card debt, sell shares from their retirement plans, such as 401(k)s and IRAs, or from their other investment accounts in order to meet their financial obligations.

Roughly two-thirds of younger Americans said the pandemic has made them realize that they need help managing their finances and investments to succeed in the future. If this sounds like you, don’t wait. By working with an adviser or financial professional, you can develop a plan that fits your financial goals at every stage of life — from working and saving right now, all the way through your retirement years — to have greater confidence about your finances and your future.

To find an adviser or financial professional, trust is important. If possible, ask friends and family for recommendations. If that’s not an option, your bank may offer financial planning services. Search online for advisory and wealth management firms. Consider sources such as the National Association of Personal Financial Advisors at www.napfa.org or the CFP Board at www.letsmakeaplan.org. Nationwide offers this resource to help you find a financial specialist who’s right for you.

Get specific. Find out if they can make your safety a priority, with a true digital experience, from a client portal to mobile aps and e-signature solutions. Find out what services they provide and what types of clients they serve. Ask how they are compensated — fee for service, percentage of assets under management or commissions. If your resources are limited, some advisers and financial professionals will even help you set goals and develop a basic financial plan for a one-time fee.

Remember: The short-term cost of getting good guidance from an adviser or financial professional is one of the smartest investments you can make in yourself.

Tip #2. Resist Temptation: Commit to a Monthly Budget

It can be easy to get caught up in buying the latest device and hottest trends. Especially now that we’re spending more time at home, living our lives online, while social media is targeting us with ads, things are instantly available at the click of a button, then delivered direct to our doorsteps overnight.

There’s true power in a monthly budget to track your spending habits, prioritize where your money goes and to keep your expenses under control. Take small steps if you need to. Cut back on multiple streaming services, cancel subscriptions you don’t frequently use, and watch your money add up over time.

Instant gratification is hard to resist. But it’s important to balance your wants with your needs, especially during uncertain times like these.

Tip #3. Pay Yourself First: Make Saving a Habit

Once you have your monthly budget, make savings your No. 1 line-item. Pay yourself first — even if it’s just a few dollars a month. As you scale back on other expenses, pay off student loans or credit card debts, all of this extra money can go straight into your savings too.

When you’re able, set up a rainy-day fund to cover unanticipated expenses, such as car repairs or home repairs. Then set up a separate emergency fund, so you have a cushion to cover several months of ongoing expenses, such as your rent or mortgage, utility bills and car lease payments.

During the pandemic, being unable to meet financial obligations is a top concern for the majority of younger Americans. Get into the habit of saving so you can be ready for the unexpected.

Tip #4. Time is Money: Maximize Tax Deferral

With decades before you’re ready to retire, the power of tax-deferred compounding can be substantial. Tax deferral allows you to minimize your tax bill now and accumulate more over time.

Start by automatically contributing to a tax-deferred qualified plan at work, such as a 401(k). This allows you to invest pretax dollars in a variety of mutual funds. Pay attention to fees and keep costs low as each dollar and every percentage point counts. Contribute enough to secure a match from your employer.

When you’re able to max out your 401(k), be sure to consider traditional IRAs to save even more tax-deferred. Also consider Roth IRAs. You’ll make contributions with after-tax dollars — meaning you pay taxes upfront. But your savings accumulate tax-free and distributions in retirement are tax-free too.

Tip #5. Think Long Term: Manage Risks and Returns

While you’re still accumulating savings, and your retirement is decades away, it can be worth taking on market risk now to build more wealth in the long term. Remember, with more than 30 to 40 years of investing ahead of you, staying invested in the market has historically produced the best long-term results . An adviser or financial professional can help you build a well-diversified portfolio to help safeguard against falling markets, ongoing volatility and record low interest rates.

If you are fortunate enough to have substantial assets, if you’ve maxed out your qualified plans and you’re looking for greater protection, your adviser or financial professional may be able to recommend an annuity. Annuities are long-term, tax-deferred investment vehicles designed for retirement. They can help you protect against the market’s downside, while allowing you to capture some of its gains. When you’re ready to retire, they can provide you with a guaranteed income stream for life. As traditional pension plans are disappearing from the workplace — and the responsibility of preparing for retirement rests squarely on your shoulders — you could think of it as a way to provide more protection for your retirement.

According to our 2020 Advisor Authority study, the adoption of annuities is on the rise, especially among younger investors. Nearly three-fourths of Millennial investors (73%) say they would feel more secure if a portion of their portfolio was invested in an annuity. Likewise, 72% of Millennials say they would choose an annuity to protect their investments against market risk and 71% would choose an annuity as part of their holistic plan to protect against outliving their retirement savings.

Keep in mind, annuities are long-term investments for retirement, so you may be charged an additional penalty if you take your money out early, if you’re not yet age 59½ (additional 10% tax penalty), or both. Annuities may fluctuate in value based on the performance of underlying investments or index, and can involve market risk, including possible loss of principal. All guarantees and protections are subject to the claims-paying ability of the issuing insurance company, so look for an insurance company that is highly rated and financially stable.

Control What You Can

Right now, the world is uncertain. But if you control what you can, you can prepare for better days ahead. Invest the time to find an adviser or financial professional who is the right fit for you and come up with a plan. Commit to a budget, make savings a habit, maximize tax deferral and manage risks and returns. While the pandemic continues to impact the economy and dominate the headlines, with these five tips, you can be on your way to a healthier financial future.

ASM-1367AO

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Craig Hawley is a seasoned executive with more than 20 years in the financial services industry. As Head of Nationwide's Annuity Distribution, Mr. Hawley has helped build the company into a recognized innovator of financial products and services for RIAs, fee-based advisers and the clients they serve. Previously, Mr. Hawley served more than a decade as General Counsel and Secretary at Jefferson National. Mr. Hawley holds a J.D. and B.S. in Business Management from The University of Louisville.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.