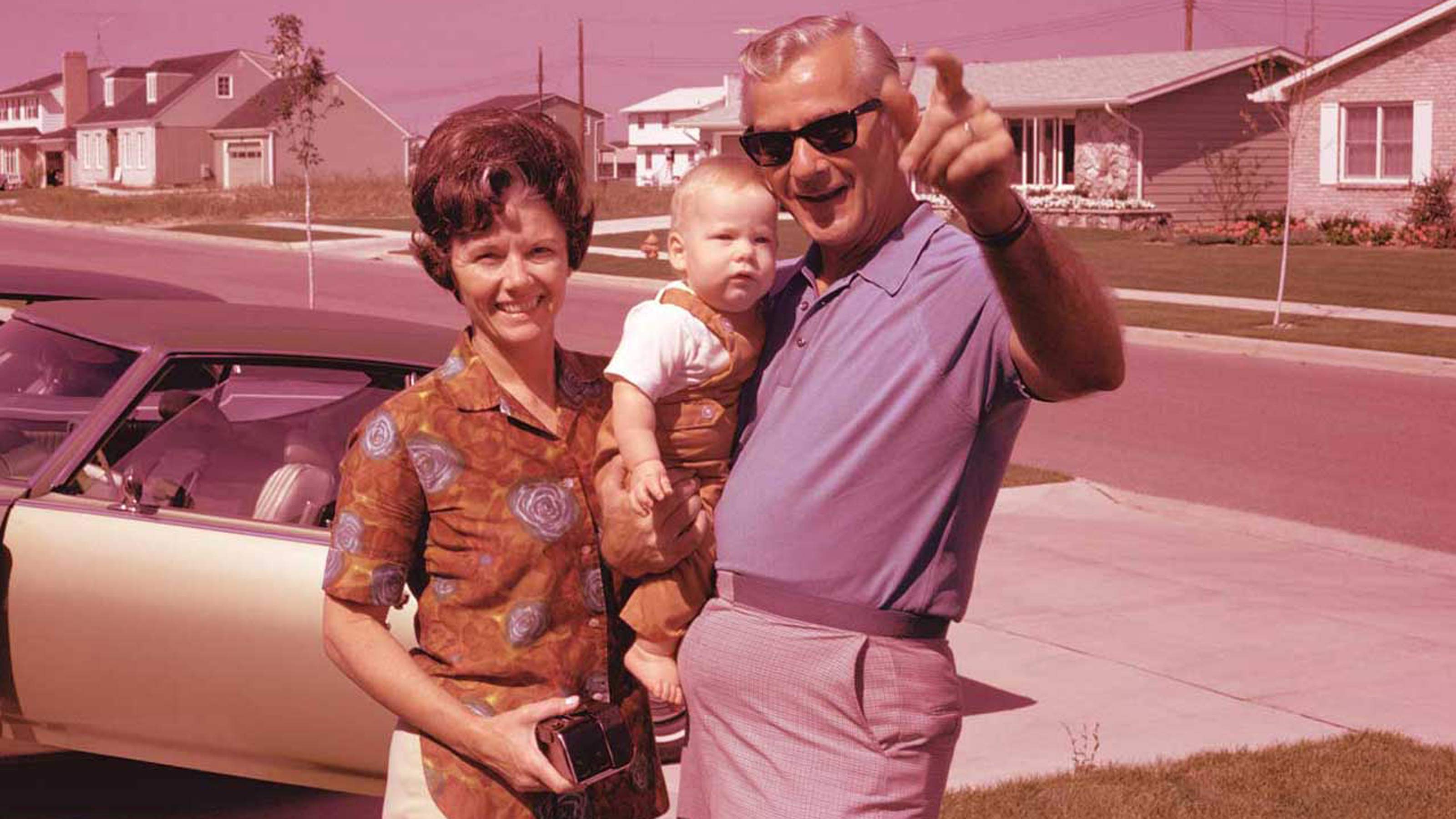

5 Generational Money Taboos That Must Die

Sorry, Mom and Dad. Some of your long-held financial truisms really aren’t all that true, and they’re no longer helpful. So dump them, and follow these useful mantras instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While often afraid of becoming our parents, the truth is, we typically inherit our relationship with money from them – as they did from theirs. Many of us were raised to think that talking about money is taboo, but this idea perpetuates financial illiteracy, and avoiding money conversations can have a lasting negative impact on our own money attitudes, relationships and life goals. Only 24% of millennials demonstrate basic financial literacy, according to a report by the National Endowment for Financial Education, which translates to three-quarters of a generation being ill-prepared for their retirement or other financial milestones. Having forthright conversations about our finances can help us learn, grow and better prepare for our future.

Money wasn’t really talked about in my own family growing up. Being raised in an Asian household, a significant emphasis was placed on education, but oddly enough, no financial education. It wasn’t until I graduated college and entered the “real world” (and had to pay my own bills) that I began to adopt my own foundational truths. Since then, I’ve shared these with countless families over the years in my work as a financial adviser.

Simply put, some long-held beliefs about money no longer hold. Many of these ideas that have been passed down through generations should be put out to pasture. Here are five outdated taboos, in particular, that need to be banished, followed by some more helpful mantras that can serve as replacement for them.

Taboo No. 1: Debt is always bad. (False!)

Many parents tell their kids that being in debt is bad and something to be avoided. But there are different kinds of debt, and not all are equal. For example, most homebuyers will need to take on a mortgage when they decide to make the big purchase, which is an example of good debt. And student loan debt isn’t necessarily bad either, since that’s considered an investment in your future!

Instead of being apprehensive about the idea of debt, it’s best to educate yourself on things like interest rates, credit scores and loan terms to make sure you can manage debt properly. In fact, if you’re disciplined enough and are one to pay off things like credit card bills in full every month, you can use some of the rewards benefits to your advantage.

Taboo No. 2: It’s never OK to cut off your kids. (Sorry, kids, but that’s false!)

I’ve seen first-hand how difficult it can be for parents to cut off their kids financially. In fact, I’ve seen clients continue to give their children a monthly allowance well into their 50s! Now, being a parent myself, I understand how hard it can be to walk the line between being supportive and helping your kids too much, which can often be to their detriment.

One of life’s critical ongoing lessons is achieving independence – including financial independence. Encouraging your children to earn their own money and support themselves is better for their confidence and growth as an individual.

Taboo No. 3: Leave your kids an inheritance, even if it means a huge sacrifice. (Definitely false!)

Many parents have the idea that they need to leave their children something when they pass. The idea of leaving a legacy in terms of financial assets or real estate is a common and long-held tradition, and rings especially true with an emotional asset such as a family home. While it’s a nice thought, remember that these assets shouldn’t be set aside at the sacrifice of your own well-being.

Most children just want their parents to live out their last years in comfort, so if you can’t afford to leave an inheritance, it’s more than fine!

Taboo No. 4: You should never keep finances separate in a marriage. (Not true!)

Many of our parents happily combined finances into joint accounts and shared everything. But that’s not the norm anymore, as couples often keep their finances separate or take a hybrid approach – a shared account plus individual accounts. According to a survey by Fidelity, one in five couples identify money as their greatest relationship challenge. Communicating about finances is necessary to help strengthen relationships and ensure your major life goals are in sync, as money is often one of the leading causes of divorce. Do whatever works best for you and your partner. The important thing is to discuss your financial aspirations and maintain open communication around finances.

Taboo No. 5: The same goals that were good for your parents are good for you. (Nope!)

Times have changed. It’s no longer the norm to get married in your early 20s, buy a house right away, and have kids. While that plan worked for previous generations, it may not be the smartest or best approach anymore, especially as housing prices skyrocket and our lifestyles change. Not to worry – renting may even be a better financial decision depending on your situation. It’s all right to let go of the dreams of your parents; what matters is that you have financial goals of own and a plan to achieve them.

Talking about money shouldn’t be taboo

According to Walden University graduate Audra Sherwood's research, "Differences in Financial Literacy Across Generations," approximately four in seven Americans are financially illiterate and report being unable to manage their finances. On top of that, a FINRA study found that over 53% of adults say thinking about their financial situation makes them anxious and 44% say discussing their finances is stressful. The cycle of financial illiteracy and negative emotions tied to money will continue unless we learn to break the taboo.

The bottom line: Having open conversations about money is how we learn, grow and build healthy relationships. As much as it wasn’t part of my childhood, I’m trying to consciously have those teaching moments around money with my 4-year-old. It’s fun to talk with him about how he’s going to divvy up his birthday money and what he wants to save for next. Even though he’s still young, I can already see him grasping some basic financial concepts. As for my parents, they have also become more open about money and finances over the years, and we’ve had many conversations around planning for the future. These discussions ultimately led to their retirement this year.

It’s also important to remember that as much as our upbringing influences the way we see finances and wealth, we ultimately define our own stories and can change our mindsets. Figure out what money stories you tell yourself and where those ideas came from. Did a belief come from a particular situation or memory from a family experience? Does the belief conflict with your life now?

If the money stories you tell yourself no longer work for you, then redefine your goals to align with your values and stop living by unwritten rules defined generations ago.

Halbert Hargrove Global Advisors LLC (“HH”) is an SEC registered investment adviser located in Long Beach, California. Registration does not imply a certain level of skill or training. Additional information about HH, including our registration status, fees and services can be found at www.halberthargrove.com. This blog is provided for informational purposes only and should not be construed as personalized investment advice. It should not be construed as a solicitation to offer personal securities transactions or provide personalized investment advice. The information provided does not constitute any legal, tax or accounting advice. We recommend that you seek the advice of a qualified attorney and accountant. All opinions or views reflect the judgment of the author as of the publication date and are subject to change without notice.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Julia Pham joined Halbert Hargrove as a Wealth Adviser in 2015. Her role includes encouraging HH clients to explore and fine-tune their aspirations — and working with them to create a road map to attain the goals that matter to them. Julia has worked in financial services since 2007. Julia earned a Bachelor of Arts degree cum laude in Economics and Sociology, and an MBA, both from the University of California at Irvine.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.