Are You Middle Class?

The share of Americans in the middle class has been dwindling for decades. Here's how to tell if you're part of the shrinking middle class.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

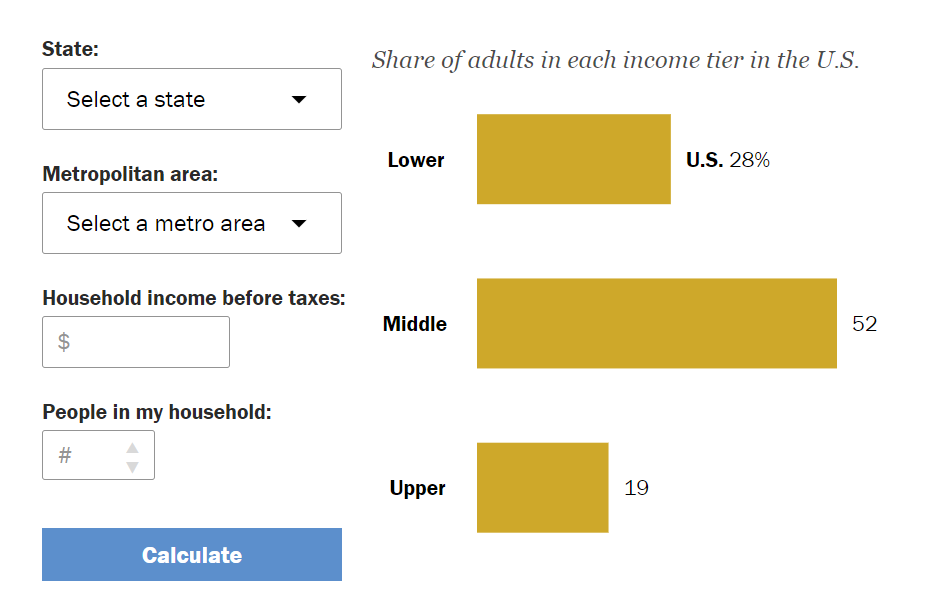

The share of Americans considered to be middle class is now the smallest it has been in five decades, having steadily contracted since the 1970s. The share of adults who live in middle-class households fell from 61% in 1971 to 50% in 2021, according to the Pew Research Center. Are you part of the “shrinking” middle class? You can use the updated calculator from Pew Research Center to find out.

In 2022, 52% of adults lived in middle-income households, 28% were in lower-income households and 19% were in upper-income households. But this varies widely between cities. For example, 42% of adults in San Jose-Sunnyvale-Santa Clara, California, are considered middle class, compared to 66% in Olympia-Lacey-Tumwater, Washington.

Here’s how to determine whether you're considered middle class and how you compare to the rest of the population.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Who is considered to be middle class?

To determine whether or not you’re considered middle class, the calculator from Pew Research Center uses your size-adjusted household income and the cost of living in your area to determine your income tier. Middle-class definitions can vary, but for this calculator, the middle class is defined as households with an income that is two-thirds to double the U.S. median household income.

To use the calculator, you’ll be asked to fill in where you live (including the state and metropolitan area), your total household income before taxes and the number of people in your household. This enables you to see the share of adults in each income tier in your area and the U.S., including which income tier you fall in.

Here's a look at the income calculator, which you can access here.

You’ll also be able to compare yourself to adults similar to you in education, age, race, ethnicity and marital status, if that’s of interest to you.

The calculator takes your household income and adjusts it for the size of your household, which is revised upward for households that are below-average in size and downward for those of above-average size, so each household’s income is made equivalent to the income of a three-person household.

For 2022, middle-class incomes ranged from about $56,600 to $169,800, lower-income households had incomes less than $56,600 and upper-income households had incomes greater than $169,800.

The shrinking middle class

As the share of middle-class households declined, the share of lower- and upper-income households increased. From 1971 to 2023, the share of Americans who lived in lower-income households increased from 27% to 30%, and the share who lived in upper-income households increased from 11% to 19%.

And while household incomes have risen across all income tiers since 1970, the gains for middle- and lower-income households are smaller than gains for upper-income households, creating a larger gap between upper-income households and other households.

The median income of middle-class households increased by 60% between 1970 and 2022, while the median income of upper-income households increased by 78%. The median income of lower-income households grew by only 55%.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.

-

4 Psychological Tricks to Save More in 2026

4 Psychological Tricks to Save More in 2026Psychology and money are linked. Learn how you can use this to help you save more throughout 2026.