How to Open a Savings Account Online

Open a savings account online to help maximize your savings

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

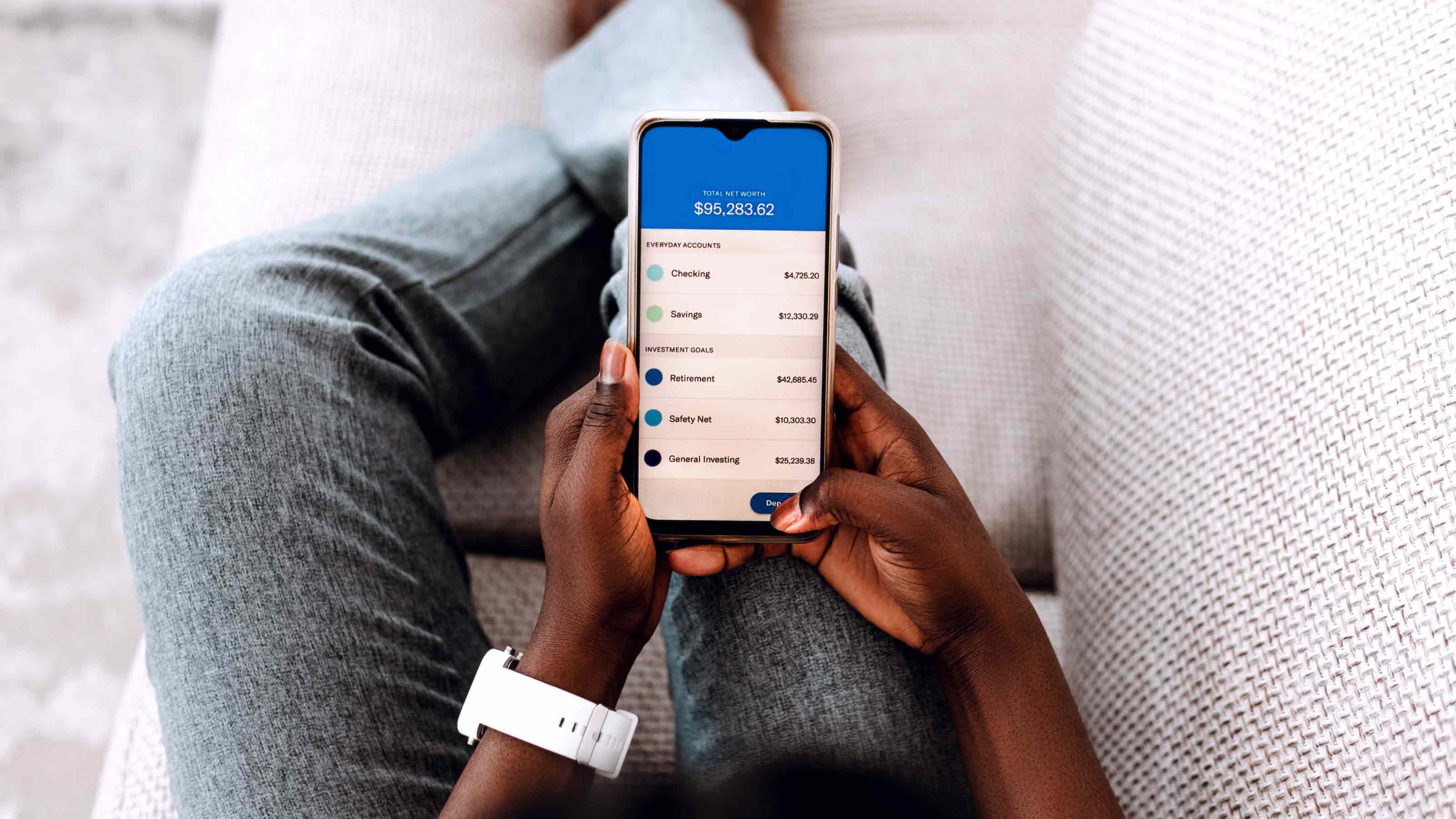

If you're looking to open a savings account online — because you don’t already have an account, or you’re dissatisfied with your current savings rates, you may be wondering what you'll need and what the steps are. The process is usually simple and straightforward. With just a few steps you’ll be able to start saving and, ideally, also earning interest on your hard-earned cash. Many online savings accounts are high-yield savings accounts — which have higher APYs than an account from a brick-and-mortar bank. So this way, you’ll get an even better rate of return on your cash.

Take these steps to open a savings account online.

Steps to open a savings account

Before opening an online savings account, you’ll want to make sure to choose the right one for your financial situation. To choose a bank, you’ll need to consider a few key factors.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Compare savings accounts

- Interest rates: APY or annual percentage yield is the amount of interest earned on an account in one year. The APY for high-yield accounts can be anywhere from 3% to 5%, much higher than that of a traditional savings account.

- Balance requirements: Some savings accounts have minimum balance requirements. If you fail to keep the minimum balance in your account, you could incur a fee.

- Monthly fees: Usually, online savings accounts don’t charge monthly maintenance fees, but it’s important to check before opening an account.

- Deposit requirements: Some savings accounts will require you to deposit a specific amount of cash into your account. This can be either a minimum opening deposit or a minimum monthly deposit.

- Reason for savings: You’ll also want to consider what you’re saving for. If you need ready access to your cash you might want to consider opting for a savings account linked to your checking account.

- Withdrawal requirements: With any savings account, the number of free withdrawals or transfers you can make is limited to six a month, due to Regulation D.

- Customer service: If you’re using an online bank, you won’t have branch access. Therefore, it’s important to find an online bank with virtual customer service that’s responsive and has "opening hours" that suit you.

- Safety: One of the most important factors to look for is whether an account is FDIC insured — so your deposits are insured.

- Potential pitfalls: Be aware of potential pitfalls associated with online savings accounts, including balance caps, rate history, ATM fees and sign-up enticements that won’t pay off in the long run.

2. Collect the information you need to open an account

Once you’ve decided on an account, you’ll want to collect some important information for your application. Typically, you’ll need to have your Social Security number, driver’s license, contact information (name, email, phone number, etc.) and checking account information from which to transfer funds from.

3. Choose between a single or joint account

When you open a savings account online, you’ll be able to choose between a single or joint account.

Joint accounts are online savings accounts for you and another person, such as your partner or spouse. If you’re opening a joint account, you’ll need all the information discussed in the previous step, for anyone else you are adding to the account.

4. Agree to terms and submit application

Finally, you’ll need to verify that you’ve read the disclosure documentation associated with the account. Make sure you read through the small print and double-check the associated fees, rates and liabilities for the account. You’ll usually be looking for an account with a high APY and with no additional fees.

Once you've read the terms and conditions, you’ll be able to submit your application. Once submitted, you just need to wait for the bank to approve your account.

5. Add funds to your account

Once your account is approved, you can transfer funds by making an ACH transfer from an existing checking account. An ACH transfer is a payment made between banks and is processed through the Automated Clearing House Network. If your account doesn’t have a minimum deposit requirement, you’ll be able to choose how much you transfer and when.

Of course, the sooner you put money in your online savings account, the sooner you’ll start accruing interest. Most accounts also let you set up automatic transfers, which can help you save in a more consistent way.

The bottom line

Opening a savings account online is a simple, straightforward process that can be completed in just a few steps. Once you choose which savings account is best for you, all you have to do is enter your personal information and agree to the terms and conditions. Since many online savings accounts have higher than average APYs, you’ll also be able to maximize your savings over time.

Related articles

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

10 Easily Fixable, But Often Overlooked, Financial Planning Items

10 Easily Fixable, But Often Overlooked, Financial Planning Itemspersonal finance It’s easy to let important financial tasks slip your mind, so take a minute to check this list for any to-do items you may have forgotten. It could make a big difference in your bottom line.

-

How to Keep Your Savings Safe

How to Keep Your Savings Safesavings If you want to keep your savings safe but they exceed FDIC and NCUA limits, it's time to open multiple accounts, preferably ones with high yields.

-

Money Market Account or Money Market Fund? How to Choose

Money Market Account or Money Market Fund? How to Choosemoney market accounts Whether you choose a money market account or money market fund largely depends on the money's purpose.

-

Are Your Bank Deposits Insured?

Are Your Bank Deposits Insured?credit & debt As long as your financial institution is federally insured, your deposits are protected — up to certain limits.