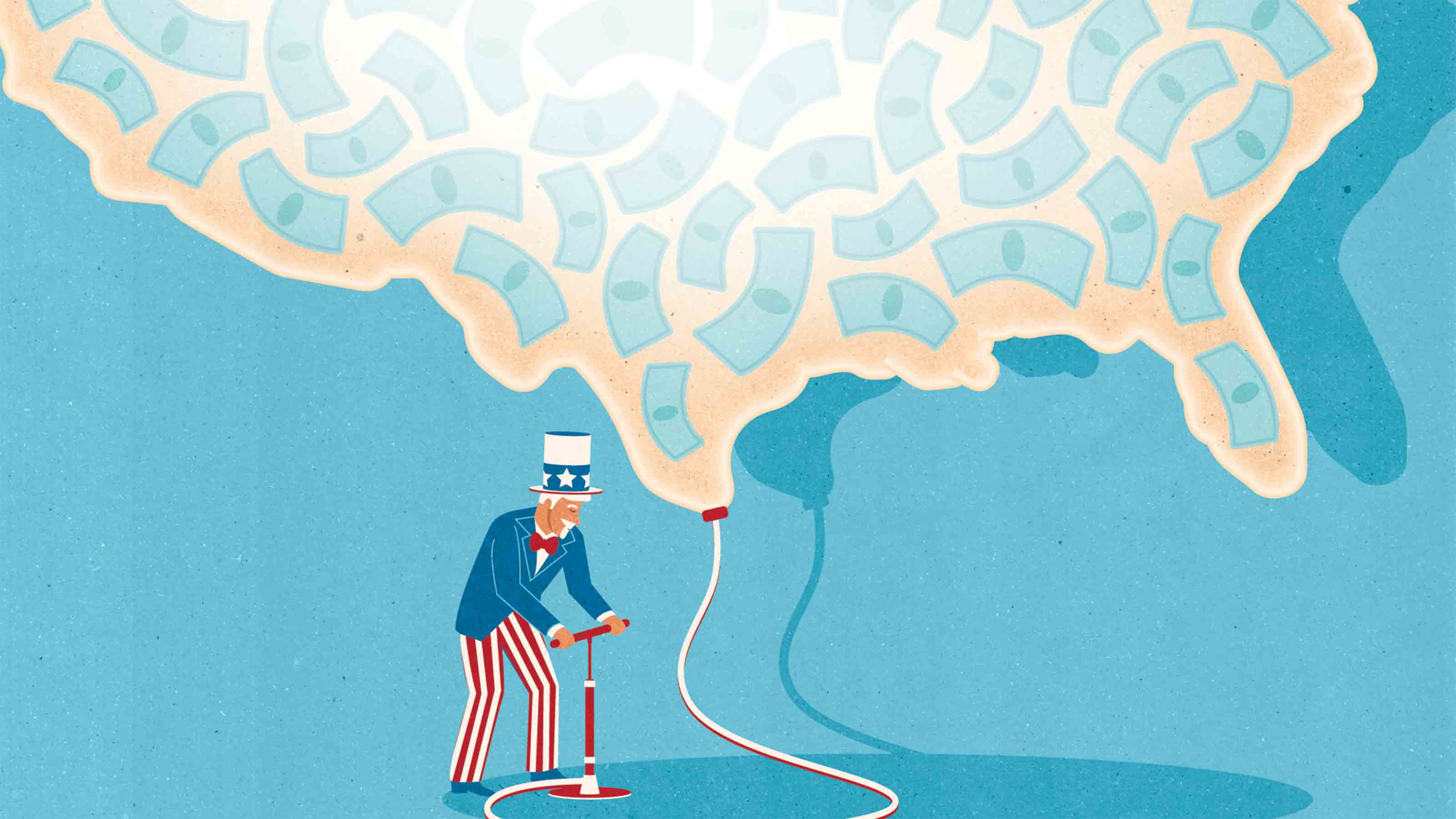

How the Fed's Moves Affect You

It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Not all that long ago, the only major decision the Federal Reserve Board had to make was where to set short-term interest rates. But in the past decade, the Fed has become increasingly aggressive in its efforts to pump up the economy—and there’s no sign it will slow down anytime soon. Whether you’re a borrower, saver or investor, this matters to you.

Some history: As the economy cratered in 2008, the Fed made the unprecedented move of purchasing large sums of Treasury bonds and mortgage-backed securities, which pumped an extra $1 trillion into the economy. Over the course of the next 10 years, it purchased an additional $2.5 trillion. Then, when the coronavirus crisis hit, the Fed purchased another $3 trillion in bonds and securities, bringing its liabilities so far to a record $7.2 trillion. (The total size of the U.S. economy is currently $21.5 trillion.)

And the Fed isn’t done. It now has the authority to support up to $2.6 trillion in new lending, which includes making loans to businesses through its Main Street Lending Facility and lending to city, county and state governments through its Municipal Liquidity Facility. The Fed is also backing loans issued through the Paycheck Protection Program, a federal loan-forgiveness program designed to help small businesses survive the coronavirus pandemic.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As for interest rates, it’s likely they will remain low for a very long time in order to encourage borrowing and keep the money flowing. Fed chairman Jerome Powell announced at the June 10 meeting of the Federal Open Market Committee that the coronavirus could continue to have an impact on the economy for the next two years and that the Fed isn’t likely to raise interest rates until 2023 at the earliest. If inflation remains contained, rates could stay low for even longer. However, although the European Central Bank has experimented with negative interest rates by allowing commercial banks to borrow at negative 1%, the Fed isn’t inclined to go that far.

Good news, bad news. Borrowers will benefit from the low-rate environment. The 30-year fixed mortgage rate is likely to remain below 4% for the foreseeable future (although home prices typically rise faster when rates are low). Auto, home-equity and other consumer loan rates will also likely remain at historic lows.

The news is not good, though, for savers and income investors. Bank deposits, certificates of deposit and short-term U.S. government securities will pay almost nothing. Returns for longer-term government and corporate bonds will also be much lower than historical norms. Annuities and life insurance premiums will cost more, because the insurance companies that back those products are earning less in the fixed-income markets where they invest those proceeds.

The stock market has typically celebrated low interest rates, but low rates are a mixed blessing for investors in general. The stock market is now the only game in town for those looking for decent returns on their retirement savings. But without a bond market that provides a reasonable rate of return, it will be more difficult for investors to protect themselves from market downturns by investing in a mix of stocks and bonds. Investors seeking higher returns may be driven into much riskier investments, such as high-yield junk bonds, commodities and private equity.

Consider investing in high-quality dividend-paying stocks, which may yield more than fixed-income investments while providing some ballast in down markets.

The Fed's money machine

Unlike the rest of us, the Fed doesn’t have a budget constraint. It can buy assets by writing checks on itself. Because the Fed doesn’t ever have to pay off its liabilities, it can never go bankrupt.

So what’s to prevent the Fed from creating as much money as it wants? Again, nothing. The only problem with creating money is that it might cause inflation, as more paper and electronic dollars chase a slowly growing supply of goods and services. This is what has caused hyperinflation in smaller countries in the past.

But so far, that hasn’t been a problem. In the past decade, no matter how many securities the Fed has purchased, inflation has remained stubbornly low, breaching 2% only when oil price run-ups occurred. The mechanisms that drove inflation in past decades don’t seem to be working the same way anymore, and for that reason it appears that inflation is going to remain low for some time to come.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

What New Tariffs Mean for Car Shoppers

What New Tariffs Mean for Car ShoppersThe Kiplinger Letter Car deals are growing scarcer. Meanwhile, tax credits for EVs are on the way out, but tax breaks for car loans are coming.

-

AI’s Rapid Rise Sparks New Cyber Threats

AI’s Rapid Rise Sparks New Cyber ThreatsThe Kiplinger Letter Cybersecurity professionals are racing to ward off AI threats while also using AI tools to shore up defenses.

-

Blue Collar Workers Add AI to Their Toolboxes

Blue Collar Workers Add AI to Their ToolboxesThe Kiplinger Letter AI can’t fix a leak or install lighting, but more and more tradespeople are adopting artificial intelligence for back-office work and other tasks.

-

AI Goes To School

AI Goes To SchoolThe Kiplinger Letter Artificial intelligence is rapidly heading to K-12 classrooms nationwide. Expect tech companies to cash in on the fast-emerging trend.

-

What To Know if You’re in the Market for a New Car This Year

What To Know if You’re in the Market for a New Car This YearThe Kiplinger Letter Buying a new car will get a little easier, but don’t expect many deals.

-

Will Lower Mortgage Rates Bring Relief to the Housing Market?

Will Lower Mortgage Rates Bring Relief to the Housing Market?The Kiplinger Letter As mortgage rates slowly come down here's what to expect in the housing market over the next year or so.

-

Car Prices Are Finally Coming Down

Car Prices Are Finally Coming DownThe Kiplinger Letter For the first time in years, it may be possible to snag a good deal on a new car.

-

New Graduates Navigate a Challenging Labor Market

New Graduates Navigate a Challenging Labor MarketThe Kiplinger Letter Things are getting tough for new graduates. Job offers are drying up and the jobless rate is increasing. Are internships the answer?