Five Biggest Frauds To Watch Out For

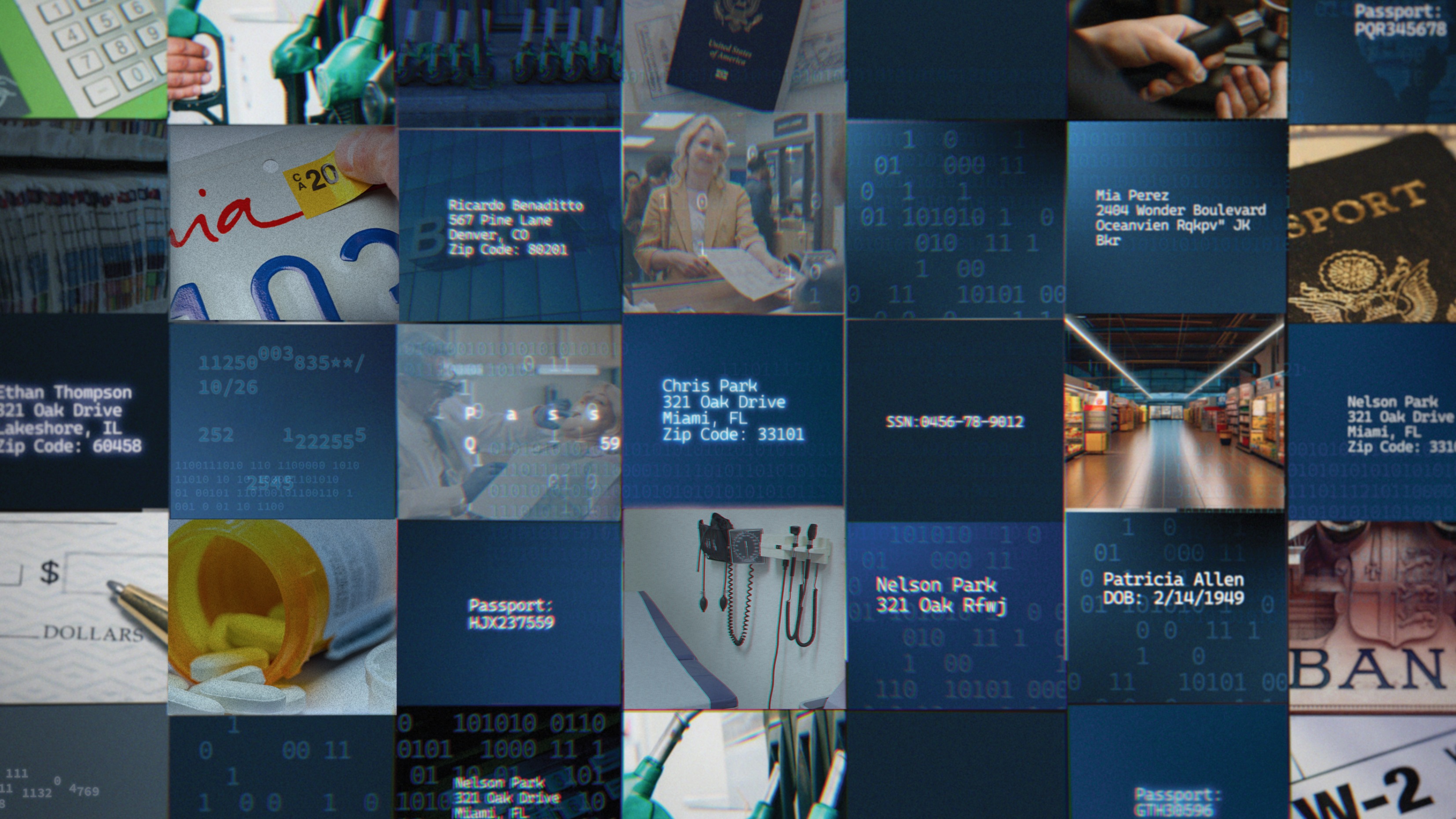

The five biggest frauds involve the use of artificial intelligence (AI) to dupe consumers and businesses. Here's what to look out for.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

AI deep fakes, identity theft and fake charity schemes are among the biggest scams targeting either individuals or businesses in 2024, according to a new report from credit reporting agency Experian.

Deceptive deepfake content, ranging from emails, voice and video and fraudulent websites, is increasing in particular due to generative artificial intelligence (AI). Deepfakes are synthetic media that have been digitally manipulated to replace a person's likeness with that of another.

More than 65% of Americans say they sometimes come across altered videos and images intended to mislead.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Deepfakes have empowered fraudsters to embrace a “do-it-yourself” approach to fraud and make consumers and businesses more vulnerable to attacks, according to Experian’s 2024 Future of Fraud forecast.

Key findings of the report:

- Nearly 70% of businesses report that losses due to fraud have increased in recent years.

- More than half of all consumers feel they are more of a target of fraud than one year ago.

Experian suggests consumers and businesses be on the alert for these five fraud threats in 2024:

1. AI scams, including deep fakes, stolen identities

Generative AI has resulted in numerous benefits across industries, but it has also made fraud more accessible and put consumers and businesses at risk. Besides escalating deepfake content, fraudsters may also use AI to engineer “proof of life” schemes socially, duping people out of hundreds, if not thousands, of dollars. Using stolen identities, fraudsters can create fake identities online and through social media and interact with these new profiles that look real to the consumer.

2. Weaker fraud protection at in-person banks

Over the years, there’s been a substantial migration to digital banking. But recently, many consumers have returned to credit unions and bank branches to open new accounts or get financial advice in person. They do this to feel safer and avoid potential online security risks. The problem is, bank checks to verify identity are currently rife with problems, including human error oversight as most banks don't use biometrics.

According to an Experian report, 85% of consumers report physical biometrics as the most trusted and secure authentication method they’ve recently encountered. However, only 32% of businesses currently use physical biometrics to detect and protect against fraud.

Experian predicts that over this year bank branches will need to substantially step up the use of biometrics when verifying the identity of new customers.

3. Increased retail fraud, as businesses are hit with empty returns

With a rise in online shopping, fraudsters have found creative ways to scam some retailers and small businesses. For example, let’s say a customer bought a pair of pants but decided to return them. However, when the company receives the return, the box is empty. The customer says they returned the product and it must have gotten lost in the mail, leaving the business to incur the loss of goods and revenue.

4. Synthetic identity fraud

During the pandemic, many fraudsters created synthetic identities. Although dormant for the past couple of years, fraudsters can now use these dormant accounts to “bust out” and steal funds.

5. Fake GoFundMe and charity scams

Fake GoFundMe campaigns, social media giveaways, charity fundraising and investment opportunities that appear too good to be true are often used to gain access to consumers’ personal information. Experian predicts these deceptive “tug-at-the-heartstrings” methods of deception will surge in 2024 and beyond.

“The speed and complexity of fraud attacks due to new technology and sophisticated fraudsters is leaving both businesses and consumers at risk in 2024,” said Kathleen Peters, chief innovation officer at Experian Decision Analytics in North America. “Now more than ever, businesses need to implement a multilayered approach to their identity verification and fraud prevention strategies that leverages the latest technology available.”

To learn more about Experian’s fraud prevention suggestions, visit https://www.experian.com/business/solutions/fraud-management.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Seven Things You Should Do Now if You Think Your Identity Was Stolen

Seven Things You Should Do Now if You Think Your Identity Was StolenIf you suspect your identity was stolen, there are several steps you can take to protect yourself, but make sure you take action fast.

-

The 8 Financial Documents You Should Always Shred

The 8 Financial Documents You Should Always ShredIdentity Theft The financial documents piling up at home put you at risk of fraud. Learn the eight types of financial documents you should always shred to protect yourself.

-

How to Guard Against the New Generation of Fraud and Identity Theft

How to Guard Against the New Generation of Fraud and Identity TheftIdentity Theft Fraud and identity theft are getting more sophisticated and harder to spot. Stay ahead of the scammers with our advice.

-

12 Ways to Protect Yourself From Fraud and Scams

12 Ways to Protect Yourself From Fraud and ScamsIdentity Theft Think you can spot the telltale signs of frauds and scams? Follow these 12 tips to stay safe from evolving threats and prevent others from falling victim.

-

Watch Out for These Travel Scams This Summer

Watch Out for These Travel Scams This SummerIdentity Theft These travel scams are easy to fall for and could wreck your summer. Take a moment to read up on the warning signs and simple ways to protect yourself.

-

5 Low-Cost Ways to Protect Against Identity Theft

5 Low-Cost Ways to Protect Against Identity TheftIdentity Theft Stay ahead of identity thieves and maintain your peace of mind with these simple, affordable steps.

-

How Identity Thieves Are Exploiting Your Trust

How Identity Thieves Are Exploiting Your TrustIdentity Theft Con artists are finding new and unexpected ways to take your money and personal information. Here's what to do about it.

-

Expert Tips To Avoid Identity Theft

Expert Tips To Avoid Identity TheftIdentity Theft How to lower your risk from identity theft when you share personal information.