Smart Ways to Save on Child Care Costs

The expenses and tax complications that come with hiring a nanny were reason enough for me to take my son to day care instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The high price of child care is all too familiar to my family. The monthly cost of care for our toddler usually tops $1,000 and is second only to our mortgage payment. More than 70% of parents spend at least 10% of their income on child care, and more than half spend at least $10,000 per year, according to Care.com.

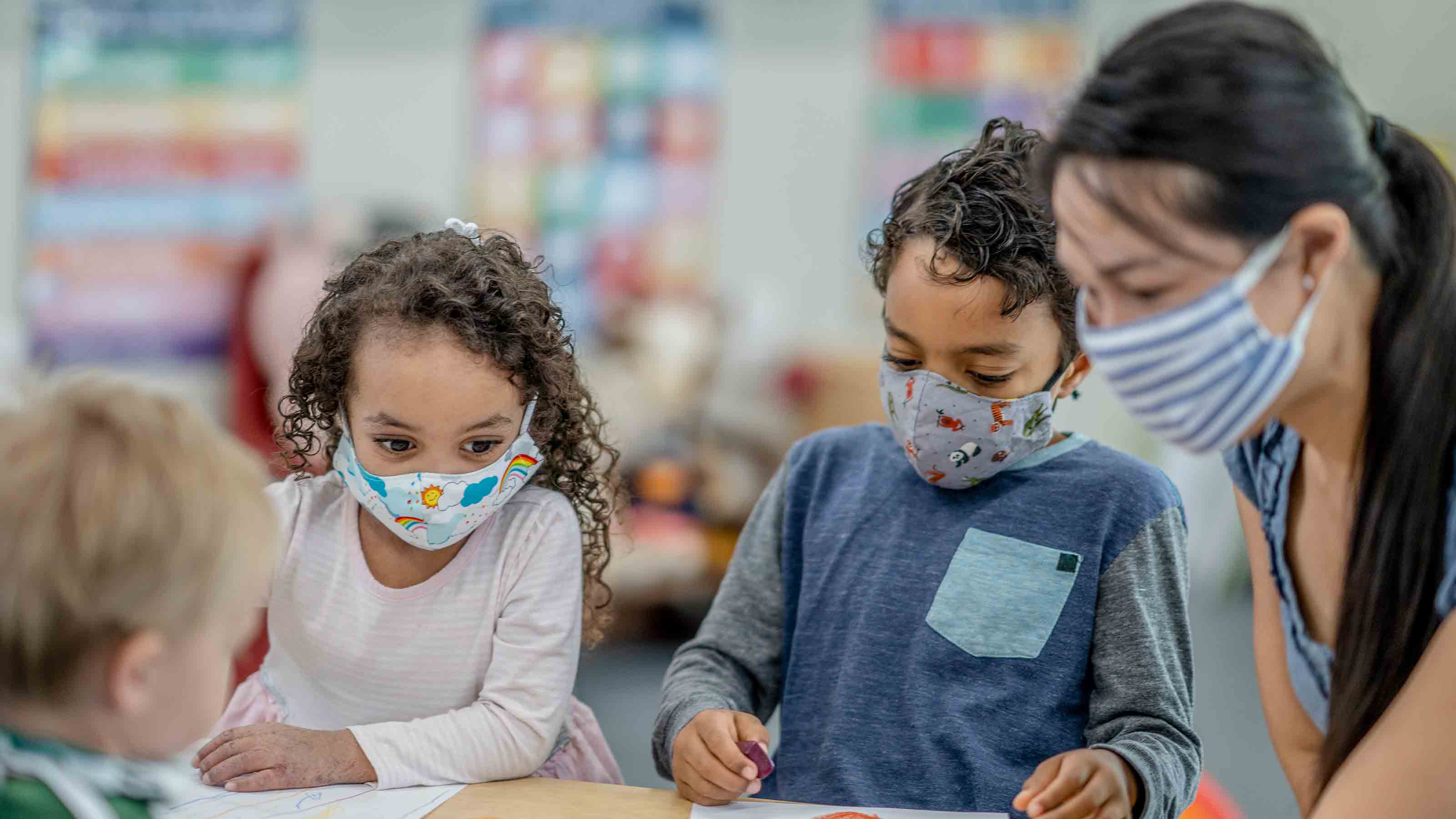

The coronavirus pandemic has added to the strain on working parents. Some have struggled to afford care following cuts in their pay or hours. Others have changed care providers or juggled job responsibilities and child care duties when schools and day care centers closed because of COVID-19. Parents have even left the workforce to care for their kids, removing care expenses from their budgets but losing income.

The Tax Rules for Hiring a Nanny

Whether you’re seeking child care for the first time or you’re reevaluating your options, be sure you understand the financial implications. A nanny, who comes to your home, is convenient. But the average weekly rate to have a nanny care for one infant is $565, according to Care.com—much higher than the $215-a-week average for a day care center and $201 for in-home day care. One way to reduce expenses is to share a nanny with another family, with whom you can split the cost.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Plus, hiring a nanny often comes with tax implications. If you pay a nanny at least $2,300 in 2021, the IRS requires you to treat him or her as a household employee. You must withhold Social Security and Medicare tax from the nanny’s pay—and as the employer, you have to kick in Social Security and Medicare tax, too (you and the nanny each pay 7.65% of wages). You must also issue a Form W-2 each January and file other forms with the IRS. And you may be expected to cover transportation, meals and two weeks of vacation, says Dana Levin-Robinson, CEO of Upfront, a price-comparison website for child care services.

The expenses and tax complications that come with hiring a nanny were reason enough for me to take my son to day care instead. Consider other costs and savings, too. Day care centers and preschools may include snacks and meals in their rate. But they may also charge annual fees or penalties if you pick up your child late.

Tax Breaks for Child Care

If you have earned income from employment during the year and pay for care while you work or look for work, you can take a federal tax credit of 20% to 35% of care expenses (the percentage depends on your income) for up to $3,000 paid for one child or $6,000 for two or more children younger than 13. You can claim the credit whether the care is in or out of your home, and you must report the care provider’s name, address and tax identification number.

Your employer may allow you to stash up to $5,000 of pretax money annually in a dependent care flexible spending account. You can use the funds to pay for a nanny or day care while you work, as well as for before- and after-school programs or summer day camp. The recently passed COVID relief law includes provisions through which employers may permit unlimited carryovers of unused FSA funds from the 2020 plan year to 2021 (and from 2021 to 2022), or extend the grace period to use 2020 or 2021 FSA funds from 2.5 months to 12 months.

You may have until the end of 2021, for example, to use money that you put in an FSA in 2020, depending on your employer’s rules. The law also temporarily raises the limit of a child’s age of eligibility for dependent FSA coverage from 12 to 13.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' Changes

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' ChangesTax Deadlines Mark your calendar: Feb 2 is the big W-2 release date. Here’s the delivery scoop and what the Trump tax changes might mean for your taxes.

-

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit Anxiety

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit AnxietyTax Season Tax audit anxiety is like a wild beast. Here’s how you can help tame it.

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.