Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Are you one of the 60 million generous households in America that give to charity each year? If so, you might be missing out on one of the best tax deductions in the tax code. Fortunately, there is a simple strategy that can help save you thousands of dollars when you file your taxes for 2023 — it’s called bunching.

In 2017, the Tax Cuts and Jobs Act roughly doubled the standard deduction through 2025. But while this large deduction helped lower taxes for millions of households, it also made it more difficult to qualify for a lot of common individual tax deductions, including one that is near and dear to the hearts of many — the tax deduction for charitable giving.

However, there is good news. A simple tax strategy called “bunching,” or “bundling,” can let taxpayers who don’t normally qualify for itemized deductions get access to the charitable deduction. All it requires is a little planning and access to an account called a donor-advised fund (DAF).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bunching: A tax strategy you should know

The concept behind bunching is simple. Instead of taking the standard deduction every year, by grouping your charitable contributions for multiple years together into a single tax year, you can exceed the standard deduction and take advantage of valuable itemized deductions like charitable donations.

The 2023 standard deduction for married couples filing jointly is $27,700, and in 2024, it will rise an additional $1,500 to $29,200. For single individuals and married couples filing separately, the standard deduction is $13,850, rising to $14,600 in 2024. For most households, that level is difficult to clear, and in 2024, it will get even more challenging. As a result, 2023 is an excellent year to take advantage of this strategy.

Examples: Standard Sam and Bunching Betty

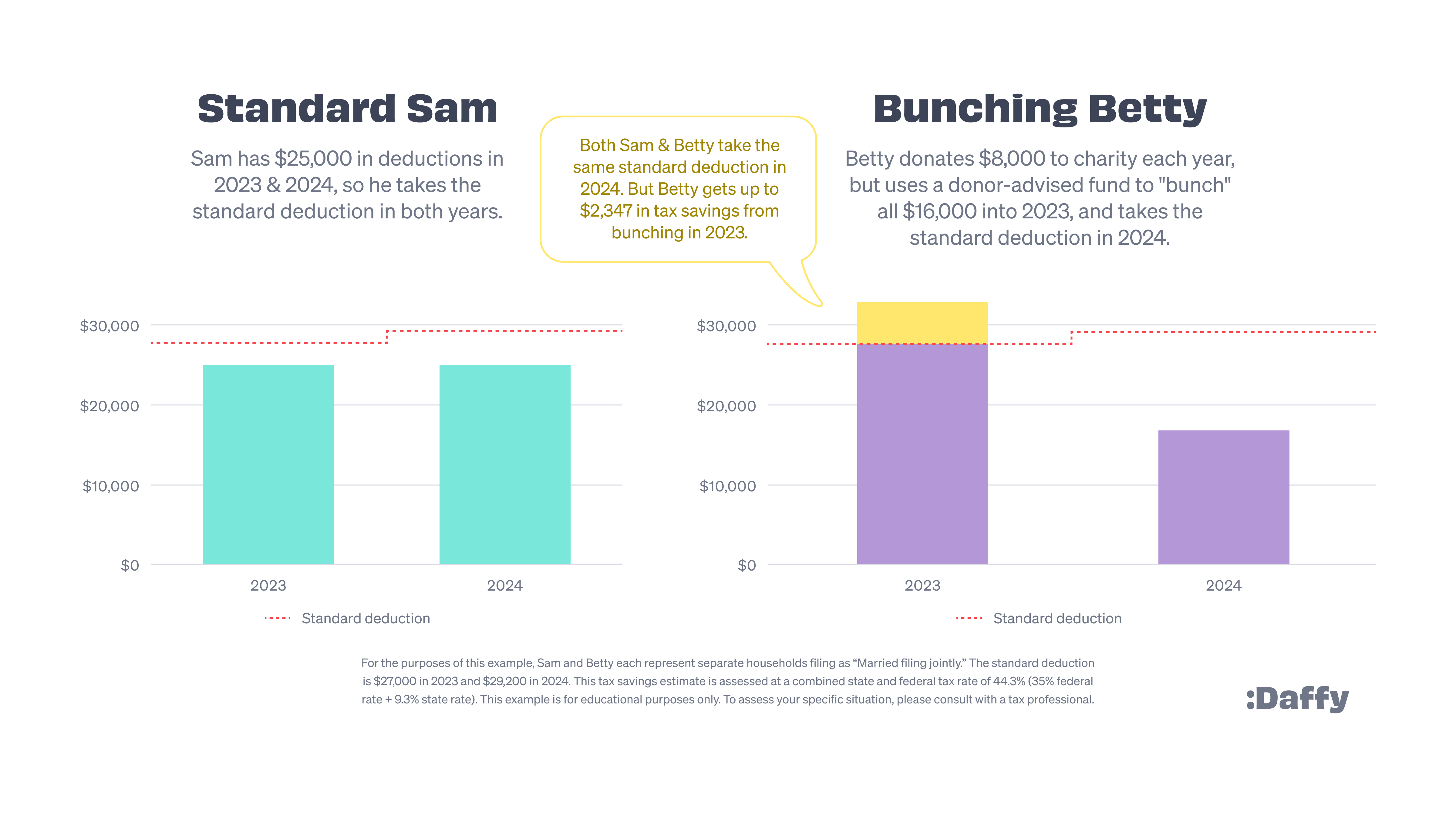

Let’s look at a simple example of how this strategy can work and potentially save you thousands of dollars in taxes. Meet Standard Sam and Bunching Betty.

Now, while Sam and Betty don’t know each other, it turns out they have a lot in common. Both Sam and Betty give generously to charity every year, making $8,000 in annual donations to their church, their children’s schools and other charities. In 2023, they both also have $17,000 in other deductible expenses, like mortgage interest and property taxes. As a result, each of their households ends up every year with about $25,000 in tax deductions — not enough to clear the hurdle to itemize.

Standard Sam decides to take the standard deduction of $27,700 in 2023. This makes sense to him, of course, since his itemized deductions of $25,000 would be lower. In fact, Standard Sam ends up taking the standard deduction in both 2023 and 2024.

Bunching Betty knows better. Looking ahead to 2024, she knows that her household will make about $8,000 in charitable donations again. Instead of taking the standard deduction two years in a row, she puts the $8,000 she intends to give out in 2024 into a DAF, a tax-advantaged account for charity, before Dec. 31, 2023. Since this is considered a charitable contribution, this allows her to claim the tax deduction for this contribution in 2023. Her deductions for 2023 now come to $33,000, well over the standard deduction.

As a result, Bunching Betty gets an additional deduction of $5,300 in 2023, while still qualifying for the standard deduction in 2024. At a combined state and federal tax rate of 44.3% (35% federal plus 9.3% state), that could mean tax savings of as much as $2,347!

Of course, the best part of this strategy is that it helps ensure that the money that Betty will need to support her charities is safely put aside for 2024, invested tax-free in the DAF. And who knows, perhaps gains on those investments will provide for even more charitable donations in 2025!

It’s not too late to open a DAF and bunch your donations

DAFs have been around for decades, and they are rapidly growing in popularity due to the convenience and flexibility they offer. There are more than 1.9 million DAF accounts in the U.S. now, according to the National Philanthropic Trust, and they have grown by an average of 22.6% per year since 2018.

Once you learn about tax strategies like bunching, it’s easy to understand why. DAFs allow you to contribute money at any time, immediately qualify for the charitable deduction in the current tax year, invest the money tax-free and then make donations to charities at your discretion.

Bunching charitable contributions isn’t right for everyone, but if your household donates to charity regularly, it would be foolish not to consider it. This strategy can be done in any year but could be even more valuable in years where you have extra income and might even be in a more expensive tax bracket.

There are three steps to leveraging this strategy:

- Estimate your deductions for this year. Did you take the standard deduction last year? The year before? Many people don’t know this offhand, but finding out can be as simple as just referring to your taxes from last year or asking your accountant. Look for significant changes in your deductions: mortgage interest, state and local taxes, etc.

- Look at your charitable giving annually. Most people who give to charity tend to support the same organizations every year combined with a few donations that were made based on current events or a specific request. How much did you give to charity this year? How much will you likely give to charity next year?

- Set up a DAF. Charitable bunching doesn’t mean you have to rush to decide on how to distribute your funds. Most major brokerages offer some form of DAF account, although many of them have high minimums and fees. Fortunately, new providers, like Daffy.org, will let you open up an account with no minimums and a fee as low as $3 per month. (I am the co-founder and CEO of Daffy.org.)

The end of the calendar year brings with it both holiday cheer and tax planning. Charitable giving has a unique way of combining both, and bunching can help generous households be more generous for years to come.

Assumptions that were used in the above example: Assessed at a combined state and federal tax rate of 44.3% (35% federal rate + 9.3% state rate).

The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.

Related Content

- 'Tis the Season for Charitable Giving's Many Benefits

- Six Charitable Giving Strategies: Feel Good and Cut Your Taxes

- Give Your Charitable Giving a Boost With These Strategies

- Tips on How and When to Donate During a Humanitarian Crisis

- What to Do if Your Passion for Charitable Giving Has Flagged

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Nash is the co-founder & CEO of Daffy.org, the Donor-Advised Fund for You™, an innovative, fast-growing platform for charitable giving. With no minimum to get started, industry-low fees and ground-breaking technology, Daffy brings the donor-advised fund back to its original goal of helping people be more generous, more often. Adam has served as an executive, angel investor and adviser to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.