Tax-Savvy Charitable Giving With QCDs Can Benefit Both Giver and Receiver

A qualified charitable distribution, or QCD, might be the answer for you – but watch those rules.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Plenty of retirees like to give back to their communities through charitable donations, but questions often arise over the best way to do that.

What approach is efficient, provides the tax benefits you’re after, and also is advantageous for the charity that’s on the receiving end?

One possibility is a qualified charitable distribution (QCD), a tax-savvy way to reduce your taxable income and maximize your donations whether you itemize deductions on your tax return or not. An added bonus is that the benefits can be large for both the donor and the charity.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here’s how QCDs work

A QCD is a distribution from an IRA that is paid directly from that retirement account to a qualified charity. QCDs lower your adjusted gross income (AGI) and therefore lower your tax bill. They can also offset required minimum distributions (RMDs), those withdrawals you must take from your IRA each year once you reach age 72. An RMD adds to your income, raising the amount of taxes you pay, but a QCD is excluded from your income. So, for example, if you withdrew $50,000 from your IRA as an RMD, you would pay taxes on that money. But if that same $50,000 was used as a QCD instead, you avoid the taxes while helping a charity at the same time.

Taxpayers can benefit from QCDs even when they take the standard deduction and do not itemize their deductions. Meanwhile, even though a QCD doesn’t count as an itemized deduction, taxpayers who itemize still benefit because an exclusion is better than an itemized deduction because it lowers their AGI. AGI is an important number on your tax return because many tax benefits, deductions, credits and other additional taxes or charges are based on AGI. With a lower AGI, income tax on Social Security benefits may be reduced and Medicare surcharges may be lowered. There may be other benefits as well.

Some rules to follow

There are important rules that govern how QCDs work, including:

- The charity you give to must be a 501(c)(3) organization that is eligible to receive tax-deductible contributions. Donor-advised funds, supporting organizations (that is, organizations that give to other public charities), and private foundations are not qualifying charities.

- The donor may not receive any benefit for making the distribution to the charity. As examples, the donor may not receive tickets to a charity event, purchase raffle tickets, or buy something in a charity auction.

- There is an age requirement involved. The donor must be older than 70½ and may make QCDs before RMDs are required, which happens beginning at age 72.

- The maximum annual QCD is $100,000 per person, not per IRA. A husband and wife can each make up to a $100,000 QCD only if the money comes out of their own IRA.

- The QCD must be a direct transfer from the IRA to the charity. Preferably, the IRA administrator would cut the check. It is not permissible for the IRA administrator to pay the IRA owner and for the owner to then write a personal check to the charity.

- QCDs are available from IRAs and inherited IRAs. QCDs also can be made from SEP IRAs and SIMPLE IRAs, but only if those IRAs are inactive, meaning that the SEP or SIMPLE IRA owner is no longer making contributions to these accounts. Additionally, only pre-tax IRA funds qualify. As a result, most Roth IRA funds won’t qualify because your contributions to them were not pre-tax. QCDs also cannot be made from employer plans, such as a 401(k).

- Taxpayers should notify their tax preparer that they made a QCD because the 1099 issued by the custodian does not specify a QCD; it only shows that a distribution was made from the IRA. If the QCD is not referred to on the tax return, the taxpayer loses the tax break.

- A required minimum distribution can be offset by a QCD (up to $100,000). However, the timing of a QCD is important in this case. The first dollars withdrawn from an IRA each year are counted toward the RMD. You cannot retroactively claim that money already distributed from an IRA was actually QCD funds. Said another way, once an RMD is taken, that income cannot be offset with a future QCD. It is therefore generally recommended that QCDs be done early in the year, particularly if IRA distributions are made monthly or quarterly.

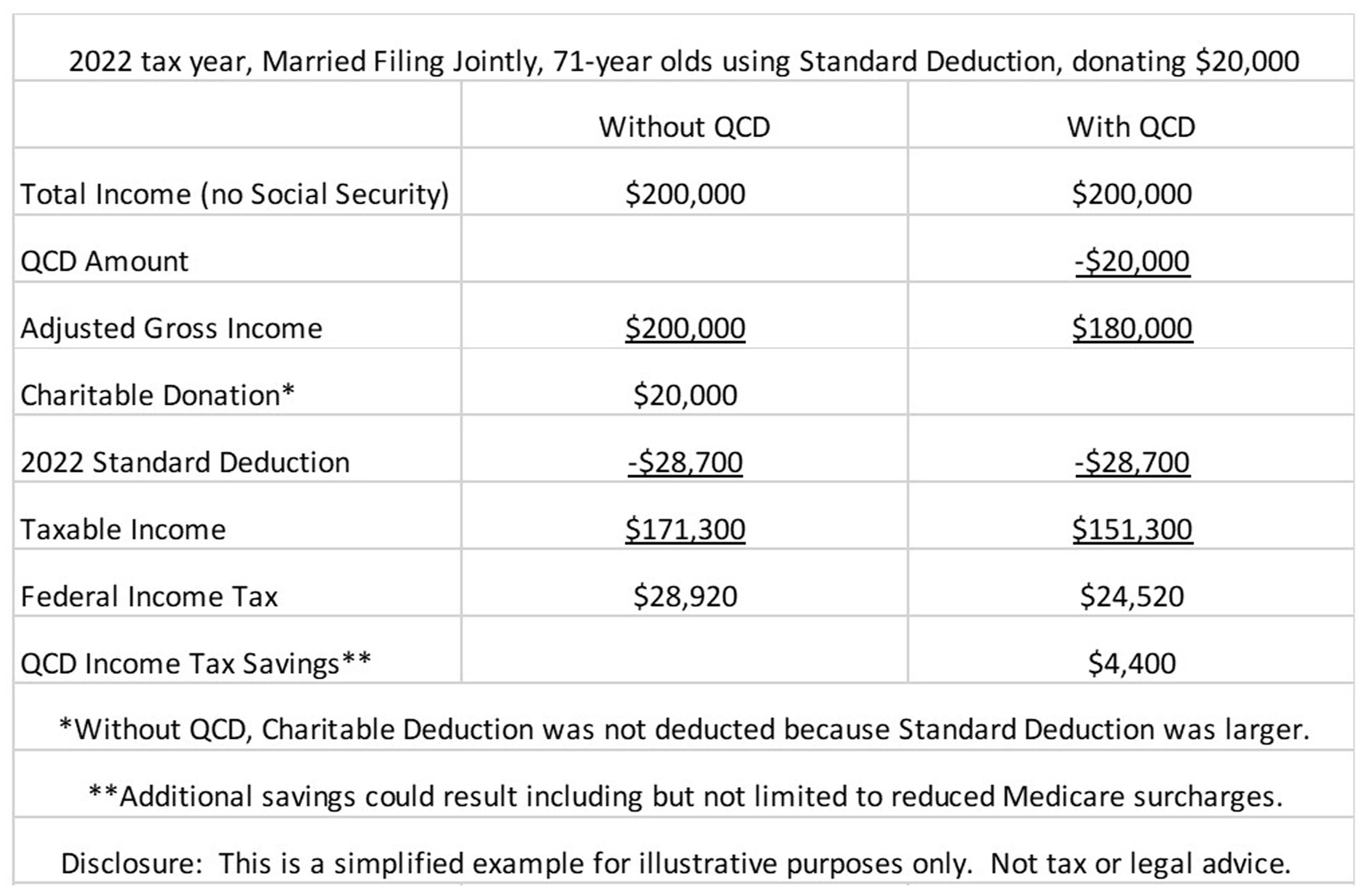

What the tax savings could look like

A qualified charitable distribution can be a powerful tax-savvy tool for those who qualify and who make sure they keep to the rules.

As you can see, though, making sure everything is done right can get complicated, so it’s best to find a financial professional who can assist you in working through these rules and getting everything right.

Example of Potential QCD Savings

Ronnie Blair contributed to this article.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Securities and advisory services offered through Sunbelt Securities, Inc. Member FINRA / SIPC. Fixed Life Insurance and Annuities offered through Charles W. Rawl & Associates, LLC. Charles W. Rawl & Associates, LLC and Sunbelt Securities, Inc. are unaffiliated companies and neither provides tax or legal advice.

Related Content

- When RMDs Loom Large, QCDs Offer a Gratifying Tax Break

- How to Report QCDs on Your Tax Return: The Tax Letter

- Six Charitable Giving Strategies: Feel Good and Cut Your Taxes

- What to Do When You Have More Retirement Income Than You Need

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As president of Charles W. Rawl & Associates, LLC, Charlie Rawl has distinguished himself as a troubleshooter by implementing creative solutions to complex financial problems. He has passed the Series 6, 7, 31, 63 and 65 securities exams and holds life insurance licenses in more than a dozen states.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.