Is It Worth Chasing Credit Card Rewards If You're In Debt?

Two out of three Americans in debt are chasing credit card rewards. Do your brain a favor and try this instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Chasing credit card rewards when you're in debt is surprisingly common. Two-thirds of Americans in debt try to maximize their credit card rewards, according to a new study by Bankrate. It's tempting to rack up miles or points to earn a vacation or cash back, but there's no way to win at that game if you're in debt.

"Chasing rewards while you’re in debt is a big mistake, says Ted Rossman, senior industry analyst at Bankrate. "The average credit card rate is a record-high 20.75%. The typical rewards payout is in the 1 to 5% range. It doesn’t make sense to pay 20% or more in interest just to earn 1, 2 or even 5% in cash back or airline miles."

Almost half of cardholders are succumbing to credit card debt, according to another recent Bankrate survey. Given the high average interest rates cited by Rossman, indebted cardholders can quickly find themselves unable to dig out of the debt hole.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Of course, some people turn to credit cards out of desperation when they can't make ends meet. Others slowly slide into debt before they realize they are in trouble.

Chasing credit card rewards

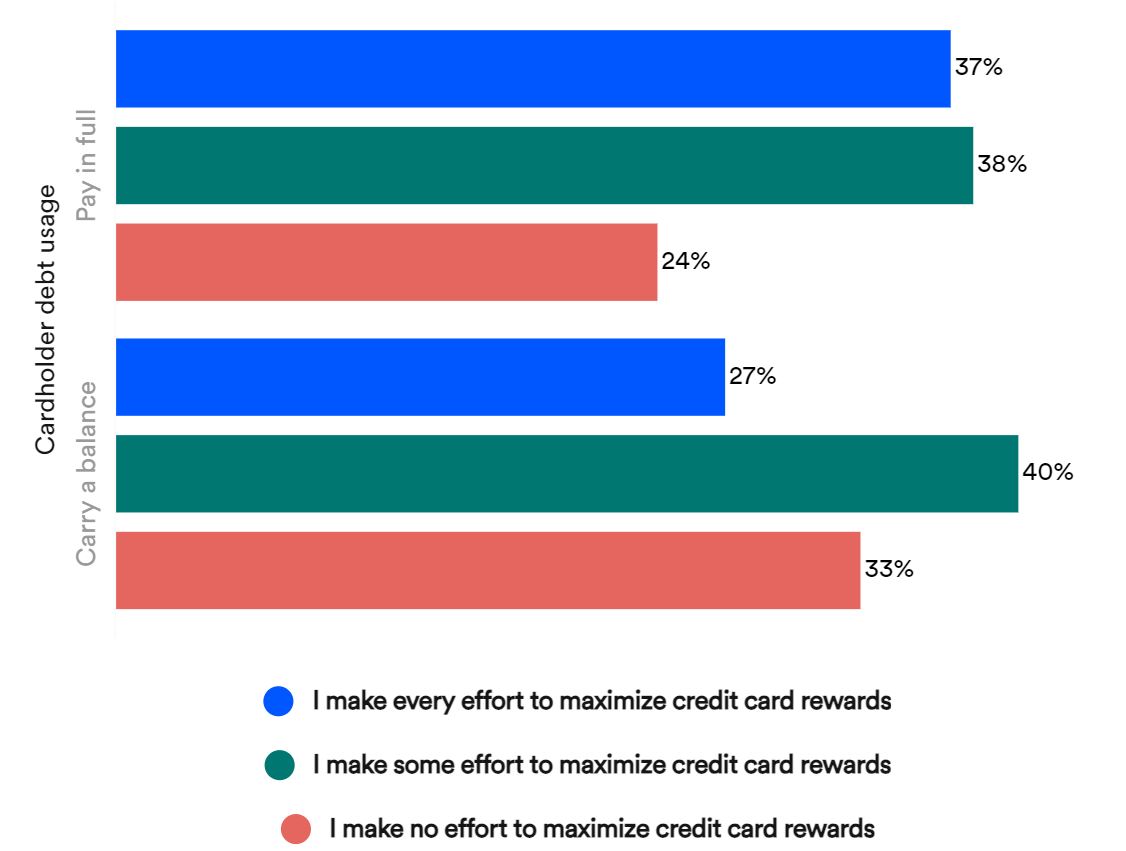

Here's how cardholders responded to the Bankrate survey about their credit card rewards strategy. A staggering 67% of those who carry a balance every month say they "make every effort" or "make some effort" to maximize their credit card rewards.

Survey responses to "Which, if any, of the following best describes your credit card rewards strategy?"

This is your brain on credit cards

It's well-established that people tend to spend more money when they pay with a credit card instead of a debit card or cash — up to twice as much. The neuroscience behind this behavior was murky until a 2021 MIT study scanned subjects' brains as they used a credit card or cash. When using the credit card, the section of the brain responsible for pleasure and the anticipation of pleasure (the dopaminergic reward center) lit up.

What else has this effect on the brain? Drugs like cocaine and amphetamines. So, using your credit card essentially gives you a shopping high. Add cash back or airline miles to that effect, and it's easy to see how those in debt might be tempted to use their rewards credit cards even when it is irrational.

Paying off debt also feels good

Out-of-control debt is a burden that stresses relationships and physical and mental health. Debt can also exacerbate existing problems, such as addiction or depression. So it stands to reason that getting out of toxic debt can be a relief. But it may also boost cognitive and psychological function according to a National University of Singapore study.

Researchers worked with a non-profit group that paid off some of the debt accounts of poor, highly indebted subjects. After three months, test subjects performed significantly better on cognitive tests and decision-making. They also had less anxiety. The study also found that the number of debts was almost as stressful as the amount of debt, so reducing total indebted accounts can also benefit brain and psychological health.

For those in credit card debt, this reward is much healthier than miles or points.

Are rewards credit cards for you?

If you hear the siren song of a cash back or travel rewards card and you currently have credit card debt, just say no.

“Ideally, you'd revisit your credit card strategy every year or two to make sure that you're using the optimal products for your spending habits," said Rossman. Credit card interest rates "should be the primary consideration if you have credit card debt. If you're debt-free, then go for rewards."

While it may be tempting to turn to "debt relief" services if you carry a balance each month, there are better ways to pay off credit card debt. Although it may seem counterintuitive to turn to another credit card for help, a balance transfer credit card with a long pay-back period could be a lifesaver — if you know you can develop a payment plan and stick to it.

Don't cut up your cards to avoid temptation. You should probably first consider keeping your credit cards active to protect your credit score. And if you or a partner struggle with compulsive spending or other behaviors that keep you in debt, consider seeing a financial therapist for a healthier relationship with money.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.