Marriott Bonvoy Three Free Nights Offer

Earn three nights of free hotel stays with the Marriott Bonvoy Boundless Credit Card.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We may get compensation if you visit partner links on our site. We may not cover every available offer. Our relationship with advertisers may impact how an offer is presented on our website. However, our selection of products is made independently of our relationship to advertisers. Rates and bonus offers updated on November 21 2024.

A Marriott credit card is one of the latest rewards credit cards to offer new bonuses for new cardholders. Get a Marriott Bonvoy Boundless® credit card and you can earn three free night awards (each night valued up to 50,000 points) after qualifying purchases.

Plus, you get a free night on each anniversary of opening your account, which can offset the $95 annual fee.

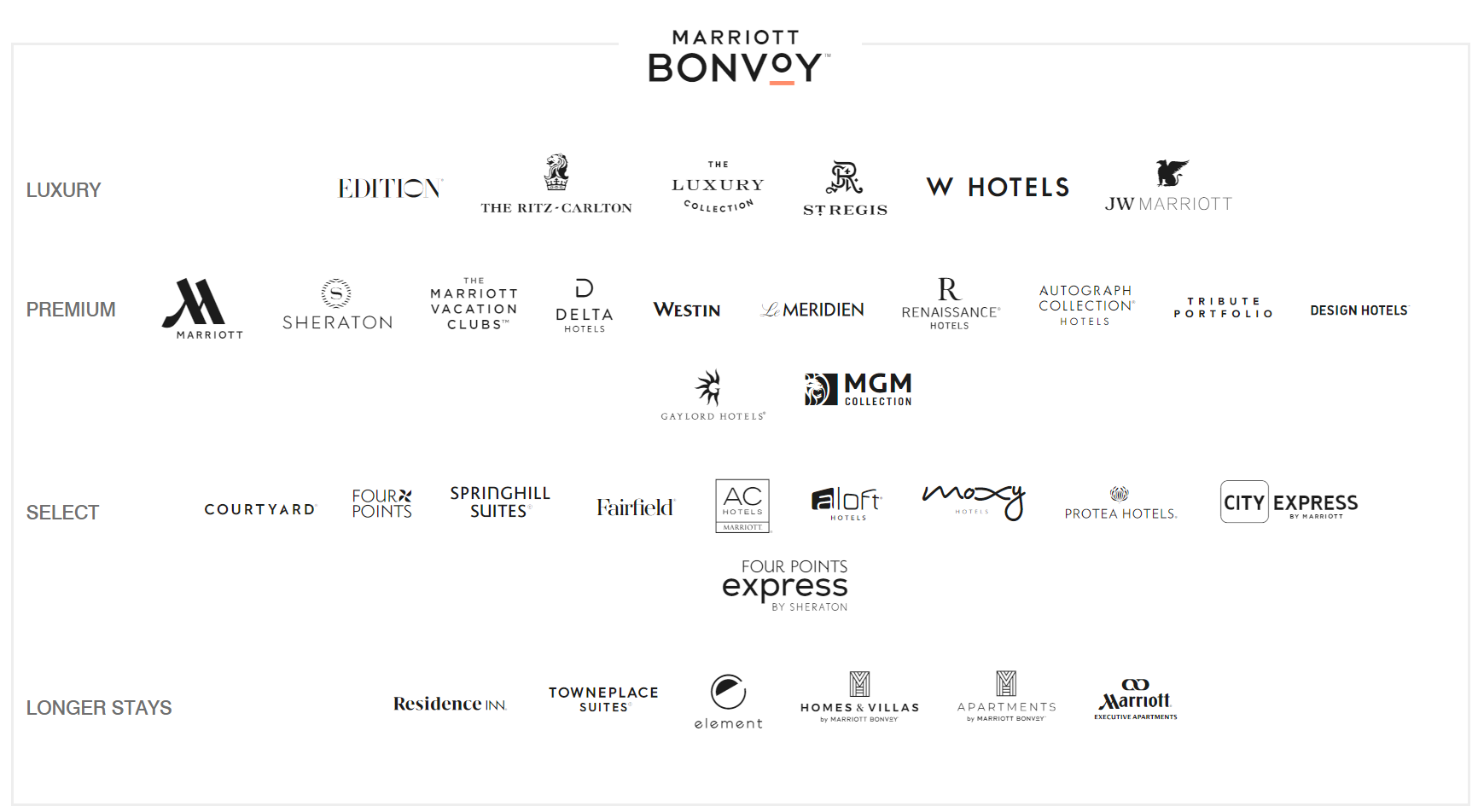

If the Marriott brand conjures up memories of budget hotels full of children, think again. In addition to family-oriented brands, Marriott offers an array of luxury hotels, such as The Ritz-Carleton and St. Regis.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Marriott Bonvoy Boundless® Credit Card

Frequent guests of Marriott hotels can get good value out of this card from Chase; you can rack up points that are redeemable for Marriott stays or transferable to the frequent-flier programs of nearly 40 airlines. You can also transfer Ultimate Rewards points earned on other Chase cards to your Bonvoy account.

The card allows you to earn three free night awards (each night valued up to 50,000 points) after spending $3,000 in the first three months of account opening.

You'll also enjoy a Free Night Award every year after your account anniversary, with some limitations.

- Earn 3 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 in the first three months of opening the account.

- Rewards at Marriott: Earn up to a total of 17x bonus points by layering reward categories for stays.

- Other rewards:

- One free night per year: Earn a free one-night Marriott stay per year after each account anniversary, valid for a one-night hotel stay at a property with a redemption level up to 35,000 points; note that certain hotels have resort fees.

- Redemptions: Marriott Bonvoy points are redeemable for stays at Marriott properties, but you can also transfer them to the frequent-flier programs of 35 airlines, including American, Delta, Southwest and United; plus, you get 5,000 bonus miles for every 60,000 points you transfer; among the card’s benefits are Silver Elite status with Marriott and a one-night hotel stay each year; points expire if your account is inactive for 24 months. And check the website for other transfer deals, such as the current offer of 10,000 bonus miles for every 60,000 points you transfer to United MileagePlus® award miles.

- Interest rate: 20.99% to 27.99% variable.

- Annual fee: $95, or if you prefer to pay no annual fee, check out the Marriott Bonvoy Bold® Credit Card.

- Foreign transaction fee: None.

Hot tip: Before booking a stay, it’s worth checking for extra deals at the Marriott offers website.

Where can I stay?

Marriott hotels are found worldwide, with almost 8,700 properties in 139 countries and territories. The properties include 24 hotel brands (see below), with luxury, boutique and family-friendly options.

Marriott also offers longer-stay options and vacation rentals to compete with Airbnb and VRBO. Homes and Villas , Apartments by Marriott Bonvoy and Townplace Suites are just a few examples.

The Luxury Collection includes unique properties. For example, a Spanish itinerary, suggests staying at a hotel designed by the architect Frank Gehry, the Hotel Marques de Riscal. This stunning hotel has a Michelin-star restaurant and is located on a vineyard.

FAQs

Is the Marriott Bonvoy loyalty program free?

Yes, there is no fee to join the loyalty program.

Do Marriott Bonvoy points expire?

Points will expire after 24 months of inactivity. One benefit of having a Marriott Bonvoy Boundless credit card is that you can keep your loyalty account active with small purchases, even if you don’t travel for two years.

How much is a Marriott Bonvoy point worth?

According to Bankrate valuations, one point is worth 0.7 cents, or 1,000 points are worth $70. You can typically redeem a free hotel stay by redeeming 5,000 to 95,000 points, depending on the property and location. Marriott uses a dynamic pricing system, so the number of points required may vary depending on where and when you search for a room.

Is the Marriott Bonvoy travel app any good?

The Marriott Bonvoy app is free to download. The app has a 4.9 out of 5 stars rating in the Apple App Store and a rating of 4.8 on Google Play.

Can I transfer points from other Chase cards to Marriott Bonvoy?

Yes, you can transfer Chase Ultimate Rewards credit card points to your Marriott Bonvoy account at a one-to-one ratio. These cards include:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Freedom Unlimited

- Chase Freedom Flex

Rewards cards dos and don'ts

As with any rewards credit card, be sure to weigh these benefits against fees — a $150 annual fee in this case — and make sure you understand how to use the card effectively. That said, $95 may be more than offset by those maxing out the benefits.

In addition, while reward credit cards are great if you use them wisely, always pay them off in full and on time each month to avoid interest, which can dwarf any rewards you earn. Don't change your spending habits to earn extra points. That's a slippery slope that can lead to overspending.

If this is your first foray into credit cards, or you just want a refresher, make sure you know how to choose a credit card. And ensure you are familiar with what counts as a good credit score.

Other Travel Rewards Cards

- Best Airline Credit Card Bonuses with a Free Ticket

- Capital One Venture Rewards Launches $1,020 Bonus Offer

- Chase Sapphire Preferred Launches $750 Bonus Offer

- Credit Cards That Cover Rental Car Insurance

As an independent publication dedicated to helping you make the most of your money, the article above is our view and is not the opinion of any entity mentioned such as a card issuer, hotel, airline, etc. Similarly, the content has not been reviewed or endorsed by any of those entities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.

-

4 Psychological Tricks to Save More in 2026

4 Psychological Tricks to Save More in 2026Psychology and money are linked. Learn how you can use this to help you save more throughout 2026.