The Secret Credit Card for Amazon Shopping

The best credit card for Amazon shopping maximizes your cash back rewards. Plus, you can get a bonus of up to $300.

Ellen B. Kennedy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

This article covers only some of our picks for best cash credit cards. We may get compensation if you visit partner links on our site. We may not cover every available offer. Our relationship with advertisers may impact how an offer is presented on our website. However, our selection of products is made independently of our relationship to advertisers. Rates and terms checked as of July 19, 2024.

We've scoured our best rewards credit cards to find this "secret" credit card for Amazon shoppers. Whether you are an Amazon Prime member or not, you can maximize your savings. One card offers an instant $200 Amazon gift card, and another offers a $300 welcome offer, but you'll have to wait 120 days and $2,000 to unlock that benefit.

Best credit card for Amazon shopping

For those in the know, there are some great credit card options available to squeeze the most out of your Amazon shopping.

US Bank Shopper Cash Rewards Visa (The "Secret" 6% Back Strategy)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Your first option is the US Bank Shopper Cash Rewards® Visa Signature® card. Why is it a "secret" strategy? Most credit card reviewers don't write about this card because it's not issued by one of the major banks, but it's still a deal. The card offers 6% cash back on the first $1,500 of combined quarterly spending at two big box retailers of your choice each quarter, including Amazon. Other retailers you can choose from include Home Depot, Kohl’s, Lowe’s, Target, Walmart and others. You’ll also earn 3% back (on up to $1,500 in quarterly spending) in a category of your choice — wholesale clubs, gas and EV charging stations, and bills and utilities — and a solid 1.5% on all other spending (most credit cards only offer 1% outside of their maximum-rebate categories).

One benefit of this card is its flexibility. For Prime Day, you can choose to earn 6% cash back at Amazon but then can change retailers afterward depending on where you typically spend the most. Plus, you can earn a $300 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening. And the $95 annual fee is waived in the first year.

U.S. Bank Shopper Cash Rewards® Visa Signature® Card

Annual fee: $95, waived the first year.

Sign-up bonus: $300 back if you spend $2,000 in the first 120 days.

This card from U.S. Bank provides an outstanding 6% cash back on the first $1,500 of combined quarterly spending at two retailers you choose. Recently, cardholders could select from 24 major stores, including Amazon.com, Apple, Home Depot, Kohl’s, Lowe’s, Target and Walmart. You also get 3% back on the first $1,500 in quarterly spending in one category you choose; the options are gas and electric-vehicle charging stations, wholesale clubs, and bills and utilities.

Plus, you earn 5.5% back on prepaid travel reservations through the U.S. Bank travel portal and 1.5% on all other spending — a higher rate than the 1% that most cards offer outside their maximum-rebate categories. You can redeem cash back as a statement credit, a prepaid debit card or a deposit into a U.S. Bank account.

Interest rate: Variable 19.74% to 29.74% APR for purchases and balance transfers.

Amazon Prime Visa (The 5% Back Strategy)

Option two is, of course, the Amazon Prime Visa credit card, which just raised its instant bonus offer for new cardholders to $200. The card earns an unlimited 5% back at Amazon.com and affiliated stores. It also earns 5% back on Chase Travel purchases, 2% back at gas stations, restaurants, and on local transit and commuting, as well as 1% back on all other purchases.

You’ll need to be a Prime member, however, to earn cash-back rewards. An Amazon Prime membership costs $14.99 per month or $139 per year. However, Amazon does offer a 30-day free trial if you’re still considering whether an Amazon Prime membership is worth it.

You’ll also earn the card’s welcome bonus immediately, with no required spending. Upon approval of your credit card application, you’ll instantly receive a $200 Amazon Gift Card loaded into your Amazon account. The card also has no annual credit card fee (apart from the cost of an Amazon Prime membership).

This card from Chase comes with a $200 instant intro bonus. As the name suggests, to open the card you’ll need an Amazon Prime subscription. An Amazon Prime membership costs $139 per year or $14.99 per month. Besides the required Prime subscription, the card has no annual fee.

The card may only be linked to one Amazon account. So, if your household has multiple Amazon accounts, be sure to keep track of which one is linked to the card, or you may forfeit the 5% back on Amazon purchases.

For more details, see our article on the $200 intro offer and card specs.

APR: 20.49% to 29.24% variable for purchases.

See rates and fees.

Can you pay for Amazon purchases with points?

We'd recommend not using credit card points to pay directly for Amazon purchases. While it may be convenient, you'll usually end up getting a lower value than if you redeemed those points elsewhere. However, according to The Points Guy, "The exception to this rule is the Prime Visa, because you’ll get the same redemption value whether you cash the points out through Amazon or for a statement credit."

Related Content

- Amazon Prime Day vs Walmart Deal Days: Which Is Better?

- Should You Cancel Amazon Prime? Here Are 12 Good Reasons

- 35 Best Amazon Prime Benefits to Use in 2024

- Best Cash Back Credit Cards

As an independent publication dedicated to helping you make the most of your money, the article above is our view of the best deals and is not the opinion of any entity mentioned such as a card issuer, hotel, airline etc. Similarly, the content has not been reviewed or endorsed by any of those entities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

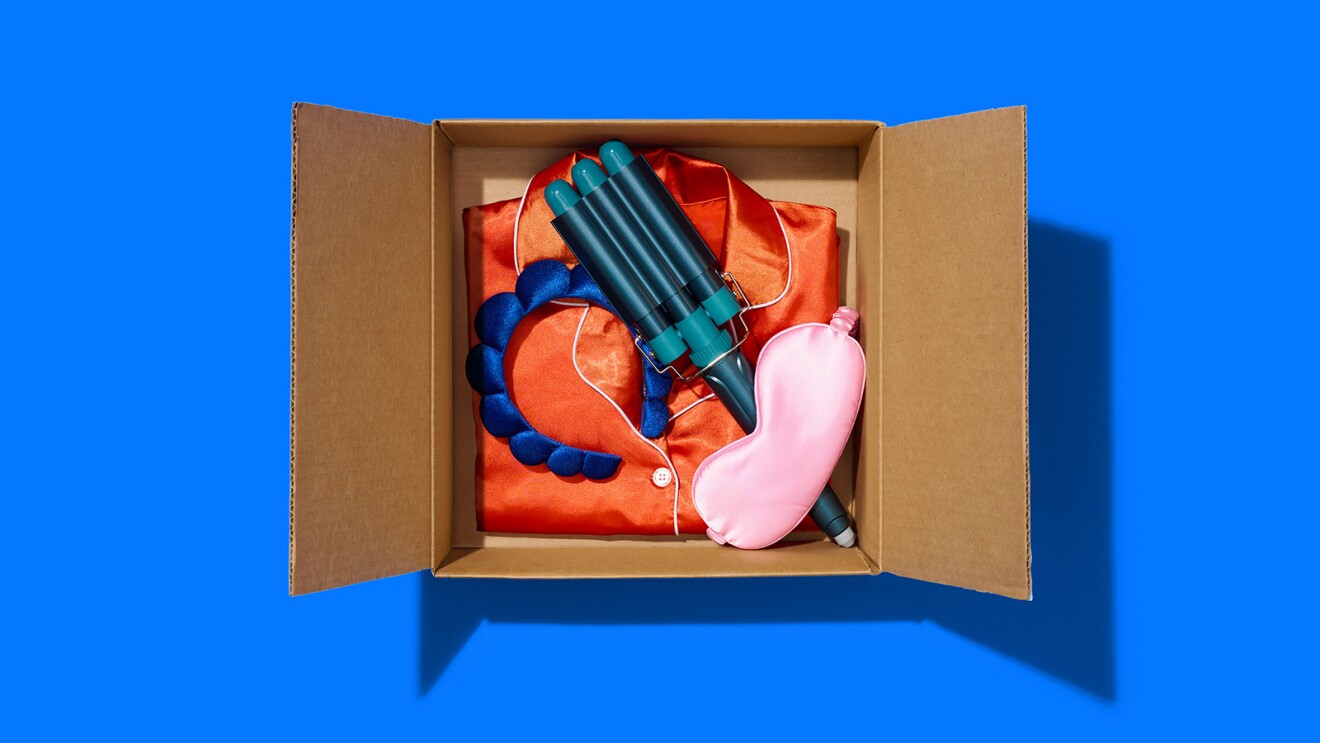

I Found the Best Gifts Under $50 and None of Them Feel Cheap

I Found the Best Gifts Under $50 and None of Them Feel CheapAmazon October Prime Day is the perfect chance to nab some under-$50 gifts that feel more expensive than they are (because normally they would be).

-

The Best Amazon Prime Day Deals for Travel Accessories, Suitcases and More

The Best Amazon Prime Day Deals for Travel Accessories, Suitcases and MoreOn the final day of Amazon's Prime Big Deal Days sale, skip the fluff — here’s how to extract real travel value via gear and strategic credit cards.

-

The Anti-Prime Day Deals Guide to Everyday Essentials at Walmart, Target and Sam's Club

The Anti-Prime Day Deals Guide to Everyday Essentials at Walmart, Target and Sam's ClubSkip Amazon and shop these anti-Prime deals at Walmart, Target or Sam's Club to save on all of your household essentials.

-

Mississippi Tax-Free Weekend 2025

Mississippi Tax-Free Weekend 2025Tax Holiday Just in time for Prime Day, Mississippi celebrated a tax holiday in July. Find out what back-to-school essentials were included.

-

Last Chance to Shop These Under-$100 Prime Day Deals for a Smarter, Safer Home: Ring Doorbells, Nest Thermostats, Leak Detectors and More

Last Chance to Shop These Under-$100 Prime Day Deals for a Smarter, Safer Home: Ring Doorbells, Nest Thermostats, Leak Detectors and MoreThese under-$100 Prime Day deals on Ring, Blink, Nest and other top smart home brands are disappearing after today.

-

Forget Prime Day: Top Walmart Anti-Prime Deals You Can't Miss

Forget Prime Day: Top Walmart Anti-Prime Deals You Can't MissWalmart Deals runs through July 13, giving shoppers two extra days compared to Amazon Prime. Here are the best anti-Prime deals to consider.

-

46 Anti-Prime Day Tech Deals You Should Get from Best Buy's Black Friday in July Sale Instead

46 Anti-Prime Day Tech Deals You Should Get from Best Buy's Black Friday in July Sale InsteadApple, Blink, Garmin, Samsung and more leading tech brands are on sale at Best Buy's competing Prime Day sale this week.

-

These Prime Day Deals Also Qualify for Disappearing Tax Credits

These Prime Day Deals Also Qualify for Disappearing Tax CreditsThere are many items for sale during Amazon Prime Day that help make your home more energy efficient and can apply towards tax credits that will expire soon.