Your Credit Card Late Fees Could be Slashed, Thanks to CFPB Proposals

Federal bureau moves to rein in credit card late fees saving customers as much as $9 billion a year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

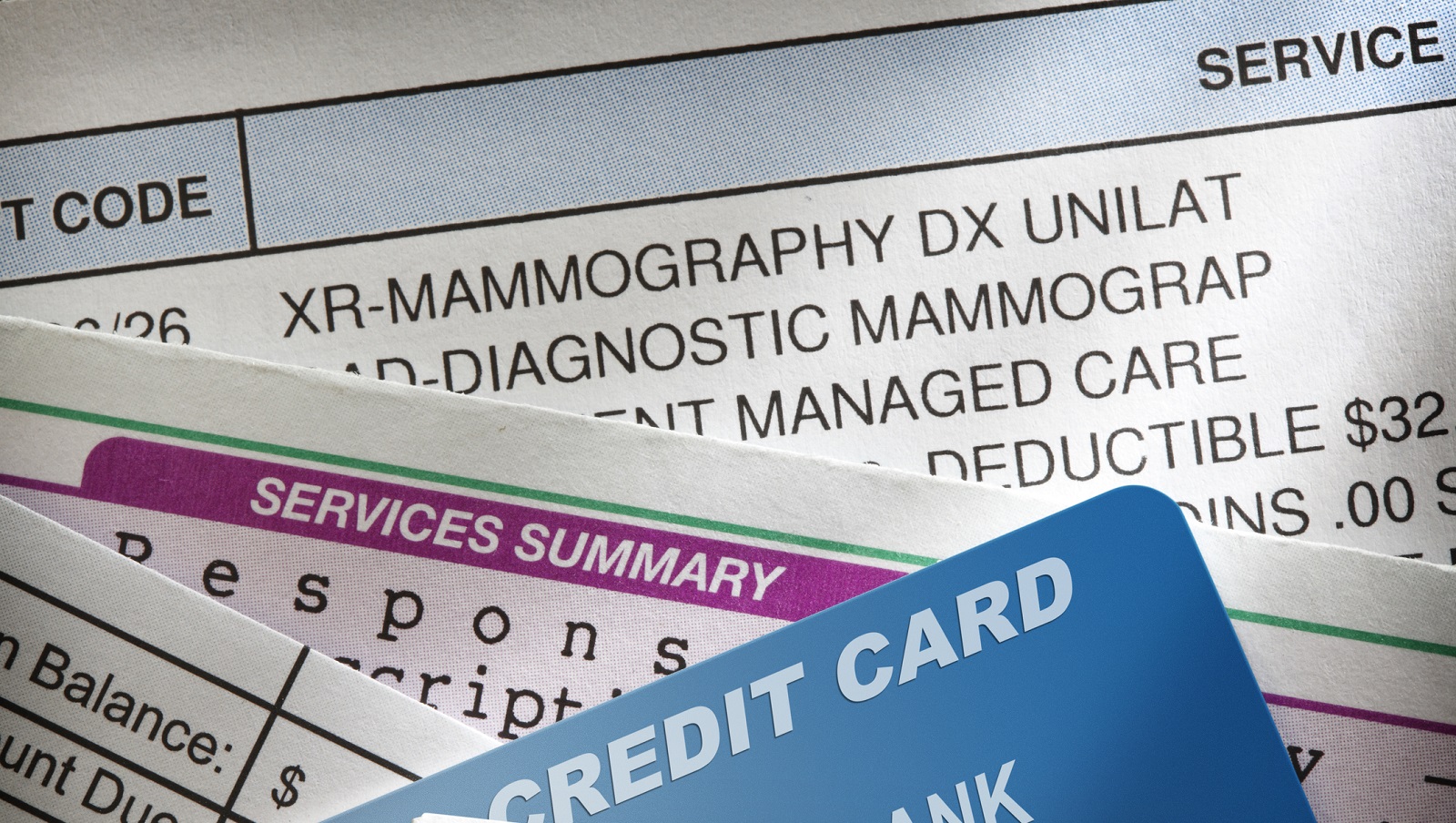

At the beginning of February 2022, the Consumer Financial Protection Bureau (CFPB) proposed rules to cap credit card late fees. In 2020, credit card late fees cost Americans almost $12 billion, and this number could potentially rise considering the expected hike in serious credit card delinquencies this year. Paying your credit card bill late not only comes with a hefty late fee but usually brings other negative consequences, like lowering your credit score or increasing your APR.

“Over a decade ago, Congress banned excessive credit card late fees, but companies have exploited a regulatory loophole that has allowed them to escape scrutiny for charging an otherwise illegal junk fee,” says CFPB Director Rohit Chopra. With these proposed changes, Chopra hopes to eliminate over the top late fees to “save families billions of dollars and ensure the credit card market is fair and competitive”

The CFPB’s goal is to amend the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) of 2009, to ensure that credit card late fees are “reasonable and proportional to the costs incurred by issuers to handle late payments.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Credit card late fees and debts are rising

In 2023, serious credit card delinquency — usually defined as being more than 30 to 90 days late — is expected to rise from 2.1% to 2.60%, the highest it's been since 2010, as inflation and multiple interest rate hikes put a strain on budgets. With more people expected to face credit card delinquencies, more are likely to incur late fees. This could easily increase the $12 billion that the credit card companies charged for late fees just three years ago.

Despite a 2010 ruling which aimed to prevent excessive credit card late fees, revenues for the sector from these fees continue to grow. As a result, the CFPB has proposed a number of changes that would severely limit what credit card issuers could charge.

Proposed changes

Lower the immunity provision dollar amount for late fees to $8:

Currently, credit card issuers can charge up to $30 for an initial late payment and $41 for any other late payment, even if cardholders pay a few hours behind the deadline, and these expensive late payments result in billions of annual junk fee revenue for credit card companies. In fact, late fee income exceeds associated collection costs by a factor of five, reports the CFPB. Therefore, an $8 late fee would suffice to cover collection costs.

End the automatic annual inflation adjustment:

Further, the CFPB proposes that the automatic annual inflation adjustment be eliminated, and instead the CFPB would monitor market conditions and the immunity provision amount, making adjustments as needed.

Cap late fees at 25% of the required minimum payment:

Currently, credit card issuers can charge a late fee that’s 100% of the minimum required payment. In order to keep late fees “reasonable and proportional,” the CFPB aims to lower late fees to only 25% of the required minimum payment amount.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

Seeing Retirement Ahead? Why Your 50s Will Be So Significant

Seeing Retirement Ahead? Why Your 50s Will Be So SignificantThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Banks Are Sounding the Alarm About Stablecoins

Banks Are Sounding the Alarm About StablecoinsThe Kiplinger Letter The banking industry says stablecoins could have a negative impact on lending.

-

Tax Rule Change Could See Millions Lose Health Insurance

Tax Rule Change Could See Millions Lose Health InsuranceThe Kiplinger Tax Letter If current rules for the health premium tax credit (PTC), a popular Obamacare subsidy, aren't extended, 3.7 million people could lose their health insurance.

-

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study Shows

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study ShowsThe mortgage market was profoundly affected by high interest rates last year, a trend that is likely to continue given this year's rate increases, CFPB director says.

-

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief Fund

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief FundShoppers at stores including Sears and Kmart were ‘kept in the dark’ about contract terms, CFPB says.

-

Medical Credit Card Marketers Are Trying More Ways to Reach You

Medical Credit Card Marketers Are Trying More Ways to Reach YouMedical credit card promotions can now be found at physician offices, diagnostic centers and hospital websites, group says.

-

Loan Lender Sued for 'Trapping' Borrowers

Loan Lender Sued for 'Trapping' BorrowersHeights Finance was charged over a loan-churning scheme that aggressively pushed borrowers to refinance.

-

Medical Credit Cards Drive Up Cost of Care, Says CFPB

Medical Credit Cards Drive Up Cost of Care, Says CFPBCFPB says medical credit cards are driving up the cost of care with more than $1 billion accrued in deferred interest.

-

Will Any Tax Priorities Gain Ground in 2023?

Will Any Tax Priorities Gain Ground in 2023?A power split in Congress for 2023 means key Democratic and Republican tax policies could be stalled.