New Way To See Free Credit Scores From FICO

Consumers now have an easy way to get free credit scores from FICO.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It now takes just a minute to sign up for a free credit score service from FICO®. There is no negative impact on your credit score for checking, and you might save hundreds or even thousands of dollars in interest by monitoring and boosting your score.

The new service was announced Tuesday by FICO in honor of Financial Literacy Month.

How To Sign Up For A Free Credit Score

Signing up is easy. Visit myFICO.com/free and enter your information to check and monitor your FICO Score for free. You will receive a credit score between 300 and 850, where a higher score is better. The score is based on data drawn from Equifax, one of three credit bureaus that monitor your payment and credit history.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Two Other Ways To Get Free FICO Scores

Credit bureau companies Experian and TransUnion also calculate FICO scores that lenders may use to consider your creditworthiness. All three credit bureaus have a slightly different way of calculating a FICO score, so it is unlikely that a customer will have a big difference between scores.

For this reason, most people don’t need to know the FICO score from all three providers, but if you are interested, there are ways to find the other two for free.

- Many financial institutions, like Bank of America, have partnered with TransUnion and provide FICO scores free to their customers.

- You can also check your FICO Score through FICO’s partnership with Experian. To get your FICO Score for free from Experian, visit: https://www.experian.com/consumer-products/credit-score.html

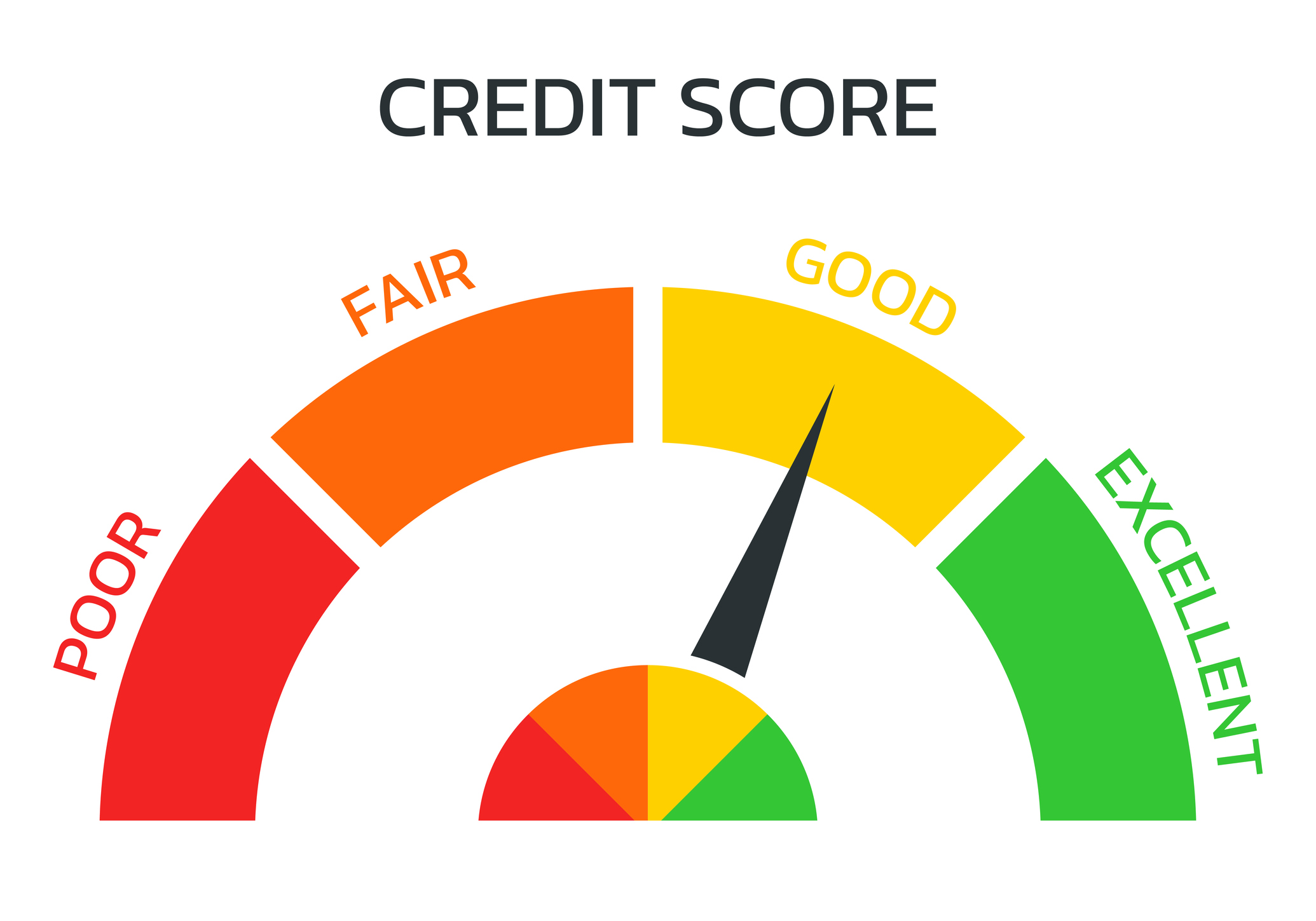

What Is A Good Credit Score?

Once you have checked your FICO score, you need to understand if it qualifies as a good credit score. FICO scores over 670 are considered good, but if you can bump your score up to 740, you’ll be in the “very good” tier and eligible for better credit cards or mortgage rates. “Excellent” credit is set at 800 to 850.

Why Bother Checking Your Credit Score?

You may already be aware of how important your FICO score is, especially if you want to qualify for one of the better rewards credit cards available to those with great credit. But did you know that your FICO score can also affect everything from the rate you get on car insurance to your mortgage? It's worth taking just a minute to check your score.

If you're not happy with it, be sure to understand how to repair your credit: pay your bills on time, pay all of your credit card balance every month, have a good mix of types of credit, and keep the amount of credit you use below 30% of your available credit. Check your FICO score each month and you should see gradual improvement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ellen writes and edits retirement stories. She joined Kiplinger in 2021 as an investment and personal finance writer, focusing on retirement, credit cards and related topics. She worked in the mutual fund industry for 15 years as a manager and sustainability analyst at Calvert Investments. She earned a master’s from U.C. Berkeley in international relations and Latin America and a B.A. from Haverford College.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.