How to Lower Home Insurance Rates When Climate Change Increases Costs

A top insurer warns the damage climate change creates make it cost-prohibitive for insurers to cover some areas. Learn how to protect your home and lower costs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The weather is causing so much damage, home insurance companies are struggling to keep up. For example, wildfires in California caused more than $250 billion in damages.

It's created a situation in which some insurance companies such as State Farm had to drop coverage in more risk-prone areas of Los Angeles.

According to insurance expert Günther Thallinger, a board member with Allianz SE, this is a preview of coming attractions. "We are fast approaching temperature levels — 1.5C, 2C, 3C — where insurers will no longer be able to offer coverage for many of these risks,” he told The Guardian.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This would have an effect on other financial sectors, as well. "This applies not only to housing, but to infrastructure, transportation, agriculture and industry,” he remarked.

The good news is solutions are available that can slow climate change's speed, such as zero-emission options. The bad news is that some countries are slow to adopt such solutions, while in other nations, such considerations aren't on the table.

How the U.S. fails to address climate change threats

Since taking office, President Donald Trump has worked to undo many efforts that his predecessors set up to combat climate change while calling it "a hoax." He withdrew the U.S. from the Paris Agreement, an international treaty in which countries pledge to work together to limit climate warming to less than 2 degrees Celsius.

In addition, members of his cabinet are dismantling other agencies that aid in assisting those impacted by climate change.

Homeland Security Secretary Kristi Noem said she supports the dismantling or severe reduction of the Federal Emergency Management Agency (FEMA). While a dismantling hasn't happened yet, the new administration changed the way it works.

Recently, FEMA announced the discontinuation of the Building Resilient Infrastructure and Communities program, which was responsible for helping communities prepare for climate change events such as flooding and wildfires. The program ended due to efforts to remove "fraud, waste and abuse."

If you feel as if you're on your own with all of this, you would be accurate. However, there are some things you can do to lower costs and protect your home.

How to save when home insurance rates rise

The average cost of home insurance on a $300,000 dwelling is $2,267 annually, according to Bankrate.

That said, your costs can vary based on a variety of factors. The age of your home, its size, claims history, weather in your area and other variables will create a more accurate depiction of what you'll pay for home insurance.

The easiest and most effective way to save when home insurance prices surge is to request a fresh quote on your property.

Using this tool from Bankrate can show you an idea of what it takes to insure your property:

Last year, I received a policy renewal that was going to add a hundred dollars per month to my home insurance premium. I didn't file any claims, but others in the area did due to hail damage.

Conducting a quick quote search allowed me to save not only on my home insurance but my auto, too. It pays to shop around for home insurance.

Improvements to make your home more climate-resistant

Doing some of the following improvements can help your home better withstand the rigors of inclement weather, and they might save money on your homeowners insurance:

- Install a metal roof: If you have an older roof, you're probably paying a little more for home insurance. By replacing it with a metal roof, you shelter your home from hail and winter weather, and you might earn a discount.

- Add storm shutters: Storm shutters can protect your windows from hail damage, and in some instances, it could earn you a small discount.

- Install a security system: Security systems can lower your home insurance because it can prevent crimes of opportunity. Some home security systems also come with excellent detection tools such as fire and water sensors, which can alert you to problems quicker.

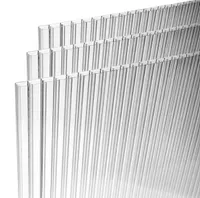

Let the light in while still protecting your windows and doors. 16 mm clear polycarbonate 3 wall construction. Easy to install and remove for storage after the storm has passed.

Make sure to notify your insurance carrier of any home improvements you do so they can reflect this in your premiums.

In the case of metal roofs, it might not lower your insurance costs, but it will lower the costs incurred by storm damage. Metal roofs also last 40 to 70 years on average, meaning your replacement costs would be minimal for the life of ownership.

The bottom line

The damage wrought by climate change creates a situation in which some locations are too risky for insurance companies, and in other areas, it's raising rates for many homeowners.

One of the best ways to lower rates is to shop around before your policy renews, which can save hundreds of dollars annually.

By making some improvements to your home, you can also help it become more climate-resistant while lowering insurance costs.

Related section

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean is a veteran personal finance writer, with over 10 years of experience. He's written finance guides on insurance, savings, travel and more for CNET, Bankrate and GOBankingRates.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

No-Fault Car Insurance States and What Drivers Need to Know

No-Fault Car Insurance States and What Drivers Need to KnowA breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.