How Financial Advisers Can Share Their Clients' Good Words

Financial professionals must follow strict regulations when they use written testimonials and endorsements by their clients to market their business.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor’s note: This is the first article in a three-part series about the processes financial advisers are required by the SEC, FINRA and their firms to follow to properly use client recommendations to market their business. Part two focuses on how to handle Google Business Profile reviews, and part three details best practices for video or audio testimonials and endorsements.

For decades, most financial advisers have built their books of business on referrals from friends, family members and business partners.

But until recently, advisers couldn’t include written recommendations from these individuals in their marketing materials, websites or social media posts.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This changed in 2020, when the SEC’s updated marketing rules began allowing financial advisers to start using these kind words publicly.

This is great news, since positive statements can help differentiate you and your firm in an increasingly commoditized market.

But you can’t just grab a “thank you for a job well done” email from a client and post it on LinkedIn. Remember, this is the SEC we’re talking about. Naturally, there are strict rules you need to follow.

In this article, I’ll focus on an overview of the process for collecting, validating and gaining compliance approval to publicly post what I’m calling advocacy statements.

While specific processes may vary from firm to firm, for illustrative purposes I’m going to discuss those mandated by a very prominent independent broker-dealer and RIA firm with thousands of affiliated financial advisers.

Defining the categories

Before we get into the specifics, let’s quickly define the two main categories of advocacy statements:

- Testimonials are the positive things your clients have to say about you or your firm.

- Endorsements are thumbs-up statements you receive from non-clients, such as accountants, attorneys and estate planners you work with. Endorsements can also come from other entities, such as non-profit organizations you support.

Collecting testimonials and endorsements

The good news is that you don’t have to wait for an advocate to send you a thank-you email. You can directly ask them for a testimonial or endorsement.

Generally, the easiest way to gather their good words is via email messages. You can also collect them via phone calls, but it’s up to you to make sure that you capture exactly what they said, rather than what you want to hear.

However, you have to be very careful in the way you do it:

- You can’t write an advocacy statement and then ask for their permission to use it as is. Nor should you ask them to say only positive things about you. They need to create their message themselves. However, you can ask pointed questions that may help them shape the kind of statement you want (“Joe, if you were going to recommend me to one of your friends, what would the most important reasons be?”)

- You can’t use quid-pro-quo arrangements as motivation (i.e., you can’t say, “Hey, Joe, if you send me a few lines about how great it is to work with me, I’ll send you $100!”)

There are certain exceptions to the second point.

You are allowed to send an advocate a gift of nominal value (such as a $25 gift card) to thank them after they’ve provided the testimonial or endorsement.

And, in certain situations, you can compensate clients or business partners for their advocacy statements, but these must be formal compliance-approved arrangements that document the nature of the compensation.

The one taboo topic

While advocates have the freedom to discuss just about any aspect of working with you or your firm, the one topic that the SEC strictly forbids mentioning is investment performance.

As tempting as it might be to post a client’s statement, such as, “John Smith’s expert investment guidance grew my IRA by 100% over five years,” the SEC considers these statements to be promissory.

Getting advocacy statements approved

The SEC is very clear that any advocacy statements you collect must be reviewed by your firm’s advertising compliance department before you can post or publish them and that they need to be documented in a written agreement between you and the advocate.

Most firms have established workflows for documenting testimonials and endorsements.

For example, the independent broker-dealer/RIA firm I mentioned before has developed a standardized testimonial and endorsement form that the adviser fills out. The information must include:

- The name of the client or non-client and a detailed description of their relationship with the adviser

- Description of any nominal, non-cash compensation the adviser provided (or plans on providing) to the advocate after the statement has been approved for use

- Any possible conflicts of interest that might exist (for example, the advocate is a relative or an investor in the firm)

- The exact wording of the agreed-upon testimonial or endorsement provided by the advocate via email or other means

Formal, ongoing compensation agreements are generally documented through a separate process.

Once the form has been filled out, the adviser signs it and sends it to the client/non-client, who then countersigns it to formalize the agreement.

The adviser then submits the completed form, along with screenshots of the materials (or website pages) where they plan on using it, to the firm’s advertising review team.

Once the testimonial is approved, Compliance provides disclosure language that must be positioned in close proximity to the endorsement or testimonial wherever it appears. This disclosure language must include:

- The date the statement was provided

- The nature of the relationship (client, business partner, etc.)

- Whether the advocate was compensated

- Boilerplate disclaimer language stating that the experience or success the client has benefited from isn’t indicative of the experience other clients may have had with the adviser or the firm and that past performance is no guarantee of future results

- If the firm has received reviews on Google or other platforms, additional language recommending that the reader search for other reviews might need to be included

The adviser then adds the statement and disclosure to the intended marketing piece or website and submits an updated screenshot to the original advertising review case file.

Once approved, the statement/disclosure can be viewed by the general public.

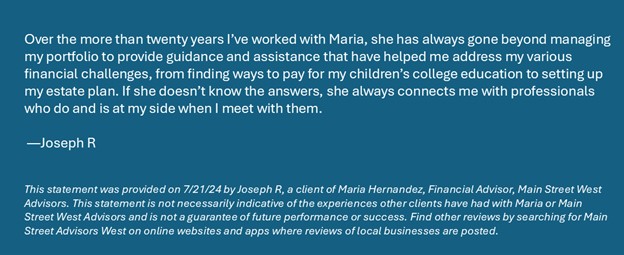

Here’s a purely hypothetical illustration of how an approved testimonial might appear on a website:

Statements don’t require the full name of advocates for attribution purposes. Initials or even generic terms such as “A client” can be used.

Once approved …

Advisers can publish these advocacy statements on their websites, social media platforms, brochures, sales sheets or any other marketing materials.

Compliance will probably require the adviser to submit screenshots of these materials for approval just to make sure everything’s kosher.

Your process may vary

Again, this example represents the process one particular broker-dealer/RIA firm requires for affiliated financial advisers who want to use testimonials and endorsements.

Your firm’s policies may be very different. That’s why if you’re sold on the idea of using advocacy statements in your marketing campaigns, talk to your firm’s marketing manager or compliance officer. If they haven’t established a formal policy yet, offer to work with them to create one.

My next article in this series will focus on Google Business Profile reviews.

Interested in more information for financial professionals? Sign up for Kiplinger’s new newsletter, Adviser Angle.

Related Content

- Seven Tips to Land Your First Client as a Financial Adviser or Entrepreneur

- How Financial Professionals Can Build Trust With Clients

- Investment Management: A Return to Simplicity

- The Four Key Pillars of Wealth Management of the Future

- What the Great Wealth Transfer Means for Financial Advisers

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Briskin is the marketing director for a Boston-area financial planning firm and principal of Briskin Consulting, which provides strategic, digital and content marketing services to asset managers, wealth management firms, TAMPs, trust companies and fintech firms. Jeff has more than 25 years of financial marketing experience with some of America’s largest mutual fund companies, banks and wealth management firms.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.