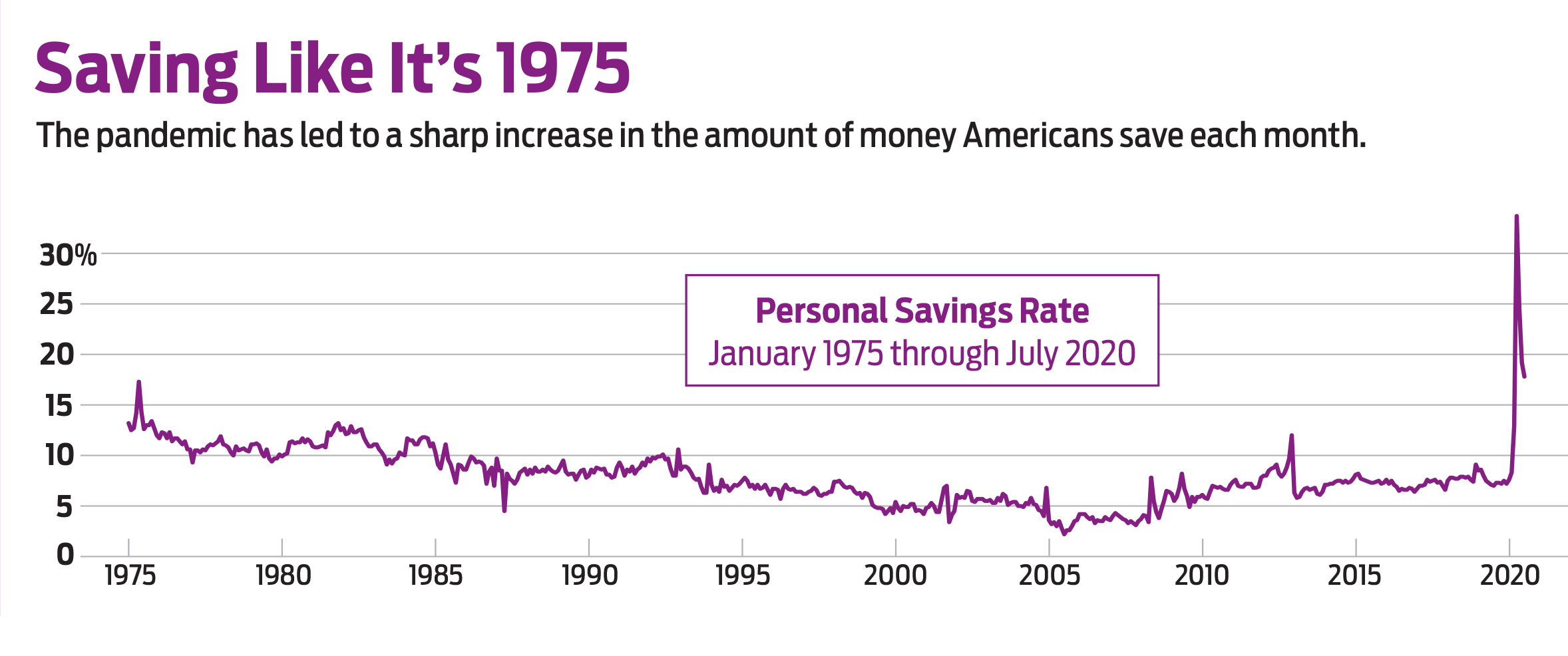

Americans Are Stockpiling Cash

With no place to go and businesses closed, we are saving more than ever.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Americans have gradually begun to reopen their wallets, but we’re still saving more than we have in decades. The personal savings rate, which measures the amount of money Americans have left over each month after spending and taxes, dropped to 17.8% in July after spiking to 33% in April, but that’s still the highest rate since May 1975. Some 45% of Americans say they’re saving more than usual, according to a survey by the Associated Press and the NORC Center for Public Affairs Research.

That means a lot of pent-up demand could be unleashed when the economy recovers. But it could be a long time before Americans return to their previous spending habits, and that has serious implications for an economy that relies heavily on consumer spending to drive growth.

“There’s a lot of uncertainty about how the pandemic is going to play out,” says Mark Zandi, chief economist for Moody’s Analytics. “Will I be working three months from now? Will my pay be cut? People are saving for a potentially stormy day.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The spike in April wasn’t surprising because most of the country was in lockdown, bringing the economy to a halt. In addition, many Americans—particularly those who had jobs—saved the $1,200 stimulus checks they received through the CARES Act. Many jobless workers also stashed the extra $600 a week they received in unemployment benefits through July, says Joao F. Gomes, professor of finance and economics at the University of Pennsylvania’s Wharton School.

The unprecedented nature of this downturn makes it difficult to predict when Americans will feel confident enough to start spending again. “There’s no real framework for this,” says Tom Porcelli, chief economist of RBC Capital Markets. Porcelli doesn’t expect spending to accelerate until the country returns to close to full employment, typically defined as an unemployment rate of 5%.

People could also be motivated to open their wallets if an effective vaccine is introduced and widely distributed, Zandi says. But the rise in spending could come more slowly if the vaccine is rolled out over several months and only helps, say, half of the people who receive it, he says.

And even then, economists say, not everyone will be eager to whip out their credit cards. The Great Recession also led to a rise in the savings rate, and boomers continued to save after the downturn ended.

That could happen this time, too, Zandi says: “I think that group will be saving more, post-pandemic. They’re the most vulnerable, and now they are even less prepared for retirement.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.