Planning a Summer Road Trip? Here's How to Cut Costs

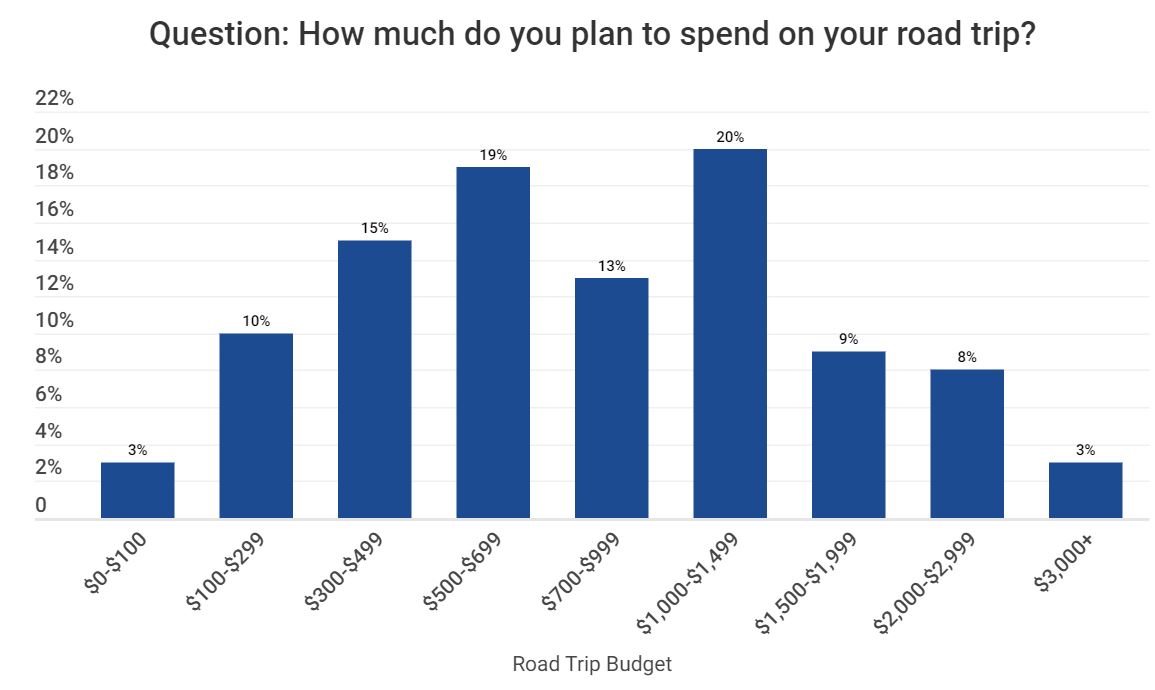

Drivers expect to spend about $2 per mile on average, or about $1,000 on road trips this summer, according to an Experian survey.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Summertime — warm weather, t-shirts, concerts in the park… and budget-friendly road trips. Errr, not so fast. And it looks like summer 2025 is shaping up to be the year of the road trip. According to a new GSTV survey, 84% of responders plan to use their own vehicle for a road trip this summer, and 56% plan to travel by car more than they did last summer.

There are a few different reasons while this seems to be the case for this year. Both higher flight prices and cheaper gas prices are root causes. According to the Bureau of Transportation Statistics (BTS), the average domestic flight cost for 2024 was $384 per person. Although this isn't a drastic change from previous years, the rising cost of other household items like groceries and rent doesn't leave much wiggle room. For a family of four, that can quickly add up.

Average gas prices in America have slightly gone down: it's currently $3.18 per gallon, while 2024 prices averaged at $3.49.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Consumers may not have much control over some of the costs of their vacation, but there are many ways to prepare in advance so that they can save more,” says Rod Griffin, senior director of consumer education and advocacy for Experian. “I always suggest consumers make a budget before finalizing their vacation plans, then research costs for different accommodations, activities and experiences, and book those accordingly.”

Additionally, Griffin suggests leveraging credit cards to earn reward points and discounts to apply toward vacation plans.

How far will you go?

According to GSTV, 60% of people polled plan to drive over 300 miles this summer. Domestic beaches and/or resorts are at the top of their travel lists this summer; 58% call it their top destination versus the 23% of people who said they were visiting a National Park this summer.

Top three road trip expenses

A 2024 Experian survey noted that most road trippers said they expect gasoline (76%) and lodging (61%) to be the biggest expenses on their road trip, and another 47% say food will be one of their big-ticket items this summer.

Indications in 2024 were that gas prices were expected to be below average as a result of the U.S. releasing some of its fuel reserves, but they are not likely to fall below $3 per gallon. The same is shaping up to be true for summer 2025. Honestly, unless you're driving an electric car this summer, you’re looking for ways to save on gas.

Fuel your road trip and earn rewards faster with Kiplinger’s top gas and transit credit cards, powered by Bankrate. Advertising disclosure.

Other anticipated costs

Other expected costs, according to Experian, while on the road are entertainment (18%), car maintenance (10%) and vehicle rental (6%). Understandably, 15% of those surveyed also mentioned insurance premium costs for their own vehicle or, if they rent, the additional coverage they'll either use or purchase for their rental.

Insurance costs have climbed more than 26% since 2023. As such, they have become a constant pain point among many motorists, even on vacation.

Griffin points out that, “consumers can consider splitting costs with friends or family members, sharing hotel rooms and packing food instead of eating out at restaurants for all of their meals to help cut back on some of these expenses.”

Test drive insurance premiums

According to Bankrate’s True Cost of Auto Insurance Report, the average cost of full coverage car insurance reached $2,638 in 2025. This was a pretty steep 12% increase from 2024.

"So, if you think this summer’s road trip may break your budget, Griffin adds, "it may be time to compare car insurance quotes online from top auto insurance carriers."

If you're rethinking your auto insurance, check out the tool below to help you compare rates, powered by Bankrate.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.

-

4 Psychological Tricks to Save More in 2026

4 Psychological Tricks to Save More in 2026Psychology and money are linked. Learn how you can use this to help you save more throughout 2026.