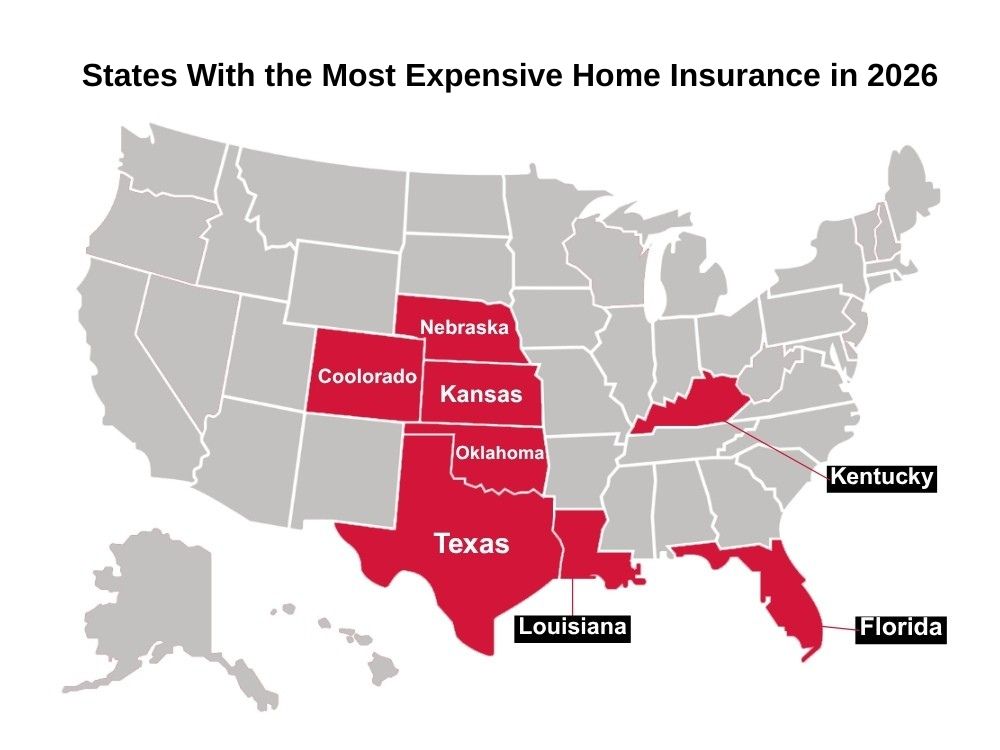

These 8 States Have the Most Expensive Home Insurance in 2026

If you live in one of these eight states, you're probably paying $1,000 or more above the national average for home insurance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Home insurance rates have skyrocketed over the past few years as natural disasters and extreme weather become more frequent and the costs of home repairs keep climbing.

While homeowners everywhere are feeling the pinch, some states have been hit harder than others. U.S. homeowners are paying an average of $2,424 per year for $300,000 in dwelling coverage, according to a recent Bankrate report. However, homeowners in eight states are paying significantly more than the national average.

That figure doesn't even include additional coverage for events like floods, earthquakes and other disasters that standard home insurance doesn't cover.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

8 states with the most expensive home insurance in 2026

If you're looking to move to cut down on housing costs, you might want to check out the states with the cheapest home insurance, especially if you live in one of the states below.

Before seeing who's paying the most to protect their homes, use the tool below from Bankrate to see how the best rates for you compare to the national average:

8. Colorado

Coming in eighth place, Colorado homeowners are paying an average of $3,412 per year for standard home insurance. Nestled between tornado alley to the east and fire country to the west, the Rocky Mountain state faces an above-average risk of both natural disasters.

It's the growing wildfire risk that has driven the surge in home insurance prices in the state this year. To combat soaring rates, Colorado lawmakers recently passed legislation to make the wildfire risk scoring models used by insurers more transparent.

While it won't take effect until later this year, the new law also establishes clearer guidelines on fire-proofing steps homeowners can take to protect themselves (and earn discounts on their premiums). If you live here, the law in question is House Bill 1182, and you can keep an eye out for when the new law takes effect.

7. Kentucky

In Kentucky, homeowners pay an average of $3,540 annually for home insurance. This is actually down slightly from last year, when the average premium was $3,643. The state is too far inland for hurricanes, but it's still prone to strong summer storms.

Come winter, freezing temperatures and heavy snow can cause damage, too. Many counties in Kentucky also have a high flood risk. So, additional flood insurance is a good idea here.

6. Texas

Even insurance premiums are bigger in Texas. Homeowners in the state pay $3,899 per year on average. While that's almost $1,500 above the national average, it's about $200 less than $4,101, Texas's average premium in 2025.

Some areas see even higher costs, though. In Galveston, for example, home insurance premiums averaged $9,831.

The Lone Star state faces multiple threats, though the risks vary in different regions. In winter and spring tornadoes roll through the state on their way north. By summer, hot, dry conditions increase the risk of wildfires statewide. On the southern coast, hurricanes coming in from the Gulf can cause severe damage.

If you do live near the coast, double check your policy. In addition to excluding flood damage, standard policies in this region sometimes don't cover wind damage. Without flood or wind coverage, you'll be more or less on your own next hurricane season. So make sure you know what your policy covers and purchase any additional coverage you need to fully protect your home.

5. Kansas

Homeowners in Kansas pay $4,444 per year on average for standard homeowner's insurance. If you've seen The Wizard of Oz, you know exactly why Kansas made the list of states with the most expensive home insurance.

It's right in the middle of tornado alley, seeing an average of 96 tornadoes per year, according to the National Weather Service. The risk is highest in summer. While these are typically covered in a standard policy, it's important to track any damage and be ready with relevant documents before making a tornado-related claim.

4. Oklahoma

Like Kansas, Oklahoma residents face above average home insurance premiums due to the higher risk of tornadoes and wind-heavy thunderstorms. The average premium for the state is $4,695 per year, according to the Bankrate report. Tornadoes are most likely to happen in spring here.

Homeowners in the eastern half of the state also face higher risks of flooding, a disaster that typically isn't covered by standard insurance. So they need to pay even more to add flood coverage.

Get more insurance tips and other personal finance insights straight to your inbox. Subscribe to our daily newsletter, A Step Ahead.

3. Florida

Florida comes in at third place, with average home insurance premiums of $5,838. While that statewide average isn't the highest in the U.S., some Florida homeowners face even more exorbitant prices. In Tavernier, for example, home insurance averages an eyewatering $18,950 per year.

Florida is often in the path of powerful storms, which is a major reason why home insurance is so expensive in the state.

The state also has a very high risk of flooding, something that's excluded from standard coverage. So, if you are planning a move to the Sunshine State, make sure you budget for additional flood insurance as well as above-average home insurance premiums.

2. Louisiana

In Louisiana, you can expect to pay $6,274 per year on average for a standard policy. The state experiences more than its fair share of hurricanes each year, and many parts of the state also face an extremely high risk of flooding. This is not the place to skimp on flood insurance.

Likewise, it may also be worth checking your deductible for hurricane-related damage. The slight increase in premiums to lower your deductible could pay off next time you have to file a hurricane insurance claim.

1. Nebraska

You might be surprised to see this midwestern state beating out Florida for the highest average home insurance premiums. But Nebraskan homeowners are paying $6,587 annually for coverage, according to Bankrate.

The reason for the sky-high premiums largely comes down to Nebraska's harsh storm season – it's one of the worst states for hail damage and intense winds.

While there are certainly some parts of the state paying more than others, no one in Nebraska is paying nearly as much as the $18,950 premiums found in some parts of Florida.

The highest home insurance bill in Nebraska is found in Sidney, where homeowners pay "just" $8,215 per year. If you happen to live in Sidney, at least you know it could be about $10,000 worse.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rachael Green is a personal finance eCommerce writer specializing in insurance, travel, and credit cards. Before joining Kiplinger in 2025, she wrote blogs and whitepapers for financial advisors and reported on everything from the latest business news and investing trends to the best shopping deals. Her bylines have appeared in Benzinga, CBS News, Travel + Leisure, Bustle, and numerous other publications. A former digital nomad, Rachael lived in Lund, Vienna, and New York before settling down in Atlanta. She’s eager to share her tips for finding the best travel deals and navigating the logistics of managing money while living abroad. When she’s not researching the latest insurance trends or sharing the best credit card reward hacks, Rachael can be found traveling or working in her garden.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

No-Fault Car Insurance States and What Drivers Need to Know

No-Fault Car Insurance States and What Drivers Need to KnowA breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.