How Patients with Lasting Symptoms of COVID Can Apply for Disability

Those who can no longer work because of COVID-19 may qualify for these benefits but the approval process can be a difficult road.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

COVID survivors who are unable to work because of lasting effects from the virus should consider applying for disability benefits, though this can be a difficult road, says Barbara Comerford, founder of the Law Offices of Barbara B. Comerford in Paramus, N.J.

Social Security disability insurance is one option. To qualify for it, generally you must have earned 40 credits during your working years, 20 in the last decade before you became disabled, though younger workers may qualify with fewer credits. In 2021, workers earn one credit for every $1,470 in wages, or a maximum of four credits after $5,880.

You must also meet the definition of disabled. That means you are unable to continue working at your job, you can't switch to a different position because of your condition, and the disability is expected to last for at least a year. Comerford, who has represented clients that have applied for disability because of long COVID, says the Social Security Administration has been more willing to pay out benefits, especially for older workers who are close to full retirement age.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

To determine your disability payment, Social Security uses a formula similar to the one for calculating retirement benefits. It's based on your average monthly income from the age of 21 until you become disabled and factors in up to 35 years of earnings. (The formula for retirement benefits is based on your 35 highest earning years.) Once you reach your full retirement age, your disability benefit changes to a retirement benefit that continues to pay out at the same amount. Taking disability does not reduce your retirement benefit.

If you have long-term disability insurance through an employer or a plan you purchased and can show that you became disabled before a certain age, these policies will pay a percentage of your salary annually until a specified end date, typically your full retirement age for Social Security. In general, once you notify your employer that you will apply for short-term disability benefits, which you may do after taking sick leave for seven days, you can request and submit the forms to the disability insurer. If your claim is approved, you will be paid the benefit for 26 weeks. After that, you will need to apply for long-term disability if you are still unwell.

Getting insurance companies and some self-insured employers to pay out these claims can be difficult -- even more so for COVID-19 patients, Comerford says. Insurers are "being harder on long COVID cases because so much is unknown and a lot of physicians don't know enough about the disease," Comerford says. Finding a doctor experienced in treating COVID patients is important for documenting your condition.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jackie Stewart is the senior retirement editor for Kiplinger.com and the senior editor for Kiplinger's Retirement Report.

-

Seeing Retirement Ahead? Why Your 50s Will Be So Significant

Seeing Retirement Ahead? Why Your 50s Will Be So SignificantThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

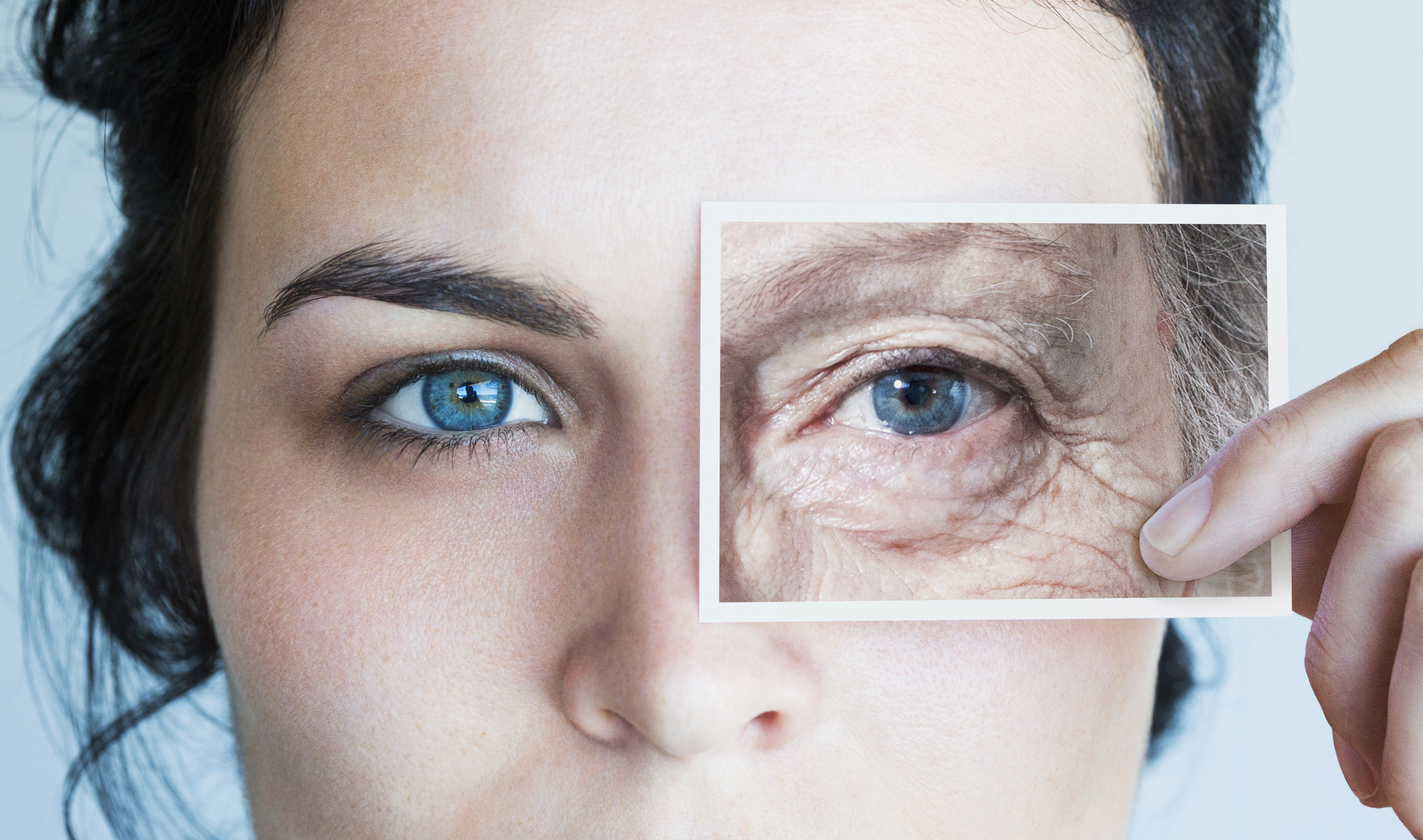

COVID Aged Your Brain Faster, Even if You Didn't Get Sick

COVID Aged Your Brain Faster, Even if You Didn't Get SickWhether you contracted COVID or not, your brain took a hit. Here's what that means for your health and what you can do about it.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

U.S. Treasury to Eliminate Paper Checks: What It Means for Tax Refunds, Social Security

U.S. Treasury to Eliminate Paper Checks: What It Means for Tax Refunds, Social SecurityTreasury President Trump signed an executive order forcing the federal government to phase out paper check disbursements by the fall.