Is It Still Worth It to Gift Savings Bonds?

U.S. savings bonds were seen as a sure bet as gifts for newborns and children.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As more and more of my family members and friends have kids, and as those kids hit milestone ages, I've been trying to strategize the best gifts for them. And, no, I'm not talking about keeping up with the latest Tickle Me Elmo trends.

I'm fine with being the boring adult who hands over an envelope at birthday parties, knowing of course the children won't understand it now, but we're giving them investments they'll appreciate when they're grown, whether in the form of 529 contributions, gifted stocks or bonds. Plus, I honestly just hate the idea of gifting plasticy toys that'll get forgotten within a few months and end up in a landfill. Blame the millennial in me.

So, as my niece approached her fifth birthday and asked for anything Elsa-related, I was planning to give her a savings bond. But her birthday was in the month of April 2025, a volatile period in the market that introduced long-term economic uncertainty due to President Donald Trump's tariff policy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As all eyes were on the 10-year Treasury yield, I wondered if it's still a good idea to gift savings bonds. Here's what I learned.

Why gift savings bonds?

Let's start with the basics of what U.S. savings bonds are: You lend money to the government (by buying a bond) and, in return, the government pays it back along with interest.

There are two types, or "series," of U.S. savings bonds, EE and I. The difference between EE and I bonds is that I bonds are linked to inflation. When you purchase an EE bond, it comes with an interest rate that stays set for 20 years. When you purchase an I bond, it comes with a combination of a fixed interest rate and a variable one that changes every six months depending on current inflation.

They're both considered safe, as they're backed by the full faith and credit of the U.S. government, and they both earn interest for 30 years unless you cash it in before then. The interest isn't huge — right now on EE bonds it's 2.6% — but it's safe growth.

That's why people have traditionally considered them useful gifts for newborns and young children: You gift it when they're young, and then when they're adults they can cash it in with interest and use it for themselves.

"If the person can have the stamina to hold on and not cash it in" within a few years of reception, they're a good form of "forced savings," said Paul Miller, CPA, founder of Miller & Company in New York City.

I can vouch for that personally. I cashed in savings bonds to spend when I was getting married, with thanks to my parents' friends' foresight. After that experience, I liked the idea of my niece and nephews having that opportunity for themselves in a few decades.

How do you gift US savings bonds?

The process to gift them, however, is complicated.

While the standard process used to be to get paper bonds and just hand them over, now, the process takes place online through TreasuryDirect. If you've ever used the government's site before, you know it's clunky, so that's the starting point.

In order to gift a savings bond, you need a TreasuryDirect account — and so does the recipient. And if the recipient is a minor, their parent or custodian also needs a TD account in order to set the child's account up in the first place.

Now, let's say everyone involved has a TreasuryDirect account. In order to gift an EE or I bond, you need the child's full name, Social Security number and TreasuryDirect account number. And once you purchase it, you have to hold it in your own account for at least five business days before you can send it to the recipient.

It takes many more steps than just writing a check, which can be a barrier for people thinking of gifting savings bonds.

"They’re pretty outdated in terms of how it was designed," Christine Lam, CFP, financial planner at Financial Investment Team in Portland, Oregon, told Kiplinger.

Still, there's one big benefit of the process being online: You don't risk the parent or child losing the piece of paper before it gets cashed in. "People have a tendency to misplace or lose the whole thing," said Miller.

Are savings bonds good gifts?

As for the overall question of if you should even bother getting savings bonds as gifts, as with anything, it's something of a personal choice more to do with risk appetite.

Historically, savings bonds are safe investments. But "safe" doesn't mean you get the best returns, and the stock market has largely outpaced the returns of savings bonds in recent decades.

David Payne, staff economist for The Kiplinger Letter, said his grandparents purchased savings bonds for his sons when they were born, and he's still kicking himself "for not cashing them out and putting it in the stock market." But, he added, "Of course, that type of stock market performance may not be repeated in the next 20 years."

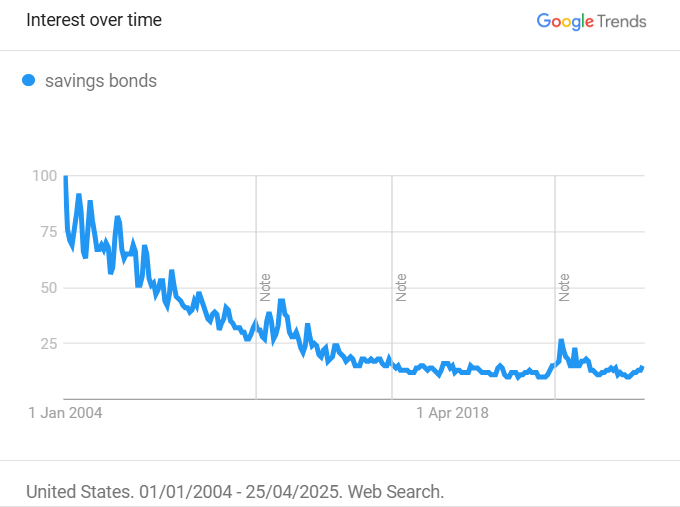

That return factor could explain why savings bonds' popularity dropped off in the new millennium. Treasury data show, adjusted for inflation, $5.8 billion of EE bonds were sold in 1999. In 2024, just $85 million were. I bonds had a jump in popularity in 2021-2023 as rates leaped with inflation, but that's generally cooled off too.

Popular interest in bonds (as opposed to interest on bonds), too, has dropped off. Here's Google search volume for the term "savings bonds" since 2004:

The lower, if safer, returns are why Payne says, "I'm not totally against [savings bonds as] stocking stuffers as long as they're not the only thing."

Your gift might get higher returns if, instead, you gifted a stock investment or contributed to a 529, which is used for tuition payments. (And if you're a grandparent, don't forget about the grandparent loophole for 529s.)

But if you knew a child's 529 was already taken care of and didn't need more funds, and if you just wanted to give the child some money they could spend on whatever they wanted as an adult, a savings bond is "still not going to be the best option to earn her the highest return in a relatively safe investment," said Lam.

Instead, she recommends, "I think [your niece would] be much happier with some sort of investment vehicle," like a broad-based index fund through a custodial investment account.

As a final point, let's say your risk tolerance is low and you just want to gift a safe savings bond. Miller, the CPA, warns that you should take into consideration who you're gifting to and what you want it to be used for.

"Is the person going to hold it till maturity? Twenty years is a long time," he said.

There's always a risk the savings bond will be cashed in long before maturity, in which case there's missed growth opportunity. If a savings bond is cashed in before five years, the recipient will lose out on three months of interest.

Plus, Miller cautioned, if you give it to, say, a teenager with a phone, "they'll Google it and they'll cash it in," he predicted. Then, your intention of gifting a forced saving for them to use in the future is dashed.

Are savings bonds safe?

In the wake of Trump's back-and-forth on tariff policy, some people have expressed hesitancy about the future of the U.S. economy. There are risks of a recession and the 10-year Treasury yield surged, indicating a lack of confidence.

"There's been a lot going on in the news, and I understand where clients are coming from where they’re asking, 'Where is my money even safe anymore?'" said Lam.

First, remember that a recession is short-term while a savings bond is longer-term. Second, remember that the deal of a savings bond is that it has fixed interest rates (even the I bond has a fixed component).

Third, Lam said, remember that our financial system is predicated on the Treasury Department and the Federal Reserve.

"It would be pretty substantial if the entire Treasury Department and the Federal Reserve was wiped out," she said. Basically if that were the case, we would have bigger problems to worry about than the fate of a savings bond you gifted.

"The main question is if the growth is worth it, and will the value of the dollar and Treasury still be solid after 20 years." said Jason Brown, founder of the Brown Report, a financial literacy company. "The reality is no one knows, but if we look at history, as of right now we do not have another currency that is going to overthrow the dollar and get widely adopted."

Lam added that a bigger change as a result of this presidential administration might be how you're able to access your money through the TreasuryDirect website. Earlier this year, the Treasury Department granted Elon Musk and the Department of Government Efficiency (DOGE) access to the federal payment system, so maybe how the TreasuryDirect site works will change. And to be completely honest, if they make the site more intuitively useable and up to the standards of the modern-day internet, I would find it a welcome fix.

Should you gift an EE or I savings bond?

Now, let's say you've taken all this into consideration and decided you want to gift a savings bond. Safe is safe, and you think they'll appreciate the forced savings as adults. Should you go with an I or an EE bond?

"EE bonds offer a fixed interest rate and has a guarantee to double if held 20 years regardless of the fixed rate and continues to earn interest for up to 30 years," said Brown. "If you want to park some money away for a child for 20 years with a guarantee it will double and never go to zero, this is not a bad option as a gift to a child."

And what about inflation?

"The rate on I bonds, which currently pay 3.11%, will adjust every six months, based on inflation, so unless you believe inflation is going to average less than 2.6% annually during the coming 20 years, I bonds offer more protection against inflation," said Jim Patterson, managing editor of The Kiplinger Letter.

"If you think inflation will average less than 3.5% over the coming 20-plus years, and the recipient of the bond is willing and able to hold it for at least 20 years, the EE bond looks better. But 20 or more years is a long time to count on inflation staying relatively low," he continued.

Overall, Brown calculated, if you invested $10,000 right now for 20 years at current rates, a series EE bond will be worth $20,000 and an I bond will be $18,450.

But if you invested that in an S&P 500 ETF at the 10.13% nominal annual return since 1957? It'll be $69,000.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Alexandra Svokos is the digital managing editor of Kiplinger. She holds an MBA from NYU Stern in finance and management and a BA in economics and creative writing from Columbia University. Alexandra has over a decade of experience in journalism and previously served as the senior editor of digital for ABC News, where she directed daily news coverage across topics through major events of the early 2020s for the network's website, including stock market trends, the remote and return-to-work revolutions, and the national economy. Before that, she pioneered politics and election coverage for Elite Daily and went on to serve as the senior news editor for that group.

Alexandra was recognized with an "Up & Comer" award at the 2018 Folio: Top Women in Media awards, and she was asked twice by the Nieman Journalism Lab to contribute to their annual journalism predictions feature. She has also been asked to speak on panels and give presentations on the future of media and on business and media, including by the Center for Communication and Twipe.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.