New Cars Are More Expensive Than Ever, As Used Car Prices Keep Sliding

New car options under $25K drop to a mere 10 models as carmakers push luxury. Meanwhile, used car prices have fallen for four straight months. Buyers take note.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

New cars at reasonable prices are like unicorns in the U.S. these days, as carmakers seem intent on implementing a fully luxury market. Perhaps it’s now time to consider the used car market, where prices are falling consistently from pandemic highs. Read on to understand the woes of new car shoppers — and the opportunity facing the used car market.

New cars are pricier than ever

According to a new report by Cox Auto Group, the U.S. new car market is becoming a luxury market, where new vehicles are available only for wealthier buyers. The dramatic shift can be pegged to supply disruptions, new tech, limited inventories, higher interest rates, and automakers increasingly focused on wealthy buyers.

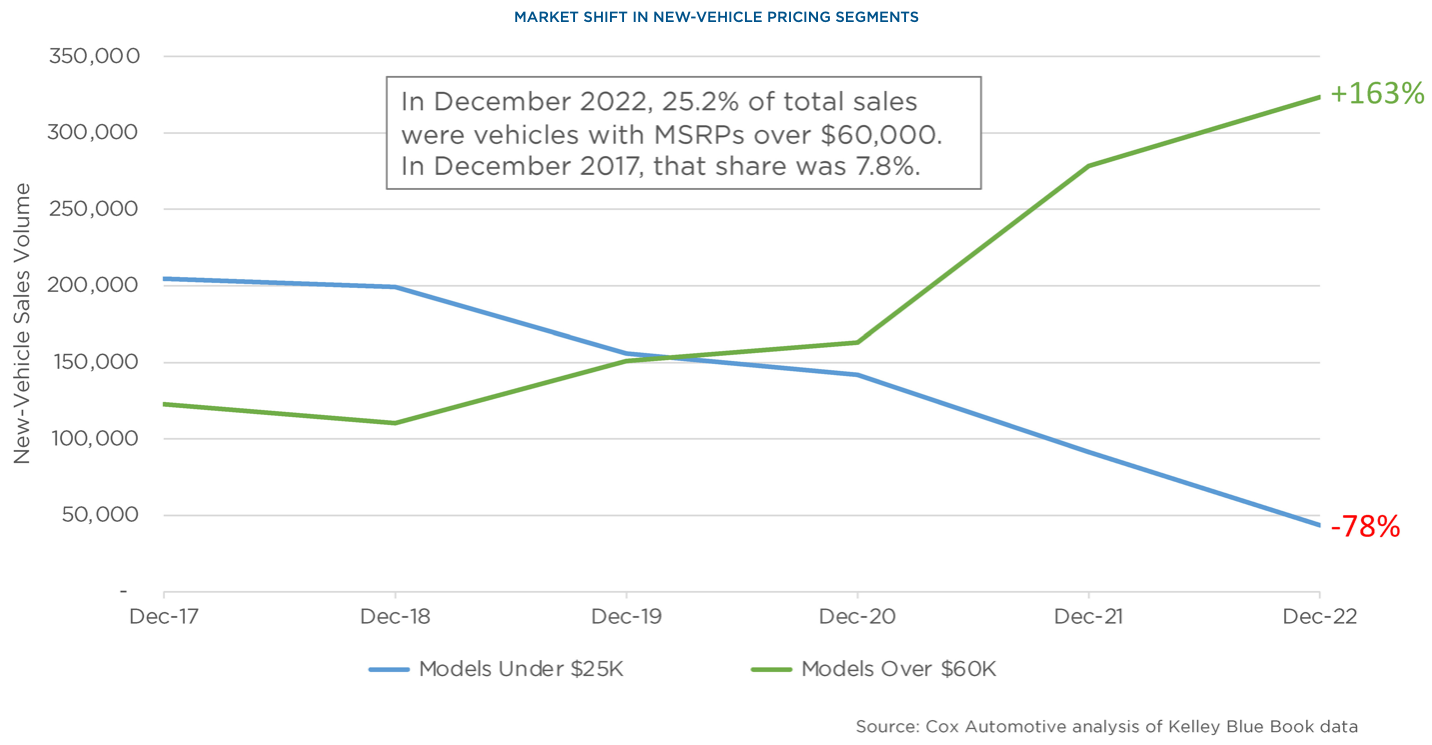

Cox Auto measured the new car market shift between December 2017 and December 2022. The study focused on more affordable vehicles priced under $25,000 alongside vehicles priced over $60,000, which is generally out of the average American buyer's price range.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In December 2017, Cox measured 36 models with MSRPs below $25,000. Then, under-$25K cars were 13% of total new-vehicle sales, with 204,593 sold. By December 2022, only 10 models with MSRPs under $25K remained on the market, with 43,557 sold — a share of just under 4%.

Meanwhile, luxury brands took more market share and non-luxury brands shifted increasingly into the luxury category. In December 2017, the share of vehicles priced over $60K was less than 8%, with 61 models and sales of 122,864. By December 2022, at least 25% of new car sales were over $60,000, featuring 90 unique models and total sales of 323,368.

Buyers looking for the fabled "affordable" car may have to shop exclusively in the used car market soon.

Used cars keep sliding

As the new car market causes heartburn, the used car market is offering buyers some welcome relief after pandemic-related price surges. Kelley Blue Book (KBB) reports that the average price of used cars sold market-wide fell to $26,510 in January, down $633 from December 2022. This marked the fourth straight month of average price drops across the market. The explanation comes down to more new cars steadily entering the market, feeding the supply of used cars, as consumers stay resilient in the face of continued inflation.

Lower-priced cars are the most scarce. Sub-$10K models have the lowest inventories nationwide, as compared to the highest inventories for used cars at $35,000 and above. The latest consumer price index report from the Bureau of Labor Statistics showed used vehicle prices were down 1.9% in the past month and down 11.6% over the past year.

CNN reports that auto wholesaler Mannheim registered a 4% jump in its average wholesale used car price in the middle of February, which could potentially trickle down to individual car buyers. Experts point to dealers hoarding used cars for when Americans receive their tax refunds, and they expect prices to resume falling slightly after this spring buying rush.

So if you're in the market for a used vehicle, waiting to buy until May could likely unlock even better used car deals. And if you're looking for auto insurance, try our new comparison tool — in partnership with Bankrate — that will help you find the cheapest deals.

How to get the best car deal

We have several tips to find the best deal, whether you're buying new or used.

- Consider lower-priced cars with high resale value. Luxury models' rapid depreciation usually can't be overcome with favorable financing and free maintenance.

- Shop around for your car financing with your local bank, your credit union, as well as a dealer. And if you don’t qualify for the best rates from the dealer or the manufacturer, ask about the full range of financing options before settling for the first offer.

- Get comfortable with ordering online. The pandemic turbocharged online commerce, and car buying along with it. Major carmakers like Volvo are shifting to offer direct online buying, matching Tesla's longtime practice. This can offer real savings by cutting out the car dealership and their fees.

- Consider an electric vehicle. The Inflation Reduction Act expanded the Electric Vehicle Tax Credit and EV Home Charger Credit to $7,500 off the MSRP of your vehicle, which could help you pull the trigger on a vehicle that's immune from fluctuating gas prices.

- Figure out what are your must-have features and where are you flexible, so you're able to keep an open mind about potential model deals that still have your essentials.

- Even if you hate price haggling, consider non face-to-face options like email, text message, and live chats to unlock better deals.

- Look for two- to three-year-old used vehicles — they’ve already lost the lion’s share of their initial value.

- Avoid leases that sharply restrict mileage (often to as little as 10,000 miles per year) and drive up the price of late-model used cars.

- Consider vehicles with more miles that are newer than an off-lease option, such as used rental cars. These cars are carefully maintained and usually carry lower prices.

- Check out all-digital used-car sites such as Carvana, Shift and Vroom, which perform full vehicle inspections, offer a seven-day return period, and claim lower prices because they don’t have dealer showrooms.

- For price savings over the more popular full-size models, consider smaller cars with higher fuel economy as well as less marquee electric vehicles such as the Chevrolet Bolt and Volt and Nissan Leaf.

- Check your target vehicle's reliability and repair history at Consumer Reports. Autotrader and Kelley Blue Book maintain top-10 monthly lists of used cars and SUVs.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.