Where Disability Benefits Are Worth the Most: How Your State Stacks Up

Recipients of Social Security disability benefits rely on the monthly check as a vital source of income, but in no state does it match up to the livable wage.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

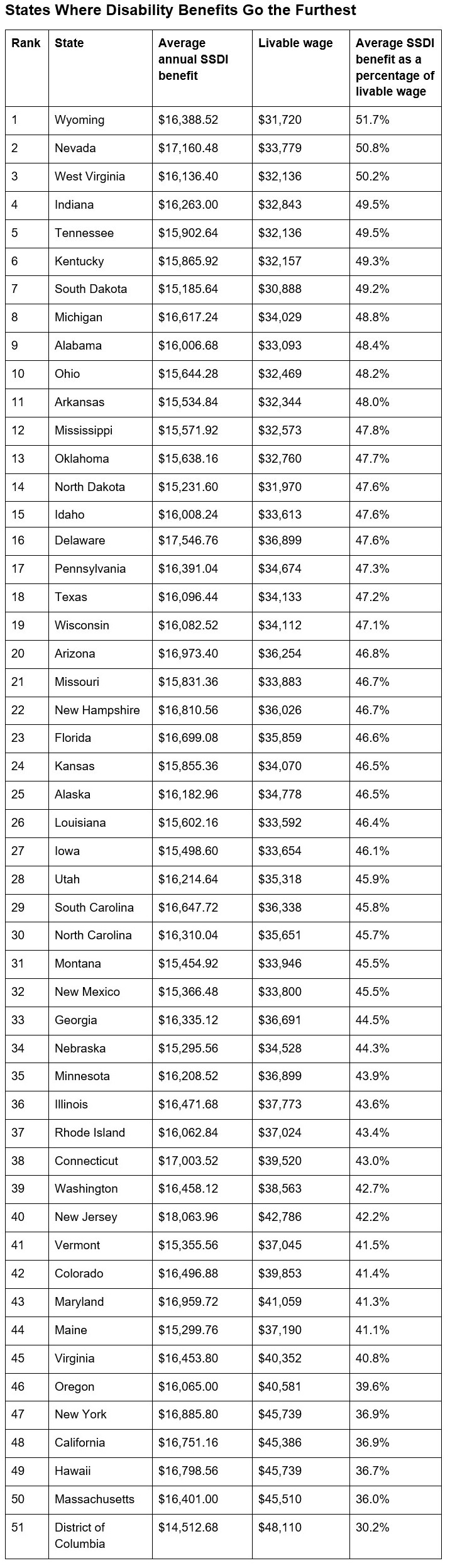

Social Security disability benefits are awarded to people who cannot work due to an injury, illness or other health condition. Looking at Social Security disability benefits by state, Atticus found that benefits are never worth enough to cover someone’s living expenses. In fact, there are only three states where the average disability benefit is worth enough to cover even half of the cost of living. In some areas, the average benefit covers one-third or less of annual living costs.

Types of Social Security Disability Benefits

There are two main types of disability benefits, both managed by the Social Security Administration (SSA).

Social Security Disability Insurance, also called SSDI, exists for people who have previously worked and paid Social Security taxes, but can no longer work because of a medical condition. Supplemental Security Income, or SSI, is available to people who can’t work, have little or no work history and have very low income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Much Are Social Security Disability Benefits Worth?

According to data released in 2022, the average SSDI benefit for disabled workers is $1,358.30 per month. The exact value of someone’s monthly SSDI benefit depends on their work experience, but it’s possible for someone to earn up to a maximum of about $3,300 per month.

In January 2023, the Social Security Administration’s highest cost-of-living-adjustment (COLA) since 1981 went into effect, increasing benefits by 8.7% for all SSI and SSDI recipients.

“Even with the COLA increase, SSDI and SSI benefits do not match up to the livable wage in any state in the U.S.,” said Sarah Ashmore, attorney at Atticus.

The average monthly SSI check is worth $568.13, according to SSA data. However, SSI recipients are also capped at $841 of total monthly income in 2022. So a person with no outside income could qualify for the maximum SSI benefit, but a person who earns some monthly income would have their SSI benefit reduced by the amount they earn. SSI benefits are also reduced if someone has savings or valuable assets.

Learn more about how SSDI and SSI benefits are calculated.

Where Disability Benefits Go the Furthest

Because costs of living vary across the country, we found the average SSDI benefit in each state and then compared that to the state’s cost of living. We found that SSDI benefits aren’t enough to live on in any state.

Based on data from MIT’s Living Wage Calculator, which looks at typical expenses for people living in each state, the income needed to meet the cost of living in many areas is between two and a half and three times higher than the income an average SSDI recipient would earn.

In most states, someone whose sole source of income is SSDI would earn only enough to cover between 40% and 50% of living expenses. There are three states where SSDI covers at least half of someone’s living expenses, with Wyoming being the highest at about 52%. On the other end of the spectrum, there are six states where SSDI benefits would cover less than 40% of living expenses. Residents of Washington, D.C., would have the hardest time, with the average SSDI benefits covering just 30% of living expenses.

Note that we looked at the living wage required for a single individual, with no children. Couples and people with children would experience higher costs of living.

Are Disability Benefits Enough to Live On?

For someone receiving Social Security disability, benefits are a vital source of income. Their monthly benefits may represent most or all of their income. However, in many places across the United States, it’s difficult or impossible to live on just disability benefits.

Someone who receives the average Social Security disability benefit ($1,358.30) for the whole year would receive $16,299.60 from SSDI. That’s only slightly more than the federal minimum wage (about $15,080 annually), and it’s well below the cost of living in every state.

In fact, someone with annual income of $16,299.60 from SSDI would barely earn at the federal poverty level, which is $13,590 for an individual in 2022. (The federal poverty line in Alaska is set at $16,990 for 2022, higher than what someone with the average SSDI payment would earn.)

Living on Social Security disability is difficult in most areas of the country, but there are some potential avenues for help. We’ve created this list of resources for people with disabilities, including places someone can reach out to for financial assistance, legal support or help with housing and health care. And if you need help applying for disability benefits — whether you’ve never had them before or lost them at any point — start with our complete guide to the disability benefits application.

What About SSI?

Supplemental Security Income benefits are often the primary source of income for recipients. But the strict income cap for SSI means that recipients can’t earn more than $841 of total income, including benefits and all outside income sources. For that reason, we considered how far that maximum benefit would take someone instead of looking at the average benefit.

Someone earning the maximum SSI benefit for the whole year would make just $10,092, about $5,000 less than the federal minimum and well below the cost of living in every state.

Comparing the maximum SSI benefit to the cost of living in each state, SSI payments are enough to cover less than a third of living expenses. There are only 15 states where annual SSI benefits are worth at least 30% of the living wage, with South Dakota being the highest at just under 33%. Meanwhile, SSI benefits are worth less than 25% of living expenses in eight states.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sarah is an attorney at Atticus Law, P.C. where she serves clients seeking Social Security Disability Insurance and worker’s compensation. Prior to joining Atticus, she was a civil public defender in Brooklyn, N.Y., where she represented low-income tenants in eviction proceedings, and a business reporter in Seattle, Wash., where she covered the booming Seattle tech industry. She is a graduate of the University of Washington School of Law.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.