The Secret to Supercharging Your Charitable Giving: Low Fees

What are you paying in investment and administrative fees? The less you pay, the more your money grows, and so does the impact your giving makes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Charitable giving vehicles can be powerful tools in maximizing philanthropic impact. Private foundations, charitable trusts and donor-advised funds (DAFs) all allow donors to invest charitable assets for growth, expand the assets they can give to charity, and help with due diligence around selecting causes and organizations to support. This kind of strategic support requires oversight and administration — both of which carry a cost.

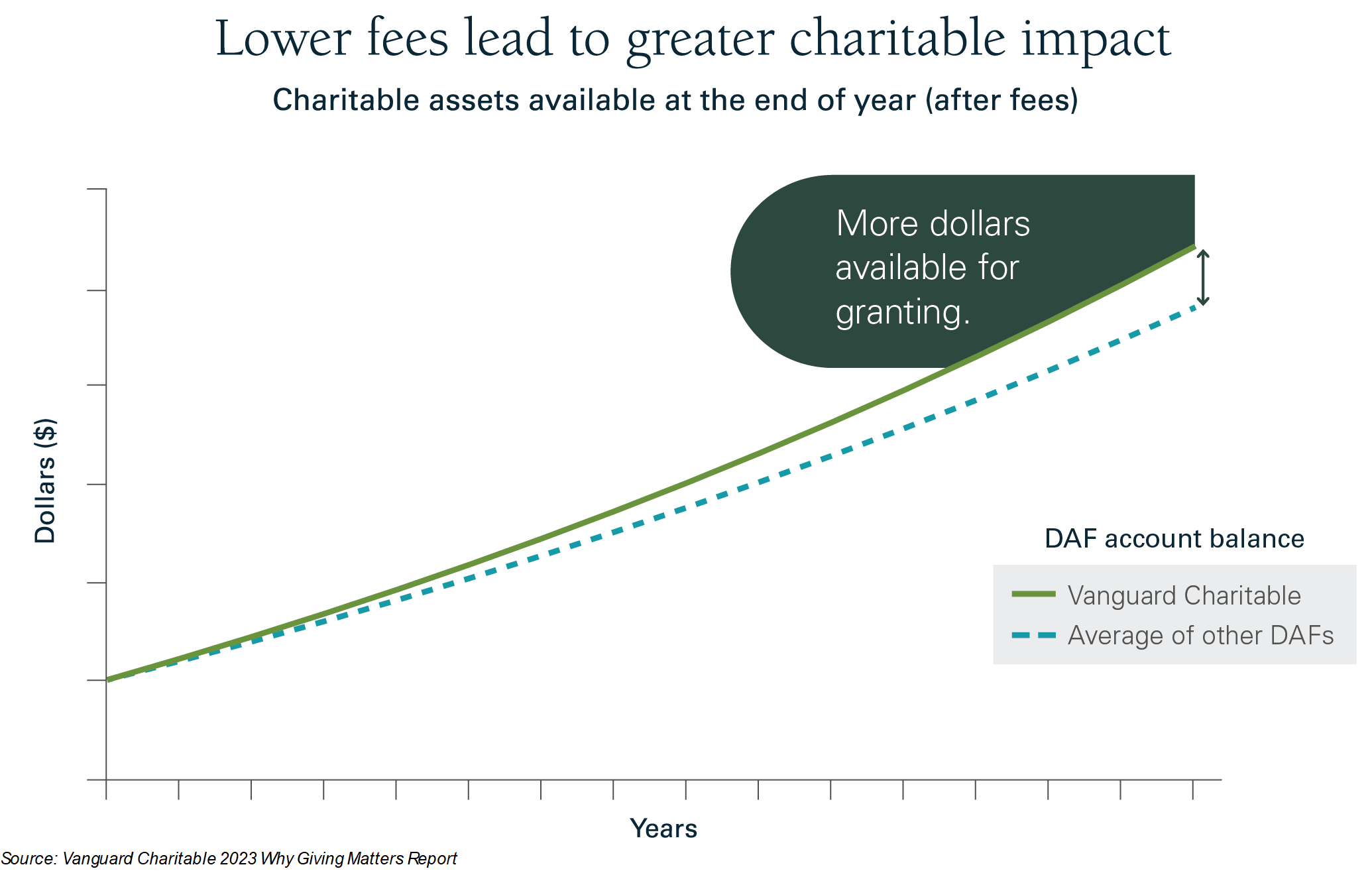

Many factors influence your ability to earn a return. That’s true across all kinds of investing, including charitable investing, where "return" equates to "charitable impact" for the causes philanthropically minded investors care about. While we can't control markets or the economy, we can control the costs we pay in managing or allocating our charitable dollars.

Ultimately, investment data is clear: The expense ratio is the most proven predictor of future fund returns. Money paid in fees ultimately comes out of the sum of assets, which means there is less to invest, grow and use for grantmaking.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Understanding the nature of fees and costs and their impact on an individual’s ability to give is an essential component of an effective charitable giving strategy. That strategy starts with a deeper dive into the fees and how they differ across giving vehicles. When evaluating costs and fees in philanthropic giving, particularly in the context of private foundations and donor-advised funds (DAFs), here are a few key points to keep in mind.

Most charitable giving costs fall into two categories

Most of the costs associated with investing — whether it be for charitable giving, retirement or other purposes — come from one of two sources: investment fees and administrative fees.

Investment fees cover the costs of managing invested assets. Different asset classes will have different fees and overall costs, and different investment vehicles and advisers will as well.

Administrative fees cover general operating costs, including legal, accounting, processing and staffing expenses. These administrative fees can also vary greatly depending on the organization or individual overseeing the philanthropic strategy. Costs related to operations, and tools such as investor services, investment portals and research, may be included under administrative fees.

Different approaches come with different costs

The complexity and focus of the charitable investment vehicle can be a driving force in cost structure and overall fees. A private foundation can include services and approaches highly tailored to a family or donor’s specific needs. Naturally, those high-touch services can increase administrative fees. At the same time, advisers and other oversight or guidance can also drive up investment fees.

DAFs, a giving vehicle that can support a wide array of causes through grants to qualified 501(c)(3) charities, tend to prioritize a low-cost, high-impact approach to philanthropy. DAFs benefit from economies of scale around operations and grantmaking, with annual administrative fees among national DAF sponsors typically falling around 0.6%, and investment fees ranging from 0.015% to 0.99%. Community foundations may charge more for DAFs but may also offer useful philanthropic and granting guidance relevant to the communities they serve.

Certain DAF sponsors, including Vanguard Charitable, utilize additional levers to maintain low costs. These can include curating a smaller number of high-performing investment options, as well as giving donors access to low-cost share classes typically unavailable to the public.

There’s also a broader philosophical perspective around fees and costs worth exploring across giving vehicles. Some organizations align their entire approach around keeping costs low. At Vanguard Charitable, for instance, recent reductions in the expense ratios for several of its 35 investment options will lead to annual savings of more than $1 million, which will be granted by Vanguard Charitable donors to hardworking charities across the country and the world.

Savings — and tax benefits — compound over time

Investors like to call compound growth “the eighth wonder of the world.” And for good reason. Just like saving for retirement or any other investment approach, the positive effect of lower fees has a greater impact over time. These compound benefits play out on a few key fronts. Lower investment and administrative fees mean a greater portion of assets can be directed toward charitable investments. This, in turn, means more dollars are available to grant to nonprofits, deliver on a philanthropic strategy, and make an impact on meaningful cause areas.

The compound benefits extend to tax savings, too. The upfront tax savings for charitable contributions means more dollars are available to potentially grow and grant out over time. At the same time, the tax-free earnings for assets in an account compound over time, again allowing more money to be directed toward charitable giving. These tax savings can be achieved with both DAFs and private foundations, although private foundations are subject to a separate excise tax on net investment income, whereas DAFs are not.

Meaningful conversations around costs and charitable giving

Strategic charitable giving can seem complex. At the end of the day, the approach to costs is simple: Lower fees mean more money can be made available for the charities you care about.

Considerations around costs and fees are vital for charitable giving planning. Individuals and families looking to extend their philanthropic mission should explore these details, seeking out partners who are transparent about their fee structures and committed to keeping costs low. Ultimately, that commitment will allow donors to do more with their charitable dollars to continue supporting the causes that matter most to them — now and well into the future.

Related Content

- Maximize Charitable Giving Tax Savings and Give All Year

- Benefits of Charitable Contributions You May Be Overlooking

- Give Your Charity Superpowers with This Dual Strategy

- How to Spot (and Squash) Nasty Fees That Hide in Your Investments

- Which Type of Donor-Advised Fund Is Right for You?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Mark Froehlich joined Vanguard Charitable, a 501(c)(3) public charity sponsoring donor-advised funds, as chief financial officer in 2019. As a certified public accountant, he works to oversee the nonprofit’s finance and operations functions. An experienced financial leader, Mark has always maintained a strong connection to the nonprofit sphere. Most recently, he was the chief financial officer at the Philadelphia Foundation.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.