Four Things to Know About Your Collectibles and Homeowners Insurance

If you're crazy about collectibles, and your hoard is growing in value, you may need to consider specialized insurance to protect your investment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

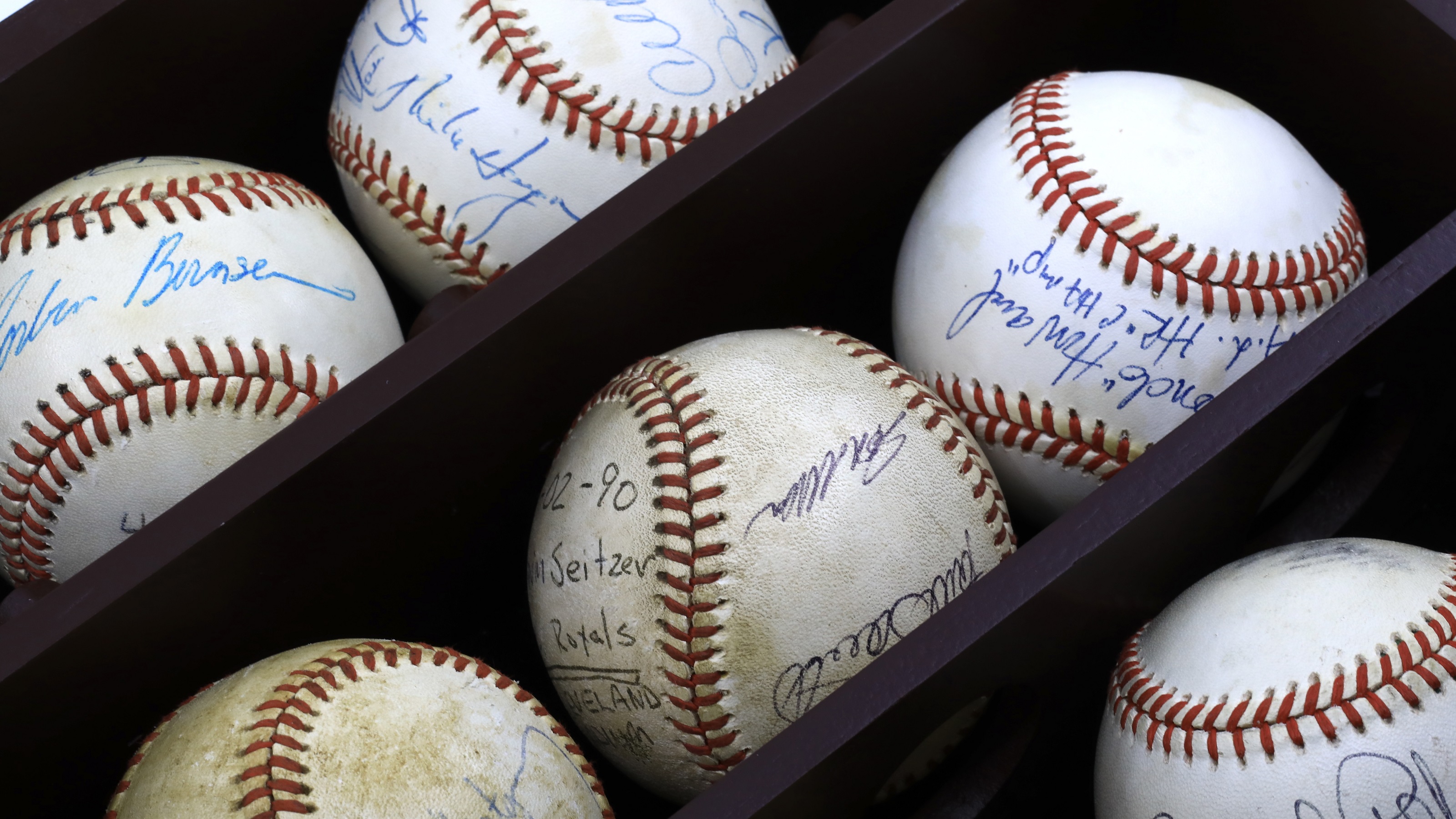

The market for collectibles has exploded in recent years, as investors increasingly view collectibles as a steady element of their portfolio worth putting both money and effort into. But as the size of their collections increases, so too does the need to appropriately insure and protect their investments.

While collectible art has long been part of the wealthy's portfolios, it’s only in recent years that the market size and value of other kinds of collectibles have increased dramatically. The pandemic seemed to set off the boom for collectibles, as casual investors were left to sit at home with cash to burn, and a longing for less troubled times fueled interest in items from the past.

Deloitte’s latest research on the value of all ultra-high-net-worth individuals’ art and collectible collections worldwide suggests that it totals almost $2.2 trillion. And that figure is expected to reach $2.86 trillion by 2026. It's not just lucky pickers and avid fans in the collectibles market anymore; there’s real value to be held in collectibles. But with real value comes real risk — and the need to protect it.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It's why the market for collectibles insurance has grown so much over the past several years. Whether it’s for cars, handbags or art, item-specific insurance companies have been steadily growing as demand for protection has increased.

Increasingly, companies like Dallas’ OpenRoad or NFP are offering insurance coverage that is tailor-made to the specific needs of collectors. OpenRoad, for example, offers services for classic and modern collector vehicles and includes a pricing model that accounts for the reduced accident frequency often associated with collector vehicles.

It’s a brave new world out there for collectors — and an essential one to be a part of if any significant part of your net worth is wrapped up in collectibles.

Here are four things collectors need to know about their options on the insurance market:

1. Your homeowners insurance policy may not cut it.

While homeowners insurance policies are made to cover a number of superfluous damages to personal goods, most policies cover only $500 to $2,000 worth — which means if you have a high-value collection, your homeowners insurance policy likely isn’t enough coverage.

While many of the major insurers like State Farm and Allstate may be able to provide additional coverage, it’s not guaranteed, and getting it will require talking to your insurance agent. In my own experience, going through your home insurance provider may have more limits and requirements in order to get the coverage that you need.

2. Be prepared to be prepared.

With most insurance providers — especially if you’re going through a non-specialized insurer — getting the coverage you need will require providing the insurance company with receipts, provenance and proof that your item is worth the value claimed. It’s not unusual for an insurer to ask for a piece to be re-authenticated, or to ask for proof of a recent authentication.

Collectors who are trying to get coverage need to come prepared and shouldn’t be surprised if the process requires a fair amount of paperwork.

3. Know what you need and read the fine print.

If you’re putting any portion of your wealth in collectibles, staying up to date with the market trends around your collections is essential — not only to understand the health of your portfolio, but to understand the extent of coverage you actually need.

There are similar concerns with collectibles insurance as there are with health and automobile coverage, in that collectors need to make sure their deductibles aren’t so high that they leave you in a perilous position should something happen to your collection. Taking a few hundred dollars of loss if your collection gets damaged may be worth it to save a few thousand more.

But with collectibles insurance, you’ll need to be meticulous about reading the fine print. Something like replacement coverage, for example, that replaces a damaged item may not cover an item of the same quality. A mint condition Mickey Mantle card that’s worth multiple millions of dollars cannot truly be replaced by a much-lower-graded card worth only a few thousand.

4. Know how to protect your goods.

Certain insurance policies are going to have specific requirements on what’s covered and what’s not. Traveling with your collectibles — as one might do to go to a show or a rally — may not be covered. Certain damages, depending on how they were sustained, also may not be covered. Other insurers may require specific protections for your goods, like requiring professional framing or defined storage conditions.

As global weather patterns become more extreme, understanding these nuances of insurance policies will become all the more critical for collectors, who may face significant financial losses in the event of flooding or fire. It’s why, in addition to the growing collectibles insurance market, companies that specialize in protective storage and transportation of collectibles are also growing.

The bottom line

Maximizing the value of your collection means putting in the work to do so. Monitoring market trends and understanding the active valuation of your collection is crucial — not only for your own knowledge, but for the sake of insurance coverage as well. As items are added or sold from your collection, ensuring that your insurance policy stays up to date can mean the difference of hundreds of thousands of dollars.

As the market for collectibles continues to rise, the need to insure them will continue to grow. With the right coverage, collectors can safeguard their investments against potential risks, providing their collections with the same kind of risk management they accord the rest of their portfolio.

Related Content

- Sports Memorabilia Appear to Have Arrived as Investing Class

- Provenance Plays a Vital Role in Car Collecting

- Estate Planning for Memorabilia Collectors: Don’t Leave Your Family in the Lurch

- Jewelry Can Be an Investment. Here's How to Find It

- Eight Tips to Declutter Your Home Before Your Retirement Move

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Ruggie, ChFC®, CFP®, founded Destiny Family Office, a Destiny Wealth Partners firm, to help clients manage the increasing complexities inherent in their business and personal lives. He has identified three key areas where his firm can make a significant difference: presenting a compelling sphere of investments, including alternative, direct and co-investment opportunities; creating a special emphasis on high-end collectors whose collections signify significant alternative investments; and strengthening the firm’s private trust capabilities. Ruggie has become one of the most respected financial advisers in the industry, receiving national recognition and rankings including: 7x Forbes Best-in-State Wealth Advisors (including 2024; #1 N Florida), InvestmentNews Awards RIA Team of the Year (2024), Forbes Top 250 RIA Firms (2023), Forbes Finance Council since 2016, 12x Barron’s Top 1200 Financial Advisors (including 2024), InvestmentNews Top 75 Fastest-Growing Fee-Only RIAs (2023), 12x Financial Advisor Magazine America’s Top RIAs (including 2024), 3x Family Wealth Report Awards Finalist (2024), USA Today Best Financial Advisory Firms (2023).

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

No-Fault Car Insurance States and What Drivers Need to Know

No-Fault Car Insurance States and What Drivers Need to KnowA breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.