The 10 'Real' Richest Counties in the US

In America's wealthiest counties, high incomes are common, yet the cost-of-living burdens are often lower than those typically found in major metro areas.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The richest counties in the U.S. are found in the places one would expect. The metro areas of Washington, D.C. dominate the list, and wealthy counties from around the country are represented, including those in Colorado, Ohio and Tennessee.

Metro areas in New York City and the San Francisco Bay Area are notably absent. Take a look at the 15 Most Expensive Places to Live to see the off-the-charts cost of living in these areas. That factor may have kept them off the list.

But as is usually the case with such things, the richest counties in the U.S. also tend to be the most expensive counties. So, although residents of the richest counties might enjoy the highest incomes, they also often bear the highest costs of living.

In the real world, purchasing power and the number of digits on a paycheck are not necessarily the same thing. That dichotomy also exists in some of the richest counties in America, where sky-high costs of living can reduce real incomes by tens of thousands of dollars.

And so we decided to find the "real" richest counties in America. Thanks to data from the Council for Community and Economic Research (C2ER), we were able to locate the counties with the highest median incomes, and then adjust those incomes to account for the counties' costs of living.

This cost-of-living adjustment gives a much more pragmatic picture of the richest counties in the U.S. It shows where the highest incomes go the farthest – not just who's winning the paycheck race.

That's the key point here: The real richest counties in America are not automatically the highest income or most expensive counties. Keeping costs in check is a critical component of financial health for folks of all income levels.

That's why many of America's real richest counties are found in some surprising places.

So, have a look at the 10 real richest counties in the U.S. Many of these names made the list because they enjoy high incomes without the heavy cost pressures that such incomes usually create. Counties are listed by cost-adjusted median household income, from lowest to highest.

Data from the Council for Community and Economic Research (C2ER), the U.S. Census Bureau and the U.S. Bureau of Labor Statistics. Source: Cost of Living Adjusted Median Household Incomes, based on 2023 county-level income data from the Census Bureau's Small Area Income and Poverty Estimates. The median income for each county is divided by the county-level index number and then multiplied by 100. By factoring in the Cost of Living, the adjusted income provides a more accurate picture of the relative buying power of households within each county. Population data, household incomes, home values, poverty rates, and other demographic information are from the U.S. Census Bureau.

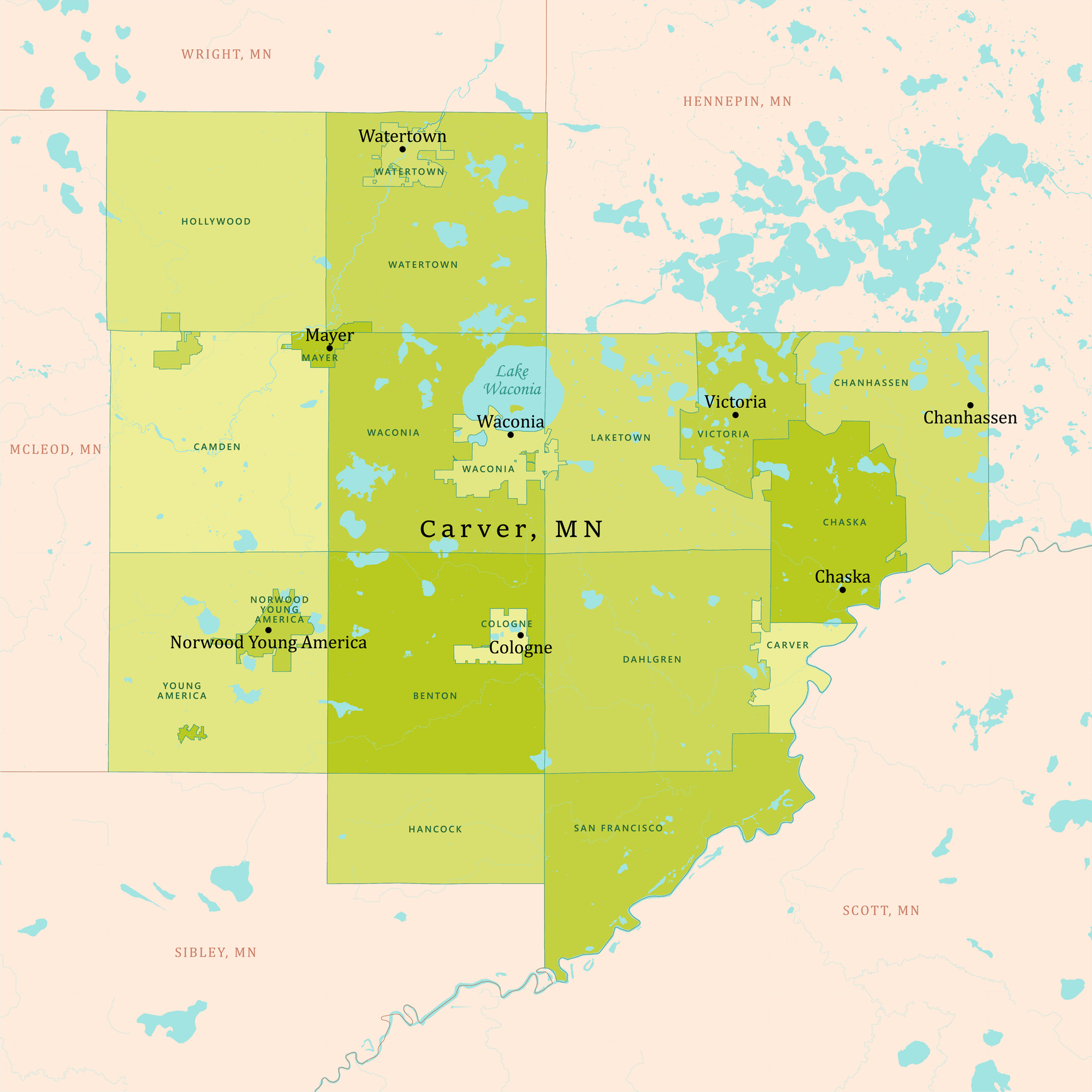

10. Carver County, Minnesota

- Population: 111,057

- Median household income: $129,437 (U.S. average: $83,730)

- Cost of living: 9.7% above U.S. average

- Adjusted median household income: $118,005

Carver County, Minnesota, is located 20 miles southwest of the Twin Cities and is part of the seven-county metro area. The county is home to 125 lakes, including Lake Waconia, the second-largest lake in the Twin Cities area. Numerous parks, protected wetlands, and nature preserves, such as Carver Park Reserve and the Minnesota Landscape Arboretum, offer ample opportunities for outdoor recreation.

It has been one of Minnesota's fastest-growing counties since 1980, known for its blend of suburban communities and rural landscapes. While much of the land is still used for farming, many residents commute to the Twin Cities for work. Key employment sectors include manufacturing, health care and retail trade.

Higher incomes and lower costs also help keep poverty in check. The county's poverty rate of 4.8% is less than half the U.S. rate (12.3%) and half the Minnesota rate of 9.3%. More than 52% of residents have earned at least a bachelor's degree, vs. 40% for Minnesota as a whole.

The county is highly regarded for its public schools, making it an attractive place for families. Cities like Chanhassen, Chaska, and Victoria are among the top-rated places to live within the county.

Housing costs remain comparatively affordable despite high incomes. The median home value of $456,700 is roughly 15% lower than the U.S. median, but unadjusted median household income is almost 60% higher.

The county offers a variety of attractions and recreational activities. One of the most unique destinations is Paisley Park: You can visit Prince's former home and recording studio, which is now a museum.

9. Williamson County, Tennessee

- Population: 264,460

- Median household income: $136,007

- Cost of living: 14.9% above U.S. average

- Adjusted median household income: $118,412

Nashville is known for its relatively low cost of living for a city, but that doesn't extend to affluent Williamson County, which sits in the southwestern part of the city's sprawling metro area.

Indeed, greater Nashville, which includes Davidson, Murfreesboro and Franklin, Tennessee, enjoys a cost of living 14.9% above the U.S. average, according to C2ER. That's hardly the case in Williamson County, though. True, median household income is more than double the state level of $67,631, but it falls to not quite $118,000 after adjusting for costs.

Tennessee is one of the few states without an income tax. It also has no estate or inheritance taxes. It does have a 7% statewide sales tax that localities can build on; the average combined state and local rate is 9.56%.

That's still good for 9th place on our list of the real richest counties in the U.S., and residents are pretty fortunate in how far their paychecks go compared to other wealthy counties.

As is usually the case, housing is a main driver of living costs. In Williamson, the median home value stands at $777,800. That's roughly 46% more the U.S. median of $532,390.

Educational levels are likewise elevated. Nearly 63% of Williamson County residents have a bachelor's degree or higher, vs. 36.2% for the U.S. The area's economic health shows up in other statistics, such as its poverty rate of 5.7%, vs. 12.5% for the nation as a whole.

8.Falls Church City, Virginia

- Population: 14,593

- Median household income: $145,755

- Cost of living: 21.2% above U.S. average

- Adjusted median household income: $120,239

Falls Church, often affectionately known as "The Little City," is an independent city in Northern Virginia, just west of Washington, D.C. Falls Church's history dates back to the late 1600s as an early colonial settlement. Its name comes from The Falls Church (Episcopal), founded in 1734, where George Washington once served as a vestryman.

Similar to fellow D.C. suburb Prince William County, Falls Church is part of the Washington, D.C. metro area, home to one of the highest concentrations of millionaire households in America.

Falls Church benefits from its prime location within the National Capital Region, just miles from Washington, D.C., and close to major transportation systems. The city boasts a highly educated workforce, with 63.9% of residents holding bachelor's and/or post-graduate degrees.

However, at 21.2% above the national average, Falls Church's living costs are much higher than those of Prince William County. Indeed, adjustments cut $21,731 from median household income, pushing Falls Church to eighth place from fifth in the rich county rankings.

Again, housing is a culprit. The median home value of $1,005,400 is almost three times the state level. The metro area's total housing costs – including rents, mortgages and more — run 179% above the national average.

The ambitious and well-paid residents of Falls Church are highly educated, of course. Equally unsurprisingly, many are foreign-born. About 50% have a post-graduate degree, while more than 17.1% were born overseas. Those figures compare to 18% and 12.9%, respectively, at the state level.

For 2025, income tax rates in Virginia will range from 2% to 5.75%. Retirees should know that Virginia has no estate or inheritance tax. Although Social Security benefits are exempt from income taxes, any pension income and distributions from IRAs and 401(k)s will be included in your taxable income.

7. Prince William County, Virginia

- Population: 489,640

- Median household income: $128,758

- Cost of living: 6% above U.S. average

- Adjusted median household income: $121,458

The District of Columbia and suburbs such as Prince William County (and some neighbors, as we'll see below) are magnets for the highly educated seeking high-powered jobs.

This agglomeration of the ambitious makes the metro area a mecca for millionaires. PWC, which sits southeast of D.C. and encircles the independent cities of Manassas and Manassas Park, offers an enviable balance of high income and not-too-high living costs.

Median household income is 63% greater than the U.S. median, but PWC's cost of living is just 6% above the national average. Income tax rates for 2025 in Virginia range from 2% to 5.75%. Eligible state residents will again get a tax rebate in 2025. For more information, see 2025 Virginia Tax Rebates Coming Soon? What to Know.

That said, PWC is not cheap, and certainly not when it comes to housing. Its median home value of $532,600 is only $330 above the national average, but towers over the state of Virginia's $382,900.

Zoom out, and C2ER notes that the D.C. metro area's total housing costs – including rents, mortgages, property taxes and related items — run 108% above the U.S. average.

As a more distant suburb, longish commutes are a way of life for many PWC residents. They spend an average of 37.1 minutes a day driving to work, vs 26.8 minutes for the typical American.

6. Delaware County, Ohio

- Population: 231,636

- Median household income: $128,300

- Cost of living: 5.3% above U.S. average

- Adjusted median household income: $121,805

Delaware County, a suburb of the state capital, Columbus, usually makes the list of the richest counties in America. And although higher incomes usually come with loftier living costs, Delaware manages to keep the latter mostly in check.

Although the cost of living is 5.3% higher than the U.S. average, median household income is roughly twice the national level. Indeed, Delaware's median household income is almost double the state median of $67,769.

Ohio taxes most types of retirement income, except Social Security benefits; income from pensions, 401(k) and IRA distributions are all subject to income taxes.

After adjusting for costs, Delaware vaults to sixth place on the list of richest counties in the U.S., up from 22nd place when expenses are left out of the equation.

The median home value of $460,600 is more than double the state median of $220,200, but housing is a relative bargain when compared to many of the other richest U.S. counties. Total housing costs in the Columbus metro area run 13.5% below the U.S. average.

The average effective property tax rate in Ohio is 1.31%, which is higher than in most states. However, if you are 65 or over, you qualify for an exemption that allows up to $28,000 of a home's market value to be sheltered from all local property taxes.

In addition to all that Greater Columbus has to offer, Delaware County has plenty of attractions of its own. The Columbus Zoo and Aquarium, the annual Little Brown Jug harness race, and the Ross Art Museum are just a sample of its activities.

The metro area's major employers include Ohio State University, OhioHealth and JPMorgan Chase (JPM). More than 59.1% of county residents have at least a bachelor's degree, vs 32% at the state level.

5. Los Alamos County, New Mexico

- Population: 19,374

- Median household income: $146,208

- Cost of living: 19.7% above U.S. average

- Adjusted median household income: $122,186

Los Alamos County sounds like an unlikely place to find a lot of millionaires, but when it comes to concentration of millionaires, it has some of the most per household of any small city in the U.S.

The tiny town about 35 miles northwest of Santa Fe is home to a government nuclear weapons laboratory and a number of chemists, engineers and physicists. It's a compact area with a small population but a large percentage of highly educated and highly trained engineers and scientists.

Indeed, incomes are so high on a relative basis that even after accounting for its steep cost of living, Los Alamos remains one of the richest counties in the U.S.

Given the presence of the Los Alamos National Laboratory and allied institutions, it's no surprise that the county is well-educated. More than 98.3% of residents have a high school degree or better, vs. the state rate of 87.7%. Fully 68.3% have at least a bachelor's degree, vs. 30.2% for New Mexico as a whole.

The county's poverty rate is likewise favorable. At 2.9%, it's a fraction of the 18.1% state rate.

The average home price in Los Alamos County is $452,500, $79,890 below the national average of $532,390. New Mexico has a low average effective property tax rate of 0.6%, and average property tax bills are below the national average. And, homeowners 65 or older may apply to have the tax valuation of their property frozen.

One quirk of New Mexico tax law: if you make it to 100 years old, the state waives your income taxes completely. For everyone 99 and under, its income tax rates start at 1.7% and top out at 5.9%.

4. Douglas County, Colorado

- Population: 383,906

- Median household income: $144,807

- Cost of living: 17.1% above U.S. average

- Adjusted median household income: $123,642

There's no question that incomes are high in Douglas County, which sits midway between Denver and Colorado Springs. Indeed, median household income is nearly double that of the U.S.

But expenses are also high. Indeed, at 17.1% above the national average, the cost of living has the effect of cutting median household income by $21,165.

Colorado has a flat income tax rate of 4.4%. However, the state also has a unique TABOR (or Taxpayer's Bill of Rights) program. Residents get a refund if the state collects more tax revenue than allowed. The TABOR limits government revenue growth to inflation plus population increases.

Housing, as usual, is the main culprit. The median home value is a whopping $725,500 — more than double the U.S. level, and about a third higher than Colorado's median. Douglas lies within the Denver-Aurora-Lakewood metro area, where housing costs run about 36% higher than what the typical American pays.

The county is highly educated, with especially low levels of poverty. More than 61.7% of residents have a bachelor's degree or higher, vs. 46.4% for Colorado. The poverty rate of 4.1% is far below the state rate of 9.3%.

Top employers include Charles Schwab (SCHW), EchoStar (SATS) and HCA Healthcare (HCA). But the great outdoors is central to the Douglas County experience. Three state parks — Castlewood Canyon, Chatfield and Roxborough State Park — lie within its borders.

3. Stafford County, Virginia

- Population: 165,428

- Median household income: $130,751

- Cost of living: 4.7% above U.S. average

- Adjusted median household income: $124,858

Stafford County, another D.C. suburb, is about a 40-minute drive from the metro area's center, and that extra distance helps keep costs in check. Expenses run just 4.7% above the U.S. average, despite Stafford being part of a metro area chock full of millionaires and other top-income counties.

Indeed, the county's favorable income-to-cost balance vaults it up the rich-county ranks. By unadjusted median household income, Stafford ranks as only the 18th wealthiest county. But after accounting for living costs, Stafford jumps to third place among the richest counties in the U.S.

Happily for homebuyers, new construction has kept up enough that the median home value of $492,500 is only 30% higher than the state median of $382,900.

The county's rapid growth — both demographically and economically — has been fueled in part by a host of federal government employers. Marine Corps Base Quantico, the FBI Academy, the FBI National Laboratory, and the Naval Criminal Investigative Service headquarters all call Stafford home.

Berkshire Hathaway's (BRK.B) Geico insurance subsidiary is the largest private-sector employer with more than 4,000 employees in Stafford.

That said, plenty of Stafford residents travel across Greater D.C. to get to work. Stafford's less-central location means folks spend an average of 38.6 minutes getting to work. Overall, Virginia's average travel-to-work time is a more manageable 27.5 minutes.

2. Forsyth County, Georgia

- Population: 272,887

- Median household income: $136,347

- Cost of living: 4.8% above U.S. average

- Adjusted median household income: $130,100

Rapidly growing Forsyth County benefits from being both a suburb and an exurb of Atlanta (metro population: 6.3 million). Situated halfway between the big city and the Blue Ridge Mountains, Forsyth provides lots of well-paid employment opportunities without the crazy cost pressures such jobs often create.

The result? A cost of living that's only 4.8% above the national average, allowing residents to keep more of their six-digit median household incomes.

Georgia recently introduced a flat income tax with a tax rate of 5.49%. Retirees do well as there is no income tax on Social Security benefits and pensions and 401(k)/IRA distributions are only partially taxed.

Forsyth's growth has come with a corresponding increase in new housing. That's helped keep the median home value at $587,300. Although nearly double the state median of $323,000, it's a bargain vs many of the other richest counties in the U.S.

Major employers include Northside Hospital, Tyson Foods (TSN) and Scientific Games (SGMS). Fully 55.1% of residents have a bachelor's degree or higher, compared to the state level of 35.4%.

The county's exurban characteristics allow residents to enjoy peace and quiet while still participating in the bustle of metro Atlanta. In addition to 37,000-acre Lake Lanier — where folks enjoy fishing, boating and water skiing — the county operates dozens of recreational facilities, including Sawnee Mountain Preserve and Fowler Park.

The Atlanta metro's famous sprawl does exact a toll, however. Forsyth County commuters spend an average of 30.6 minutes getting to work, vs. 28.3 minutes for all Georgians, and the U.S. average of 26.6 minutes.

1. Loudoun County, Virginia

- Population: 436,347

- Median household income: $173,655

- Cost of living: 13.0% above U.S. average

- Adjusted median household income: $153,698

Incomes are so high in Loudoun that even after adjusting for a cost of living 13% above the national average, it remains the richest county in the U.S. by a wide margin.

With an unadjusted median household income of more than $173,655, this northeastern suburb of D.C. tops its closest competitor (Forsyth County at $136,347) by more than $37,000. Factor in costs — which lop off nearly $20,000 in income — and Loudon still beats Stafford by over $23,500.

The origins of Loudon's wealth begin in the early 1960s with the construction of Washington Dulles International Airport. Businesses followed, leading to rapid growth and eventually a boom in high-tech, well-paid jobs. Major employers include Northrop Grumman (NOC) and Raytheon Technologies (RTX). The county also hosts scores of massive data centers that power Amazon.com's (AMZN) cloud services business.

Naturally, Loudon is a contributor to the metro area's sky-high housing costs. The median home value of $734,700 is nearly twice the state median of $382,900.

Given Loudon's demand for workers with advanced degrees in often highly specialized industries, it follows that residents are highly educated and frequently foreign-born.

More than 62% have a bachelor's degree or higher, vs 42.4% at the state level. Over a quarter of the county's population was born overseas (28.4%) — double the Virginia rate — and almost a third speak a language other than English at home.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Tariffs: An Uninvited Valentine's Day Guest

Tariffs: An Uninvited Valentine's Day GuestExpect to pay more for flowers and chocolates this year or find creative alternatives to save on Valentine's Day without looking cheap.

-

Should I sell my silverware and gold jewelry now that prices are high?

Should I sell my silverware and gold jewelry now that prices are high?My family silver and gold have sentimental value, but I hardly use them. Should I sell? We asked a professional metals dealer and investment adviser to weigh in.

-

One Country Just Pushed the Retirement Age to 70. Is the US Next?

One Country Just Pushed the Retirement Age to 70. Is the US Next?These countries have the highest and lowest retirement ages in the world — but that doesn’t give the full picture of which is best and worst for retirement.

-

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your Retirement

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your RetirementTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.

-

2026's Tax Trifecta: The Rural OZ Bonus and Your Month-by-Month Execution Calendar

2026's Tax Trifecta: The Rural OZ Bonus and Your Month-by-Month Execution CalendarReal estate investors can triple their tax step-up with rural opportunity zones this year. This month-by-month action plan will ensure you meet the deadlines.

-

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?Individuals and businesses should work closely with their financial advisers to refine tax strategies this season in light of these five OBBBA changes.

-

Ask the Tax Editor, January 23: Questions on Residential Rental Property

Ask the Tax Editor, January 23: Questions on Residential Rental PropertyAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on reporting income and loss from residential rental property.

-

How to Find the Best International Moving Company for Your Big Move Abroad (and Avoid Costly Mistakes)

How to Find the Best International Moving Company for Your Big Move Abroad (and Avoid Costly Mistakes)It's best to use an international moving company to protect your belongings and budget when relocating to another country. Here's how to find a reputable firm.

-

I'm 61 and Want a Divorce, but I Worry About My Finances. Should We Live Separately but Stay Married?

I'm 61 and Want a Divorce, but I Worry About My Finances. Should We Live Separately but Stay Married?We asked Certified Divorce Financial Analysts for advice.