Delaware Statutory Trust: The Landlord’s Exit Many CPAs Don’t Know Exists

Are capital gains taxes holding you back from selling your rental property? A Delaware statutory trust could be the answer you’re looking for.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Are you a landlord, tired of dealing with tenants, trash, toilets, etc.? Why don’t you just sell your property and invest the money somewhere else that won’t require your (or your management team’s) ongoing support? At some point, you want to retire, right?

Many retirees and near-retirees are finding themselves stuck with their rental properties. What was a great investment years ago can become a ball-and-chain situation. The property may need repairs that you don’t want to pay for. Maybe the neighborhood has changed significantly since your original purchase. So, what's holding you back from selling and moving on? Chances are the problem can be summed up in three words: capital gains tax.

Investment property sale with capital gains taxes

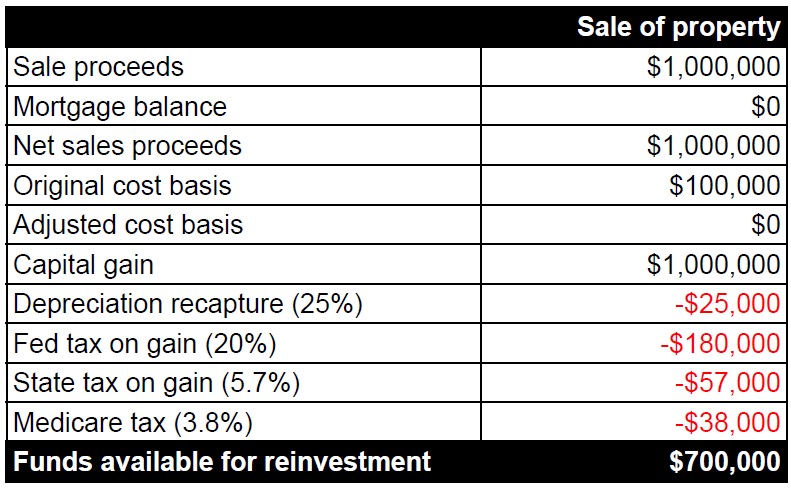

Here’s an example. Let’s assume that you sell your investment property for $1 million. You have no mortgage. The original purchase was $100,000, but you’ve depreciated the asset to $0. That gives you a total capital gain of $1 million.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When you sell, you’ll need to calculate the depreciation recapture ($100,000 of the original purchase price x 25% = $25,000). Next, you’ll need to consider federal taxes for the gain ($900,000 x 20% = $180,000). If state taxes apply, like in Kansas, where capital gains are taxed as income, you’ll need to account for that ($1,000,000 x 5.7% = $57,000). Last but not least, you’ll need to consider Medicare tax ($1,000,000 x 3.8% = $38,000). Once you account for all the taxes expected when you sell your real estate property, your $1 million becomes about $700,000. Here’s a quick breakdown to help you follow along.

That’s a pretty big hit, which makes sense why many real estate investors begrudgingly keep their real estate and continue to be a landlord. Many investors will eventually hire a property management group, which makes the day-to-day easier but can cut into cash flow and profits.

Another reason why you may hold on to your properties longer than necessary is to get a step-up in basis when you pass, potentially adding multiple six figures to your beneficiaries’ inheritance. Sure, it’s hard work, and you may be tired of it, but that hard work and sacrifice could greatly benefit the kids, right?

What if there was a way that you could sell your property, get rid of the landlord's responsibilities while maintaining reasonable cash flow and defer capital gains taxes? When this question is asked, the response, more often than not, typically is, “If there were such a thing, my CPA would have told me.”

You probably have heard about 1031 exchanges. If not, here's a quick definition. According to the Internal Revenue Code Section 1031, real estate investors are allowed to sell one investment property and use those proceeds to purchase a replacement property, wholly owned or with fractional ownership, while deferring capital gains. There are many options that qualify as “like-kind” investments. One of the like-kind options that is not understood or mentioned enough, in my opinion, that your CPA may not know exists, is called a Delaware statutory trust, or DST.

Investment property sale with a Delaware statutory trust

A Delaware statutory trust is a trust that is kind of like a passive investment. Basically, it allows you to purchase fractional ownership in an investment property, allowing another entity to take on the landlord's burdens while you maintain your passive income stream. Typically, Delaware statutory trusts are funded through a 1031 exchange because of the tax benefits, as mentioned above.

It is important to clarify that a Delaware statutory trust is different from a real estate investment trust, or REIT. DSTs allow you to invest in fractional ownership of the property, whereas REITs allow you to invest in a company. You cannot use a 1031 exchange with its tax benefits if you want to fund a REIT. This is why Delaware statutory trusts have become more popular over the past decade or so.

Here’s a side-by-side breakdown of the previous hypothetical property sale comparing a traditional sale where funds go to your bank account vs. using a 1031 exchange to move funds into a Delaware statutory trust.

Placing funds in a Delaware statutory trust, in this hypothetical comparison, would allow an extra $300,000 to contribute to potential cash flow. Many times, a real estate investor who sells their real estate investments and moves assets into a Delaware statutory trust will continue to keep funds in the DST until they pass, allowing their beneficiaries to benefit from the step-up in basis.

Benefits of a Delaware statutory trust

Delaware statutory trusts are not your typical investment vehicle. Here are some of the benefits:

- No management responsibilities

- Lower personal liability

- Potential step-up in basis for estate planning

- Passive cash flow

- No financials or loan guarantees needed from you

- Lower minimum investment than wholly owned properties

- Real estate diversification

There are many institutional-quality properties to consider when looking at current offerings. DST investors can pick from a number of options, like commercial real estate, student housing and more.

Detriments of a Delaware statutory trust

It is important to note that there’s no such thing as a perfect investment or a perfect investment strategy. Delaware statutory trusts also have some detriments. For example, Delaware statutory trusts are typically illiquid for seven to 10 years. You cannot renegotiate the terms of the lease. They are available only to accredited investors. You cannot reinvest proceeds (cash flow). You cannot invest in a Delaware statutory trust without a qualified intermediary (QI) and a DST sponsor. QIs are the third party, like an escrow company, that facilitates the process of the 1031 exchange and purchase of the replacement property or Delaware statutory trusts. DST sponsors manage and maintain the property. Make sure you work with a well-vetted QI and DST sponsor.

In conclusion

Even though there are many benefits to a Delaware statutory trust, it is important to work with a skilled financial professional and a seasoned QI. Do your due diligence on your Delaware statutory trust options before you put your property up for sale. There are a lot of moving parts when you sell a property and move the proceeds to a Delaware statutory trust. The more planning and preparation you have, the smoother the transaction is likely going to be.

related content

- IRS Quietly Changed the Rules on Your Children’s Inheritance

- Why Investing in Debt-Free DST Properties Makes Sense Today

- Opportunity Zones in 2023: A Look Back, a Look Forward

- Four Ways Savvy Investors Use DSTs for Their 1031 Exchanges

- DSTs Are the Carpool Lane of Investments

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Mike Decker, NSSA®, is the founder of Kedrec Wealth, a flat-fee financial planning firm that offers one-time services or ongoing management for a fixed monthly fee. He is also the creator of Cash Flow and Capital, an app designed to help people develop a healthier relationship with money by improving awareness around spending and decision-making. Mike is the author of How to Retire on Time, How to Prepare to Retire on Time (coming soon) and The Bear Market Protocol (also coming soon). He shares practical retirement and wealth-building strategies through his podcast, weekly newsletter and two YouTube channels.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.