3% Mortgage Rates: Gift of a Lifetime or Low-Rate House Arrest?

A homeowner planning to relocate or downsize might find the higher costs related to higher mortgage rates too much of a hurdle to clear. What are their options?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For many Americans, homeownership became a reality during the years of ultra-low mortgage rates following the 2008 financial crisis, an environment that essentially lasted all the way up until the Federal Reserve's campaign to raise interest rates, which started last year. Many were even able to take advantage of refinancing opportunities as recently as 2021 or late 2020 when rates dipped below 3%. In fact, over 50% of all outstanding mortgages originated in 2020 or after.

That interest rate dynamic has now completely flipped on its head. Had you been fortunate enough to be able to buy or refinance during that low interest rate period, you are likely counting yourself lucky. For many, that low fixed rate now feels like a gift that keeps on giving.

However, that is not necessarily the case for everyone. For some, it may also start to feel like a sort of low-rate-induced house arrest — they feel trapped in their home.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The average 30-year fixed rate mortgage was 3.1% at the start of 2022. It has now approached 7%. The ability to relocate is starting to feel more like a far-fetched idea rather than a viable opportunity. The math for many no longer works.

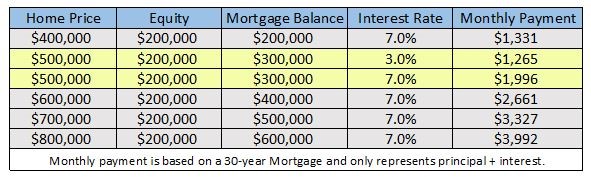

Take for example the hypothetical homeowner who wants to move closer to family. They own a $500,000 home with $200,000 in equity. If they sell their home and buy a home of similar value, giving up their 3% mortgage and replacing it at the 7% rate, the new principal and interest payment on that $300,000 mortgage has gone up 58% from $1,265 to $1,996.

Mortgage Rate Math Doesn’t Work for ‘Move-Up’ Buyers

The math for a “move-up” buyer? It simply doesn’t work out. If that same homeowner instead was looking to buy a $600,000 home (so 20% more house), that would mean their monthly payment would go up 110% from $1,265 to $2,661. This is ignoring any increases in property tax or insurance.

Even those looking to downsize won’t catch a break in this new world of higher rates. Take the prior example, but this time consider an elderly homeowner who is struggling to maintain and get around in their larger home and is seeking to relocate to a smaller $400,000 home. Despite reducing their mortgage balance from $300,000 to $200,000, their new monthly payment will have increased from $1,265 to $1,331.

These higher rates have definitely put a damper on home sales, which are down about 23% over the last year. However, despite this fall in the number of sales, prices are essentially flat since this time last year. Homeowners reluctant to give up their low-rate mortgages are certainly a contributing factor, limiting supply.

The longer these high rates persist, we can expect more significant ripple effects throughout the economy, particularly in the context of limited job mobility. This dynamic could prove troublesome, especially in combination with the continued tight labor supply. Consider a homeowner seeking to move for a new job opportunity. Their potential employer will have to up the ante with even more incentives than before. This type of added wage pressure certainly doesn't help the Federal Reserve's efforts to reduce inflation.

No Incentive to Pay Down a 3% Mortgage

So were you fortunate enough to get a fixed-rate mortgage in the 3% range? Enjoy your home and the gift of that low rate as long as possible. With savings rates and CD rates where they are, there is no incentive to pay down that mortgage early.

For those forced to move, whether that be for a job or otherwise, one option to consider is renting out your current home with its associated low-rate mortgage and finding a rental for a couple years to see where these rates and housing markets settle down.

While another option is to just buy at the new higher rate and hope that rates come back down so you can refinance later – you should not count on that outcome. Rates could stay high for quite some time. You should accept that higher rate only if it is something that you will be able to afford long-term.

This is something you should be especially sensitive to with housing prices continuing to be historically elevated. If you were to buy at this new higher rate and housing prices fell, you could find yourself in a situation where you no longer have enough equity in your home to refinance even if rates did fall.

It's anyone's guess how these factors might intersect and shape the broader economic landscape moving forward. However, one thing is for sure — we are in for an interesting ride.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Jordan is Director of Investments and Chief Compliance Officer at Paul R. Ried Financial Group, an RIA firm based out of Bellevue, Wash., specializing in serving individual retirees. Adam joined the firm in 2002. His responsibilities include designing the overall asset allocation strategies, conducting in-depth market analysis, investment manager due diligence, as well as carrying out the firm’s compliance responsibilities. Adam is also the author of the firm’s client-focused market commentaries.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

2026's Tax Trifecta: The Rural OZ Bonus and Your Month-by-Month Execution Calendar

2026's Tax Trifecta: The Rural OZ Bonus and Your Month-by-Month Execution CalendarReal estate investors can triple their tax step-up with rural opportunity zones this year. This month-by-month action plan will ensure you meet the deadlines.

-

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?

Have You Aligned Your Tax Strategy With These 5 OBBBA Changes?Individuals and businesses should work closely with their financial advisers to refine tax strategies this season in light of these five OBBBA changes.

-

A Financial Plan Is a Living Document: Is Yours Still Breathing?

A Financial Plan Is a Living Document: Is Yours Still Breathing?If you've made a financial plan, congratulations, but have you reviewed it recently? Here are six reasons why your plan needs regular TLC.

-

Your Guide to Financial Stability as a Military Spouse, Courtesy of a Financial Planner

Your Guide to Financial Stability as a Military Spouse, Courtesy of a Financial PlannerThese practical resources and benefits can help military spouses with managing a budget, tax and retirement planning, as well as supporting their own career

-

3 Steps to Keep Your Digital Data Safe, Courtesy of a Financial Planner

3 Steps to Keep Your Digital Data Safe, Courtesy of a Financial PlannerAs data breaches and cyberattacks increase, it's vital to maintain good data hygiene and reduce your personal information footprint. Find out how.

-

Here's Why You Can Afford to Ignore College Sticker Prices

Here's Why You Can Afford to Ignore College Sticker PricesCollege tuition fees can seem prohibitive, but don't let advertised prices stop you from applying. Instead, focus on net costs after grants and scholarships.

-

'You Owe Me a Refund': Readers Report Challenging Their Attorneys' Bills

'You Owe Me a Refund': Readers Report Challenging Their Attorneys' BillsThe article about lawyers billing clients for hours of work that AI did in seconds generated quite a response. One law firm even called a staff meeting.