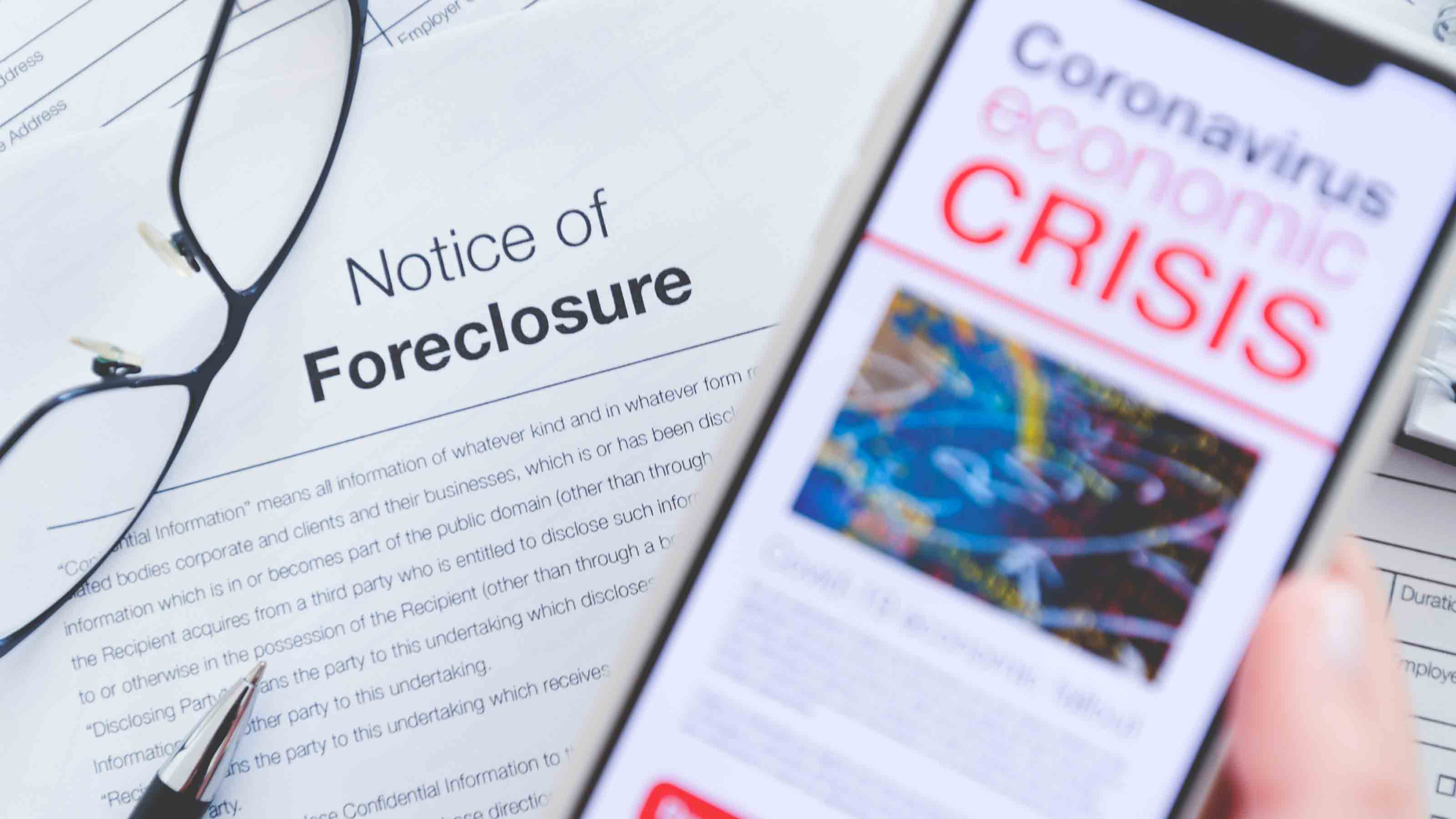

Update: Biden Administration Extends Eviction and Foreclosure Moratorium, Again

Getting to work right after the inauguration ceremony was over, President Joe Biden included assistance for renters and homeowners among a slew of executive orders to help struggling Americans.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Update: The Biden Administration has extended the foreclosure and eviction moratorium for homeowners with federally backed mortgages until the end of June 2021. These same homeowners have until the end of June to request mortgage payment forbearance if they haven’t already done so. The new order also allows up to an additional six months of mortgage forbearance for those who entered mortgage forbearance on or before June 30, 2020. The new order did not address extension of relief for renters.

Renters and homeowners with a federally backed mortgage who are struggling to make monthly payments can breathe easier. President Biden signed an executive order asking federal agencies to extend the moratorium on evictions and foreclosures. Originally set to expire on January 31, the relief now lasts at least another month and in some cases two months, with the possibility of more extensions.

[Stay on top of all the new stimulus relief developments – Sign up for the Kiplinger Today E-Newsletter. It's FREE!]

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Relief for renters. On September 4, 2020, the Center for Disease Control announced a nationwide halt on evictions for qualified tenants. This was originally set to expire at the of December but was then extended until January 31, 2021. Now Biden has extended it again.

To qualify, tenants must complete a CDC Eviction Declaration Form and give it to their landlord. The form certifies that you have been specifically affected by the pandemic and have exhausted all other avenues for help. There is also an income requirement. Single renters must have earned less than $99,000 ($198,000 for couples) in 2020 or received a stimulus payment. Renters also qualify if they were not required to report income in 2019 to the Internal Revenue Service.

Biden has also requested that Congress provide $30 billion in additional rental assistance. The proposal sets $25 billion aside for direct rental relief to landlords, with the other $5 billion slated to help cover energy and water costs through programs such as the Low Income Home Energy Assistance Program.

Your state may also provide rental assistance. For example, Maryland has suspended evictions for tenants that can demonstrate the pandemic has caused a severe drop in income. In Michigan, utility companies are not allowed to cut off water service until at least March 31, 2021.

Help for homeowners. Holders of mortgages insured by the Federal Housing Administration or guaranteed by Fannie Mae and Freddie Mac are covered by the Biden administration’s extension of the moratorium on foreclosures and evictions. The foreclosure moratorium for FHA-insured single family mortgages was extended to March 31, 2021. Freddie Mac and Fannie Mae extended its moratorium on foreclosures to February 28, 2021.

The deadline to request forbearance has also been extended. Borrowers with an FHA-insured single family mortgage have until February 28, 2021, to request a forbearance in response to COVID-19.

If your mortgage is owned by a private company, check with your loan provider to see if it provides assistance. For example, Bank of America, Chase and Wells Fargo have their own payment deferral and forbearance programs. If you’re unsure of whether your loan is federally backed or not, call your mortgage servicer and ask. You can also see if Freddie Mac backs your loan at https://ww3.freddiemac.com/loanlookup, or Fannie Mae at www.knowyouroptions.com/loanlookup.

Keep in mind that these relief measures could be extended again as the pandemic continues. When the CARES Act was signed into law in March 2020, the eviction and foreclosure moratoria were slated to last only 60 days.

For more information about stimulus relief that could affect your finances, see 12 Ways the Biden Stimulus Package Could Put (or Keep) Money in Your Pocket.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rivan joined Kiplinger on Leap Day 2016 as a reporter for Kiplinger's Personal Finance magazine. A Michigan native, she graduated from the University of Michigan in 2014 and from there freelanced as a local copy editor and proofreader, and served as a research assistant to a local Detroit journalist. Her work has been featured in the Ann Arbor Observer and Sage Business Researcher. She is currently assistant editor, personal finance at The Washington Post.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Quiz: Do You Know How to Maximize Your Social Security Check?

Quiz: Do You Know How to Maximize Your Social Security Check?Quiz Test your knowledge of Social Security delayed retirement credits with our quick quiz.

-

Will You Get a Trump Tariff Refund in 2026? What to Know Now

Will You Get a Trump Tariff Refund in 2026? What to Know NowTax Law The Supreme Court's tariff ruling has many wondering about refund rights and how tariff refunds would work.

-

Could Tax Savings Make a 50-Year Mortgage Worth It?

Could Tax Savings Make a 50-Year Mortgage Worth It?Buying a Home The 50-year mortgage proposal by Trump aims to address the housing affordability crisis with lower monthly mortgage payments. But what does that mean for your taxes?

-

Biden Proposes New Homebuyer Tax Credits

Biden Proposes New Homebuyer Tax CreditsTax Credits President Biden is calling for new middle-class tax breaks including a mortgage tax credit.

-

10 Predictions for 2024 from The Kiplinger Letter

10 Predictions for 2024 from The Kiplinger LetterThe Kiplinger Letter As 2023 wraps up, here are 10 big predictions for the new year.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

5 Ways to Shop for a Low Mortgage Rate

5 Ways to Shop for a Low Mortgage RateBecoming a Homeowner Mortgage rates are high this year, but you can still find an affordable loan with these tips.

-

Mortgage Rates and Payments Keep Rising, Creating Market Misery

Mortgage Rates and Payments Keep Rising, Creating Market MiseryMortgages Current mortgage rates and payments continue to rise resulting in buyer demand stalling and housing sentiment at low levels.

-

How Four Recent Supreme Court Rulings Impact Your Money

How Four Recent Supreme Court Rulings Impact Your MoneySupreme Court Some U.S. Supreme Court decisions could affect your finances. Here’s what you need to know.

-

Time to Invest in Multi-Family Real Estate Stocks? Not So Fast

Time to Invest in Multi-Family Real Estate Stocks? Not So FastThe Fed's aggressive rate hiking is weighing on the housing market, leading many to wonder if it's a good time to invest in multi-family real estate stocks.