Nationwide Rent Increases Slow to Lowest Rate in More Than Two Years

Rent pricing trends defy rental market history during peak moving season.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's been a tough stretch for Americans who rent their homes. The COVID-19 pandemic corresponded with historic monthly price increases across the U.S., driving many to stretch their finances to the breaking point.

A recent report from rental search engine Zumper has good news for beleaguered renters: Landlords are finally adjusting to a new normal, leading to the lowest monthly rental increases in years.

A surprising rent slowdown

Zumper's latest National Rent Report analyzes long-term rental data from over one million active listings across the country. The Zumper team aggregates monthly listings and calculates median asking rents for the 100 top metros by population and in-migration.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

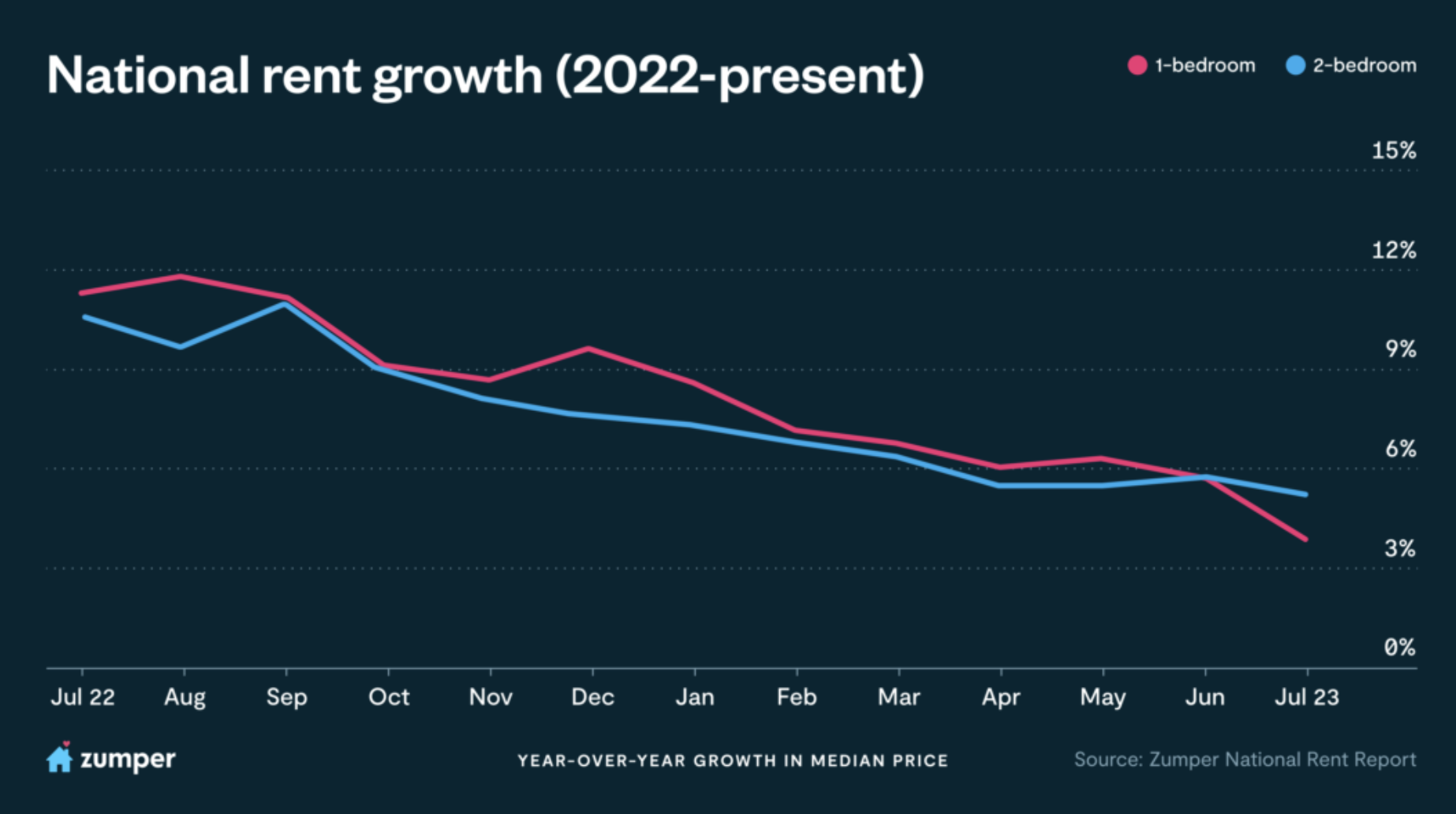

Their key finding for July 2023: The national median for one-bedrooms rose a mere 0.1% month-over-month and 3.9% year-over-year, the smallest monthly increase in more than two years.

This finding goes against historical July rent dynamics, which normally see prices rise thanks to peak moving season and rental demand. Rather than follow this pattern, price increases continue to fall from pandemic highs.

The report notes that the national median rent for one-bedroom homes reached $1,506 in July, just $2 more than June. That's only 3.9% up year over year, the smallest year over year growth seen in their monthly survey since June 2021. Meanwhile, two-bedroom homes reached $1,862, a monthly increase of only $1.

Renters can take real solace in this persistent downward trend. However, Zumper CEO Anthemos Georgiades notes: “Though price increases have slowed dramatically, we don’t expect to see rents decrease anytime soon. In reality, prices are still correcting after astronomical pandemic-era rent hikes.”

Don’t expect to see rents decrease anytime soon...prices are still correcting after astronomical pandemic-era rent hikes.

Zumper CEO Anthemos Georgiades

The chart below shows just how much landlords squeezed renters during the pandemic, and how far the rate of increase could still fall in the coming months ahead:

Most expensive rental markets

Zumper's data on the priciest cities for renters contain several obvious choices alongside a few surprises. Here are the top 5, broken down by median 1 and 2-bedroom rental statistics.

| City | 1 Bedroom Statistics | 2 Bedroom Statistics |

|---|---|---|

| New York, NY | $3,980/month; +2.10% month-over-month; +5.30% year-over-year | $4,470/month; +5.40% MOM, +7.70% YOY |

| Jersey City, NJ | $3,390/month; +0.60% MOM; +23.30% YOY | $4,000/month; +1.00% MOM; +39.40% YOY |

| San Francisco, CA | $3,000/month; +0.00% MOM; -3.20% YOY | $4,100/month; -0.70% MOM; -1.70% YOY |

| Miami, FL | $2,800/month; -2.10% MOM; +12.00% YOY | $3,900/month; -0.80% MOM; +18.20% YOY |

| Boston, MA | $2,800/month; +1.80% MOM; 7.70% YOY | $3,400/month; +0.00% MOM; +13.30% YOY |

What's next for renters?

Zumper's report postulates that a volatile economic climate marked by rapidly rising interest rates has softened rental demand and influenced rent inflation downward. Zumper also projects that the Federal Reserve will soon wind down its rate-hiking campaign (Kiplinger agrees), restoring a general sense of financial stability while increasing demand from renters.

But historic levels of new apartment construction will mostly cancel out this resurgent demand, leading to a continued softening of rent increases, if not an actual nationwide decrease in rent prices.

The report authors also reiterate a widely-known but important fact of renting life: rental prices vary greatly from one city neighborhood to the next. To take New York City as one example, median one-bedroom apartment rents Staten Island reach $1,600, while in Manhattan they can fetch as high as $4,200.

Even as renters are likely to gain more breathing room, the relief will be spread unevenly among the American landscape. So balance your target neighborhood's rent dynamics against your own needs and finances. There are plenty of lovely, livable cities out there offering urban amenities with a lower cost of living.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.