Qualified Opportunity Zone Investing 101

This type of real estate investing offers significant tax breaks on capital gains for the right investors. Could that be you? Check out this case study to see how it works.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In Congress, political discourse took a temporary break from feuding when both sides supported creating significant tax incentives for Qualified Opportunity Zone (QOZ) investing — as part of the 2017 Tax Cut and Jobs Act. The Act was co-authored by Sens. Cory Booker, a Democrat from New Jersey, and Tim Scott, a Republican from South Carolina.

The concept centers around tax incentives for those who invest capital in designated areas around the country that could benefit from economic development. The idea is to reward investors who are helping in areas where revitalization is most needed.

How much money is flowing into Opportunity Zones is hard to gauge. However, research firm Novogradic reported that over $12 billion streamed into Qualified Opportunity Zone funds during 2020, and that number is expected to be significantly higher in 2021 and even higher going into 2022.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Qualified Opportunity Zones

So why are investors flocking to Qualified Opportunity Zones – or “QOZs” – in staggering numbers?

It is because of tax breaks, of course, and significant breaks at that.

Investors are lining up for the tax benefit of deferring capital gains until 2026 and then paying them in 2027 when they are due.

If held for a full 10 years, all the real estate investment gains can be 100% tax-free. That’s huge, and savvy real estate people know it. However, Congress also created a set of flexible rules, because taxpayers generally have 180 days from the date a capital gain is triggered in which they can invest that gain, or a portion thereof in a QOZ, and defer federal income tax on the gain.

Aren’t These Investment Opportunities in Really Bad Areas?

But wait a minute, a skeptical investor says, “Aren’t these investment opportunities in really bad areas where maybe no one would want to invest their capital?” That’s a good question.

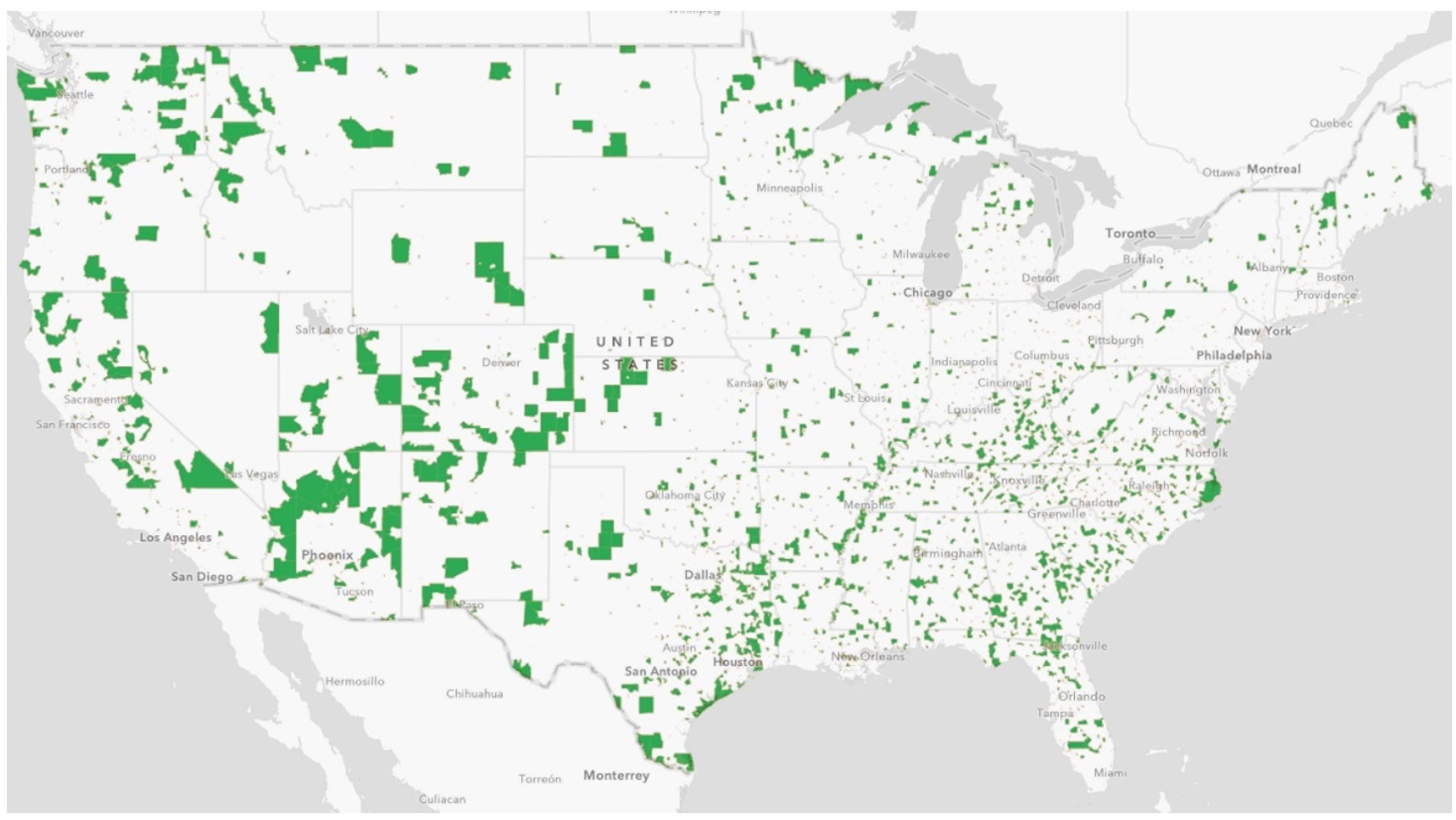

To gain some insight, let’s go back to when this legislation was formed. In the U.S., 8,760 Census Tract areas are designated as QOZs. When this legislation was created, the governor of each state was asked to participate in naming the areas in their state that could benefit most from economic development.

As you might expect, many of these areas are economically blighted, and some are high-crime areas. Many are just rural parts of the country and lack services and opportunities for the residents. Some areas, however, are what real estate investors are calling “diamonds in the rough.” These are areas that developers’ studies show to be ripe and ready for development due to shifting demographics that provide a real demand for real estate development and bring services and an increased tax base to a community in need.

It’s important to note that when these areas were selected, it was 2010 Census data that was used for the selection. Much can change in a decade, and today, real estate developers are finding many QOZ areas can stand on their own two feet, apart from all the tax-favored treatment.

It’s been said that tax incentives won’t make a bad deal a good deal, but they can make a good deal a great deal, and herein exists the ethos of why so many investors are “doing well by doing good.” Below is a map of all the Qualified Opportunity Zones in the United States.

How Qualified Opportunity Zone Investing Works

Bill and Linda (not their real names) owned a machine shop in Durham, North Carolina, for 32 years. The business had belonged to Bill’s father, who had long since retired.

Bill and Linda were both 62 years old and had just begun to think about retirement. Their two grown children had taken positions in Texas, and Bill and Linda’s first grandbaby was soon to be born.

Selling the Business

Conversations kept coming up about selling the business and moving to Texas to be closer to the kids. The business was a grind, and Bill and Linda reasoned that being closer to the kids was a sound move as they aged, and they were certain they didn’t want to miss seeing their grandbabies growing up.

As luck would have it, no sooner than Bill put the word out that they may be selling, three potential buyers expressed interest, and one buyer provided them with a letter of intent and a written purchase offer of $2 million.

Tax Impact

Bill and Linda had been working with their CPA, Ed, for 32 years and decided it was time to bring Ed into the conversation. First, Ed said he would need a couple of days to run the calculation as to what the tax bill might look like. Then, he mentioned something about basis, depreciation, net investment income tax, capital gains taxes, and other considerations he would need to examine to determine the impact of taxes upon the sale were it to go through.

Investing

Ed also told Bill and Linda that they had better start thinking about what they would do with the funds left over and how they would invest those funds for retirement income. This statement stopped Bill and Linda in their tracks. Neither Bill nor Linda had ever spent much time learning about investing. They had funded IRAs and investment accounts with their local Edward Jones agent at their CPA’s suggestion but had never been overly impressed with how the funds had grown. The accounts were up and then down and then back up again. The adviser talked to Bill and Linda in terms they found difficult to understand, and after talking things over, Bill and Linda knew they would not want to turn the sale proceeds over to their local adviser.

The Burden of Selling a Business

Suddenly, both Bill and Linda begin to feel the heaviness of the burden of selling their business, the taxes that would be involved, moving, how to invest and solving for retirement income. They knew they needed help, and while Ed was an excellent CPA, he did not offer the scope of services to address all their newfound and complex needs.

In Search of a Solution

Bill and Linda decided to turn to Google. They began searching for ideas for selling a business, tax-smart investing, income planning, real estate investing and retirement planning.

Qualified Opportunity Zones

The couple came across several articles about how capital gains taxes could be deferred and how investments could grow tax-free in something called Qualified Opportunity Zones. Bill and Linda had never heard of a Qualified Opportunity Zone, and since the benefits sounded attractive, they decided to reach out to Ed, their CPA, for his input.

As it happened, Ed had just in the last week attended a CPA continuing education class on QOZs. He told Bill and Linda that the QOZ might be an excellent idea for them and that he had not mentioned it to them before because he had only just learned about how QOZs could work for his clients and the tax and investment problems they could solve for investors.

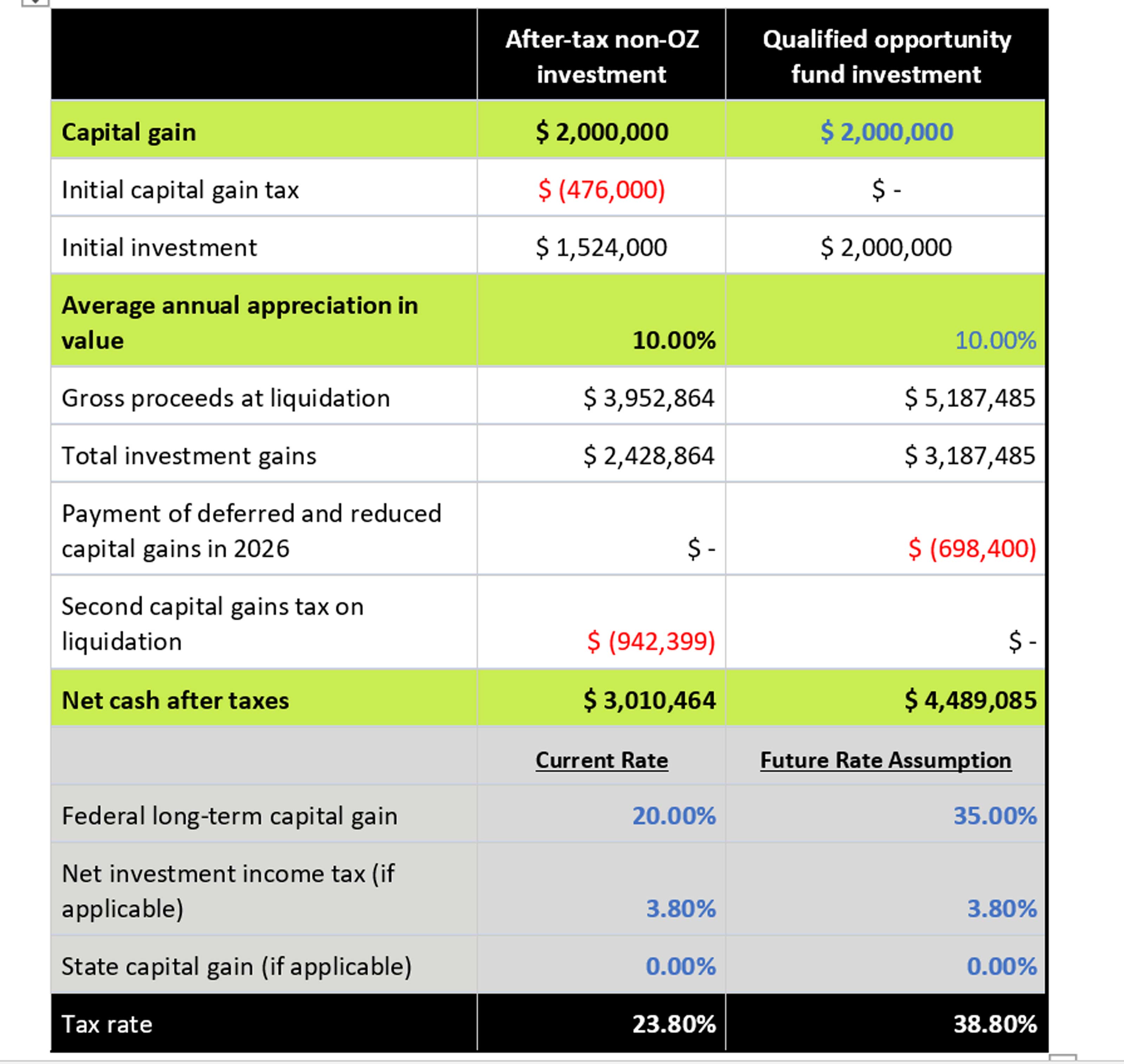

Ed said he would work on a side-by-side comparison of investing in a QOZ with the sale proceeds versus paying the tax now and investing in whatever Bill and Linda decided to invest in.

The QOZ sounded attractive to Bill and Linda because it solved for both the taxes and the investment they would need to make with the sale proceeds. But they had to see the numbers first and get Ed’s blessing that this could be a good strategy for them. They trusted Ed’s input.

One week later, Ed presented to Bill and Linda the spreadsheet below.

Paying the Tax Now

Ed’s first column calculation ran assumptions on paying the tax now, growing their money, and then paying capital gains tax on their gains over a 10-year period.

Deferring the Tax Until 2026 and Paid in 2027

Then he ran a QOZ comparison where all the cap gains taxes were deferred until 2026 and paid in 2027. He calculated that all the investment gains would be tax-free per the rules of the QOZ legislation, and then he further calculated that cap gains rates would be going up in the future significantly. He did this because Bill and Linda reasoned, as most people are these days, that taxes are headed up.

Bill and Linda were pleased to learn that they could potentially end up with almost $4.5 million in wealth for their retirement, net of all taxes — about $1.5 million more than if they had chosen an after-tax non-OZ investment approach.

QOZ Investment Portfolio

Bill and Linda had reached out to an advisory firm specializing in QOZs and were pleased to know that the investments would be made with high-quality firms with long and substantial track records.

The investments they were most interested in were in class-A apartment buildings and storage portfolios. Bill and Linda already had a much higher confidence in investing in real estate rather than in stocks and bonds, and then with the tax benefits factored in the deal seemed like the perfect solution to their needs.

Registered Investment Advisers

QOZs are offered today by fiduciary-based Registered Investment Advisers and by the Broker-Dealer community. They are registered securities that are available only by Private Placement Memorandum and only to Accredited Investors.

Investors should seek competent tax and legal counsel and perform their due diligence on any real estate QOZ opportunities.

Ed’s Assumptions for his calculations

- The source of investment is from a gain that qualifies for OZ benefits.

- Assumes that the new OZ investment is held for the required 10 years to be eligible for all OZ benefits.

- Note that the deferred gain taxed in 2026 will be at the rates in effect at that time. However, future changes to the tax law could result in higher rates.

- The calculation does not include the positive net present value benefit of deferring payment of the original capital gain until the 2026 tax return.

- The simplified model assumes a single investment and return of appreciated value after 10 years at a 10% rate of return.

- The model uses the Excel Future Value (FV) function to calculate the value of each investment using a fixed figure entered by the user for the OZ investment.

- The model does not account for other complex tax-basis matters, such as depreciation and periodic cash distributions.

- This is a simplified illustration and should not replace personal and individual tax and legal counsel.

No tax advice in this article is to be used by any taxpayer to avoid penalties. 10% step-up in basis ends Dec. 31, 2021. Investors should seek competent tax and legal counsel and perform their due diligence on any real estate QOZ opportunities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Daniel Goodwin is a Kiplinger contributor on various financial planning topics and has also been featured in U.S. News and World Report, FOX 26 News, Business Management Daily and BankRate Inc. He is the author of the book "Live Smart - Retire Rich" and is the Masterclass Instructor of a 1031 DST Masterclass at www.Provident1031.com. Daniel regularly gives back to his community by serving as a mentor at the Sam Houston State University College of Business. He is the Chief Investment Strategist at Provident Wealth Advisors, a Registered Investment Advisory firm in The Woodlands, Texas. Daniel's professional licenses include Series 65, 6, 63 and 22. Daniel’s gift is making the complex simple and encouraging families to take actionable steps today to pursue their financial goals of tomorrow.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.