Drop and Swap 1031 Exchange: A Guide for Real Estate Investors

The tax benefits of real estate investing are attractive, and one way to keep the good times rolling for partnerships is through a drop and swap 1031 exchange.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investing in real estate with partners in an LLC is a popular way to grow your wealth, but it comes with kinks. When it’s time to sell and some of the partners want to cash out while others want to take advantage of a 1031 exchange to continue to defer taxes, what can you do?

Limited liability companies (LLCs) are great in that their income is taxed as "pass-through income" and they can defer capital gains taxes by using like-kind exchanges. However, 1031 exchanges have several governing clauses that determine how exchange transactions work and which LLCs are eligible for 1031 swap transactions.

Since partnership LLCs present significant tax planning challenges for partners and their tax advisers, the IRS doesn't allow partners to sell or dispose of their partnership interests while deferring taxes if they acquire like-kind replacement property.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, there's a workaround in the form of the “drop and swap” strategy.

What Is a 1031 Drop and Swap?

Drop and swap allows real estate investors to "drop" their ownership structure out of an "entity level" to a co-ownership – turning former partners into tenants in common. When the property is sold, the proceeds are divided proportionally, and co-owners can now either cash out and pay their taxes or reinvest into another investment property through a qualified intermediary (QI) and still defer taxes.

In these types of transactions, co-owners and multi-member or partnership LLCs can sell a property, allocate the proceeds, and still purchase a new property.

Are Drop and Swaps Legal?

Yes, a drop and swap is legal. Partnership interests fall under the definition of personal property, which unfortunately can't be exchanged under the Internal Revenue Code IRC 1031 and can't be used to acquire real estate of a like kind.

However, a partnership can still do a 1031 exchange of investment property on the entity level, meaning that the entire partnership has to sell the relinquished property, purchase the replacement property and still defer taxes for as long as it remains intact.

The reason for this is that Section 1031 requires that exchanges of partnership property be handled by the same taxpayer, which applies to partnerships as long as they do not change their compositions prior to acquiring a new property as described above.

1031 Exchange with Multiple Owners

Assets held by LLCs, multiple partners and tenants in common can be exchanged in 1031 exchanges as long as each owner mutually agrees to relinquish the property and complete a 1031 exchange.

Can I Sell a Property I Co-Owned and Do a 1031 Exchange with Just My Portion?

In short, yes, as long as all co-owners mutually agree to sell the property. However, if you don't employ a drop and swap, you might be liable for capital gain taxation.

An Example: Dissolution of Partnership in a 1031 Drop and Swap

Let's consider the following scenario. Fred, Bill and Jill are partners in an LLC that owns real property. Let's say that all three partners agree that they want to sell the real estate but disagree on what to do with the proceeds.

For example, Fred and Bill want to roll the proceeds into a new property through a 1031 exchange, while Jill wants to take the cash generated from the sale — cash out.

Two of the following things may happen:

1. The real estate is sold by the partnership LLC, and the proceeds will be distributed to Fred, Bill and Jill, and all parties will be taxed. While this is OK for Jill, Fred and Bill are now left with less money to invest in a new property.

2. The real estate is exchanged through 1031 exchanges, and the relinquished property is exchanged for a new one. No cash was received, as all equity went into the acquisition of the new property, and thus no taxes were assessed. While this is OK for Fred and Bill, Jill still hasn't cashed out.

The Drop and Swap

Drop and swap exchanges fill this need.

A drop and swap allows Jill to transfer her membership interest to the LLC (Fred and Bill) and receive a percentage ownership interest in the property that's equivalent to her relinquished membership interest.

This "drops" the ownership of the real estate from the "entity level" to tenancy in common interest (TIC) between an LLC (Fred and Bill) and Jill. When the property is eventually sold, the co-owners will be allocated the proceeds pro rata. Jill would receive cash from the title company and pay taxes, and the LLC (Fred and Bill), can transfer their proceeds to the qualified intermediary and swap them into a new property, deferring taxation.

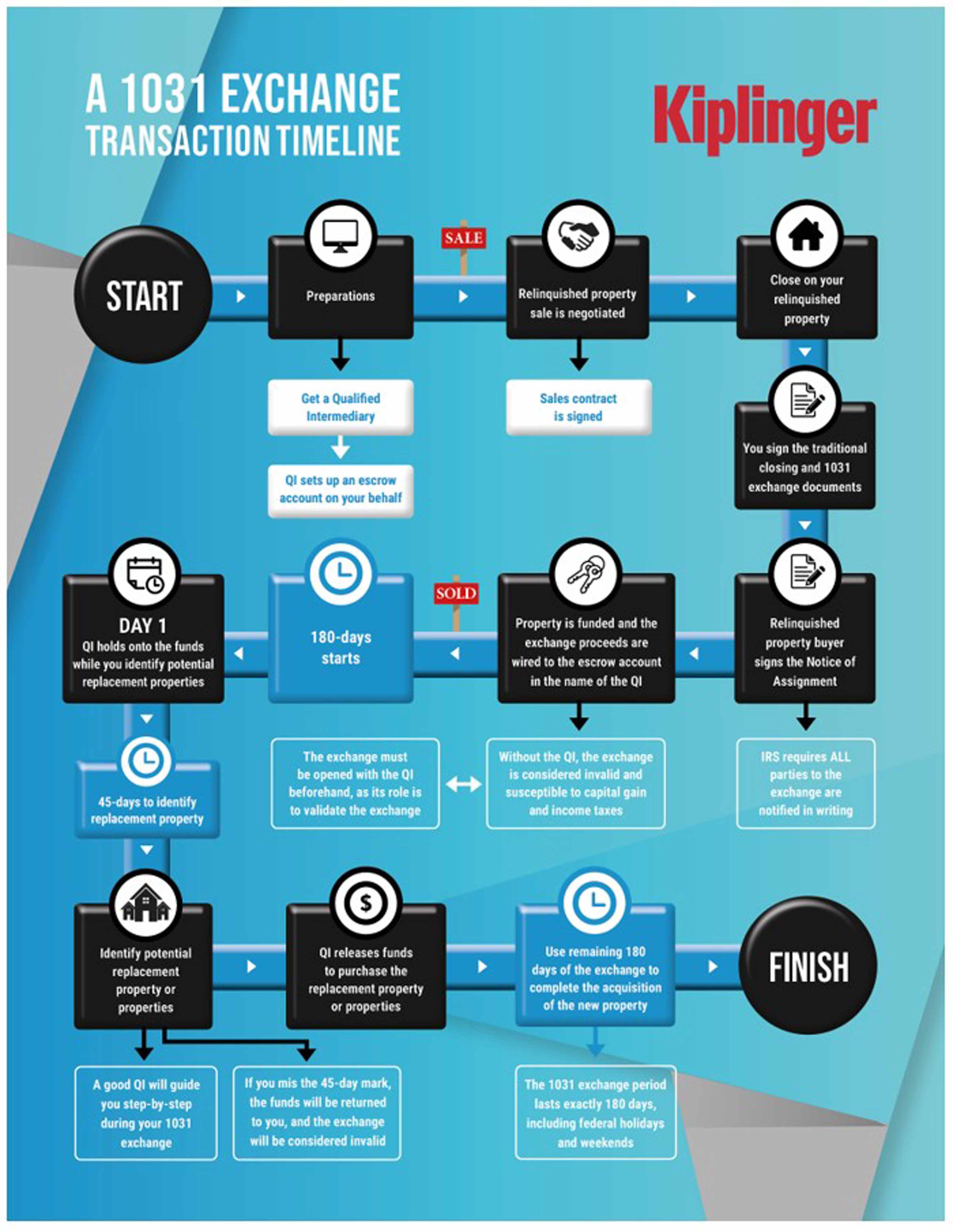

However, it's also worth noting that the standard 1031 transaction rules and time frames apply to an LLC looking to perform a like-kind exchange.

A potential third scenario would dictate that Fred and Bill, as partners in an LLC, and Jill want to roll into different properties. Then a more complicated, reverse version of drop and swap is used, called "swap and drop" — however, these are rarely used.

Drop and Swap Holding Timing

One would be wise to seek tax and legal counsel about the time between the entity is restructured into a TIC (tenants in common) and a subsequent sale and exchange. The IRS may disallow the exchange if the drop and swap was done just before the sale, and there is no clear rule in the tax code about how long before a sale the drop and swap can be performed.

This is where an investor must lean upon the advice of a qualified CPA who has experience with 1031 exchange rules and the drop and swap strategy.

Can You Do a 1031 Exchange after Closing?

Generally you cannot do this, because 1031s require qualified intermediaries (QI). However, you could rescind the transaction in the same tax-reporting period and contact the buyer to agree to rescind the transaction. When the transaction is rescinded, the IRS will treat the sale as if it never happened; the taxpayer receives the property back from the buyer, and the buyer receives the full purchase funds from the taxpayer.

You can then file for a 1031 exchange and repeat the sale. Rescission has long been recognized in law in relation to transactions other than 1031 exchanges. The Internal Revenue Service, on the other hand, has authorized rescission to be used to fix a fault with an exchange transaction.

This is not to be confused with a reverse exchange. A reverse exchange means the reverse of a conventional delayed 1031 exchange: Instead of selling your old property and then buying a replacement, you buy your replacement property first, and then sell your old property.

The reverse 1031 exchange works for investors who have a great, time-sensitive opportunity to buy and have to act fast to secure the property.

Key Takeaways

Drop and swap structures are useful for dissolving partnerships, where parties want to go their separate ways, cash out or simply invest in different properties.

Make sure you talk to your CPA and attorney about this strategy well before you attempt to restructure your entity and sell your property to make sure you are in compliance with the 1031 exchange IRS rules and regulations.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Daniel Goodwin is a Kiplinger contributor on various financial planning topics and has also been featured in U.S. News and World Report, FOX 26 News, Business Management Daily and BankRate Inc. He is the author of the book "Live Smart - Retire Rich" and is the Masterclass Instructor of a 1031 DST Masterclass at www.Provident1031.com. Daniel regularly gives back to his community by serving as a mentor at the Sam Houston State University College of Business. He is the Chief Investment Strategist at Provident Wealth Advisors, a Registered Investment Advisory firm in The Woodlands, Texas. Daniel's professional licenses include Series 65, 6, 63 and 22. Daniel’s gift is making the complex simple and encouraging families to take actionable steps today to pursue their financial goals of tomorrow.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.