Doing This With Your 401(k) Could Cost You $18,000

Your old 401(k) accounts may be slowly bleeding money, because the power of compounding can work against you, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Workplace 401(k) plans play a major role in helping Americans prepare for retirement, with around one-fifth of all retirement assets held in 401(k) accounts as of 2022.

There's good reason so many Americans turn to 401(k)s to save for their future, including the convenience of contributing to a workplace plan, the potential to earn a company match, and the tax breaks that 401(k) plans offer.

Unfortunately, because 401(k) plans are tied to employment, there is also a significant potential risk many Americans are unaware of — and it could cost them if they don't take steps to avoid the damage.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Americans risk losing thousands in 401(k) funds if they don't act

New research from PensionBee revealed the potential problem 401(k) holders are facing. The issue arises from the fact that most Americans no longer stay at one company for their entire career, but instead change jobs often — and this can result in new fees on their 401(k) plans.

As PensionBee explained, companies often cover retirement plan fees for workers while they are employed, but stop paying those fees when they stop working. PensionBee likened this to situations when employees remain on company health plans under COBRA but their employers stop paying premiums.

However, while employees receive clear notification about added health costs they'll owe under COBRA, the 401(k) fee changes happen with "minimal transparency" and continue for the duration of the time the employee has the account open — often without workers knowing they're now being charged new costs to maintain the 401(k) account.

Providers managing 401(k)s can also force out employees with low plan balances, issuing employees checks for accounts under $1,000 or transferring accounts with between $1,000 and $5,000 into an IRA with the participant's name on it. Unfortunately, this could lead to early withdrawal penalties or added fees, depending on the IRA chosen.

How much could this cost you?

PensionBee examined the financial consequences of the added fees that can occur when a 401(k) is left behind, and the numbers are startling.

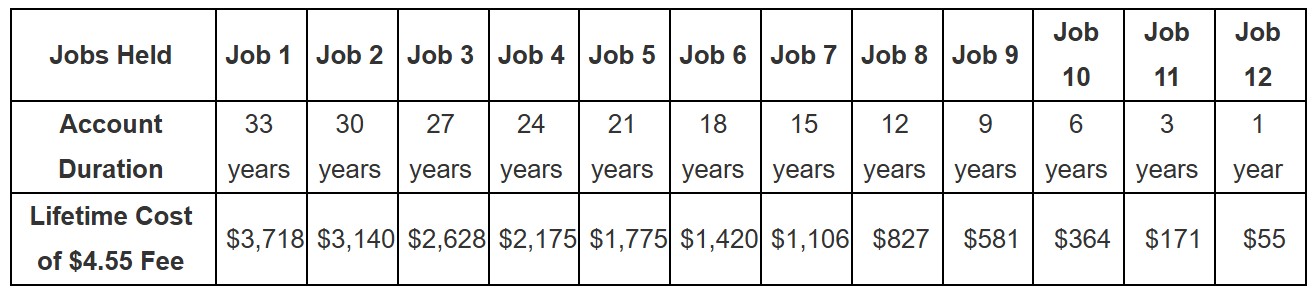

A typical employee who works for 33 years, changes jobs every three years, and earns a 5% investment return stands to lose $17,905 in fees over their career if they are charged just $4.55 per month in 401(k) account maintenance fees with each job switch. Those who earn higher returns or who pay higher fees could face even larger losses.

That $4.55 monthly fee may not seem like much — it's about the price of a good cup of coffee — but it can diminish your 401(k) balances over time.

The table below shows the lifetime costs of these fees for a typical employee over a 33-year period.

The effects of a small fee are outsized because every account that incurs a fee reduces the principal balance, causing the accountholder to lose not just the money taken out, but also the compound growth they would have earned on the funds lost to fees.

Unfortunately, many Americans are unaware that they're losing this money. A study from the Government Accountability Office revealed that 41% of 401(k) account holders are unaware that they pay any 401(k) fees at all. And 40% don't fully understand the expenses associated with their workplace retirement plans.

How to protect your retirement security

The good news is, you don't have to lose thousands to 401(k) fees when you make a career change.

You have other options for your retirement plan, including rolling over your old 401(k) to your new employer's plan, or rolling the funds into an IRA of your choosing when you change jobs. Rolling over your funds can also help you to avoid forgetting about your account, which a surprising number of Americans do.

You should also pay careful attention to the fees you're paying in any 401(k) plan you are participating in, whether the plan is held by a current or former employer. This includes:

- Plan administration fees

- Investment fees

- Individual service fees

- Sales fees (commissions for buying and selling assets)

- Management fees or investment/advisory fees

- Other fees for recordkeeping, providing statements, or investment advice

Your 401(k)'s summary plan description (SPD) and annual report should include information about the charges you have to pay each year. With the Department of Labor warning that even a 1% difference in fees can reduce your balance by close to 30% over your career, you can't afford to ignore this issue.

When you find yourself with added 401(k) charges after leaving a job, take action quickly — and, when it comes to your current plan, if it has high fees, consider contributing only enough to earn your full employer match before shifting additional funds earmarked for retirement to an IRA. You'll have more choices for brokerage firms and investment options and can better control your costs if you take this approach.

You work too hard for your money to lose it to fees — so do the research you need, especially when changing jobs. If you make sure you understand how your account expenses will change, you won't put your retirement security at risk while making financial firms richer.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.