5 Steps to Turn Your Nest Egg into a Retirement Paycheck

Sponsored Content by Sensible Money

While working, you accumulate a collection of investments, steadily building up your nest egg. How do you turn this collection into a consistent, tax-efficient retirement paycheck? It can be challenging because you have 30 to 40 years of investing experience that applies to the accumulation phase. Now, you’ll need to shift your approach to focus on cash flow, not total return. Following the ensuing five steps can help get you on the right path, ensuring you sidestep critical mistakes and have a smooth transition into retirement.

1. Identify Your Money Mindset

Like a rogue computer virus running in the background, behavioral biases impact how we make financial decisions. For example, recency bias is a mental shortcut that causes people to overestimate the significance of what's happened lately while undervaluing or forgetting past trends, which often skews decision-making and judgment. With recency bias, as you near retirement, if market returns have been solid, you may underestimate the detrimental impact of a downturn. This can lead to an overly aggressive allocation, which works well during good times, but may work against you once you require regular income from your portfolio.

Another behavioral bias is overconfidence, which causes us to have an inflated belief in our knowledge, abilities, or predictions. Unfortunately, research on aging and cognitive abilities shows that in our 60s, a consistent and linear decline in financial decision-making begins while our confidence in our abilities remains high. This means we are as confident as ever that what we are doing makes sense, while our actual ability to weigh financial risks and consequences may not be as sound as it used to be.

These two biases come into play as we shift our mindset from accumulating wealth to creating reliable cash flow from that wealth. These are two distinct goals, and it can be difficult to realize that the portfolio structure that got us to retirement may not be the right approach to get us through retirement.

By becoming aware of your potential biases, you can take a step back and examine the unique risks you face when designing a plan to create cash flow for life. Becoming aware of biases is the first step to shifting from a focus on maximizing returns to a focus on stability of cash flow. Once you’ve made this mental shift, you’ll want to turn to the past for additional perspective.

2. Learn from the Past

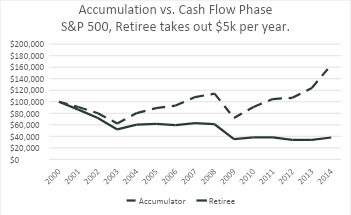

Suppose it was the year 2000, and you had $100,000 invested in the S&P 500. Your investment growth is reflected in the graph with the dashed line labeled Accumulator. Now, suppose instead, you retired in 2000 and began withdrawing $5,000 per year from your investment. The solid line labeled Retiree illustrates your outcome. The investment performance was the same, but the investor outcome differs when you are in the cash flow phase while taking withdrawals.

History is full of examples where your retirement date could vary by only a few years while your wealth level and withdrawal amounts remain constant. In one period, your wealth continues to grow, while in another, your portfolio dwindles, and you are forced to adjust your spending downward or risk running out of money.

You can’t simply benchmark your retirement portfolio against the S&P 500 and expect it will all work out. It might, or it might not. You’ll need an investment approach that considers the cash flows you’ll need and a monitoring process that benchmarks against your household needs, not against an external market factor.

3. Divide for Success

Instead of thinking in terms of the total return of your portfolio, divide your portfolio into two segments: one for growth and one for paycheck replacement. How much do you put in each segment? Start by projecting what you will need to withdraw in future years.

For example, if you need to withdraw $100,000 per year and you have a $1.8M portfolio, by the time you retire, plan to have $800,000 in your paycheck replacement portfolio, investing it in individual bonds or CDs that mature each year to cover your first eight years’ worth of withdrawal needs. This personalized bond ladder structure, where bonds mature with the timing and amounts matched to your cash flow needs, is a playbook from the pension plan world. It’s called asset-liability matching. Think of each year of maturing bonds as a rung on a ladder, providing you with designated assets maturing to provide the cash flow you need early in retirement. You continue to invest the remaining $1M in growth.

Then, you develop a monitoring process. When your growth portfolio has gone up enough to cover an additional year’s worth of cash flows, you skim the growth off and move it to your paycheck replacement portion of your portfolio. For example, in your first year of retirement, while you spend the first $100,000 out of your paycheck portfolio, if your growth portfolio were up 10%, you’d sell $100,000, and it to the tail end of your bond ladder maturing eight years into the future.

You can deploy this structure at the account level, with each account designed to match the specific cash flow it needs to produce during your retirement years.

While you still experience market volatility with the paycheck and growth portfolio structure, mentally, it helps you remain invested, and sticking with your investment plan is a crucial component of long-term success.

4. Invest Smartly

Once you outline your cash flows and segment your portfolio, you must choose how to invest each segment. The purpose of the paycheck replacement portion is safety, so this isn’t the place to take risks. Those with high tax rates may want to use high-quality municipal bonds within their taxable brokerage accounts. For retirement accounts, Treasury and agency bonds may be a desirable choice. Bonds funds are not as well suited when you have specific cash flow needs, and corporate bonds may entail too much risk.

For the growth portfolio, look at which asset mixes have held up best during past downturns. And make sure you diversify. While U.S. large-cap stocks have had excellent recent returns, in the past, we’ve experienced a lost decade, approximately from 2000 to 2009, when returns were flat. During that time, other asset classes had positive returns. Diversification is vital to maximize the odds that your growth portfolio will grow. You don’t get a do-over in retirement, so if you concentrate investments in a stock or sector that doesn’t do well, there won’t be a second chance to recover and rebuild.

5. Set Up Seamless Paychecks

While working, most of us receive regular, direct-deposited paychecks. This works well in retirement, too. You can set up a holding account to collect income from various account types, such as IRAs or Trusts, and then direct deposit one monthly paycheck from this holding account to your daily checking account. This makes budgeting easy and brings far more consistency to the process than withdrawing funds ad hoc when you think you need them.

You’ll also need to pay taxes. If you have IRA withdrawals, you can have taxes withheld directly from the distribution, the same way that tax withholding occurred while you were working. This also applies to Social Security, pensions, and most deferred compensation distributions.

If you own investments in a non-retirement brokerage account, you may need a different plan to cover taxes on investment income and realized capital gains. To avoid underpayment penalties, work with a tax professional or retirement planning specialist to see if you’ll need to make estimated quarterly payments.

The transition to living off your acorns can be scary. It’s even more frightening if you don’t adjust your investment strategies around the new goals required of them. When building something important, you’re supposed to measure twice and cut once. This applies to retirement too. Use these five steps to measure and adjust your plan more frequently so that you can relax and enjoy retirement when the time comes.

Additional Resources

To learn more, attend the upcoming August 28th, 2025, webinar. Register here.

Four things near retirees need to know about the 4% rule: Download free report.

How to build a retirement income plan: Download free report.

Connect with a Retirement Planning Specialist. Book a complimentary consultation here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

This content is part of a paid partnership

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.