Drawing Down Retirement Savings in a Pandemic

Tapping the right accounts at the right time matters. Knowing how much a retiree can spend each year without running out of savings in old age is even more important.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the coronavirus shut down the economy last spring, many consumers had their budgets cut by default. Trips and shows were canceled, nonessential medical procedures were postponed and restaurants closed.

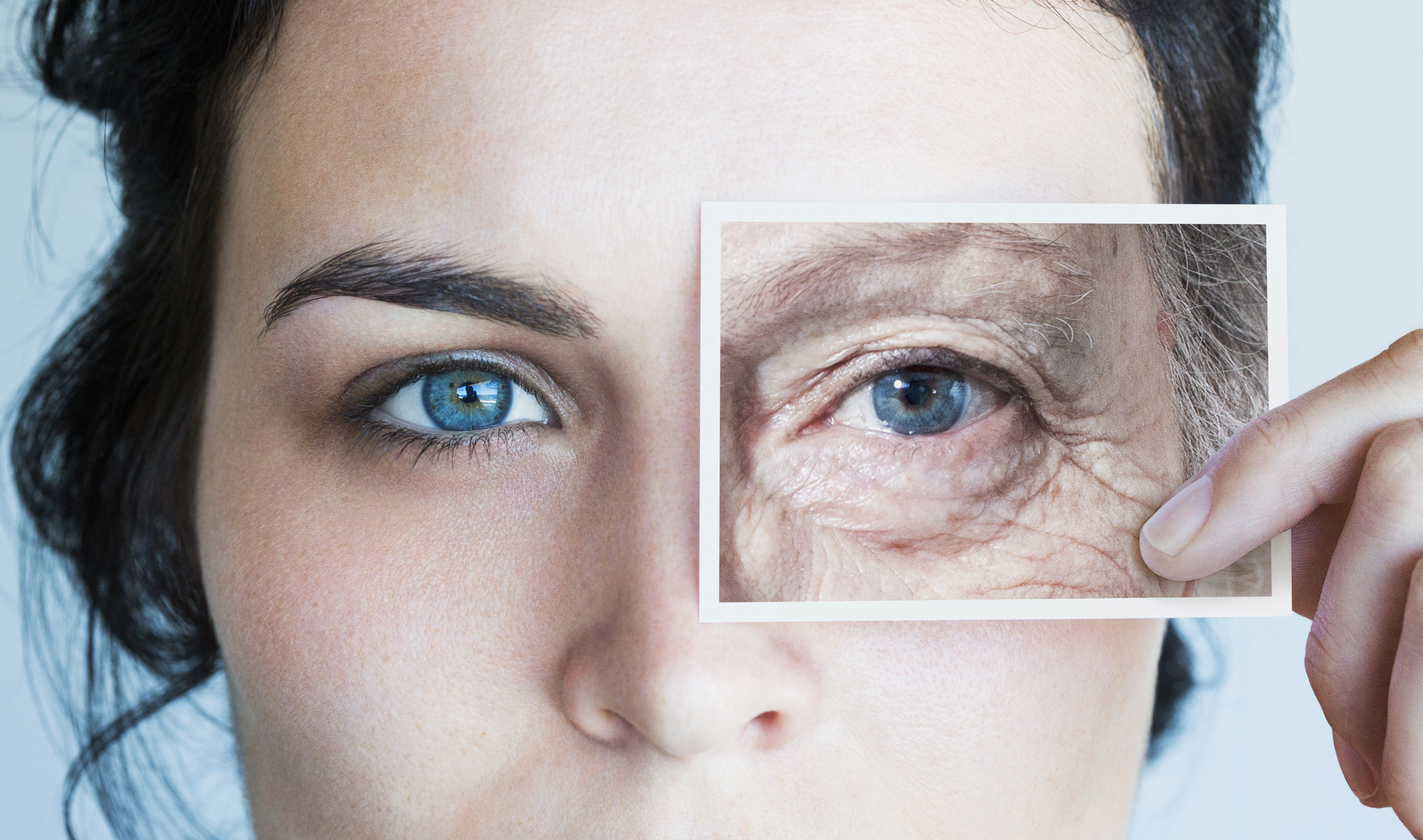

For retirees living on portfolios—or those forced into retirement unexpectedly due to the virus—the forced spending slowdown may have helped cushion the financial blow as they watched their investment account values plummet. Then, stocks lurched ahead and have since been volatile, leaving many retirees to wonder if they should adjust their game plan for retirement income as the economy opens up.

“The first quarter of this year represented the very definition of sequence risk,” notes Patrick Nolan, a BlackRock portfolio strategist. “Early in retirement, it’s the most challenging situation for a retiree who has begun to take cash flow from retirement accounts. You’re selling assets, locking in losses and impairing the future value of the portfolio.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

To be sure, drawing down the right percentage amount from a portfolio each year is complex business. There are tax implications, so drawing from the right accounts at the right time matters. But knowing how much a retiree can spend each year without running out of savings in old age is even more important.

Plenty of tax and financial pros like to argue over the most tax-efficient ways of drawing down a portfolio once retirement has begun. Far fewer enjoy talking frankly about overall spending levels. Who wants to wade into the weeds of telling couples that trip to the Galapagos is off the table?

But let’s go there, because the economic fallout from the pandemic is challenging old assumptions about withdrawal strategies, leaving some retirees cash-strapped and in a bind while others aren’t forced to cut back at all. Here’s a look at some of the most common methods financial planners use to figure out how much people can safely spend from a retirement portfolio each year, and how sudden market shifts (like the one we saw in the spring) can affect them. The results may surprise you.

4% Revisited

Consider someone who retired this year and decided to use the withdrawal method popularized by William Bengen, the financial adviser who in the 1990s came up with the Bengen rule. It involves withdrawing roughly 4% of a portfolio in the first year of retirement and adjusting for inflation thereafter, regardless of market conditions.

Using the Bengen rule, a retiree with a $1 million nest egg would withdraw $40,000 for living expenses the first year. In year two, if inflation was 3%, the withdrawal amount would increase to $41,200.

But what if stocks had plunged, say, 15%? If after taking out the $40,000 at the beginning of the first year, and the portfolio then declined to $816,000, our retiree would now be removing 5% of the actual portfolio value by withdrawing $41,200 in year two.

That’s the problem with the 4% rule; it doesn’t account for portfolio performance. Amid lower expectations for both stocks and bonds ahead, it’s little wonder why more experts are suggesting retirees walk away from withdrawal rules that don’t respond at all to market changes.

The RMD Method

Other retirees try to limit spending to the amount calculated for their annual required minimum distributions from tax-advantaged retirement accounts. This calculation is based on the ending balance of the accounts on the last day of the previous year, divided by the person’s life expectancy.

As this year demonstrates, however, this strategy can be tough to follow in volatile times. Had RMDs not been skipped in 2020 because of the CARES Act, for example, retirees would have been forced to take big withdrawals based on 2019’s high balances and, potentially, much lower withdrawals next year if this year ends sharply lower than last.

‘Dynamic’ Strategies

The trick, experts say, is to smooth out withdrawals over time, hitting a sweet spot that allows retirees to keep a fairly steady income even when markets are tanking, while not becoming so conservative that important lifestyle goals are sacrificed. That’s the definition of a dynamic withdrawal strategy.

Interestingly, experts who advocate dynamic withdrawal strategies haven’t been pulling in the spending reins too tightly thus far.

“We had one client who, out of the blue, wanted to make a big purchase that was beyond the expected annual withdrawal, and we said, ‘This isn’t the time to do this,’” says Stephanie McElheny, president of wealth planning at Aspen Wealth Strategies in Arvada, Colo., who uses financial modeling software that calculates the probability of clients maintaining their assets throughout their life expectancy.

For other clients, however, she saw no reason to trim planned withdrawals right away, even as markets were in freefall in March. Using modeling software to simulate possible market returns based on the March portfolio lows, the probability that her firm’s clients would run out of money rose by about 15 percentage points at the market lows in March, she says. So why the lack of concern? The simulations at any given time are based on a portfolio’s current value, and the range of bad outcomes can appear much worse than they might if an investor looked at the numbers over a period of months.

“Nobody likes to see their probability of success go down, but I told clients it’s just one point in time,” she says. “Now, if a client wasn’t retired and had just lost their job, that would be a different scenario.”

Jonathan Guyton, founder of Cornerstone Wealth Advisors in Edina, Minn., also hadn’t altered client withdrawals by mid-June. He devised “guardrails” on portfolio withdrawals—rules for taking higher amounts with the caveat of adjusting spending slightly if markets decline significantly.

For his model portfolios to trigger a 10% cut in spending, withdrawals would have had to exceed 6.4% of his clients’ current portfolios, meaning a portfolio drop for both stocks and bonds of 22%. At the market lows in March, he says, the withdrawals got to 5.9% of the model portfolios. (Individual portfolios vary slightly due to clients’ age or other circumstances.)

The model allocations are 65% stocks and 35% bonds, the sweet spot, he says, for maximizing withdrawals.

“When events make you question if your retirement income plan is still sustainable, dynamic withdrawal policies can tell you when you need to make a change,” says Guyton, who described the decision rules in detail in a 2006 Journal of Financial Planning article. “We went into the year with slightly lower equity positions because valuations had gotten so high and withdrawal rates were slightly lower than normal.”

That doesn’t mean clients were taking out less money to spend but that the amount withdrawn simply accounted for a slightly lower percentage of the total because asset levels had increased.

When the stock market had declined 35% in March from the highs earlier that month, he rebalanced client portfolios. Then stocks recovered, and by mid-June his 65/35 portfolios were down just 2%, so they never triggered a cut in retiree withdrawals. “We were getting close to the guardrail, but then the recovery came and we never hit it.”

Dynamic Withdrawals in Action

Let’s say our hypothetical retiree withdraws $50,000—5%—from the $1 million nest egg, leaving $950,000. The market stays flat, and the next year our retiree takes a 2% “raise” for inflation, to $51,000. That’s fine, because it amounts to a withdrawal rate of about 5.3%.

But the next year, if the portfolio takes a big hit—say, to $760,000—that $51,000 is 6.7% of the remaining nest egg, which could cause trouble down the road, Guyton says. So, our retiree instead cuts 10% off the $51,000, to $45,900. The process is repeated annually until the withdrawal is within the acceptable range—6.4% of remaining assets. (You could also round the 6.4% to 6% without affecting the strategy, Guyton says.)

Had the market return merely been slightly negative and the withdrawal rate only up a bit from the previous year, the investor would have simply not taken an inflation adjustment that year. A caveat: Older retirees more than 15 years into retirement may not need to take a spending cut, or as large of a cut, because their time horizon is shorter.

In booming years, when the withdrawal rate falls below 4% of remaining assets, the retiree can boost spending 10%.

A Fund for the Unexpected

It’s important to note that Guyton’s strategy works best for couples who have discretionary wiggle room

in their retirement budgets and money set aside in a contingency fund—typically 10% to 20% of a total nest egg—for occasional expenses like cars, weddings and major trips that go beyond the routine budget. Invest that money according to how often you expect to raid the account, he says. If it’s going to be every year, invest more conservatively, and vice versa. Some clients also carve out a chunk of this money to help fund long-term care costs if they exceed the regular annual withdrawal from the portfolio, Guyton says. Or, they can get a long-term care insurance policy to cover about half the cost of a nursing home; he counts on the portfolio for the rest.

As a general rule, he says, couples whose monthly retirement income from all sources (Social Security, pensions and portfolio withdrawals) is at least $6,000—or $3,000 to $4000 for singles—are candidates for the strategy. It’s just not realistic to ask retirees living on the bare essentials to take a 10% hit to their budgets, he acknowledges.

Several of Guyton’s retired clients said the spending strategy helped them navigate the stock market volatility earlier this year.

“We’ve been fully prepared to have a 10% reduction in spending when markets are bad,” says Al Washko, 76, a retired health care executive.

Before hiring Guyton, Washko and his wife, Judy, 74, a retired critical care nurse, were banking on what they now say were inflated expectations for both investment returns and withdrawal rates.

“We now have several contingency accounts and areas of spending where we could cut back, and we’re willing to do it, even if it hurts,” Judy says. “We could always find places to cut without making us crazy.” This year, though, it was the pandemic that prompted the Milwaukee-area couple to cancel travel plans, including a trip to Maine, creating a budget surplus.

Bernie and Kathy Raidt, of Shakopee, Minn., have also spent less over the last few months as the pandemic curbed their activities. Even with Guyton’s assurances they could safely spend more, that has been a difficult concept to embrace, Bernie, 66, says.

“We just bought a place in Florida, and when we had the discussion with Jon about how much we could spend, we cut that by 40%,” he says. His caution stemmed, not from market conditions, but from a more general fear of running out of money at the end of life. “If I had it to do all over, I’d probably be less conservative.”

It’s an interesting sentiment for younger retirees to consider. Countless studies show Americans have under-saved for retirement, leading to lean retirement budgets. But regrets about not using savings in early retirement—foregoing a trip here or there or not going for the extra bedroom in a condo—can have consequences, too. Even at Guyton’s more aggressive withdrawal rates, if retirees are stockpiling cash elsewhere, are they actually being too conservative with spending?

Maybe. But when his models did call for 10% spending cuts during the Great Recession a decade ago, Guyton says, most clients realized the adjustments were worth it to be able to spend more in other years.

“These static rules that assume you have to have a raise every year, no matter what, is just not the way people behave,” he says. “People feel like they should dial back spending when things get bad.”

Smaller Legacies

There is no free lunch, of course. In typical retirement scenarios, the higher withdrawals Guyton’s method allows for will mean most retirees using the strategy will die with smaller piles of cash leftover for heirs than will people who used the 4% rule. For many, that’s a good tradeoff, however, because it means they used their money more effectively in retirement.

“That’s the ultimate goal, isn’t it?” asks Bernie Raidt, the retiree who now questions some of his conservative spending patterns early in retirement. “Dying the day after you spend the last dollar.”

Michael Finke, a professor at The American College of Financial Services who has written extensively about sustainable withdrawal rates, echoes the sentiment about retirement spending.

“Part of the game of retirement is deciding where to lay your chips. You’ve got so many chips and a finite number of years,” he says. “Do you want to lay more chips on your 60s and 70s? I think that’s the way to do it. It may mean spending less in your 80s and 90s, but you’re not spending a lot of money then, anyway.”

For BlackRock’s Nolan, it comes down to picking a strategy retirees can live with. For most retirees, he says, sticking with an initial withdrawal percentage of 3% to 4% (lowered from Bengen’s original system because of market expectations) will get retirees to their financial goal.

“If an investor’s lifestyle can withstand their dynamically reducing spending at critical moments in the retirement journey, then they are in a stronger position than those who can’t,” he says. “But the idea of cutting spending may not be realistic. It’s great if you can do it, but not everybody can.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Janet Kidd Stewart created The Journey, a nationally syndicated personal finance column that ran for more than a decade in dozens of U.S. newspapers. As a reporter for the Chicago Tribune and Chicago Sun-Times, she covered banking, derivatives, markets and economics. She holds bachelor's and master's degrees from the Medill School of Journalism at Northwestern University. Widowed suddenly in 2013, she joined online grief groups and began talking with other widows about survivor benefits and adjusting to a new financial reality. Now living and working in Minneapolis, she is compiling those stories, and her own, into a forthcoming book.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

COVID Aged Your Brain Faster, Even if You Didn't Get Sick

COVID Aged Your Brain Faster, Even if You Didn't Get SickWhether you contracted COVID or not, your brain took a hit. Here's what that means for your health and what you can do about it.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

QCD Limit, Rules and How to Lower Your 2026 Taxable Income

QCD Limit, Rules and How to Lower Your 2026 Taxable IncomeTax Breaks A QCD can reduce your tax bill in retirement while meeting charitable giving goals. Here’s how.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.