The Dimensions of Wealth: Influencing Your Financial Path

Generalized financial advice and rules of thumb aren’t good enough. Unless your financial plan takes into account all of the special things that make you “you,” it could steer you off course.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A nuanced and thoughtful approach to financial planning is like peering into a kaleidoscope. Each kaleidoscope design comprises a unique set of pieces and patterns, and those specific dimensions come together to create a one-of-a-kind mosaic. With each slight turn or shift, the pattern rearranges to reveal a new image.

This same concept applies to the decisions we make about our finances. The circumstances impacting your financial decisions are not the same as those of your friends or colleagues. Why then, do many of us take advice from friends and family, or rely on financial advice created for the masses?

Many DIY investors and robo-advisers underestimate the number of facets in a person’s life — and possible combinations of those facets — that should be considered when making financial decisions. With these models, the scope of what is considered in the financial decision-making process is limited. At times, generic advice is delivered without considering a person’s unique financial needs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

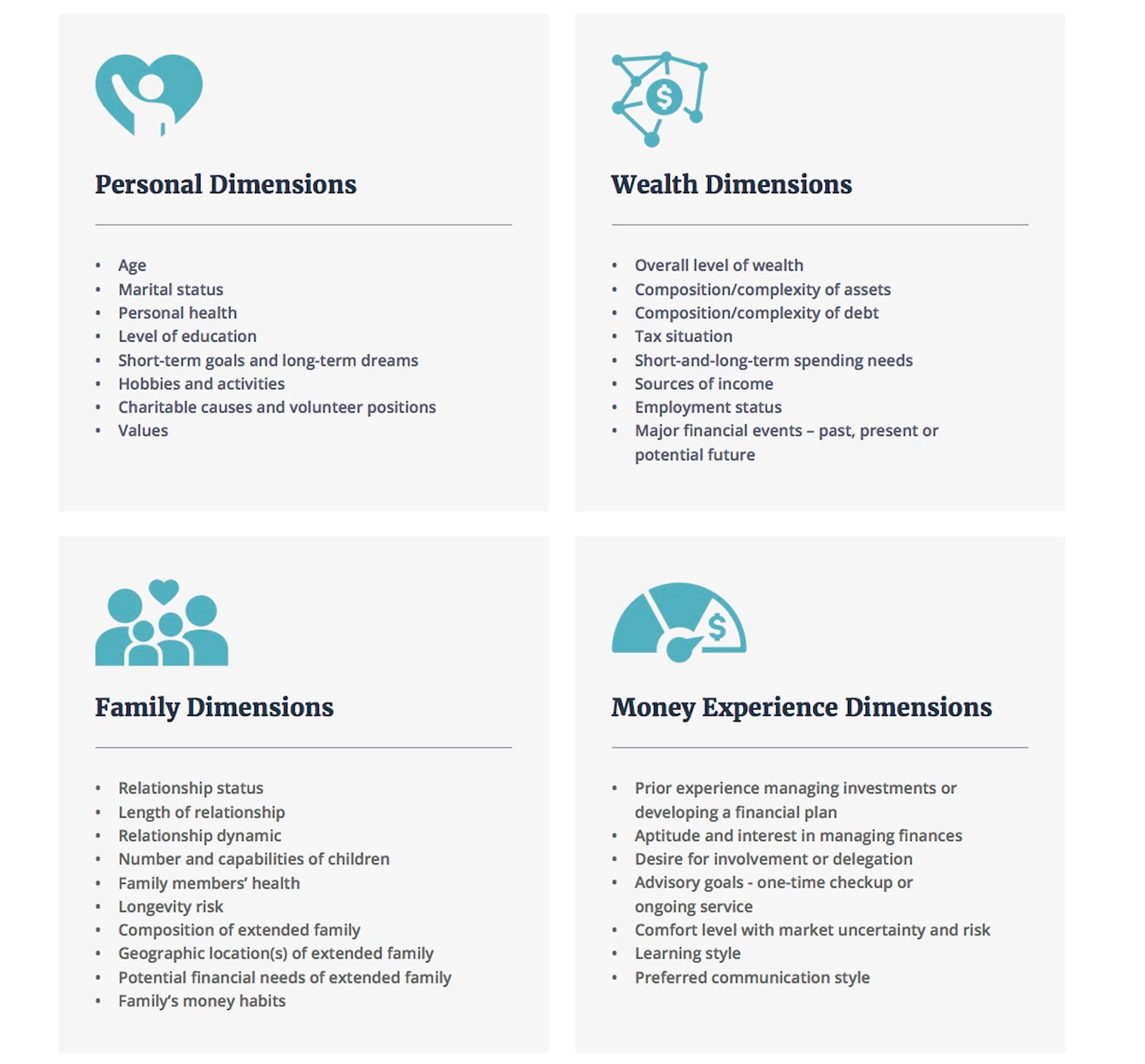

The following outlines the dimensions of wealth and how they influence your financial path.

1. Personal Dimensions

While some personal dimensions are simple to identify — age, marital status, etc. — other attributes that color financial decisions are more subjective. Dimensions like personal values, long-term dreams and charitable interests tend to be more fluid and prone to evolve as one moves through life. Therefore, these need to be routinely re-examined.

2. Wealth Dimensions

Income, saving, spending, investing, debt and taxes all are interconnected; overlooking even one area can be costly.

Your sources of income — from salary, real estate, pensions or investments — affect how you structure your portfolio. As income composition changes over time, you may need to deploy different investment strategies. Unexpected life events, financial losses and legislative changes also call for a nimble and thoughtful plan.

Changing course is easier if you have advice based on all your circumstances, rather than being squeezed into a box that doesn’t quite fit.

3. Family Dimensions

The size of your family, ages of your children, and any age difference with your partner can play a big role in determining sufficient savings levels for things like college funding, health care costs and retirement income.

While family circumstances should be an important consideration across portfolio management and tax planning, legacy and estate settlement planning, in particular, require a more delicate and thoughtful approach in weighing sensitive situations and dynamics. A child’s special needs, health issues and/or money management skills should be reflected in your financial plan and in estate planning to provide for your loved ones.

4. Money Experience Dimensions

Your prior experiences with money color your financial decisions going forward.

Awareness of behavioral factors and understanding how they may affect your decision-making can help to avoid reacting in a way that is detrimental to financial success. Some questions to ask yourself when evaluating this dimension may include:

- Do you have the knowledge to assess how risky an investment may be?

- Are you comfortable asking an adviser how much you’re paying in fees?

- Have you had past experiences with planning and investing that may impact your current decisions?

- What is your interest in managing your money, and do you have the time, or will you need to delegate this task?

- If you are married, how do you and your spouse interact when discussing money matters?

Applying the dimensions of wealth

A single factor can have an incredible impact on the outcome of a financial decision. Consider how the dimensions of wealth might impact the following common planning scenarios:

For sustainable retirement withdrawals, the standard “4% rule” says you can spend 4% of your principal balance annually during retirement without exhausting your portfolio during your lifetime. However, upon layering in the dimensions of wealth, we find that this rule doesn’t apply universally. For example:

- Family: If your family dimension includes a history of a chronic illness, you may need to preserve more funds for assisted living costs as these conditions may render you uninsurable for long-term care. Asset preservation is also a factor if you have a younger spouse.

- Wealth: If you receive a pension or other source of income that reliably covers a majority of your living expenses, you may be able to withdraw more than 4% per year because you are less likely to be forced to liquidate portfolio assets during down markets.

Another common scenario that requires thoughtful consideration of the family and wealth dimensions is educational planning. For families preparing to send their children to college, starting a 529 college savings plan helps to defray tuition costs. However, when factoring in different dimensions of wealth, we see that 529 plans may not be the optimal savings vehicle for every family:

- Family: If your child has any earned income, a Roth IRA may be preferable over a 529 plan, especially if you are not certain they will attend college. Similarly, a 529 plan may not be right if your child might qualify for financial aid or scholarships, or if they have special needs.

- Wealth: If you have significant family wealth, you may not qualify for aid at all. In this case, funding a 529 plan is a better way to save for college and might also be used to transfer assets to future generations.

We can see that generic advice often can lead people to make misguided financial decisions. Another “rule of thumb” that falls short is the notion that one should have enough emergency funds on hand for three to six months. However, this amount of cash may be insufficient to sustain many individuals with a particular set of attributes:

- Wealth: People facing job instability and high debt levels should have closer to one year’s worth of cash on hand as a cushion.

- Personal: Single people or sole breadwinners might want to maintain more than one year’s worth of cash reserves in case of unexpected disability or the sudden need to step back from full-time work.

- Family: Similarly, if someone is facing marital problems or serves as the primary caregiver for a loved one, then they may need higher levels of cash reserves.

One size fits one

In layering specific dimensions to the above scenarios, we see that a standard rule rarely applies. Conventional wisdom practiced by many robo-advisers and DIY investors often fails to realize the nuances that may call for a more restrained or aggressive approach to financial planning.

These various dimensions of wealth can result in an endless range of combinations. Since your dimensions of wealth are as unique as you, it’s important to ask if any of the financial advice you are following reflects the many facets that make up your financial life.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dawn Doebler is a Senior Wealth Adviser at The Colony Group, providing wealth management, financial planning and corporate finance solutions to clients for over 25 years. As an MBA, CPA, Certified Financial Planner (CFP®) and a Certified Divorce Financial Analyst (CDFA®), she understands the challenges and financial needs of clients from executives to entrepreneurs, women in transition, and single breadwinner parents. Dawn is a co-founder of Her Wealth®, an organization to empower women with financial confidence.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.