A Kiplinger-ATHENE Poll: Retirees Are Worried About Money

Concerns about recession, inflation and health care costs weigh on retirees and near retirees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

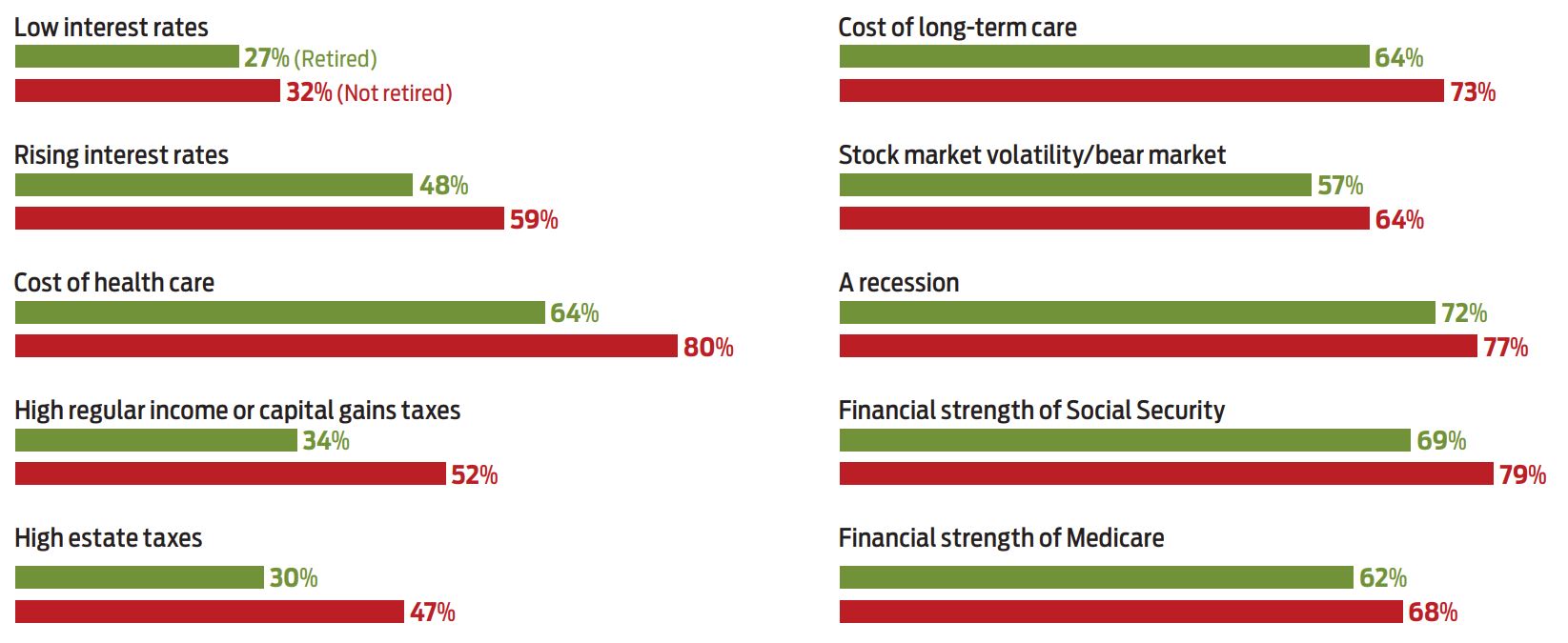

A bear market accompanied by market volatility has led to shifting perceptions of what constitutes a secure retirement, according to a new national poll by Kiplinger and retirement services company Athene. Top concerns of retirees and near-retirees include a possible recession, the financial security of Social Security, the cost of health care and inflation.

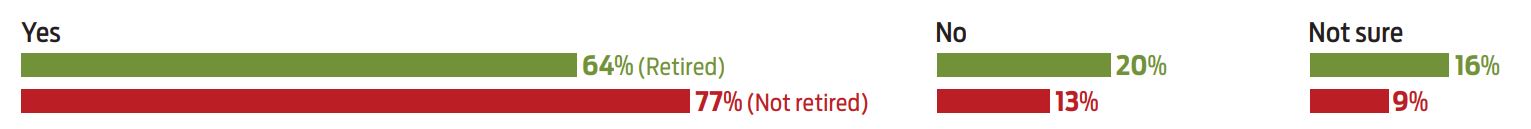

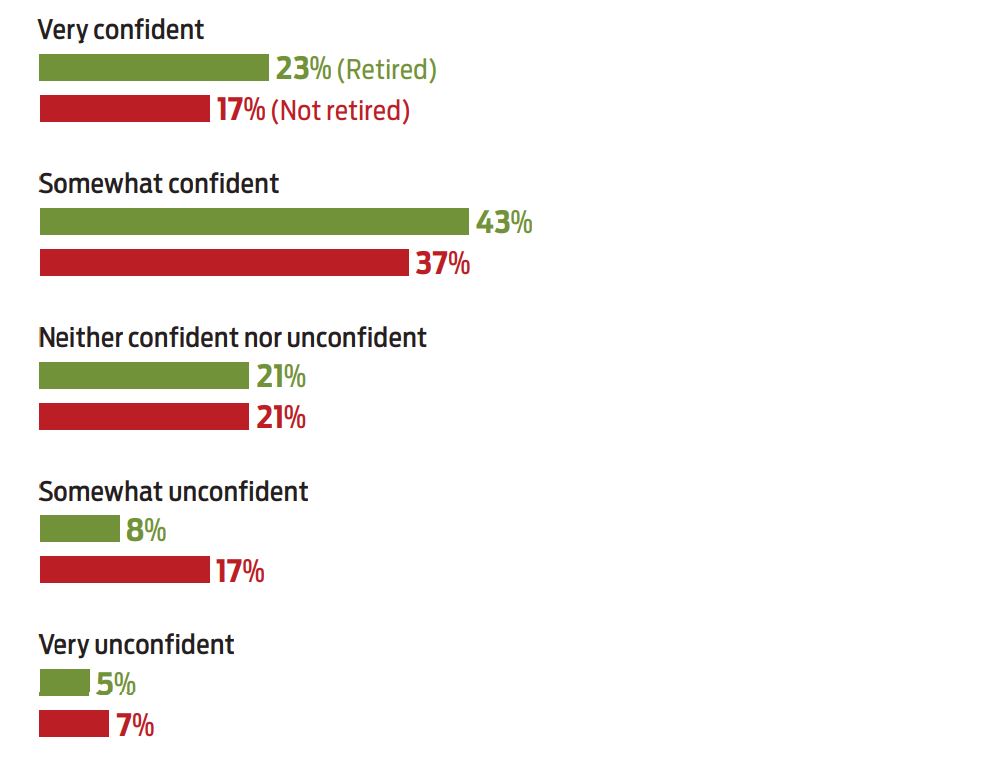

A majority of respondents say that having more guaranteed income in retirement would ease their concerns about running out of money. Even so, an overwhelming majority of current retirees report high levels of satisfaction and happiness. And retirees are generally confident about their financial future, with 70% reporting they expect to have enough income to live comfortably, and 66% saying they are confident they will not run out of money in retirement. However, preretirees are less sanguine. Less than 55% of respondents not yet retired expressed confidence that they will not run out of money at some point.

The poll targeted retirees and pre-retirees with a net worth of at least $100,000; the respondents’ median household net worth (excluding primary residence) was $369,979 for retirees and $322,506 for pre-retirees. The relatively high net worth is one likely reason financial confidence in this survey is higher than reflected in other retirement-confidence surveys.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Retirees are a bit more positive about stock market volatility than preretirees. Nearly half (49%) of retirees are concerned that stock market volatility could cause serious economic hardship in retirement (versus 64% of preretirees). Some 68% of retirees say they are doing nothing (and waiting) in response to volatility this year (versus 60% of preretirees).

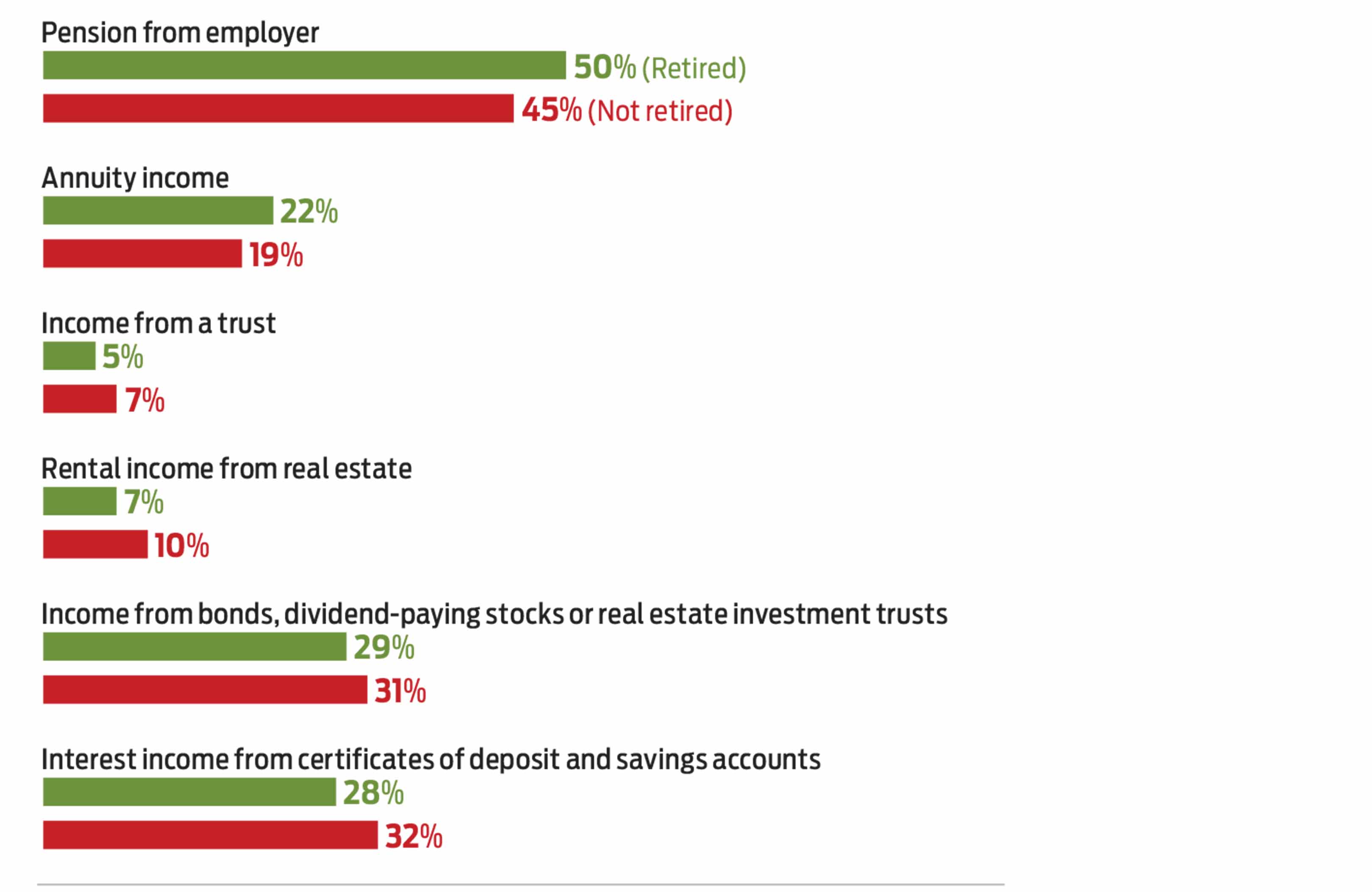

Among retired respondents, 83% have already claimed Social Security benefits, with a mean claiming age of 63. For 43% of these respondents, Social Security provides 50% or more of their annual retirement income. Top sources of stable income for current retirees (beyond Social Security) include an employer pension; income from bonds, dividend-paying stocks and REITs; CDs and savings accounts; and annuities. More highlights from the poll:

Are you worried about the following economic issues in retirement?

Are you concerned that inflation could cause serious economic hardship for you in retirement?

How confident are you that you will not run out of money in retirement?*

Which of the following things would you worry less about if more of your retirement income were guaranteed?

Which of the following strategies most closely matches how you currently withdraw or plan to withdraw money from your retirement savings each year?*

Which of the following sources of income do you receive or expect to receive at some point?†

Methodology

We surveyed 818 Americans ages 50 and older (about evenly split between retirees and preretirees). Respondents had a net worth of at least $100,000, and the median household net worth (excluding primary residence) was $369,979 for retirees and $322,506 for preretirees. About half of the respondents were men and half women. The poll was conducted by Qualtrics from June 21 to June 24, 2022. The margin of error is 3.4% with a 95% confidence level.

*Figures do not add up to 100% due to rounding.

†Respondents were asked to select all that apply.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.