Want Stock Market Gains but Hate Risk? Buffer Annuities May Be for You

Index-linked annuities are a new-ish way to help buffer your portfolio from market downdrafts while still allowing for some growth. Here are three things you must know before buying one.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Fed Chairman Jerome Powell's first action when the COVID-19 pandemic hit was to further loosen monetary policy by dropping interest rates to near zero. There's almost nowhere for rates to go but up … or sideways. Neither scenario is rosy for investors who need to take some risk off the table.

Because of the inverse relationship between interest rates and bond prices, a rising-rate environment promises to take the teeth out of fixed income investments for a while, at least. This is significant for recent retirees and those nearing retirement when they aim to navigate sequence-of-returns risk by decreasing their allocations to equities.

Without traditional fixed income safe havens, many investors have had to look elsewhere or possibly take on additional risk to meet their retirement goals. But for recent retirees, or those late in their careers, taking on additional risk without some measure of safety may not be an option.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

An Alternative: The Index-Linked Annuity

A relatively new solution in the marketplace, the index-linked annuity (ILA), allows investors to transfer some risk without sacrificing the possibility for some upside potential. Developed in the wake of the Great Recession, ILAs have piqued the interest of investors during the Coronacrash when markets cratered, then came roaring back in a five-week span.

When used as a portion of the overall portfolio, these protections may reduce the portfolio's overall risk by adding a buffer to smooth out the ride when markets get choppy.

With so much uncertainty, a flight to safety makes sense. Before pulling the trigger on an ILA, there are three important things to know:

- How you are paid.

- How the protections work.

- How the insurance company is paid.

How You are Paid

Depending on the type of protections you want, the return potential of the index-linked annuity may be dialed up or down. These options are offered in the form of performance “cap” rates.

To provide market-linked growth, the insurance company takes a portion of the funds you invest in the ILA to purchase call or put options. The cost of the options then determines the caps, or just how much of an index's performance you may be credited in a given one-year or three-year term — call it a ceiling of 10%, for instance.

Some points to keep in mind about how ILAs earn you money:

- There are many different index options to which your annuity can be linked. Instead of investing directly in underlying investment options like traditional variable annuities, you are credited interest via an index like the S&P 500 or Russell 2000. ILAs may offer many crediting choices, including indices built to track foreign markets, specialty indices or passive indices that track hedged ETFs, for instance.

- Dividends do not contribute to index returns. When the actual S&P 500 index delivers a 12% return, that generally means with dividends reinvested. Dividends can make up 1% to 2% of that return (source: ycharts), so the actual credit in an ILA may be more like 10% to 11%.

- Commonly, interest is credited to ILA owners on an anniversary via point-to-point crediting. The credit is then applied at the end of the cycle. And, generally speaking, the longer the cycle duration, the higher the cap rates and buffer protections. So a three-year point-to-point crediting method generally offers more growth potential — and safety — than a one-year point-to-point crediting method.

- Caps limit the amount of gains you may earn via a particular index. When you choose an index, you are subject to the rates offered by the issuing insurance company at that time. If a cap of 10% is placed on the S&P 500 index, then 10% is the most you may be credited for that period. If the S&P 500 returns 12% that year, you get 10%. If it returns 8%, you are credited with 8%. If it returns 50%, you still get 10%.

- In some cases, a flat return in an index will credit nothing to the ILA owner. However, some crediting options (precision rate strategies) promise a fixed rate of return if the indices are flat or positive for a given period.

- Gains grow tax-deferred for as long as you remain invested in the ILA.

How the Protections Work: Buffers and Floors

Index-linked annuities are also known as buffer annuities because of their primary protection feature: the buffer. Some ILAs also feature floor protections designed to limit losses as well, but again, transferring more risk to the issuing company may further limit upside.

- The buffer mechanism provides protections from losses up to a certain threshold — say 10%. If you have a buffer of 10%, this means that if the index to which your investment is linked loses 4%, you lose nothing. If it records a loss of 10% you lose nothing. You have been protected from losses for that period. However, say it falls 30%, then the insurance company absorbs the first 10% of that loss and you only lose 20%.

- Buffers may be offered in 10% increments, from 10% on up to 30%.

- Floors, if available, offer absolute protection against any losses above a certain amount, say 0% or -10%. The floor is essentially a stopper. Unlike the buffer, which protects against losses up through a certain percentage, the floor prevents any losses at all beyond a certain percentage. A 0% floor is a very conservative option, and it would protect against any losses at all. A -10% floor would protect against any losses beyond 10%. For instance, if you chose a -10% floor option and your crediting method lost 2% in a given period, you would suffer a 2% loss. If the index fell 9%, you would tally a 9% loss as well. But if the index lost 11% or more, your loss would not be more than 10%.

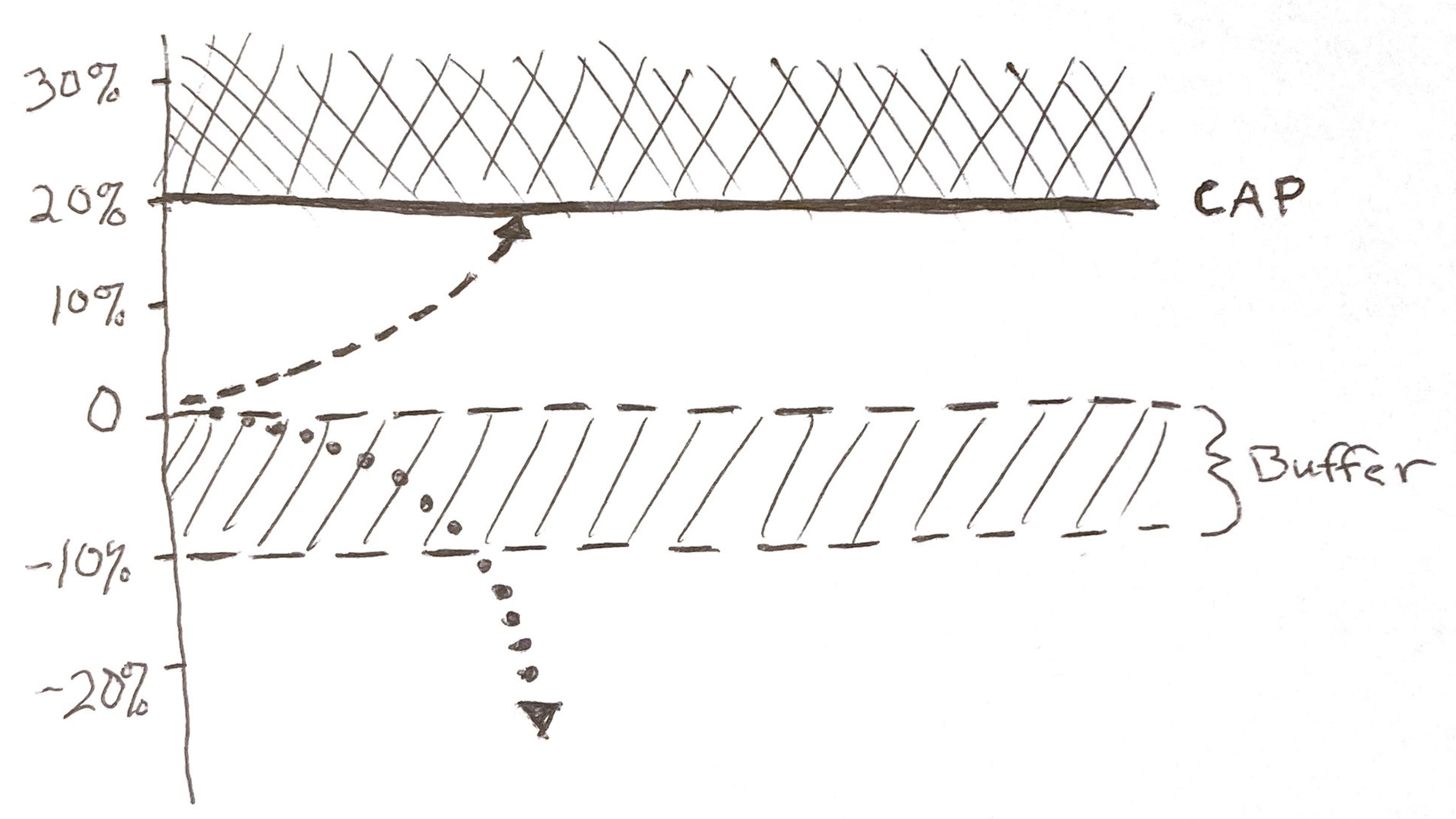

- To illustrate how caps and buffers work, let’s look at it graphically, with an index-linked annuity with a market participation cap of 20% and a loss buffer of 10%. In my napkin art below (Figure 1), you can see that even if the market rises above the 20% mark, the annuity’s performance hits a wall at 20%. Meanwhile, if the index suffers a loss, your investment won’t feel it until the loss surpasses 10%.

Figure 1: Example: 20% performance cap with 10% buffer. For illustrative purposes, only.

How Insurance Companies Make Money

ILA issuers traditionally invest the lion's share of ILA premiums in fixed income securities, like Treasuries, via their general account. The companies are then able take some profit from the yield generated in the general account. A very small amount of premium also goes into buying derivatives to protect the downside and create the index-linked performance caps. And while investors might think the insurance companies could profit through the caps on earnings, they don’t. Because investments aren’t actually made in the indices, but through using puts and calls, insurance companies don’t profit from the difference between the actual index return and the capped return.

ILAs may also charge a product fee, which varies from product to product. Many, in fact, charge no explicit fee. These product fees, if any, should be considerably lower for ILAs that don't pay commissions on their sale. Eliminating the commission lowers the internal cost, and the savings are passed on to you.

These zero-commission ILAs are often referred to as “advisory” solutions, because they were designed for financial advisers who charge a fee for their advice — as opposed to brokers who are paid commissions on the sale of investments.

ILAs recognized in the Barron's top 100 annuities for 2020 charge fees ranging from 0% to 1.25%. In fact, most ILAs on the Barron's list charge no explicit fee at all (source: Barron's). Generally speaking, the lower the fees, the better.

So how does that cost compare to, say, an index fund like an S&P 500 ETF? According to ETFdb.com, the most popular ETF by trading volume is the SPDR S&P 500 ETF (SPY) with an expense ratio of 0.095%. Mind you an ETF is an investment, and an ILA is an investment vehicle with insurance protections.

Other Potential Fees and Options

There's no additional cost for investing in the underlying index of an ILA (since you don't actually invest directly in the index). Of course, ILAs may offer other investment options (subaccounts) and/or optional enhanced features and protections that can increase their costs, so keep that in mind.

Some ILAs charge surrender penalties for a period of five or more years. Some do not. When speaking with your financial adviser about ILAs, be sure to ask about any surrender period, and what the penalties, if any, may be. Generally speaking, ILAs charging surrender penalties are able to offer better cap rates, and many grant 10% penalty-free annual withdrawals.

Both advisory ILAs and commission-based ILAs have their positives. Some people favor advisory ILAs for their low fees and flexibility, but there may be other factors to consider, such as the fees you may pay a financial adviser for their advice. Work with her or him to determine which may best suit your needs.

Forecast: Ongoing Volatility

As we await the development of a COVID-19 vaccine to safely return to our normal activities, market volatility promises to remain with us like a rude houseguest. Investors in the "fragile decade" — the last five working years through the first five years of retirement — may want to consider their options for safely bridging this period of uncertainty.

If an ILA is something you are considering, remember that while index performance on the upside may be limited, the buffers and floors can protect you from some or all losses. This is what you are paying for: a guarantee against some losses.

Staying invested in markets right now may be critical to long-term investing success, but being roiled by extreme volatility may be more than some portfolios can bear.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Stone is founder and CEO of RetireOne™, the leading, independent platform for fee-based insurance solutions. Prior to RetireOne, David was chief legal counsel for all of Charles Schwab's insurance and risk management initiatives. He is a frequent speaker at industry conferences as well as an active participant on numerous committees dedicated to retirement income product solutions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.