Using a Fixed Annuity for Fixed Income

Fixed annuities provide principal stability, competitive interest rates and tax-deferral. Here’s a look at how a fixed deferred annuity works, including some pros and cons.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Last year was a tough year for fixed income investors. Most major bond indexes finished lower. Going forward, finding opportunities for value in today’s bond market isn’t easy. Valuations are soaring and persistently low bond yields can drive investors to chase yield – looking for income in risky places. That may not end well.

So, what should you do with your bond portfolio? Dump bonds altogether and go to cash? Cash is low yielding, and the interest is taxable. CDs? Not a fan. Interest on CDs is taxable, plus you lock into a low interest rate today, just when yields may be rising this year. There are other solutions, like building a diversified actively managed bond position, buying bonds at different maturities to capture more yield, or building a CD ladder by buying different maturities. But one solution that has a few interesting advantages is a fixed annuity. Here’s what I mean:

What is a fixed annuity?

A fixed annuity is a contract issued by an insurance company that guarantees* a fixed interest rate on your savings for a specified period of time. There are deferred and immediate fixed annuities. A deferred annuity focuses on accumulating savings, less so on income. An immediate annuity is for immediate income. I will focus on deferred fixed annuities.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

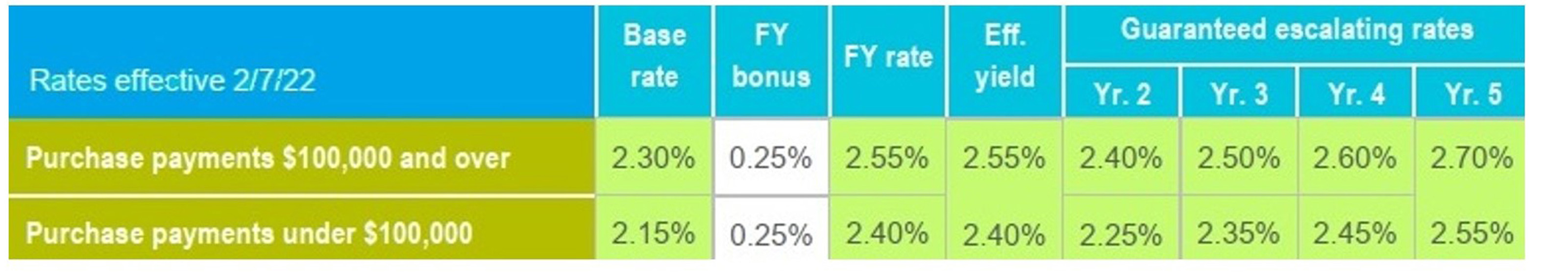

When you purchase a deferred fixed annuity, the insurance company pays a rate of interest on the premiums invested in the contract, less any applicable charges. The interest rate is determined by the insurance company and is spelled out in the annuity contract. While the insurance company guarantees* that it will pay a minimum interest rate for the life of the annuity contract, a company may also pay an "excess" or bonus interest rate, which is guaranteed for a shorter period, such as one year. Below are the current rates, net of expenses, for a 5-year fixed annuity from a major insurance company:

Figure 1: Rates are for illustrative purposes only; actual experience may differ.

The year 1 rate includes the initial or “base rate” plus a bonus. In years 2-5, the insurance carrier guarantees the base rate will increase 0.10% annually. The rates can reset annually after year 5. The interest rates are higher for contributions over $100K. This is common.

Fixed annuity pros

Principal protection

The insurance company guarantees your principal from loss. Contrast that to a traditional bond, where prices can go down if interest rates rise. Keep in mind, the guarantee is only as good as the company offering it, so you want to pick a highly rated carrier.

Tax-deferral

Interest accrues tax-free each year that you wait to withdraw. Taxes are delayed until you take money out, then the earnings are taxed as ordinary income (assuming you purchased in a regular non-retirement account; qualified Roth IRA distributions are tax-free).

In this low-interest rate environment, tax-deferral is a key advantage to using fixed annuities. The interest earned on Treasury bonds and CDs is taxable at ordinary income rates. The interest on municipal bonds is federally tax-exempt, but there may be state taxes and the interest could trigger an AMT preference item. Ideally you want to wait to withdraw from a fixed annuity till you are in a lower tax bracket, as in retirement, or at least until age 59½.

Higher interest rates

Fixed annuities typically pay a higher interest rate than CDs. Though this may not be a fair comparison, since CDs are guaranteed from loss up to $250K by the FDIC, a better guarantee than an insurance carrier (some readers may disagree). Either way, the interest on CDs is taxable each year, an important distinction.

Disadvantages or what to watch out for

No investment is perfect. Here are some things to keep in mind:

- There is a penalty to withdraw all your money from a fixed annuity in the early years, usually years 1-5. However, most carriers allow you to withdraw 10% of the contract (interest and principal) annually without penalty.

- Interest is taxable when withdrawn.

- If you are younger than 59½ there is a 10% early withdrawal penalty.

For these reasons, you want to ensure you have other cash readily available for emergency purposes. For my clients in retirement, we usually have the interest paid out monthly from the fixed annuity – assuming it falls under the 10% free withdraw – to provide income.

You also want to choose a highly rated insurance company. Some fixed annuities pay high rates, but they are from a lower-quality company. High ratings are important, since the principal guarantee is backed by the claims-paying ability of the company. Check the insurer's ratings from agencies such as A.M. Best, Standard & Poor's and Moody's.

Final thoughts

If you want principal protection, tax-deferral and a competitive interest rate, a fixed annuity is worth considering for a portion of your fixed income. I say a “portion” because I do believe in creating a diversified fixed income portfolio – a mix of taxable and non-taxable bonds, Treasury inflation protected bonds, active and passive styles of management.

There is no one size fits all, only different strokes for different folks.

For more information on how a fixed annuity works, please email me at maloi@sfr1.com.

* All guarantees are based on the claims-paying ability of the issuing insurance company.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.