Annuity Payments Are 30% to 60% Higher: Time to Reconsider

When interest rates rise, so do payments on new annuity contracts. Maybe it’s time to take another look at how annuities can fit into your retirement income.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Yes, interest rates are up, and that hurts new home buyers and other borrowers.

Yes, short-term interest rates paid on your bank account are higher.

Yes, long-term interest rates paid on new bond investments are up, too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Did you know that higher interest rates also increase the payments on new annuity contracts? Those higher payments raise another important question: Is this the best time to start, or add to, the annuity payment portion of your retirement income?

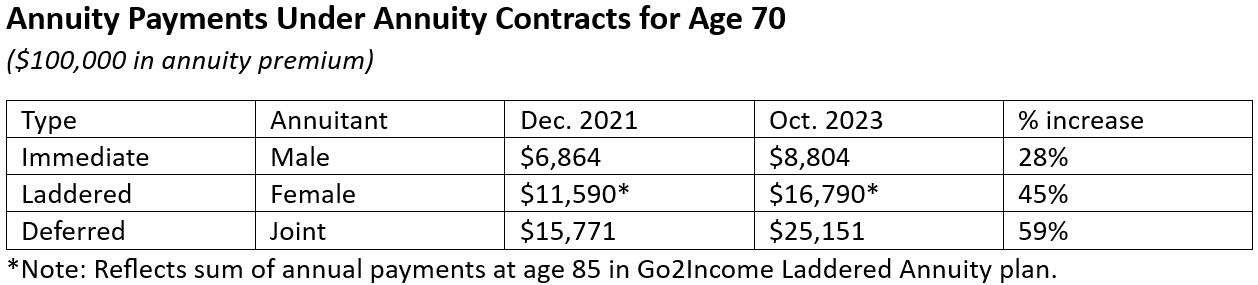

Dollar-and-cent impact of higher interest rates on annuity payments

The impact of higher interest rates on your annuity payments is often hidden from view, since insurance companies don’t publish them; rather, they are a component of the company’s internal pricing. (Go2Income is one of a few organizations that reverse-engineer the annuity payment industry to estimate those interest rates.) Let me just state that these rates are up significantly, and they vary by the type of annuity, when payments start and whether they are for life or not.

You can see below how different types of annuity payments, in different situations, compare today with what they were at the end of 2021.

If you’d like to get a quote for today’s annuity rates, you can use Go2Income’s annuity calculator.

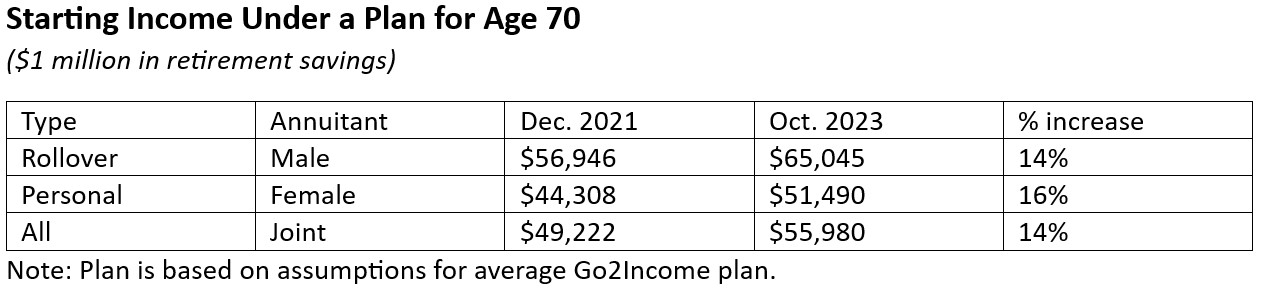

How do higher payments flow through your plan for retirement income?

Annuities provide lifetime income, so depending on the number and type you consider in your plan, you could experience a significant increase in starting retirement income since 2021 of about 15%. All because interest rates are up.

Other reasons to add annuity payments

And, as part of our weekly survey of annuity rates completed on Nov. 2, we observed a 1% to 2% increase in the majority of cases. Of course, more income should be a key factor in your planning, but what else is important?

- Your percentage of safe income increases with annuity payments, particularly late in retirement

- You can reinvest your extra income in tax-favored accounts like a Roth IRA or use it to pay for your life insurance or long-term care insurance premiums.

- Annuity payments can continue for the life of a surviving spouse, or for a beneficiary, until your annuity premium has been paid

- And the safe income from annuities enables a higher allocation to equities in your portfolio

It adds up to having more control over your retirement for you and your family.

What about what’s happening in the world?

JPMorgan Chase CEO Jamie Dimon — “as close as Wall Street has to a statesman,” according to The New York Times — has described the current wars and economic situation as possibly “the most dangerous time the world has seen in decades.” However, even during the financial crises in the 1930s, highly rated U.S. life insurance companies met all their obligations. In addition, since the 1930s, there have been significant regulatory reforms, including the establishment of state insurance guaranty associations and stricter regulations on insurance company investments. That’s why we consider annuity payments as “safe income.”

Some advisers argue against annuities because you can theoretically make more money by investing in the stock market. They don’t seem to worry about down markets that might limit your income when you need it most, and they don’t mention taxes either.

What I say is, why not build a plan that integrates both investments and annuities?

Peace of mind

We can’t predict the markets or the peak of interest rates, we don’t know what catastrophe will happen next, and we certainly can’t predict exactly how long we will live. All we can assume is that our finances will need protection if we plan to enjoy a long and happy retirement. That’s why reliable, safe income is important.

You can test annuities for yourself and see how various amounts and types might work for you. Order a no-obligation plan from Go2Income to build a plan for retirement income that fits your specific needs.

related content

- Too Heavy in Stocks? Annuities Could Be a Rebalancing Option

- Advisory Annuities Let You Eliminate the Middlemen

- Considering Annuities? Here’s What to Keep in Mind

- Annuities Have an Awareness Problem: Why That Matters

- Why So Many Experts Consider Annuities a Win for Retirees

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.