Five Steps to Sorting Out Your Asset Allocation

Investing decisions can be daunting, but following this five-step process can make it easier to figure out how to allocate your investments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Maintaining a stable and secure income is an essential financial priority for retirees. Risks such as inflation, stock market fluctuations and unexpected expenses can pose threats to retirement security and cause sleepless nights. Fortunately, retirees and people approaching retirement can take steps to help ensure their retirement income remains secure.

One essential component of retirement security: strategic consideration of investments.

While investing is a complex topic and can be intimidating, there are steps just about everybody can take to manage their investments. Once the following steps are taken, making asset allocation decisions for how you divide your money between stocks, bonds and/or cash in a way that balances returns and safety according to your comfort and needs becomes easier. Asset allocation is one of the most important investment decisions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Step #1: Determine the character of your income.

You should take into account income from both your employment and other sources. And “character” refers to how steady and secure your income may be. Income that is uncertain or volatile might call for a lower-risk investment portfolio, and a more secure, steady income might be able to withstand a riskier portfolio that offers higher potential returns.

Step #2: Assess your risk tolerance.

Once you’ve figured out your income’s character, you should take stock of how tolerant you are of the potential ups and downs of investment returns. For instance, oftentimes, portfolios with a greater chance of high returns in the long run experience more ups and downs from year to year, and higher returns are not guaranteed.

You should be honest with yourself about your tolerance for potential volatility and the accompanying risk.

Step #3: Consider your risk capacity and your risk tolerance together.

Risk capacity refers to how well your finances can bear risk. If you have a high tolerance for risk, but your income and other financial resources wouldn’t be able to recover adequately if the market takes a downturn, you’ll need to carefully balance your need to stay financially secure and your preference for risk-taking.

Step #4: Decide how to allocate your funds.

Allocation of funds means figuring out where to put them, usually in stocks, bonds and/or cash. For example, if you want to potentially earn more, and both you and your funds can withstand greater risk, you might choose to have more stocks than bonds in your portfolio.

On the other hand, if you want to avoid as much risk as possible and are willing to earn less on your investments, make sure your portfolio has more bonds. Savvy investors make allocation decisions before thinking about specific investments.

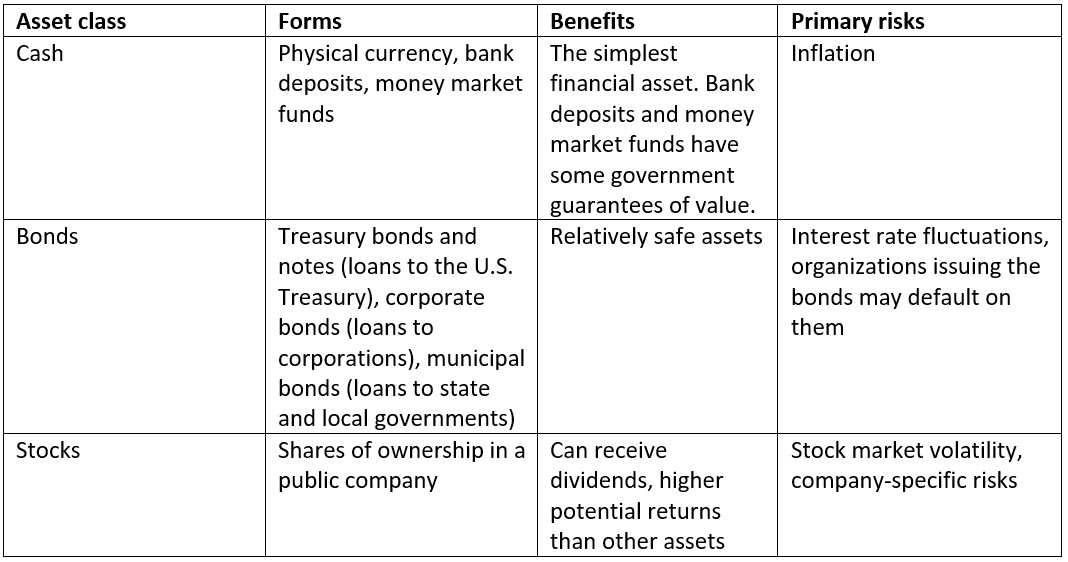

Asset classes are the building blocks of asset allocation. There are three basic classes: stocks, bonds and cash. Below is a summary of the asset classes:

As listed in the table above, each asset class poses its own risk. Investment risks tend to fit into these categories:

- Inflation. This refers to a decline in a currency’s purchasing power.

- Interest rate fluctuations. Interest rates change in response to economic conditions, and these affect bond prices. For instance, generally, when interest rates rise, bond prices fall.

- Stock market volatility. If investors expect a good economy in the near future, the stock market tends to rise. On the other hand, if investors feel wary or negative about the economy’s prospects, the stock market tends to fall.

- Individual companies’ stocks. Good news about a company can make its stock price go up faster than the rest of the stock market, while bad news can do the opposite.

- Currency risks. Currencies from different countries and regions fluctuate in relation to one another and can impact the U.S. dollar’s purchasing power.

Diversification — dividing investment funds between a variety of stocks and/or bonds — is a good strategy to reduce risk. Diversification won’t eliminate risks, however. If the stock market drops, a diversified portfolio will likely drop, too.

Step #5: Choose how to implement your asset allocation decisions.

You can choose to make your investment decisions a reality by using a pre-packaged method, a customized solution or a combination of these approaches.

Mutual funds and exchange-traded funds (ETFs) pool investors’ money in stocks, bonds and other assets. Both are pre-packaged solutions and managed by professional fund managers.

A customized or self-directed approach enables you to design your own asset allocation strategy, choosing among several mutual funds, ETFs, bonds, government Treasury bonds and notes, real estate or individual securities, to create a portfolio aligned with your preferences.

A financial plan provides a good framework to help you choose your asset allocation target by quantifying a spending plan and setting savings and investment return targets. It can also help you see the potential impact of investment risks, expenses and tax implications.

When taking the self-directed approach, you’ll need to choose specific investments once you’ve decided on an asset allocation target. Below are a few things to consider:

- Active vs passive mutual funds. Active mutual funds are actively managed by a portfolio manager, usually to achieve returns higher than the market average (though this isn’t guaranteed). These funds tend to have higher costs due to the activities performed by the fund manager. Passive mutual funds (such as indexed mutual funds and ETFs) typically mirror the structure and performance of a specific market index, such as Standard & Poor’s 500 index. These funds tend to have lower costs.

- The impact of investment costs on potential returns and tax implications.

You don’t have to be completely on your own if you decide on the customized or self-directed approach to asset allocation. A financial adviser can help you design and implement your investment mix.

Find out more about asset allocation and learn practical considerations and advice on related topics from retirement professionals in the Society Of Actuaries Research Institute’s Asset Allocation: A Roadmap to Investing and other briefs located at Managing Retirement Decisions.

Related Content

- Should You Use a 25x4 Portfolio Allocation?

- Five Ways to Make Retirement a Little Less Scary

- Five Mistakes High-Net-Worth Individuals Make in Retirement

- Five Things I Wish I’d Known Before I Retired

- New to Investing? Six Expert Tips for How to Do It Smartly

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Carol is a retirement actuary who retired after a 30-plus-year career of consulting with corporations, non-profits and governmental employers on their employee retirement programs. She is a member of the Society of Actuaries Committee on Post Retirement Needs and Risks, the Aging and Retirement Strategic Research Program and the Research Executive Committee providing leadership, project oversight and speaking and media work for the research produced by the committees. She has a focus of interest on managing risks in retirement for individual retirees and increasing retirement financial literacy so people can retire with a secure lifetime of income.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.