A Challenging Retirement Plan Mission: Not Impossible

A reader makes a request that at first appears not achievable, but with some maneuvering of the retirement income plan building blocks, we find it can work.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A one-size-fits-all approach will never be a perfect solution when it comes to designing a plan for your retirement income. As it turns out, there are billions of potential combinations available to do what you want, whether that is creating as much income as possible, leaving a financial legacy, cutting the tax bite or covering inflation.

The best planning system does the best, if not perfect, job in meeting your objectives. Go2Income does that by examining the building blocks of a retirement plan and fitting them together in a way that meets as many of your objectives as possible.

However, when I got the following unique query from one of our article readers, I wasn’t sure that the Go2Income approach I’ve based on my years of experience, with some help from artificial intelligence, could address it.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How to address a challenging retirement question

The question: Can I get a 7% yield on $5 million of retirement savings for the rest of my life without risking my capital?

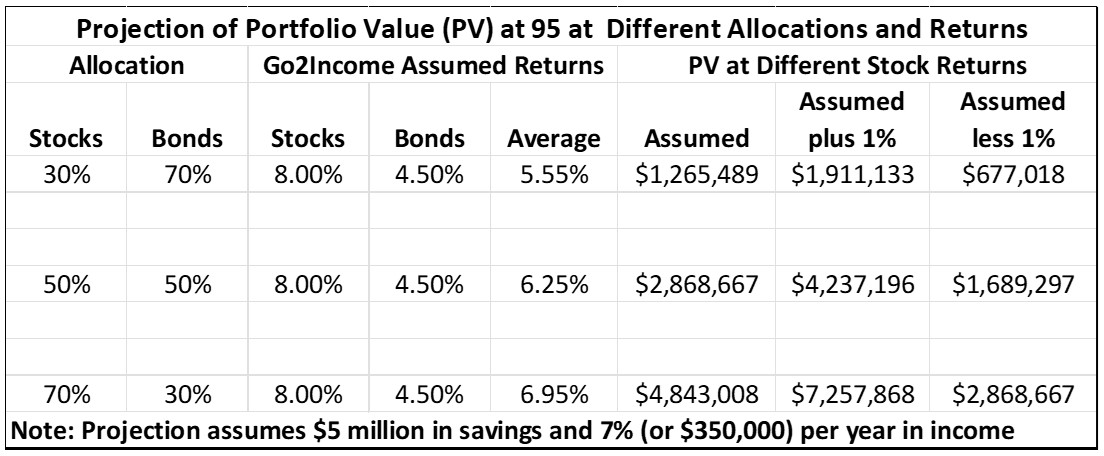

I raised my eyebrows, because 7% is a lofty goal in today’s market. As of this writing, with 20-year Treasuries paying less than 4.5%, we knew the investor would face a lot of financial risk to achieve that objective. In an all-bond portfolio, the investor needs to find an additional 2.5% in yield each and every year. And an alternative of a balanced 30/70 equity/bond portfolio would need to deliver a 12.5% stock market return (vs Go2Income’s assumed 8.0%), in addition to Treasury yields, each and every year. Both work against the goal of minimizing capital losses. This chart covers several scenarios:

You should note that Go2Income’s assumed 8% return is less than the 30-year average of the S&P 500 index (with dividends reinvested) of 10% by a margin of 2 percentage points, since individual investors underperform the average, particularly when there’s a need to liquidate securities.

Comparison to Go2Income plan

To add some perspective, the female investor, age 70, before posing her question had just received and, I guess, passed on our Go2income plan that, based on the above assumptions, produced a 6% starting income, growing by 2% a year. But the portfolio value would only regain that $5 million in savings at age 95. While the plan offered other favorable aspects, like safety of income and a low tax rate, those were not our questioner’s priorities.

I sharpened my metaphorical pencil and crunched the numbers through several versions of the Go2Income planning algorithm. I also had the advantage of something not available in present Go2Income plans: a newly developed program that can consider the value of your home in the plan. So HomeEquity2Income (H2I), which will be unveiled to everyone soon, is also part of the solution we might present to our investor.

With support from our analysts, we did develop a Go2Income plan that consistently produces an economic return equal to 7%, minimizes risk and taxes and delivers a reasonably consistent $5 million economic value.

Go2Income planning with annuities

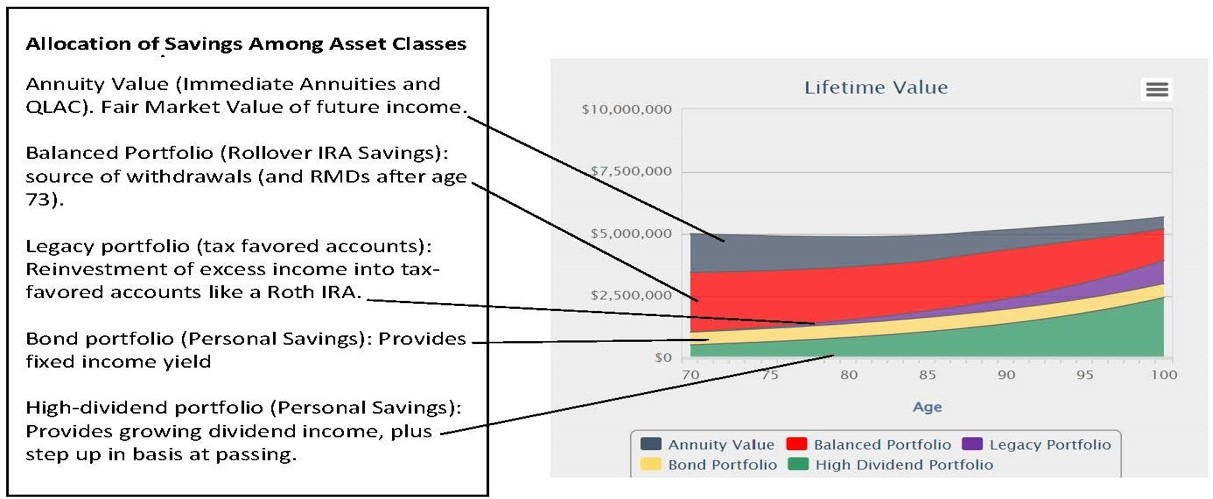

Here’s what happens when we analyze the possibilities and examine the impact of adding different asset classes to the mix. (For a primer on assets and how to consider them for your plan, read my article For Sustainable Retirement Income, You Need These 5 Building Blocks.) Two strategies are particularly important: (1) We allocate a portion of personal savings to an immediate income annuity for higher cash flow and lower taxes, and (2) we broaden the fixed income portfolio beyond high-quality bonds to include an allocation to a fixed index annuity and a high-yield portfolio.

The asset class mix that produces the desired 7% annual cash flow is shown below with its building blocks called out. And while the construction may initially seem complex, it is a safer way for our investor to preserve capital and have the income to spend every year.

And by considering the sources of savings in making the allocations, the plan is tax-efficient:

- Only 60% of the income at the start is taxable

- There is no planned sale of securities with a potential capital gain tax

- 60% of the portfolio is free of income taxes at the investor’s passing

Note that this approach might give up some of the value of legacy at the start because of the form of annuity. That could be protected by life insurance already in place, or the purchase of an annuity with beneficiary protection.

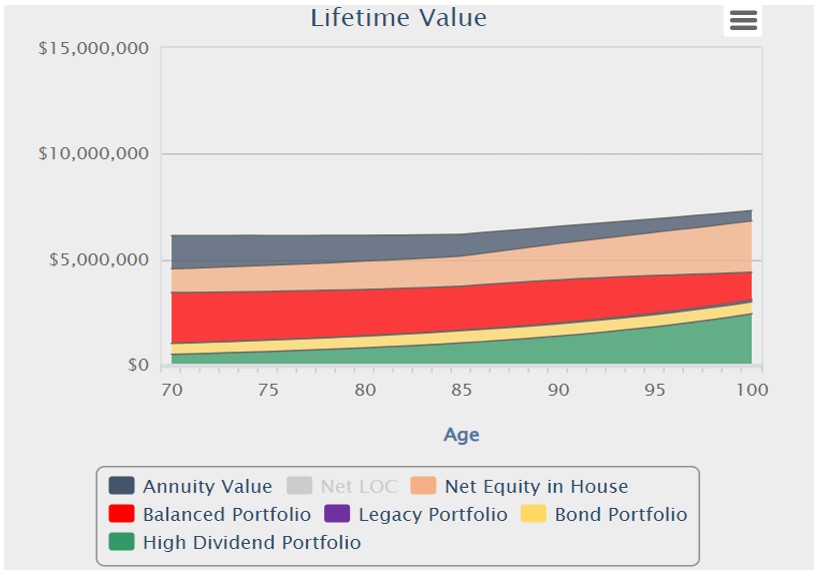

Considering HomeEquity2Income for additional security

Adding H2I to a plan provides a layer of protection that will help pay for late-in-retirement expenses or, if you are healthy for the rest of your life, add to your legacy and even increase your income. This chart shows how H2I gives you peace of mind:

One reason Go2Income works in creating an approach to retirement income is that you choose the goals that will benefit you and your family, and then the algorithm determines the combination of asset classes that do the best job. Like our investor above, you can mix, adjust and ask questions until you are satisfied.

Visit Go2Income to develop a plan — on your own or with our advisers — to produce the income, tax rate, level of risk and amount of liquidity you need and desire. And ask about how H2I might benefit your plan.

Related Content

- How a Fixed Index Annuity Can Manage Retirement Income Risks

- Retirees: Worry Less About Markets, Long-Term Care and Taxes

- How You Might Need to Adjust Your Retirement Plan in 2024

- How Finances Can Improve for Retirees — and the Next Two Generations

- Annuity Payments Are 30% to 60% Higher: Time to Reconsider

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.