Collective Investment Trusts: Should Your 401(k) Hold Them?

Your retirement plan may offer a collective investment trust (CIT), which could help reduce fees and expenses in your 401(k).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

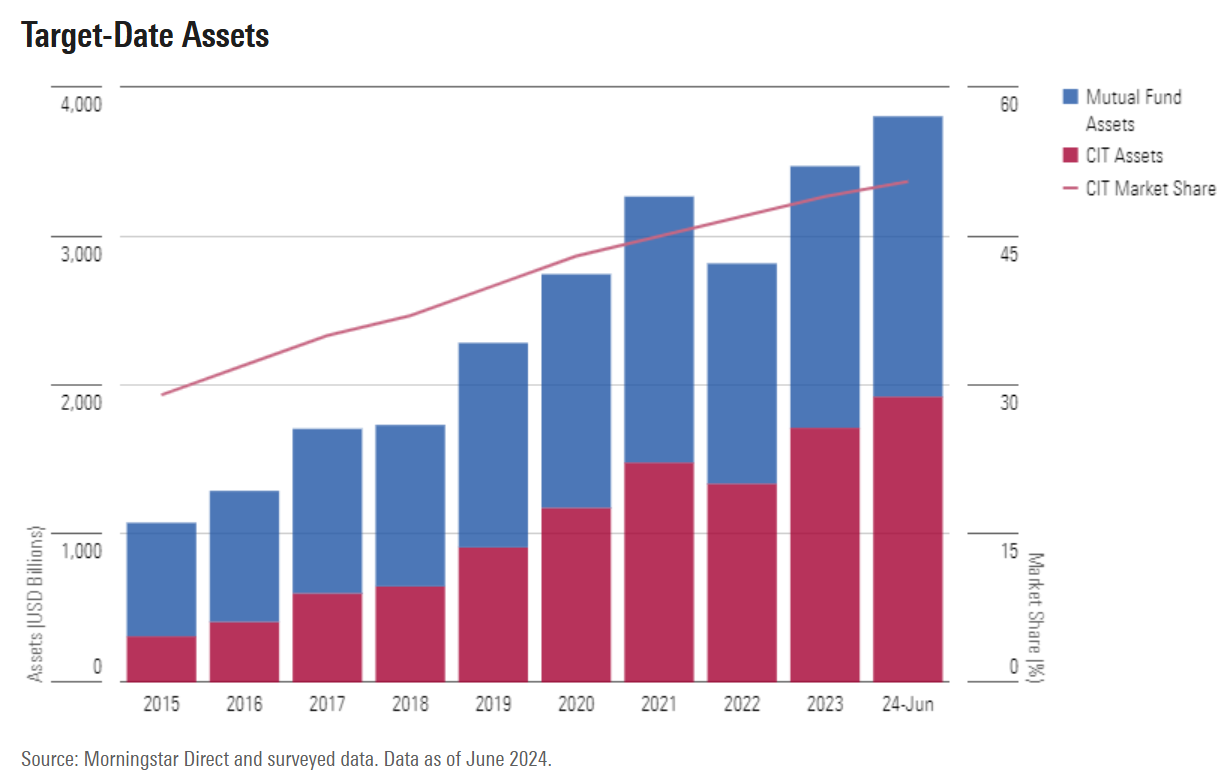

Most people saving for retirement have never heard of collective investment trusts (CITs), even though they may hold them in their employer-sponsored plans. This savings tool may offer many benefits over the mutual funds your employer might provide in your 401(k), with lower fees, added tax efficiency and flexibility. But it also comes with risks. Given how popular CITs are — they hold almost a third of the assets in defined contribution plans, worth about $7 trillion — you should give your retirement plan a once-over.

A CIT is an investment vehicle that pools investor funds to purchase a portfolio of investments, much like a mutual fund, but with some important differences. CITs are not traded on the stock market and are administered by banks or trust companies. They may even hold the same companies as a mutual fund, but CITs are almost always cheaper because they have lower regulatory and marketing requirements.

CITs are only available in qualified retirement plans, such as 401(k), 457(b), and federal Thrift Savings Plans. They may also become available to 403(b) plan participants starting in March 2025.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"CITs come in many different varieties," says Corbin Grillo, director of Investment Strategy with Linscomb Wealth. "For example, some may invest only in U.S. or international stocks, while others may focus on high-quality bonds. Additionally, qualified retirement plans often offer CITs that include a combination of different asset classes."

How to know if your 401(k) has a Collective Investment Trust

Since CITs aren't traded on open exchanges, they don't have ticker symbols like mutual funds or stocks. Instead, you can spot a CIT in your 401(k) by looking for the word "Trust" or the abbreviation "Tr" in the investment's name.

CITs don't publish prospectuses, but your retirement plan administrator should provide a fact sheet or profile of the CIT.

CIT target-date funds have eclipsed mutual funds

If you have a target-date fund in your retirement plan, you probably own a CIT. As of June 2024, CITs with target-date strategies represented 50.5% of target-date assets, according to Morningstar. Mutual funds made up 49.5% of target-date assets, down sharply from a decade ago.

CITs vs. mutual funds

CITs are similar to mutual funds in that both are pooled investment vehicles with holdings chosen to achieve a specific investment goal. However, the two are not the same.

Some of the key differences between CITs and mutual funds include:

- Access: Mutual funds are usually open to the general public, whereas you can only invest in a CIT through your retirement plan.

- Cost: "CITs generally have lower operational costs compared to similar mutual funds, and these savings are often passed on to investors through lower expense ratios," Grillo says. CITs may also have different fees based on how much you invest in the fund. According to a Morningstar study, "When comparing the net expense ratio of CIT tiers and mutual fund share classes of the same strategy, CITs are cheaper 91% of the time."

- Dividends: CITs are not required to pay out dividends or capital gains the way mutual funds must. Instead, the CIT may reinvest these earnings in the trust, which can help increase the investment's net asset value over time.

- Liquidity: CITs may have redemption restrictions, such as only allowing you to withdraw your funds on a monthly or quarterly basis. And you may not get your money back the next.

- Regulation: CITs are regulated by the Office of the Comptroller of the Currency (OCC) or a state banking regulator, whereas mutual funds are regulated by the Securities and Exchange Commission (SEC).

- Transparency: Since CITs aren't subject to the same regulation as mutual funds and often don't have ticker symbols, researching what's going on under the hood of these products can be challenging. Grillo says it may be harder to find details regarding a CIT’s holdings and management practices.

Pros and cons of CITs

The decision to invest in a CIT often depends on whether these investment vehicles can give you benefits that other options don't provide. For example, in addition to low fees, CITs may provide even greater flexibility and diversification than mutual funds.

"Managers of a CIT may be able to customize their investment strategy to better align with the objectives of retirement plan participants," Grillo says.

However, CITs are also less accessible than mutual funds. Because CITs are typically only available in employer-sponsored retirement plans, you likely won't be able to use the same CIT if you are rolling over your 401(k) into an IRA, Grillo says.

Depending on your objective, some features may be either a pro or a con. For example, the lack of dividend and capital gain distributions may be a benefit if you want to increase your position. But you may not appreciate this feature if you'd rather accumulate extra cash to invest in other assets.

Should you invest in a CIT?

You should follow the same decision process when considering a CIT as you would any other investment. Start by determining your investment goals.

"If a CIT, or combination of CITs, aligns with those goals, they could be the proper vehicle to use," Grillo says

A CIT could be a great addition to your portfolio if you're looking for a low cost, diversified asset. But it may not be a good fit if you think you're looking for income or need to make regular withdrawals from your portfolio.

Ultimately, it all comes down to personal preference. No investment vehicle is right for every investor. Every investment choice should be based around your needs, goal and time horizon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day. She has ghostwritten financial guidebooks for industry professionals and even a personal memoir. She is passionate about improving financial literacy and believes a little education can go a long way. You can connect with her on Twitter, Instagram or her website, CoryanneHicks.com.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.