How to Donate Your Life Insurance Policy to Charity

Donating an unneeded life insurance policy to charity can extend your charitable legacy. To maximize that gift, consider methods that may reduce your tax burden.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you originally invested in your life insurance policy, you were likely thinking about taking care of others after your lifetime. But you may now find that you and your family no longer need that extra layer of financial protection. You may have even asked yourself, “Should I surrender or cancel my policy?”

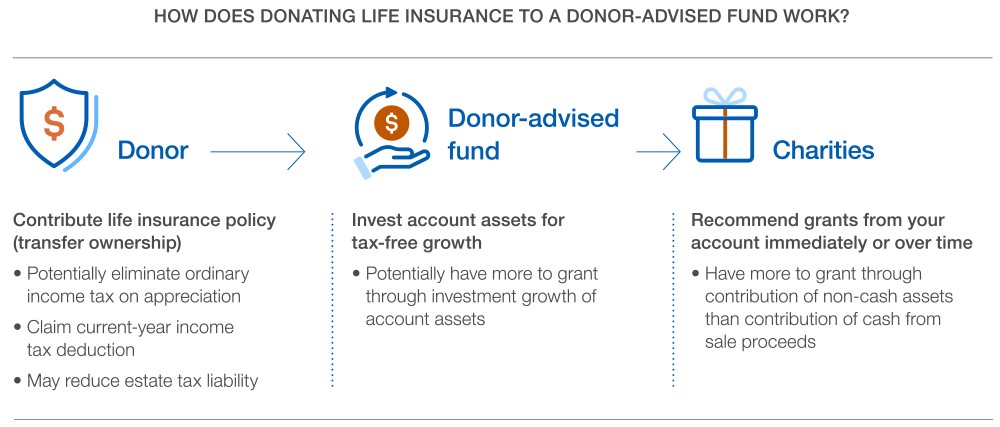

If you’re philanthropically inclined, you can contribute your life insurance to a 501(c)(3) public charity, like a donor-advised fund. By contributing your policy during your lifetime, you’re able to use the value of your policy to benefit your favorite causes, while also claiming a current-year income tax deduction (if you itemize) and potentially reducing your estate tax liability. You can also name a charity now to be a beneficiary of your policy after your lifetime, helping to extend your charitable legacy.

What are the different ways you can donate life insurance?

There are two primary methods to contribute life insurance to charity, and each one has different timing and tax benefits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Transfer the policy ownership and beneficiary interest to your favorite charity, which is generally possible with permanent life insurance. After taking ownership, the charity may opt to surrender the policy for its cash value. (Life insurance companies often allow a policy owner to “surrender” their policy — in other words, cancel it to receive a cash value, minus any surrender charges and fees.)

Tax benefits to this method:

- Life insurance is considered an ordinary income asset, meaning that surrendering a policy for its cash value would trigger ordinary income taxes for you on the policy’s appreciation — even if you took that money and then donated it to charity. But, by contributing your policy directly to charity, you potentially avoid the tax you would otherwise incur if you surrendered the policy yourself and donated the proceeds. And because U.S. public charities are tax-exempt, the charity can surrender the policy for its full, untaxed value, maximizing the impact of the contribution.

- Assuming you itemize your deductions, you may also claim a current-year tax deduction for the policy contribution. Because life insurance is an ordinary income asset, the deduction is limited to the lesser of the policy's value or your adjusted cost basis in the policy (generally, premiums paid to date).

- An added benefit is that the policy’s value could potentially be removed from your gross estate, lowering your estate’s eventual tax burden.

2. Retain ownership of your policy but name a charity as a full or partial beneficiary. In this situation, the charity would receive a designated payout from the insurance company after your lifetime. While you can’t claim a charitable income tax deduction during your lifetime in this situation, your estate will be entitled to claim a charitable estate tax deduction for the beneficiary proceeds distributed to charity at your death.

This method can offer you more flexibility in case your circumstances change (you can change the beneficiary named on your policy), and it can be appealing to those who might not otherwise be able to make a significant gift during their lifetimes. Keep in mind that you may need to continue paying policy premiums for the remainder of your life.

More advanced donation strategies exist, including options that replace income. If you’re interested in exploring those strategies, contact your tax adviser or estate planning attorney.

What types of life insurance can you donate?

You can donate both permanent life insurance (including whole life and universal life) and term life insurance to charity, but the donation options differ.

Permanent life insurance policies hold cash value that can be surrendered. A cash value policy (in particular, a paid-in-full cash value policy) can be an appealing donation because you have the option of gifting during your lifetime, not just at the end of it. And by gifting during your lifetime, you may be able to take advantage of the tax benefits described above.

On the other hand, term life insurance donations have their limitations. While term policies can still be used to benefit charity, gifting during your lifetime is not an option. You can only name a charity as an end-of-life beneficiary. And because term policies are only active for a specified period, you should investigate whether the term policy could expire during your lifetime.

Can you donate life insurance to a donor-advised fund?

A donor-advised fund account, like the one offered by Schwab Charitable™, is a simple, efficient and tax-smart giving solution. By contributing to a donor-advised fund, you can potentially reduce tax burdens, invest contributed assets for tax-free potential growth and recommend grants to qualified U.S. public charities immediately or over time.

Donor-advised funds like Schwab Charitable are public charities themselves. Subject to prior due diligence review, Schwab Charitable can accept your policy as a charitable contribution and surrender it for a cash value. The funds are then made available for you to recommend investments and grants.

Once you have an account open, you may also name your account as a beneficiary of your policy. Recommended grants to charities after your lifetime would then be based on your account’s succession plan or granting history.

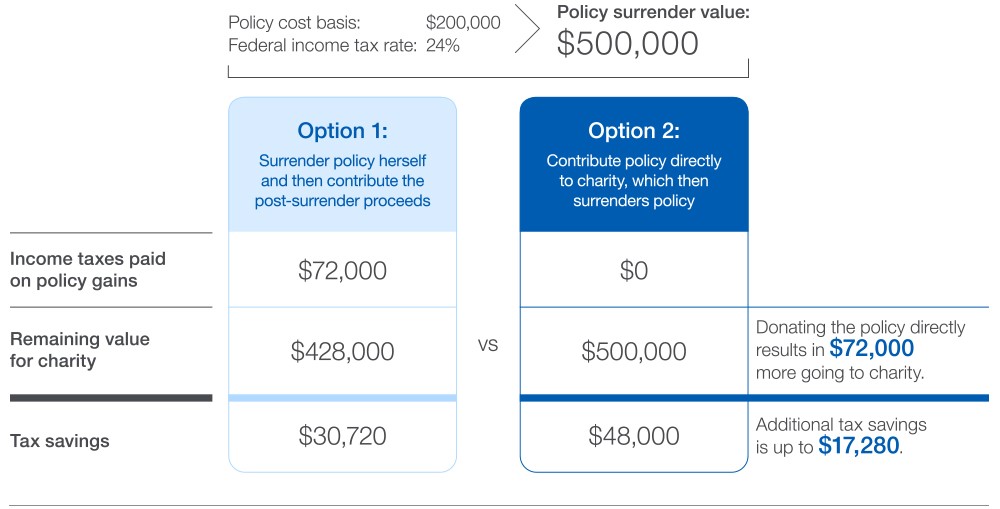

Maximizing a gift during a donor’s lifetime: A case study

Years ago, Shannon invested in permanent life insurance, ensuring that her family would be cared for after her lifetime. Now in retirement, Shannon realizes she’s accumulated more wealth than her family needs, even without the life insurance policy, and she decides she wants to make a charitable impact during her lifetime.

Shannon learns that the value of her life insurance policy can be used as a charitable contribution. Alongside her financial adviser and tax adviser, she explores her policy surrender options and how she can maximize charitable impact.

Option 1: Surrender the policy herself and then contribute the post-surrender proceeds. Shannon’s policy has a $500,000 surrender cash value, with $200,000 in basis (premiums Shannon has paid over the years), without a loan against it. Because life insurance is an ordinary income asset, if Shannon surrendered the policy herself and then contributed the proceeds, she’d incur income tax on $300,000 (the policy gains). Assuming a 24% income tax rate, the post-surrender charitable contribution would be reduced from $500,000 to $428,000. (For simplicity, this hypothetical example assumes no surrender charge or other fees.)

Option 2: Contribute the policy directly to charity, which then surrenders the policy for its cash value. If Shannon transferred the policy ownership to her desired charity and let the charity handle the surrender (rather than Shannon surrendering the policy herself), she would eliminate the taxable income. And, as a tax-exempt entity, the charity would not pay income tax when surrendering the policy. Unlike the first option, the charity would receive the full $500,000 value. (Again, for simplicity, this hypothetical example assumes no surrender charge or other fees.)

Here’s a chart showing the tax impact for Shannon and the charity:

Note: This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or potential surrender fees. The tax savings shown are the tax deduction multiplied by the donor’s marginal income tax rate (24% in this example) minus the income taxes paid. In Option 2, the deduction is limited to the $200,000 policy basis.

Other considerations when donating a life insurance policy

1. Loans against the policy can complicate your charitable contribution.

If you have taken out any loans against the insurance policy, you may be subject to IRS “bargain sale” rules, which can generate taxable income for you and lower the value of your charitable deduction.

2. Annual limits apply to charitable deductions.

If you itemize deductions when filing taxes, your deduction for a during-life contribution of a cash value life insurance policy is generally limited to 50% of your adjusted gross income (AGI). Any deduction amount above this AGI limit may be carried forward for up to five additional tax years, subject to AGI limits in each year.

3. Qualified appraisal requirement rules may apply.

To claim a charitable income tax deduction for during-life contributions of permanent life insurance policies, you must not only itemize income tax deductions, but also must obtain a qualified appraisal from a qualified appraiser if the claimed deduction is greater than $5,000. You also must file IRS Form 8283 with your taxes for the tax year that the life insurance gift is made.

4. You may potentially minimize your gross estate’s tax exposure.

Your life insurance is included in your gross estate after your lifetime. By donating your policy during your lifetime or by retaining your policy’s ownership and naming a charity as a policy beneficiary, you can reduce the value of your gross estate, potentially minimizing its eventual tax exposure.

5. Donors must work directly with their policy administrator to update ownership and/or beneficiary information.

It can take time to finalize the policy ownership transfer through your policy administrator (insurance company), which could result in a delay in making the gift. If you’re planning to make your contribution near year-end, consider starting the process early to avoid any deadlines for yearly tax deduction eligibility. Please note that most charities want to know if you are planning to donate a life insurance policy, whether during or at the end of your lifetime. Some due diligence review before acceptance may be required by the recipient charity.

It’s simple to contribute to your donor-advised fund account, but life insurance and other non-cash assets can be nuanced. Refer to online resources, or experts, such as the Charitable Strategies Group at Schwab Charitable for specialized knowledge on contributing complex assets to charities.

Please be aware that gifts of appreciated non-cash assets can involve complicated tax analysis and advanced planning.

A donor's ability to claim itemized deductions is subject to a variety of limitations depending on the donor's specific tax situation. Consult a tax adviser for more information.

Contributions of certain real estate, private equity, or other illiquid assets may be accepted via a charitable intermediary, with proceeds transferred to a Schwab Charitable donor-advised account upon liquidation. Call Schwab Charitable for more information at 800-746-6216.

Schwab Charitable Fund™ is recognized as a tax-exempt public charity as described in Sections 501(c)(3), 509(a)(1), and 170(b)(1)(A)(vi) of the Internal Revenue Code. Contributions made to Schwab Charitable Fund™ are considered an irrevocable gift and are not refundable. Once contributed, Schwab Charitable has exclusive legal control over the contributed assets.

Schwab Charitable does not provide specific individualized legal or tax advice. Please consult a qualified legal or tax adviser where such advice is necessary or appropriate.

Schwab Charitable™ is the name used for the combined programs and services of Schwab Charitable Fund™, an independent nonprofit organization. Schwab Charitable Fund has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation. (0624-7PJ3)

Related Content

- Wealth Transfer and Strategic Gifting Opportunities for 2024

- The Different Types of Life Insurance

- The Most Expensive States to Die In (Due to Death Taxes)

- How Life Insurance Can Help You Preserve Your Wealth

- Revocable Trusts: The Most Common Trusts in Estate Planning

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Caleb is Director of the Charitable Strategies Group at Schwab Charitable. He oversees the specialized team that conducts due diligence review of complex non-cash assets and educates advisors and donors on tax and legal issues associated with such assets. Caleb brings over a decade of nonprofit management and gift planning experience, which includes serving as a planned giving director for several universities.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.