Do I Need a Family Office? A Guide for the Rich and Not So Famous

Ultra-wealthy people, including Bill Gates, have family offices, but so do about 10,000 others. What is a family office, and is it right for you? Get the answers and take a quick quiz to see if you’re a candidate.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Several years ago, I spent an entire day with a client walking the opening round of the Byron Nelson Golf Tournament. I enjoy time like that with my clients, and it makes for the perfect opportunity to hear what’s really on their minds. As we watched the best players in golf hack their way into the second round, he asked me his one, and only, business-related question of the day: “Should I start a family office?”

Most wealthy families eventually face this question, often as the result of peer pressure. Like vacation homes and private air travel, forming a family office seems to be something that friends and neighbors are doing. If your business and career have brought you significant net worth, someone in your circle may eventually suggest forming a family office.

This paper, and the questionnaire that accompanies it, is meant to help you and your family decide whether such an organization is right for you. This is the starting point for families asking themselves the question. The execution of the idea, however, is a longer topic best discussed with experienced advisers. It is important to note that each story truthfully illustrates a concept, but specific details have been changed to protect client confidentiality.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What Is a Family Office?

According to Ernst & Young, there are more than 10,000 family offices globally, and some estimates put the figure in the U.S. at 6,000. The largest family offices are well known: Bill and Melinda Gates’ Cascade Investment, Sergey Brin’s Bayshore and David Rubenstein’s Declaration Partners Capital are just a few examples. With large office spaces, dozens of employees and seemingly unending resources, these family offices are easy to spot. Thousands of family offices are much smaller, with most employing as few as one or two people to help the principal manage their wealth.

There are three categories of family office:

- The traditional family office. The concept is straightforward. A wealthy principal forms a legal entity, and then hires a staff whose job it is to invest and protect the family’s wealth, manage the family’s assets and assist with their lifestyle.

- The multifamily office. The rapid growth of family offices has been accompanied by new, creative variations. One of the most common is the multifamily office. These outside firms are set up to perform most of the functions of a fully staffed family office: They help set investment strategy, perform due diligence on private investments, assist with tax and estate planning, interface with investment managers and advise on family governance. They charge a fee, typically a percentage of total net worth, and have dozens of client families. These models are more affordable than a traditional family office, but because you share resources with other families, they lack the same level of control as a traditional family office.

- The outsourced family office. Finally, an outsourced family office isn’t an office at all, or a single organization, but a collaborative effort across several supporting players. A financial adviser handles the investment portfolio, an attorney handles the estate plan and a CPA handles tax strategy and pays bills. Concierge services, next-generation education and family governance advice are types of services often included in the fees at large wealth advisory firms. Creating an outsourced family office lacks the total control and coordination of a traditional family office, but it is the least expensive approach.

How is an outsourced family office different than your current financial adviser/CPA/attorney trio? The principal will need to give authorization for the parties to communicate at any time, and then he/she chooses a “quarterback” to coordinate most family financial matters. This is often the financial adviser, who will now guide the family on much more than asset allocation and portfolio management. Topics such as family meeting coordination, next-generation financial education and philanthropic planning become routine conversations.

Who Needs a Family Office: 3 Factors to Consider

Do you need a family office? If so, which model should you use? It is unfortunate that most financial advisers answer this question with a simple range of personal net worth. Your balance sheet is an important factor, but there are many other questions that should be answered about income, diversification, staffing, overhead, geographic disparity, family dynamics, philanthropic interests and time commitments. This longer, more thoughtful discussion can be grouped into three categories: the size of your wealth, the complexity of your life, and the priorities of your family.

No. 1: The Size of Your Wealth

The client I mentioned at the golf tournament was a serial entrepreneur who was successful across multiple industries. Already wealthy by any standard, his largest business was on the verge of selling. The transaction would multiply his personal liquidity, and nearly end his day-to-day business responsibilities. Large-scale liquidity events are usually the catalyst for someone to start considering a family office.

How much wealth justifies a family office? Most advisers will offer a balance sheet measure. However, the most important measure is income, not assets or net worth. Either from private investments or from a large liquid portfolio, a family’s sustainable income — after paying all lifestyle needs — has to be enough to pay the overhead of the staff they want to hire. When a principal burns into their liquidity to pay for the office, they have transformed the family office concept into a business venture that requires excess market returns to fund itself. This is called a private equity firm — not a family office.

Even small offices can be very expensive. Citibank estimates that a small family office with two professionals and four support personnel can cost $1.5 million to $1.8 million per year. Morgan Stanley and Botoff Consulting routinely publish a family office compensation report. In 2019, their survey found that the average small family office in Chicago can expect to pay a chief investment officer over $300,000, and a general counsel over $200,000. These figures are base salaries and do not include benefits, bonuses or carried interest compensation.

Many clients still think in terms of total net worth, and it can be a quick back-of-the-napkin measure. I usually advise clients that you should only consider a traditional family office if your total net worth is above $100 million minimum and most will need more than $250 million. This is simply a practical matter: Total assets below $50 million can easily be served by a more traditional group of advisers for a much lower cost.

No. 2: The Complexity of Your Life

In my early days I met a successful entrepreneur who owned a very large, well-known business. His accountant shared his personal balance sheet to help us formulate a solution for him. The man was worth almost $500 million, and nearly all of it was in the value of the company. In fact, his personal liquidity was less than $3 million, held entirely in cash. His entire balance sheet could be summarized across three line items: the business, the cash and the house. In his case, his income and total net worth more than qualified him for a family office. But the lack of complexity meant he could lean on his company’s management team and a single financial adviser without having to build out a family office.

A single, large portfolio of stocks and bonds, regardless of the enormity, is not complicated nor is it time consuming. Financial advisers who specialize in the ultra-wealthy can easily manage this portfolio according to your goals and risk tolerance. In addition, if your entire wealth is held in a single, family-owned business, you don’t need a family office staff to help grow your wealth. Your management team at the business is already helping you drive value.

Depending on age and personal preference, some clients sell their primary business and “go to the farm,” leaving their financial advisers with a portfolio to manage. This straightforward approach rarely requires full-time employees, HR oversight and a long-term office lease. Other clients, however, build more businesses on the foundation of their early financial success. One client parlayed his early victories as a real estate developer into a diverse portfolio of closely held businesses across a dozen industries. Another client, in his early 60s, is on his third wildly successful career in as many industries. Choosing to manage a myriad active, private investments takes a staff, and not just management teams at each business. In these cases, family offices will look like single-investor private equity firms, with staff members sourcing deals and performing due diligence.

An overweight of personal assets can also create complexity. One of my clients, who did not have a family office structure, owned four vacation homes in addition to his primary residence. “One for every season!” he once told me. He, his wife and their grown children would use private aviation to spend as much time at each vacation property as they could. After a few years, he admitted that the properties were “just too much,” and he sold all but one. The sheer breadth of his properties — the upkeep, property taxes, scheduling and in some cases staffing — warranted a full-time employee. He chose to simplify his life rather than make the long-term investment of a family office.

It’s worth noting one of the most controversial subjects in the family office conversation: paying household bills. I’ve known many clients who achieved tremendous financial success and wonder, justifiably, why they’re still the person to write their lawn crew a check every Thursday. One of the advantages of a traditional or multi-family office is the outsourcing of the bill pay function. If your personal receipts and expenditures look more like a small business than a small household, you should consider a multi-family or traditional family office.

Another factor to consider is the complexity of your estate plan. The plan itself and its various legal entities should never, on their own, factor into the choice to form a family office. The best estate plans, however, reflect the principal’s desires on how best to leave a legacy for the next generation. Simple wills and remainder trusts describe an approach that requires very little interpretation when you’re gone. If, instead, you find yourself with multiple family limited partnerships, family foundations and an array of trust structures, you might require a professional staff to help implement your strategy. Many of the nation’s largest family offices have existed for multiple generations and continue to carry out their founders’ wishes.

No. 3: The Priorities of Your Family

It is hard to discuss the formation of a “family office” without discussing the family. It is entirely possible for a single individual with no heirs to have the resources and requirements to create a family office. But most family offices are built around a family, or at least the legacy that the family wants to leave the world.

One of the advantages of the formal structure of a family office is the flexibility it gives the parents when it comes to their grown children. If the wealthy individual wants his or her children involved in the daily business of managing the family’s wealth, the office has built-in roles for their children. One client had considerable success in the aviation business. His grown son was competent and hardworking but had no interest or inclination to work in the airline industry. By giving his son a role in the family office, he helped his son grow and mature and kept him involved in the family’s financial picture.

This same flexibility can also go the other direction. One of my early family office clients was five generations removed from the founders. Decades ago, the descendants who controlled the business made the decision that no family members were allowed to work in the family office; instead, each was expected to blaze their own way. This approach is sometimes easier than having to decide which child or grandchild is qualified enough to earn a paycheck. It also allows the office staff to focus on growing and protecting the wealth without the drama of family politics.

You should also understand and acknowledge the issues of trust and confidentiality when considering the formation of a family office. Every wealthy family takes risks of confidentiality when they hire any outside firm. Using a CPA, attorney or financial adviser means sharing details that you hope will remain confidential. On one hand, building a traditional family office gives the principal a higher level of oversight and control over the flow of information. On the other hand, principals need to know that their new employees will become extremely close to the family, exposing them to personal information that the principal might otherwise want to keep private.

Finally, you and your family should weigh the benefits of the office against the time and emotion spent managing this new enterprise. Regardless of your staff size, hiring people means interviews, job offers, benefit plans, security protocols, performance evaluations, office politics, vacation time, raise discussions and much more. You will become the chief executive of the new enterprise, and ultimately will be responsible for all the people you employ. Creating a family office is intended to make the principal’s life easier, but it still requires personal responsibility.

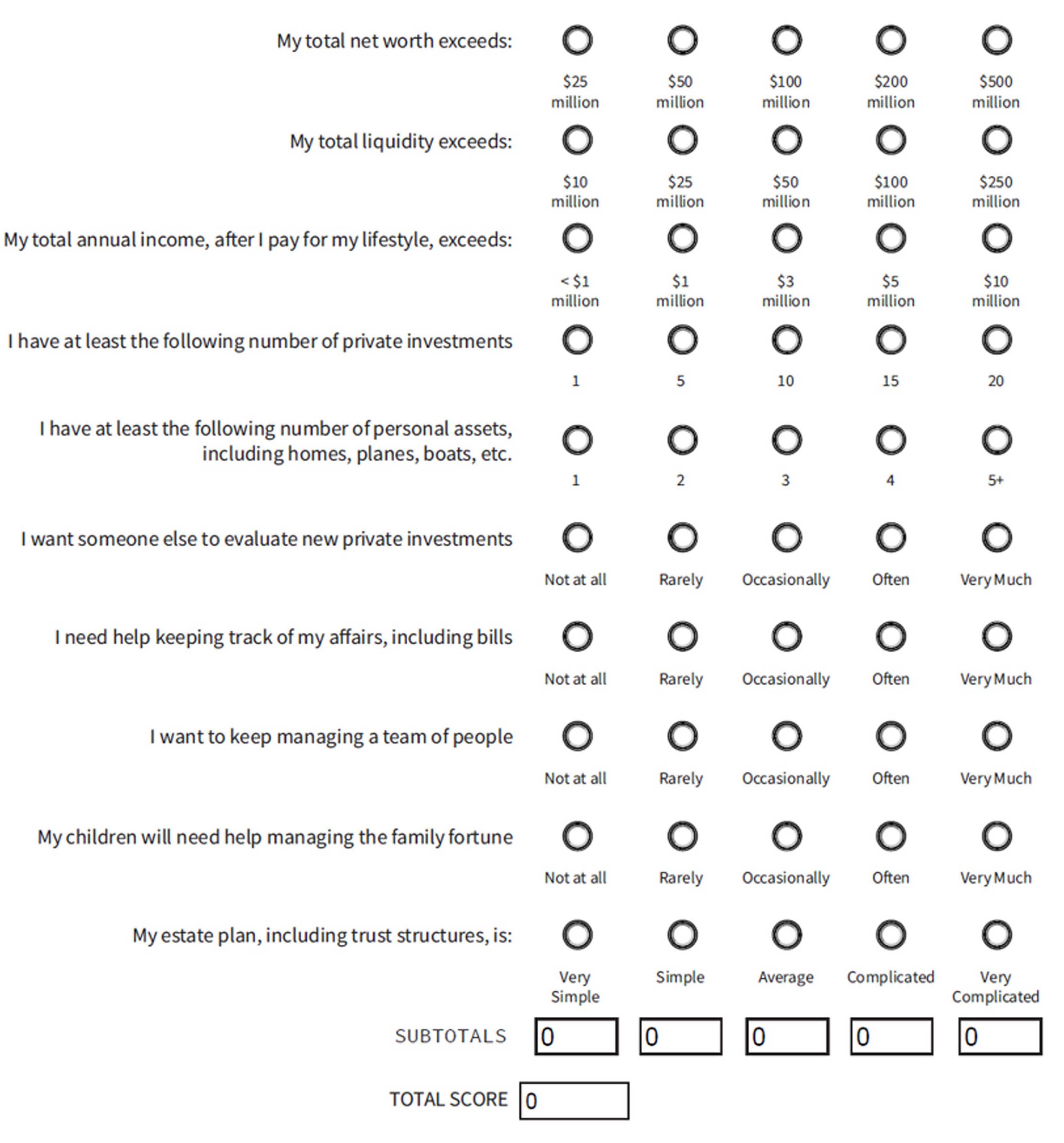

A Quick Test to See Where You May Stand

The questionnaire below encompasses these concepts in 10 questions. I urge you and, if you’re married, your spouse to take the test and discover if your opinions are aligned and if the outcome is the same. Answer each question by checking the appropriate box. If none of the answers apply to you, leave that row unchecked. Give yourself 1 point for every check in column 1; 2 points for each check in column 2; 3 points for checks in column three; 4 points for checks in column 4; and 5 points for checks in column five.

Evaluating Your Score

If you scored fewer than 20 points, a family office is likely not for you. Continue to lean on your financial and other advisers to help protect and grow your wealth. You should have the time and inclination to coordinate your financial matters across your advisers.

If you scored 20–29 points, you should consider an outsourced family office. Unlike a traditional family office, this structure is a collaborative effort across several parties, usually with the financial adviser as quarterback. Sit down with him or her and show them the results of this questionnaire. Share your desire to broaden the type of advice you want them to provide beyond portfolio management, including, for example, financial education, estate advisory or family governance. Ask if their firm has expertise in these matters, and what accessing that expertise would cost. Discuss how they would coordinate these services between your accountant and attorney.

If you scored 30–39 points, investigate the benefits of an outsourced family office and the multi-family office. In addition to asking your current financial adviser about their outsourced family office services, interview several multi-family offices. Confirm fee schedules, ask for client references, and spend time getting to know the people who you will trust with your family’s wealth.

If you scored 40 points or more, you have the resources and the requirements of a traditional family office. Your financial adviser and CPA are good resources to gather information about forming a family office. Take your time, meet with other family offices, and choose your staff carefully. This is a big step; one that is meant to last for generations.

My Final Words of Advice

The decision to form a family office requires plenty of thought and consideration over topics that some principals haven’t considered before. The framework above is just one tool to help you discover whether this endeavor is a fit for you and your family. Never forget that this wealth is yours, and the family office should be a help, not a hindrance.

You may be wondering what happened to my client at the Byron Nelson tournament. When he asked if he should form a family office, I didn’t hand him a survey or pepper him with questions. I just replied, “Well, do you want one?” He answered, “No, not really.”

Decision made.

This material has been prepared for Illustrative purposes only. It does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The views expressed herein are those of the author and do not necessarily reflect the views of Morgan Stanley Wealth Management or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

Morgan Stanley Smith Barney LLC (“Morgan Stanley”), its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not provide tax or legal advice. Clients should consult their tax adviser for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

Morgan Stanley Smith Barney LLC. Member SIPC. CRC 3405626 01/2021

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Matthew Smith is an Investment Adviser at Morgan Stanley. He works with high net worth families to create and implement strategies that include investment management, estate planning, and cash management. Matthew was previously a Managing Director at the J.P. Morgan Private Bank, where he most recently was Market Manager for the High Net Worth Market in Dallas.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.