Six Reasons to Disinherit Someone and How to Do It

Whether you're navigating a second marriage, dealing with an estranged relative, or leaving your assets to charity, there are reasons to disinherit someone. Here's how.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What if you no longer want to include someone in your will? Well, how you choose to divide your estate is a personal decision and entirely up to you. There may come a time when you need to update and change the beneficiaries in your will because you no longer want to leave them a bequest or have them inherit anything from your estate.

To show your intention to disinherit someone, there has to be actual language in the written will stating that a particular person is disinherited. No reasons have to be given, but the language that is used has to be clear and easy enough to understand to prove that this is, in fact, your intention.

Those considering how to disinherit can use either a disinheritance clause or leave a bequest with a no-contest clause to cut off any challenges from anyone dissatisfied with what was left to them.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We've covered the pitfalls of incomplete or sloppy estate planning by highlighting these avoidable errors that bedeviled several celebrity estates. Soulful crooner Barry White passed while estranged from his second wife; she inherited his entire estate with nothing going to any of his nine children from his first marriage. And Michael Jackson created a trust to ease the transfer of his assets to his mother and children, but failed to fund it.

What happens if you die without a will?

If you die without a valid will, you die intestate, and your state's intestacy laws determine how your assets are distributed, typically to close relatives. Intestate succession laws would then dictate the order in which your assets are distributed to your heirs. The order of intestate succession begins with the decedent’s immediate family and extends out to distant relatives. Close relatives like spouses, children, grandchildren, parents, and siblings are typically prioritized.

- Spouse, children and grandchildren

- Parents and siblings

- Nieces, nephews

- Grandparents

- Aunts, uncles

- Cousins

Do you have to disinherit all possible heirs?

Fortunately, the law doesn't require you to name every blood heir that could inherit under intestate succession. Laura Cowan, estate planning attorney and founder of 2-Hour Lifestyle Lawyer, says you need to be clear and plan for contingencies or what she calls "the exploding Thanksgiving turkey." This is a hypothetical example of what would happen to your estate if all of your heirs died simultaneously.

She said you can make sure your money goes where you want it to by naming successors to stand in the place of your heirs, such as allowing your grandchildren to inherit in the place of your children if they should predecease you. This is called a per stirpes designation.

Per Stirpes, a Latin phrase meaning “per issue,” is a legal term that directs that each branch of the family inherits an equal share of the estate per the wishes of the testator (the person who created the will). As such, the beneficiary's share of the estate will be passed on to the beneficiary's heirs or descendants, even if the beneficiary should die before the testator.

After exhausting your list of intended heirs and beneficiaries, you can name a charity or another entity to inherit your assets. This demonstrates your intentions and shows that you contemplated what would happen if your heirs/beneficiaries were deceased and where you want your assets to go.

People you can't disinherit

There are some people whom you can't disinherit. You have a legal obligation to financially support your minor children and can't disinherit them. As long as your estate has assets, state law would dictate that those assets be used to pay for the care and maintenance of any minor children.

And without a prenuptial or postnuptial agreement, you can't disinherit a spouse. Spouses are entitled to their "elective share" regardless of the deceased spouse's wishes or what was in their will. If a spouse is overlooked or explicitly excluded, they can elect to receive their statutory percentage, typically 30% to 50% of the estate of the deceased spouse. The size of an elective share varies because it is based on state law.

How to disinherit someone

The type of relationship you have with the person you intend to disinherit will play a large part in determining which is the best course of action. These are four tools you can use to effectively make sure an heir does not inherit or challenge a nominal bequest:

- Use beneficiary designations to transfer property outside of probate. You name a beneficiary or co-owner of your financial accounts and life insurance policies and that asset will avoid probate. The exception is ERISA-protected retirement accounts. These employee-sponsored retirement and health care accounts, such as 401(k)s, give surviving spouses the right to and inherit all the money in the account even if there are other named beneficiaries. However, you can name another beneficiary to your account if your spouse signs a waiver; a non-spouse beneficiary would be invalid without it. If you are not married, you can name a beneficiary on your 401(k) and that overrides any will.

- Trusts. You could also establish trusts that reside outside your will. By transferring assets into an irrevocable trust, you remove them from your taxable estate, protect them from creditors and, most importantly, ensure they go to your chosen beneficiaries.

- Other legal documents to disinherit spouses. You can only disinherit your spouse with their consent. You can use prenuptial and postnuptial agreements to “waive” estate rights or use a separate document that does not even address a future divorce.

- Multiple marriages. These types of agreements are useful when there is a second or third marriage between spouses who are each bringing their property into the marriage. In this instance, these spouses often want to keep their property separate so that it can go to their family members after they pass away.

- No-contest clause. If an heir with a claim to your estate is left nothing, they have nothing to lose. A no-contest clause states that if someone contests the will, they get nothing. For a no-contest clause to be effective, leaving more than a nominal bequest is the best route.

- Disinheritance clause. This is a provision that explicitly states a person/heir will not receive any portion of your estate upon your death, ensuring they are excluded from inheriting any of your assets. Merely including text that states, “I don’t like my child because they vote the wrong way and therefore they get nothing," is not sufficient. This clause needs to identify who you are disinheriting and include an explicit statement that they will receive nothing from your estate. It's important to leave no room for ambiguity. The delicate nature of these clauses is why 2-Hour Lifestyle Lawyer's Cowan suggests you meet with a professional to avoid drafting errors that could render your disinheritance clause insufficient.

- State law controls. Every state has laws that govern estate planning and probate procedures. That's why using a professional in this circumstance is highly advisable. There is too much room for error if you or anyone not trained in a state's estate law attempts to draft an inheritance clause.

Six reasons to disinherit a family member:

1. Divorce and second marriages

Why? A change in marital status should prompt you to look over your estate documents. It’s important to update your will after any divorce or remarriage, particularly if you have children from your prior relationship. Your new spouse will have statutory spousal inheritance rights, and depending on the state in which you are married, he or she might be entitled to at least half of your estate.

If you have divorced, not updating your estate plan could mean your ex-spouse could still inherit directly from the will or as a designated beneficiary on your investment or retirement accounts.

How? If you want to leave an equal share to all your children, it might mean your current spouse would receive less than what they are legally entitled to. This is a circumstance where you must put this in writing and get your spouse's consent. This can be achieved with a prenuptial agreement, a postnuptial agreement, or a separate legal document.

2. Troubled offspring

A parent can disinherit an adult child for just about any reason or even for no reason at all.

Why? Sometimes, parents don’t have a good relationship with their adult child. That can be enough. However, one of the most common reasons for disinheriting a child is when the child is erratic or has some specific problems they are dealing with. These could include addictions to alcohol or drugs. In these circumstances, parents may realize that any money, assets, or property left to the child may contribute to or exacerbate the problem.

How? Simply leaving the name of your child out of your will is not enough to guarantee that he or she doesn’t receive part of your estate. If you want to disinherit an adult child, you must include this explicit information in your will, making it clearly understood that the omission is intentional and not an oversight. Otherwise, a court might assume the exclusion in estate documents was unintentional and award an equal share to the adult child not named.

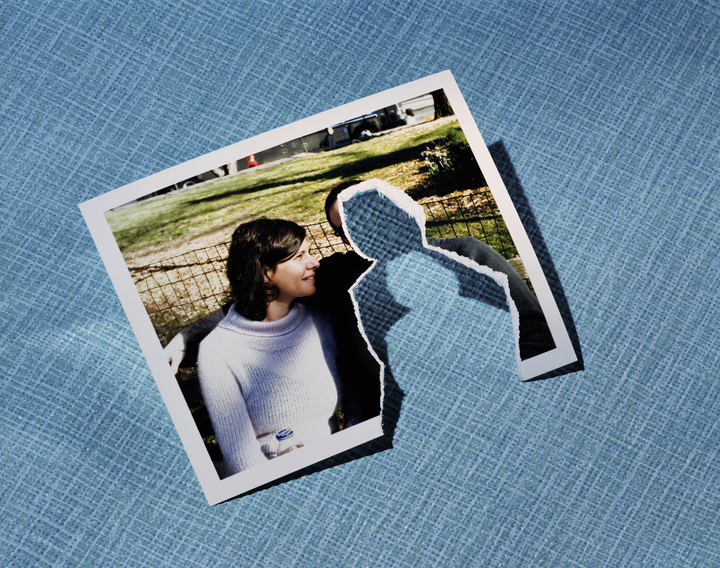

3. Estrangement

Why? If you’re estranged from a family member, it might make sense to disinherit them. Estrangement can happen for many reasons, and the time apart may lead you to conclude you no longer want them to benefit from your estate. If you are estranged from an adult child or other potential heirs, you have to be clear. Cowan suggests consulting an estate planning professional to make sure your plans to exclude an heir are carried out properly.

How? Leaving an adult child out of your will alone is not enough to legally disinherit them. Likewise, if the estrangement arises after you draft your will, you can’t just cross out their name to keep them from inheriting. You’d have to add a codicil or draft an entirely new will to ensure that your wishes are upheld.

Using a properly drafted disinheritance clause, according to Cowan, can make sure your final wishes are enforced.

4. Child or grandchild with disabilities who is receiving benefits

Why? There are situations where cutting someone out of your will is the best decision for your heir. If you have a child or grandchild who has disabilities, it may make sense to legally disinherit them. The reason for this is benign; the income from your estate may disqualify them from accessing any government assistance they would otherwise be entitled to receive.

Most federal, state, or local disability benefits include guidelines regarding the amount of money a recipient can earn or the type of property a person can own without having it impact their benefits. If you were to leave an inheritance directly to your child or grandchild, they may lose those benefits.

That doesn't mean you can't still help them financially and make sure their needs are met. Cowan says the use of a special needs trust or supplemental needs trust would allow you to set aside money for their enjoyment and care without upending their eligibility for government programs and assistance.

The trust is irrevocable and is managed by a trustee for the benefit of your heir. By not owning the assets, the trust beneficiary preserves your child/grandchild's eligibility for need-based government assistance programs. It is the best way to ensure your loved one's financial needs will be met, even after you are no longer able to care for them.

How? The best option here is the disinheritance clause. Because you can still pass assets to your child/grandchild through a supplemental needs trust, and any monetary bequest could disrupt their care plan.

5. Previous support, gifts already given or no financial need

Why? This is another situation where a disinheritance is not an expression of rejection. You may have already given your heirs their share of your estate in a lump sum, or exhausted their share over the year by providing day-to-day support or money for a down payment or to retire student loans.

You may have more than one child with vastly different financial resources. Cowan told me that many parents are reluctant to deviate from leaving equal shares to their children, even though some children would benefit more from the bequest.

How? Either a disinheritance clause or a no-contest clause would suffice. Cowan said the property that causes the most disputes "is often of little value" in a monetary sense. Property with sentimental value, such as your grandmother's teapot or a cherished holiday decoration, can stir up the biggest problems. She offers a simple solution — to use specific bequests to distribute those heirlooms.

6. Leaving your estate to charity

Why? You've decided to leave all or the majority of your estate to a charitable cause. There can be a variety of reasons for this, including one of the five listed above. Regardless of the reason, you need to be explicit about your wishes to leave your estate to a charity and not any of your heirs.

If you have already designated other beneficiaries to receive any portion of your estate, you will need to disinherit them or revoke your existing will so you can designate the charity of your choice.

How? First, you must determine your personal and financial goals in making a charitable gift so as to determine the best gifting strategy.

These are three ways to pass assets to a charity:

- Will or trust. If you want to leave the charity property, be very clear about the name of the charity and include its taxpayer identification number (TIN). This will avoid a mix-up, as many charities can have similar names. TIN numbers are usually available on their website.

- Designate it as a beneficiary. A charity or nonprofit can be the beneficiary listed on your investment accounts or life insurance policies.

- Donor-advised fund (DAF). You can contribute cash, securities, real estate, or other assets to a DAF. A huge plus to tax planning is that the contributions are considered a gift to charity for tax purposes.

Should you tell someone they are disinherited?

Making those who are disinherited aware of the situation can make things easier after you pass. Bad news is never truly welcome, but forewarning can be constructive for the rest of your family. Some people choose to include a letter of disinheritance to explain their reasons for excluding someone from their will. This is another tactic to make circumstances clear and avoid ambiguities.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.