Five Things You Can Learn From Jimmy Buffett's Estate Dispute

The dispute over Jimmy Buffett's estate highlights crucial lessons for the rest of us on trust creation, including the importance of co-trustee selection, proactive communication and options for conflict resolution.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

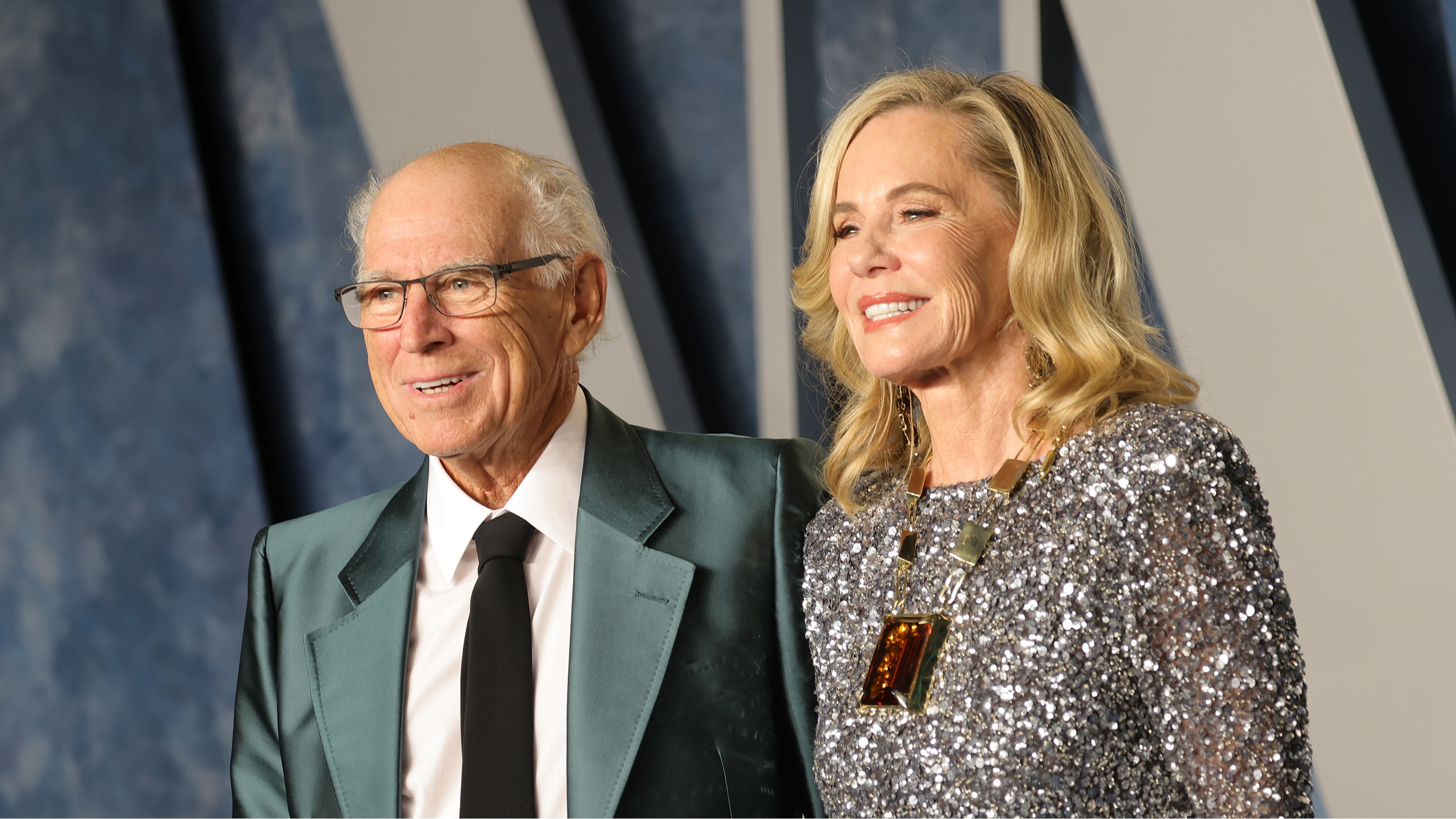

Jimmy Buffett died in September 2023. While his estate exceeds $275 million, we all can learn from the dispute between Buffett's widow, Jane Slagsvol, and his business manager, Richard Mozenter.

Slagsvol and Mozenter are co-trustees. Slagsvol was married to Buffett for 46 years. Mozenter worked for Buffett for more than 30 years and viewed himself as Buffett's friend for more than 15 years. On paper, they seem to be a great combination to be co-trustees.

Most of Buffett's assets were funded or transferred into a marital trust that designated Slagsvol as the primary beneficiary. Other trusts were established for Buffett and Slagsvol's children and are not part of this dispute.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

A marital trust is designed to qualify for the estate tax marital deduction. This means Slagsvol, as the surviving spouse, is to receive all of the income from the trust for her life.

As the income beneficiary, she has the right to require that the assets in the trust are invested appropriately to produce income.

Slagsvol seeks the removal of Mozenter as a trustee for failing to generate sufficient income with trust investments and for failing to inform her of trust investments, income and expenses.

She asserts that Mozenter has been "openly hostile" and working against her interests. Mozenter also seeks the removal of Slagsvol as a co-trustee.

Slagsvol notes that Mozenter was paid $1.7 million in 2024 in trustee fees while the trust earned a less than 1% return on income. She indicated that the 1% return does not cover her expenses.

Lessons we can learn

While your estate may be significantly less than $275 million, there are lessons to be learned from the Buffett estate issues.

1. Use additional caution when selecting co-trustees.

Here, Buffett chose probably the two people he trusted the most. Slagsvol and Mozenter have known each other for decades and, on paper, this seems like a good match.

Due to the size and complexity of the estate, using a professional co-trustee would seem to be a good choice. Including Slagsvol as a co-trustee ensures that she retains a measure of control over assets in a trust where she is the primary beneficiary during her life.

In addition to finding trusted people to act as trustees, we also want to be confident that the trustees will be able to work together. The use of a professional co-trustee can be particularly helpful with the administration of a special needs trust.

A family member can control the investments while a professional trustee works under the family member co-trustee's direction to creatively pay benefits that comply with the many rules to maintain needs-based governmental assistance.

2. The independent trustee and the beneficiaries should meet prior to the death to make sure that they are all on the same page.

Meeting prior to death gives everyone an opportunity to be sure that their expectations will be satisfied. Without a meeting before, there is a greater chance of conflict after death, when the trust cannot easily be changed or adjusted.

3. Anticipate trustee conflict in the trust.

Establish guard rails within the trust to help avoid formal litigation, which is expensive, emotionally damaging to the family and generally completely public when filed with the court. (That is why the Buffett trust litigation is in the headlines.)

If the trustees are in conflict, each trustee typically retains independent counsel, and another independent attorney represents the trust.

With so many attorneys, the cost of such litigation is high. Litigation can also injure family relationships, and it is often much easier to begin than to finish or resolve.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

Perhaps the most common first step is to provide for a "tie breaker" if the two co-trustees cannot agree or are deadlocked. The co-trustees each explain their respective positions to the tie breaker. The tie breaker is authorized to resolve that dispute, and then the co-trustees are duty-bound to follow the tie breaker's decision.

The tie breaker does not actually act as a trustee or co-trustee other than to resolve the disagreement between the co-trustees.

You will want to identify alternate tie breakers if the designated tie breaker is unable or unwilling to act. An independent professional is an excellent choice for a tie breaker.

4. Consider including the power to remove a co-trustee.

Consider if it is appropriate for the primary beneficiary (Slagsvol, in this case) to be allowed to remove and replace the independent co-trustee with a different independent co-trustee. If the primary beneficiary is not trusted to make good financial or other decisions, then this power may not be appropriate.

When appropriate, we may require a professional trustee to fulfill this role, especially if we are concerned about the financial maturity of the primary beneficiary.

In the Buffett case, Slagsvol is the primary beneficiary, and there is no indication that she might abuse this power. The apparent failure of the current co-trustee to account for assets and income appears to be problematic.

A 1% return on investments, at first blush, does not appear to be a very good result in today's markets. There may, however, be unstated reasons for that 1% rate of return.

5. Include detailed compensation provisions for the independent (nonfamily) co-trustee.

Limit professional fees to a percentage of the assets, an hourly rate or even lump-sum amounts. Care must be taken to ensure that the limitations are reasonable, or no professionals will accept the project.

A trustee who is also a beneficiary is often less concerned about compensation because what they receive is often not taxable. The co-trustee's compensation is taxed as ordinary income.

If there are multiple beneficiaries, the trustee beneficiary may be more concerned about compensation because it will be paid before splitting the shares for distribution to the beneficiaries.

In conclusion

While the specifics of Buffett's estate dispute are unique because of his considerable wealth, the underlying lessons offer valuable guidance for anyone establishing a trust.

Careful consideration in selecting co-trustees, proactive communication among all parties, built-in mechanisms for resolving conflicts and clear provisions for trustee compensation are essential steps to help ensure that a trust achieves its intended purpose.

By learning from a high-profile challenge like this one, high-net-worth individuals can better protect their legacies and their loved ones from future disputes.

Related Content

- Lessons to Be Learned From a $1 Billion Divorce

- Tony Bennett's Daughters Share Thoughts on How to Prevent Inheritance Disputes

- Five Estate Planning Lessons We Can Learn From Elvis’ Mistakes

- Nine Lessons to Be Learned From the Hilton Family Trust Contest

- Eight Types of Trusts for Owners of High-Net-Worth Estates

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Founder of The Goralka Law Firm, John M. Goralka assists business owners, real estate owners and successful families to achieve their enlightened dreams by better protecting their assets, minimizing income and estate tax and resolving messes and transitions to preserve, protect and enhance their legacy. John is one of few California attorneys certified as a Specialist by the State Bar of California Board of Legal Specialization in both Taxation and Estate Planning, Trust and Probate. You can read more of John's articles on the Kiplinger Advisor Collective.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.